Key Observations

- The S&P 500 rebounded nearly 24% in Q2, reaching new highs after early-year losses.

- Consumer spending has softened, dragging down earnings expectations across sectors.

- The bond market is gaining traction, but longer-term fiscal concerns are driving outflows.

- A weakening U.S. dollar is supporting international equities and reshaping global positioning.

A Swift Rebound for U.S. Equities

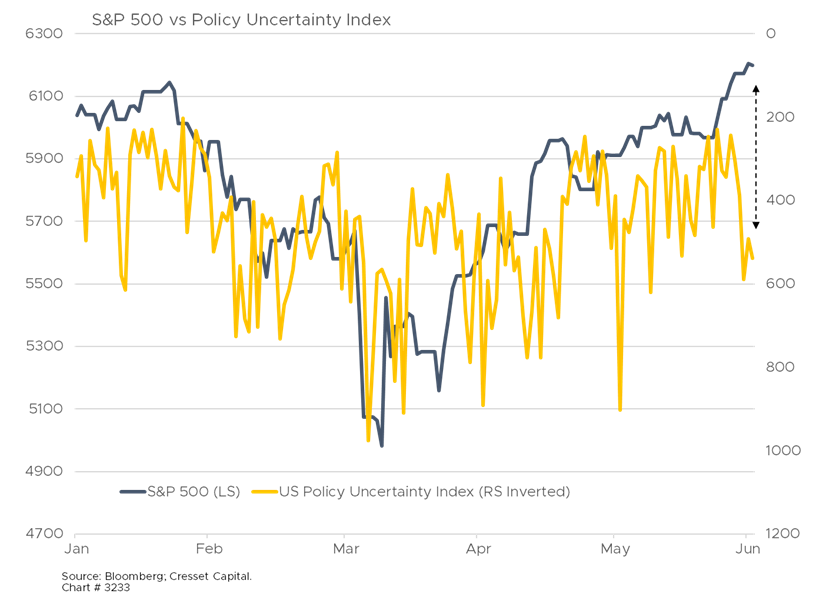

After a sell-off in the first quarter, the U.S. stock market has staged a remarkable comeback in the second quarter, fueling both the S&P 500 and Nasdaq Composite to record highs by the end of June. The S&P 500 rose in its fastest-ever surge into record territory following a decline of at least 15%. The index rebounded nearly 24% after President Trump softened his stance on sweeping tariffs in early April.

Trade Policy: Less Impact, More Uncertainty

While the initial economic impact has been milder than expected, Trump’s tariff policies continue to create uncertainty. The average U.S. tariff now stands at over 10%, according to the Yale Budget Lab, its highest rate since the 1940s, yet the economy has shown resilience in the early stages of implementation.

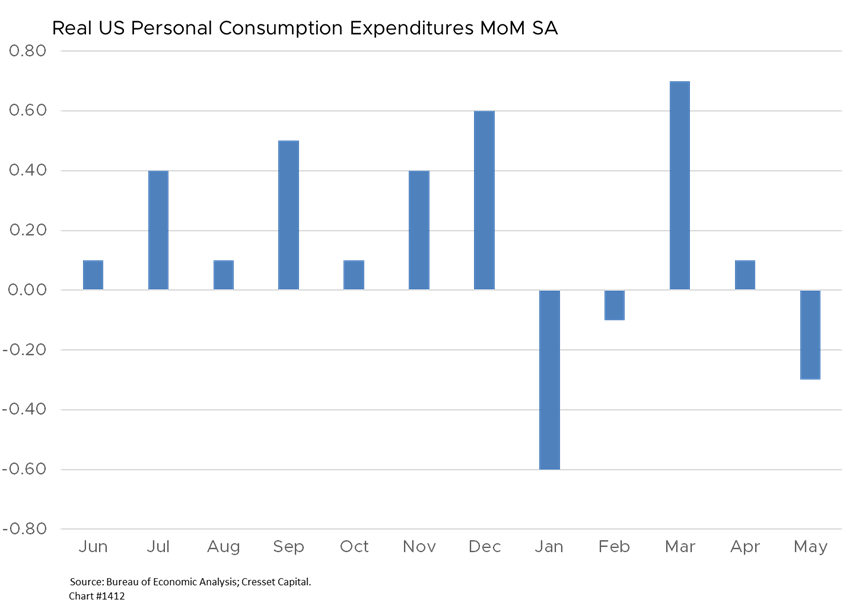

Consumer Spending and Earnings Reset

Consumer confidence remains well below December levels, but did rise in June as fears of worst-case scenarios diminished. However, consumer spending has weakened significantly, with inflation-adjusted consumption slipping 0.3% in May from April, leading analysts to expect earnings at S&P 500 Consumer Discretionary companies to slip 5.1% in the second quarter, down from a projected 2.2% gain at the end of March. S&P 500 earnings growth overall has been downgraded to 6.5% for the year from nearly twice that in January.

Winners and Laggards: Tech Rebounds, Discretionary Slips

Within the equity market, industries that were specifically targeted for tariff relief, like semiconductors, rebounded sharply in the second quarter, while food and beverage companies languished as investors grappled with the impact of tariffs on the consumer. NVIDIA, a Magnificent Seven semiconductor company, rallied 46% in the second quarter; with the exception of Apple, which faces notable tariff-related headwinds, all of the Magnificent Seven stocks rebounded meaningfully in the second quarter. That said, after a challenging first quarter, only three of the Magnificent Seven stocks were up in the first half of the year, with Tesla, Apple and Alphabet under water and Amazon flat.

Fixed Income: Higher Yields, Deeper Challenges

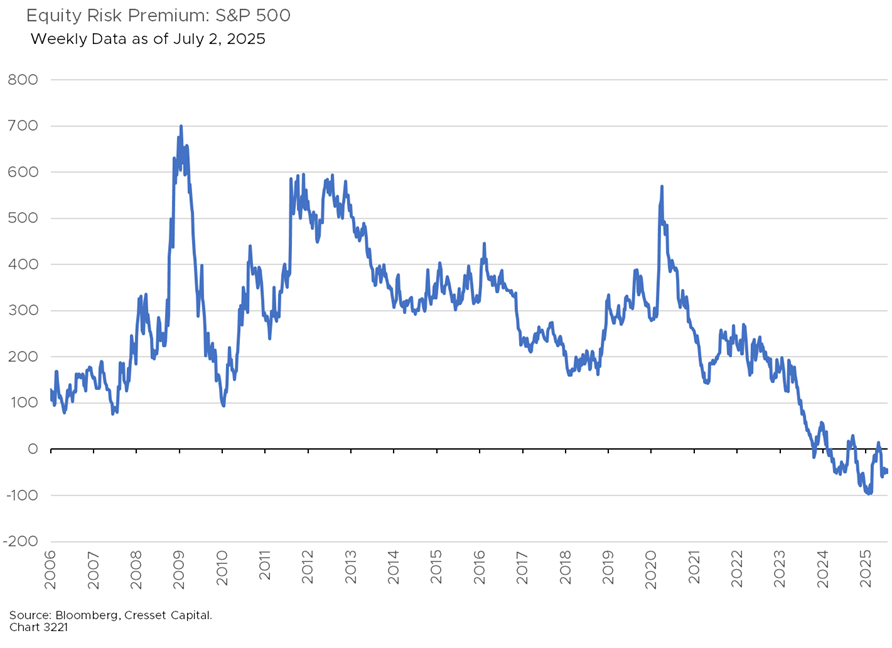

The bond market presents a complex picture in 2025. Despite bonds’ mediocre performance over the past decade, on average barely mustering 2% annual returns versus the S&P 500 Index’s 13% return, bonds are having a solid 2025, generating returns close to 4% through late June, almost in line with the S&P 500. The outlook appears favorable with the Federal Reserve poised to cut short-term rates by as much as half a percentage point before the end of the year and inflation running closer to 2%. It should be noted that the U.S. Treasury must refinance nearly $8 trillion of maturities this year on top of nearly $2 trillion of new issues.

Treasury yields around 4% represent significantly better rates than most of the last decade when the Federal Reserve held interest rates below fair value. The bond market, despite recent challenges, offers compelling opportunities in certain sectors. Municipal bonds, particularly single-A and double-A issues yielding 4.5-4.75%, provide tax-equivalent yields over 7% for high-tax-bracket investors. Agency mortgage-backed securities offer yields over 5.5% with high credit quality, preferred stocks yield 6% or more, and junk bonds yield 7%. Today’s yields offer a compelling alternative to U.S. large cap equities which are currently trading at extended valuations.

Debt Dynamics and Market Sentiment

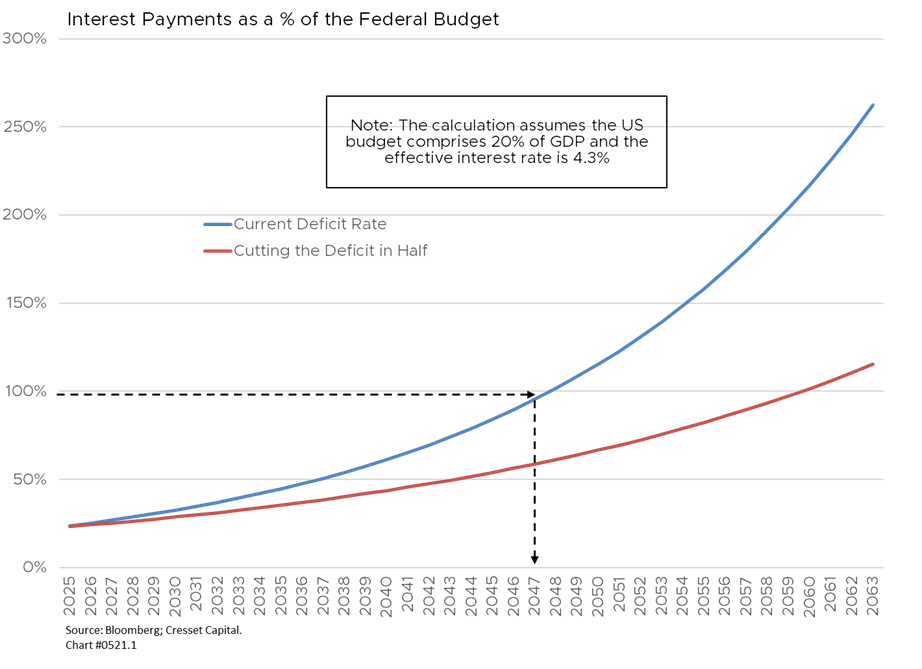

That said, investors concerned about America’s long-term fiscal imbalances are withdrawing capital from long-term U.S. bond funds at the swiftest rate since the height of the COVID-19 pandemic, with net outflows hitting nearly $11 billion in the second quarter. The Congressional Budget Office estimates the House version of the reconciliation bill would increase interest payments on federal debt by an average of $55 billion annually over the next decade, while the Senate bill could add $3.3 trillion to deficits by 2034.

The government is on pace to pay more than $1 trillion in interest to lenders in 2025, with debt service payments now exceeding military spending and roughly equaling Medicare’s annual cost. This represents a fundamental shift in federal spending priorities, with debt service consuming government resources that could otherwise fund infrastructure, education, or other priorities.

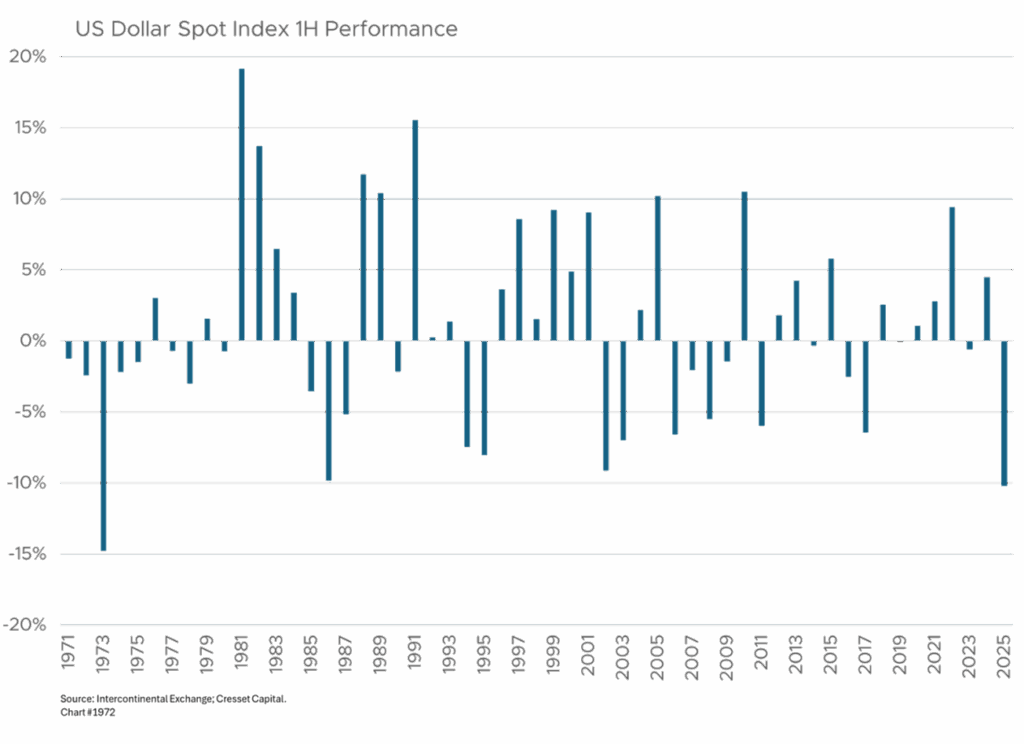

Dollar Weakness Reshapes Global Positioning

This has led to the U.S. dollar experiencing its worst first half since 1973, declining more than 10% against a basket of major currencies. This dramatic weakening reflects concerns about erratic trade policies, rising debt levels, and questions about Federal Reserve independence. The Euro has risen 13% to above $1.17, confounding predictions that it would fall to parity with the dollar this year.

International markets are benefiting from dollar weakness, with European stocks outperforming U.S. markets year-to-date. In the first quarter in particular, a weakening U.S. dollar and questions on the prospects for the U.S. economy resulted in investors rotating into international markets, which featured well-capitalized companies trading at attractive valuations.

Outlook: Key Risks and Strategic Implications

The remainder of 2025 faces several key challenges with many already upon us: Trump’s July 9 deadline for new trade deals, the progression of his tax legislation through Congress, upcoming earnings season in July, and the Federal Reserve’s monetary policy decisions as the year progresses. While markets have shown resilience, underlying economic fundamentals suggest continued volatility as policy uncertainty persists and structural fiscal challenges mount.

Bottom Line:

The economy and market system are in transition, with investors balancing recovery optimism and fundamental concerns about debt sustainability, trade policy effectiveness, and long-term competitiveness in an increasingly complex global environment. Given the current environment, we recommend defensive positioning, with a particular tilt toward dividend-paying stocks and international diversification.