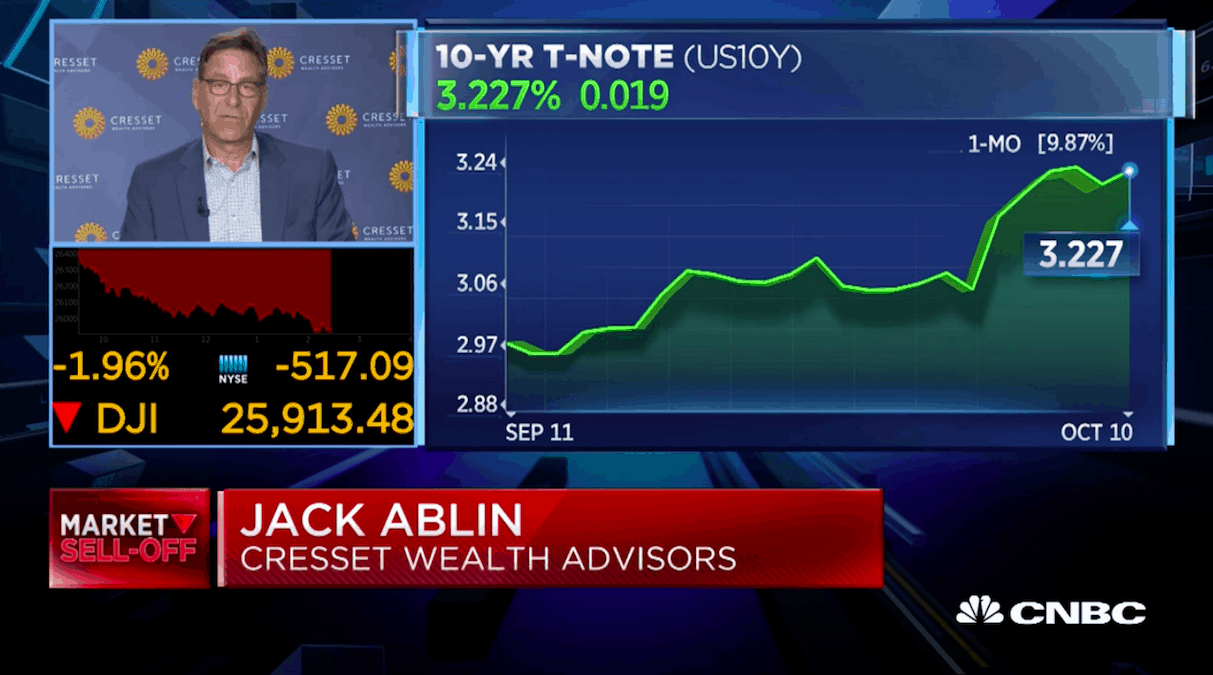

The recent sell-off in the stock market may not be over as interest rates finally begin to climb back to normal levels, Jack Ablin, CIO of Cresset Wealth Advisors, told CNBC viewers on October 10, 2018. As Ablin explained, the stock and bond markets are in a constant tug-of-war for investors’ assets. For nearly a decade, the Federal Reserve has been helping to pull money toward stocks by keeping bond yields artificially low. But as rates begin to rise as the economy accelerates, bonds are starting to look more attractive, which is yanking money back toward fixed income. Ablin, however, does not believe this tug of war is over as he thinks the “fair value” for yields on 10-year Treasuries, which closed on Oct. 10 at 3.22%, is around 4.5%.

A fourth interest rate hike in December isn’t guaranteed

The post Stocks could slide further as interest rates begin their ascent appeared first on Cresset.