Key Observations:

- Trump-Powell monetary policy tensions triggered massive market volatility

- Global financial establishment stands behind Powell

- History offers sobering lessons about political interference with central banks

- A politically compliant Fed could trigger severe and lasting market disruptions

The financial establishment has been rallying for Fed independence in the face of growing tension between President Trump and Chairman Powell. Financial markets have sent clear warning signals about the consequences of political interference. We believe an independent central bank is paramount, and irreparable financial harm could ensue if global investors sense the Fed has been co-opted.

Trump-Powell Monetary Policy Disagreements Triggered Massive Market Volatility

President Trump considered firing Powell earlier this month, citing cost overruns in the Fed’s headquarters renovation project as potential grounds for removal. While Trump later walked back the statements, the suggestion triggered massive market volatility. Treasury yields spiked, the dollar weakened, and stocks sold off before recovering when Trump clarified his position.

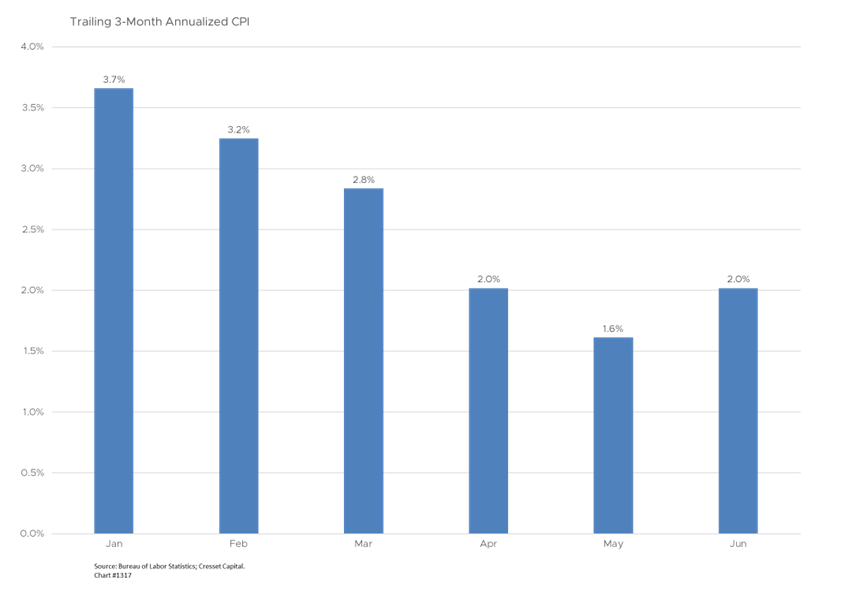

The President’s frustration with Powell centers on monetary policy disagreements. Trump has repeatedly demanded dramatic interest rate cuts, suggesting rates should be “three points lower” than the current 4.25-4.5 per cent Federal funds rate, arguing this would reduce government debt service costs and stimulate economic growth. Powell, however, has maintained the Fed’s cautious approach amid persistent inflation concerns, particularly as Trump’s tariff policies show signs of adding to price pressures. Trailing three-month annualized inflation ticked up in June, ending a steady downtrend that began in January.

Global Financial Establishment Stands Behind Powell

The financial establishment has rallied around Powell with unprecedented solidarity. Major bank CEOs have publicly defended Fed independence. The European Central Bank’s Christine Lagarde praised Powell as “the standard of the courageous central banker,” while central bankers from around the world stood in applause at a recent conference. This support reflects deep concerns about the precedent that would be set by firing Powell. Bank of America CEO Brian Moynihan recently noted the Fed’s independence from political pressure is “critical for the economy” because premature rate cuts could reignite inflation, forcing more aggressive tightening later.

Trump faces significant legal hurdles in any attempt to remove Powell. Even if Trump were to succeed in removing Powell as chair, he would likely remain as a Fed governor until 2028, and the Federal Open Market Committee would likely recognize him as their monetary policy leader, creating an awkward scenario for the newly appointed chairperson.

History Offers Sobering Lessons About Political Interference with Central Banks

Presidents from Lyndon Johnson to Richard Nixon pressured Fed chairmen with disastrous results. It’s been argued that Nixon’s influence over Arthur Burns contributed to the inflation crisis of the 1970s. More recently, Turkey’s President Erdogan repeatedly fired

central bank governors who refused to cut rates despite soaring inflation. The result was catastrophic: inflation reached 80 per cent, the lira collapsed 60 per cent against the dollar, and the economy suffered severe damage before orthodox policies were eventually restored.

While the US is not Turkey, the global implications of undermining Fed independence could weigh heavily on markets. The dollar serves as the world’s reserve currency, involved in 90 per cent of cross-border transactions. US Treasury yields are global interest rate benchmarks. Any loss of confidence in Fed independence could trigger capital flight, weaken the dollar’s reserve status, and destabilize international financial markets.

Trump’s Demands to Cut Rates Present an Economic Paradox

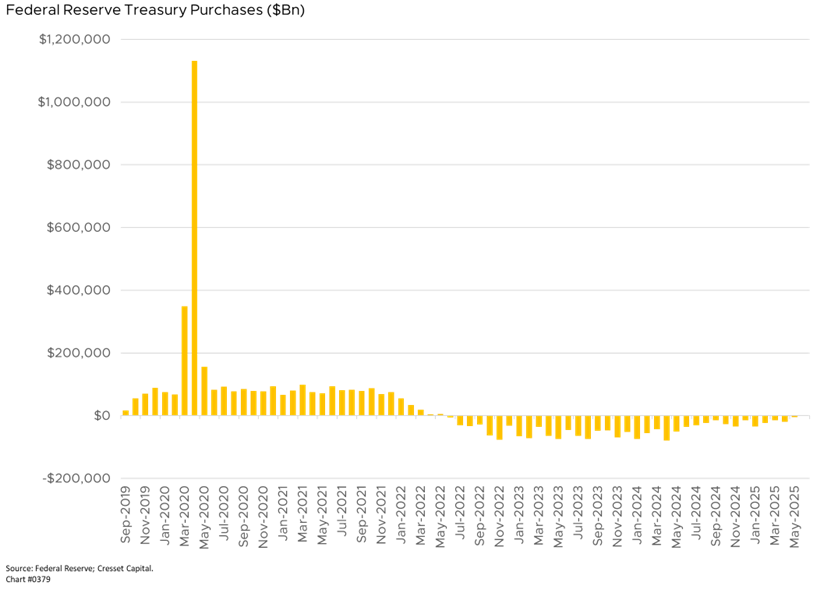

While lower short-term rates might reduce government borrowing costs, they will likely drive long-term rates higher if markets lose confidence in the Fed’s inflation-fighting credibility. This would increase borrowing costs for businesses and consumers, undermining Trump’s stated objectives. The Administration could prompt the Fed to buy intermediate term Treasurys through quantitative easing to hold longer-dated rates low, but it should be noted that even though the Fed has been consistently selling its Treasury holdings since mid-2022, its balance sheet still sits at nearly $7 trillion.

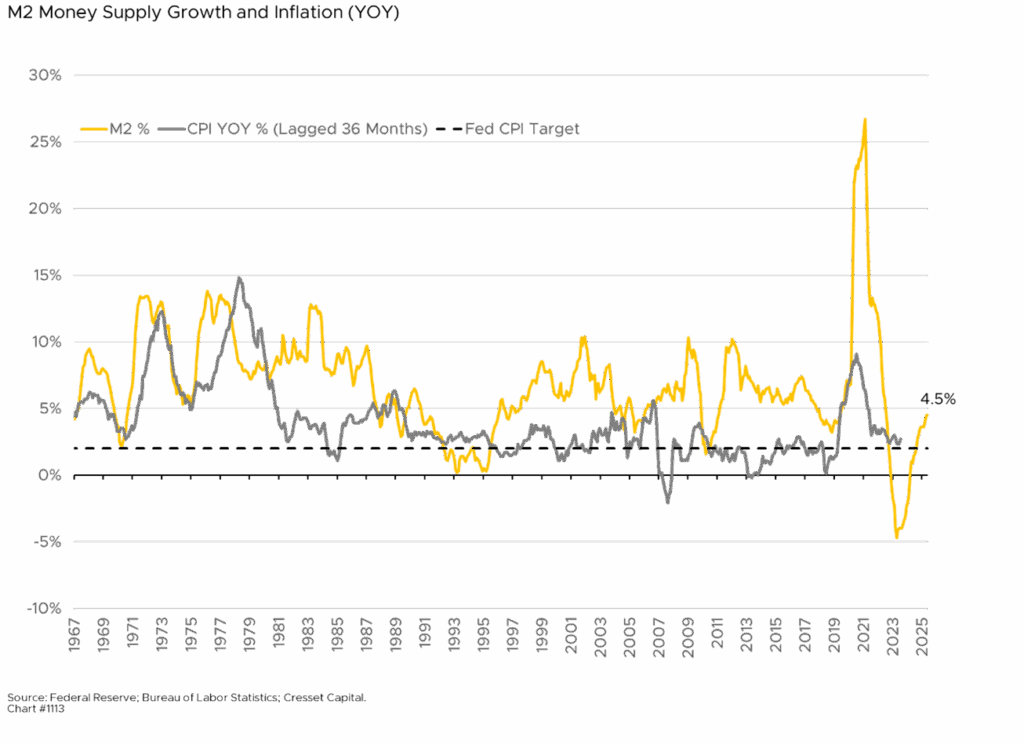

Recent inflation data showing acceleration to 2.7 per cent in June – partly due to tariff effects, which underscores the challenges facing monetary policy. The Fed’s cautious approach reflects genuine concerns about rekindling price pressures just as inflation appeared to be moderating.

A Politically Compliant Fed Could Trigger Severe and Lasting Market Disruptions

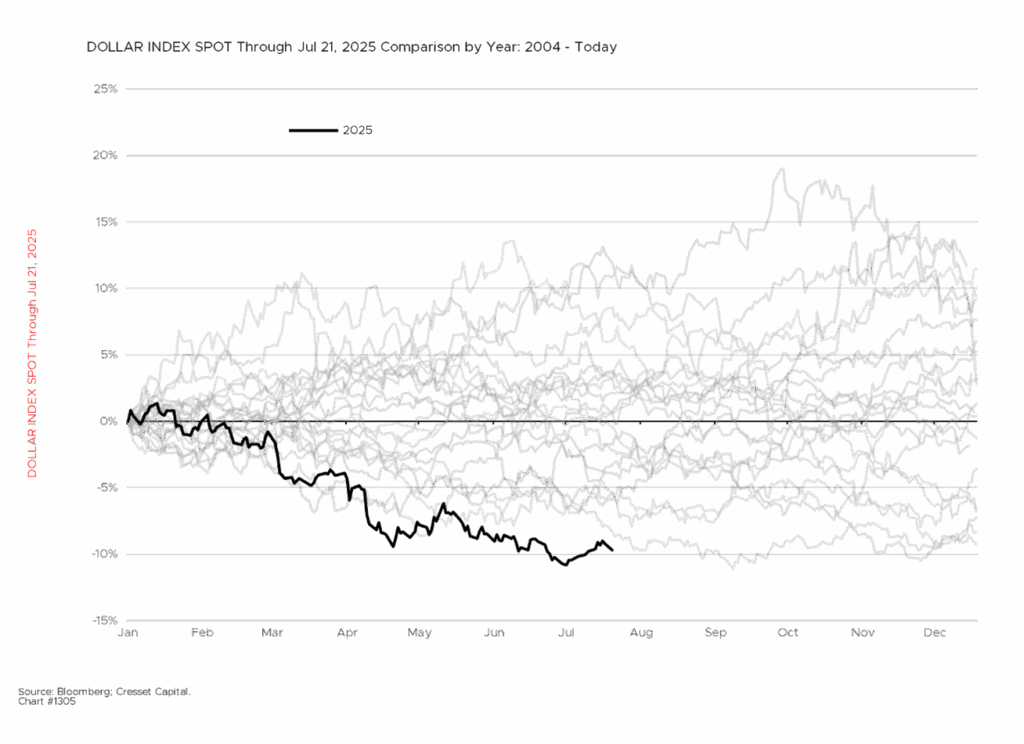

A politically compliant Federal Reserve could trigger severe and lasting market disruptions across multiple asset classes, fundamentally altering the global financial landscape. The dollar’s reserve currency status rests fundamentally on Fed independence and credibility. A co-opted central bank could trigger massive capital flight as foreign investors lose confidence in US monetary stability, weakening the dollar. Currency strategists worry that a sudden, permanent dollar downdraft would harm the US currency’s dominance in global trade and finance, prompting the US to finance its deficits at much higher costs while inhibiting America’s ability to impose financial sanctions. Already, the dollar is off to its worst start to the year in over 50 years.

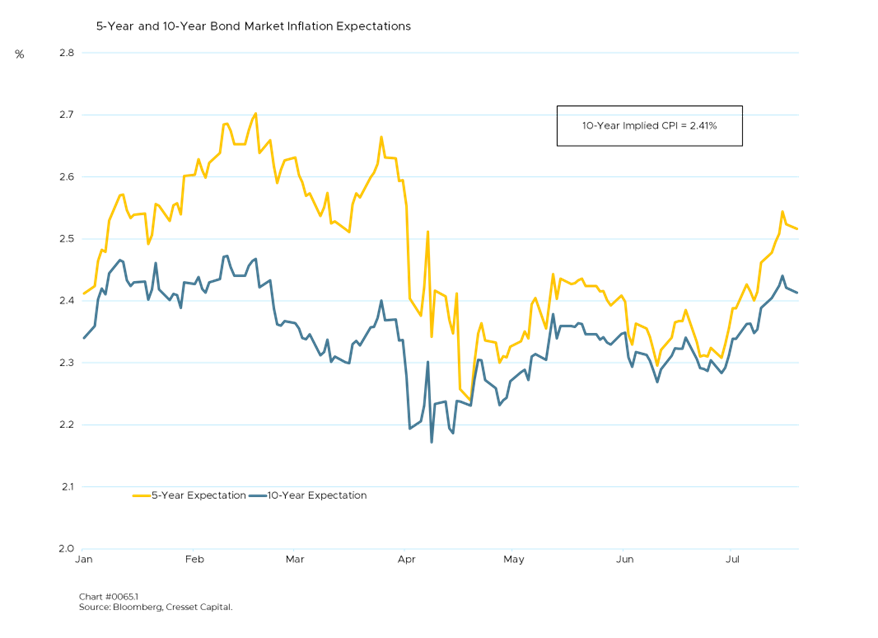

Without the Fed pursuing its dual mandate of full employment and price stability, markets would immediately anticipate higher long-term inflation expectations, potentially resulting in a self-fulfilling prophecy and culminating in the opposite of what President Trump wants to achieve. If investors believe the Fed won’t aggressively fight price pressures, workers will demand higher wages and businesses would raise prices preemptively. While we don’t expect it to unleash the kind of inflation spiral that devastated the economy in the 1970s, higher inflation would prompt more painful monetary tightening later. Five-year inflation expectations have risen by 0.2 per cent in the last month.

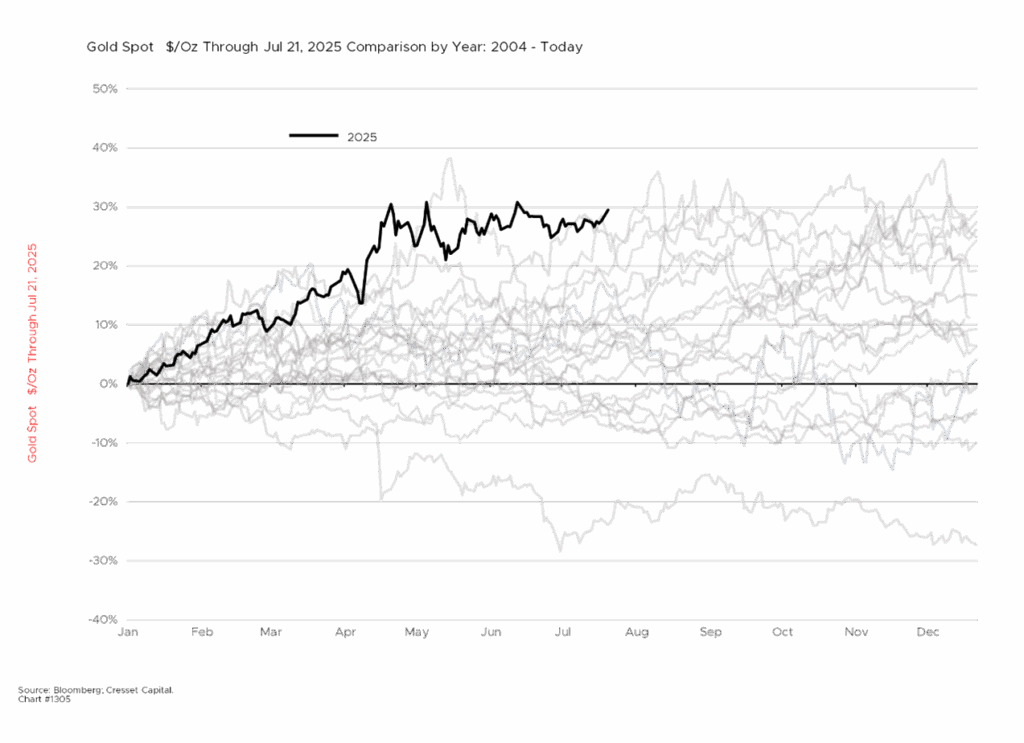

Meaningful dollar instability would ripple through global markets, particularly to countries holding dollar-denominated debt. Many global central banks, including China, India and Japan, have begun diversifying away from dollar reserves. Any hint of a political thumb on the Fed policy scale would accelerate that trend. China has shifted dollar assets into gold in recent years, doubling its gold reserves to $250 billion over the last decade.

On the flip side, artificially low rates would be a boon to rate-sensitive markets, like small caps, real estate and corporate bonds among others, at least in the near term. Longer term, reconciling the interest rate imbalance, particularly against a backdrop of higher inflation, could burst asset bubbles across markets. A politicized Fed would lack credibility to respond effectively, potentially amplifying the damage.

The Trump-Powell standoff represents a critical test of American institutional independence. While Trump might ultimately refrain from firing Powell due to market and political pressures, the episode has already dented Fed credibility and raised global concerns about US monetary policy stability.

Bottom Line:

The unified opposition from financial markets, international allies, and domestic lawmakers to President Trump’s suggestions that Powell could be fired implies that the costs of political interference with the Fed would outweigh any benefits. Historical precedents and international examples demonstrate that central bank independence is not merely a technocratic nicety but a crucial foundation for economic stability and market confidence.