Family Office Guide / What is a Multi-Family Office?

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.

12 minute read

Family offices have a rich history spanning centuries. Many historians trace the lineage of family offices back to 15th-century Italy, where wealthy families like the Medicis relied on trusted advisors to manage their affairs. However, the modern family office as we know it emerged in the late 19th century with the rise of industrial tycoons like the Rockefellers and Vanderbilts in the United States.

Initially, family offices primarily focused on managing investments, taxes, and philanthropic activities for wealthy families. However, their roles have evolved over time to encompass a broader range of services, including estate planning, wealth preservation, family governance and education, as well as concierge services.

The 20th century witnessed a proliferation of family offices, especially following the economic boom after World War II. As global wealth has increased, more families have sought to establish dedicated offices to manage their wealth.

Multi-Family Office – A multi-family office works with multiple high-net-worth (HNW) families, providing private wealth management through tax and estate planning, risk management, investment management, trusteeship, lifestyle and concierge services, coordination of other financial professionals, and philanthropic strategy.

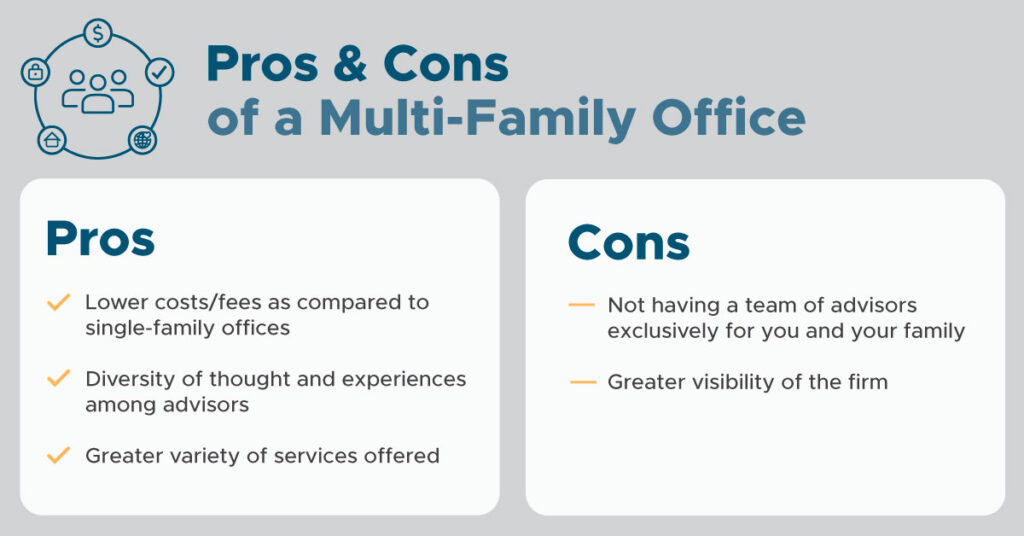

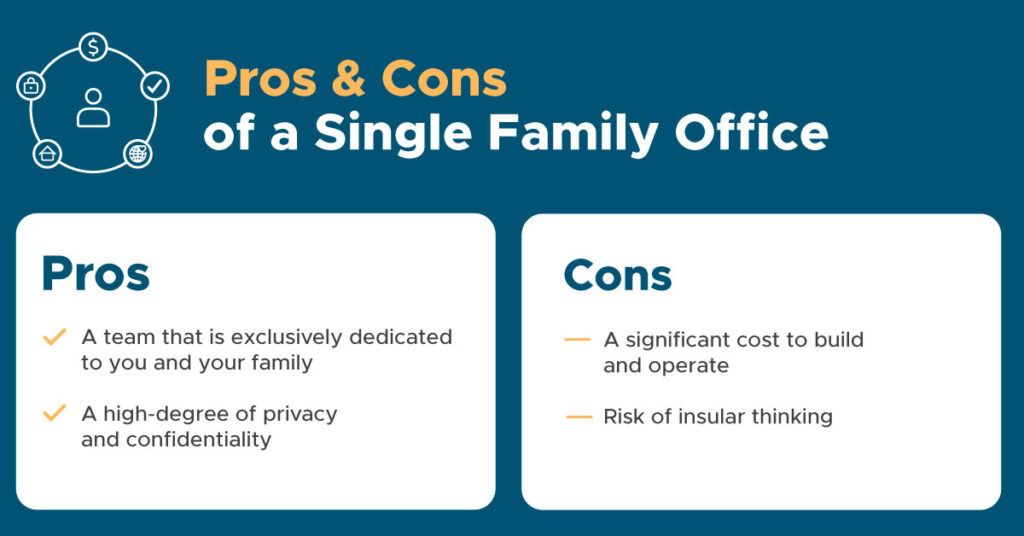

Single-family offices are typically developed for just one family, although they can have multiple generations and branches of a family represented. A multi-family office is designed for multiple families to share in the resources and talents of the firm, reducing the cost of operating the office and increasing the scale and diversity of services offered.

Family office services can also provide access to institutional-quality private investments and other alternative investment opportunities that are typically accessible only to large endowments and other institutional investors.

A fractional family office and a multi-family office share many similarities, yet have distinct differences:

A multi-family office offers a team of specialists to work with your family, as opposed to a typical wealth manager, who is often a lone generalist. Using a multi-family office can provide visibility into wealth management best practices that similar families are using to manage their wealth. Finally, multi-family offices exist to help families aggregate their investments, particularly private investments, which allows greater leverage and buying power, as well as access to leading managers and investment opportunities.

Multi-family office services typically include a multitude of other offerings, including wealth planning, estate and tax planning, charitable giving advice, concierge services, family vision and values exploration, advisory services, and more. These services are often provided with multi-generational families in mind.

Family office services can also provide access to institutional-quality private investments and other alternative investment opportunities that are typically accessible only to large endowments and other institutional investors.

Team members of a multi-family office include experienced investment managers, financial advisors and wealth planners, family governance and education professionals, as well as advisors who are knowledgeable in tax planning and risk analysis.

Multi-family office services provide a comprehensive suite of offerings that the complex financial situation of successful families requires, including:

The definition of a multi-family office is a firm that works with several high-net-worth families who pool resources. Because of this, they can offer those client families economies of scale that allow for cost sharing. That lowers fees and expenses for client families, while simultaneously broadening the depth of resources available to those families.

As stated above, family office team members can include experienced investment managers, financial advisors and wealth planners, family governance and education professionals, as well as advisors who are knowledgeable in tax planning and risk analysis. There are numerous other potential roles within a family office, depending on the needs and types of families served.

As families become more successful and grow their wealth, particularly over generations, their financial pictures become more complex. This is when a multi-family office can make a lot of sense. Clients of a multi-family office typically have a minimum net worth in excess of $25 million. Comparatively, a single-family office often only makes sense once a family’s net worth is in excess of several hundred million dollars, as the cost of operating a single-family office can be significant.

Multi-family offices typically charge fees based on the services they provide and the level of customization required by each client. Below are some common fees and costs associated with multi-family offices:

Asset-Based Fee: Many multi-family offices charge an annual fee based on a percentage of the assets they manage for the client. This fee can range anywhere from 0.5% to 2% or more, depending on the size of the client’s portfolio and the complexity of their financial situation.

Performance-Based Fee: Some multi-family offices also charge a performance-based fee, which is a percentage of any investment gains they generate for clients. This fee structure incentivizes the MFO to achieve positive returns for the client.

Hourly Fees: For specific services, such as tax planning, estate planning, or legal advice, some multi-family offices may charge hourly fees for the time spent by their professionals working on behalf of the client.

Retainer Fees: In some cases, multi-family offices may charge a flat retainer fee for providing ongoing financial planning and wealth management services to a client, regardless of the size of assets under management.

Setup Fees: When onboarding a new client, multi-family offices may charge a one-time setup fee to cover the costs associated with establishing accounts, transferring assets, and conducting initial assessments of the client’s financial situation.

Transaction Fees: Multi-family offices may charge fees for executing trades on behalf of clients, such as buying or selling securities, real estate, or other assets. These fees can be based on a flat rate per transaction or a percentage of the transaction amount.

Custodian Fees: If the multi-family office uses a third-party custodian to hold and safeguard client assets, there may be additional fees charged by the custodian for their services.

Administrative Fees: Multi-family offices may charge administrative fees to cover the costs of managing client accounts, processing paperwork, and providing ongoing support and communication to clients. It’s essential for clients to thoroughly review and understand the fee schedule of any MFO they are considering working with to ensure that the fees charged are reasonable and transparent.

Research a multi-family office that shares the vision and values of your family. A multi-family office should be a fiduciary that is committed to transparency and acts in your family’s best interests at all times, with no conflicts of interest. Ensure that the family office you select can provide the full range of services you desire and has the depth of talent and experience to deliver on your family’s wishes long-term.

Contact us to learn more about how you can benefit from the scale and services of a multi-family office.

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.

Cresset is an independent, award-winning multi-family office and private investment firm with more than $65 billion in assets under management (as of 1/15/25). Cresset serves the unique needs of entrepreneurs, CEO founders, wealth creators, executives, and partners, as well as high-net-worth and multi-generational families. Our goal is to deliver a new paradigm for wealth management, giving you time to pursue what matters to you most.

https://cressetcapital.com/disclosures/

Chicago | Atlanta | Austin | Charlotte | Dallas | Denver | Greenwich | Houston | Kalamazoo | Los Angeles | Menlo Park | Minneapolis | Naples | Nashville | New York City | Phoenix | San Francisco | Santa Barbara | Sioux Falls | Tulsa | Washington D.C. | West Palm Beach

Cresset refers to Cresset Capital Management, and all its respective subsidiaries and affiliates. Cresset Asset Management, LLC, also conducts advisory business under the names of Cresset Sports & Entertainment, CH Investment Partners, and Cresset Capital. Cresset provides investment advisory, family office, and other services to individuals, families, and institutional clients. Cresset also provides investment advisory services to investment vehicles investing in private equity, real estate, and other investment opportunities. Cresset Asset Management, LLC is an SEC registered investment advisor. SEC registration does not imply any specific level of skill or training.

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.