Key Observations

- Ambitious “90 deals in 90 days” goal has fallen short of expectations

- Tariff uncertainty having chilling effect on capex, onshoring, private equity deals

- U.S. equities resilient despite tariff tensions, but currency markets more sensitive

- Tariffs pressuring U.S. consumer prices and industries such as autos

- Biggest uncertainties for pharma, semiconductors, lumber . . . and China

President Trump has launched an aggressive tariff campaign as part of his broader trade war strategy, with multiple threats and approaching deadlines creating significant uncertainty in global markets. The administration initially announced sweeping “reciprocal” tariffs on April 2, 2025, followed by a 90-day pause that expires July 9, 2025. However, Trump has now extended the timeline to August 1, giving countries additional negotiating room. Uncertainties abound, and are having an impact on capex, onshoring, and private equity deal-making.

The U.S.’ average effective tariff rate now stands at 15.8 per cent, its highest level since 1936 and an increase of over 13 percentage points since the beginning of Trump’s term. Specifically, Trump threatened to impose an additional 10 per cent tariff on any country aligning with the BRICS nations’ “Anti-American policies,” and doubled steel tariffs to 50% in June, which affects the EU, Japan, and Canada.

Ambitious “90 Deals in 90 Days” Goal Has Fallen Short of Expectations

Only two preliminary agreements have emerged. The United Kingdom was the first country to reach a deal in May, though details remain unclear and subject to revision. Britain still faces 10% tariffs and must comply with restrictions on Chinese supply chain involvement. Second, Vietnam recently agreed to 20% tariffs plus additional 40% duties on transshipped goods to combat Chinese circumvention.

Other trading partners like the EU, Japan, Canada, and India remain in negotiations. Germany’s Chancellor Merz warned that “time is running out,” while EU officials report progress but uncertainty about final terms.

Tariff Uncertainty Has Chilling Effect on Capex, Onshoring, Private Equity Deals

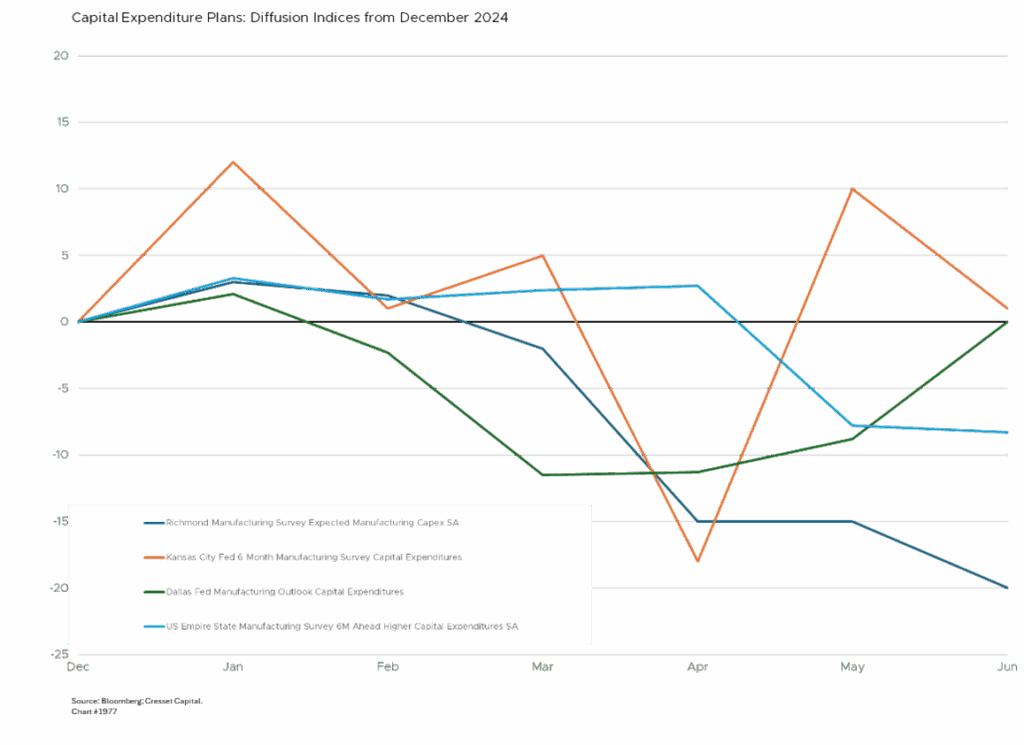

Private equity firms are holding approximately $1 trillion in assets that could have been redeployed if planned exits hadn’t stalled. A recent PwC survey found 30% of dealmakers are pausing or revising transactions due to tariff uncertainty. Planned capital expenditure surveys paint a mixed picture, with the Richmond and Empire State surveys showing sizable reductions in spending plans while Dallas and Kansas City showing slight improvements, perhaps related to energy production.

Rather than reshoring production, companies are taking a “wait-and-see” approach. While 80% of chief operating officers plan to increase supply chain onshoring over three years, only 2% have successfully completed such plans. The complexity of relocating production, especially for regulated industries like pharmaceuticals, makes immediate factory relocations unlikely even with high tariffs.

Tariffs Pressure U.S. Consumer Prices and Industries Such as Autos

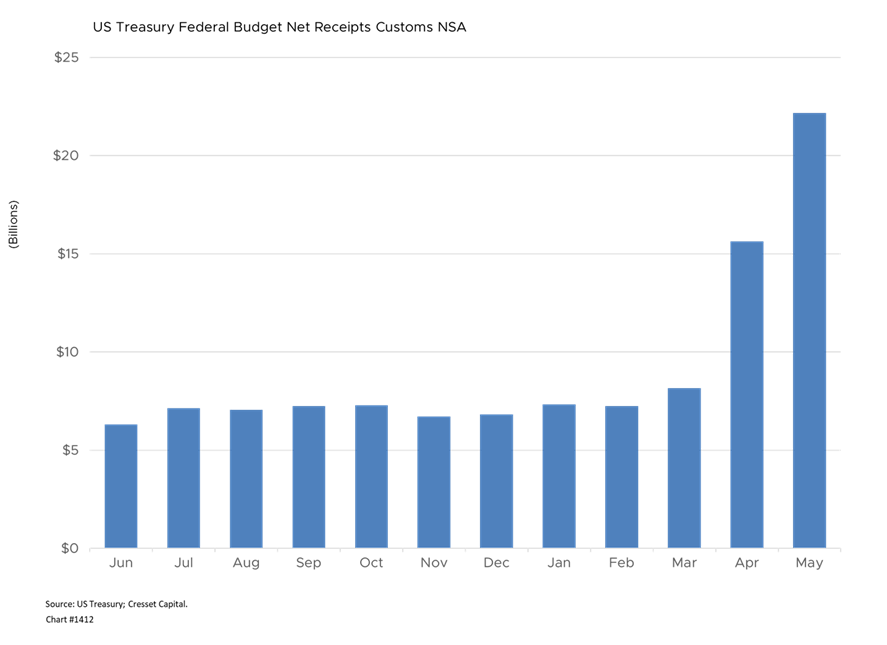

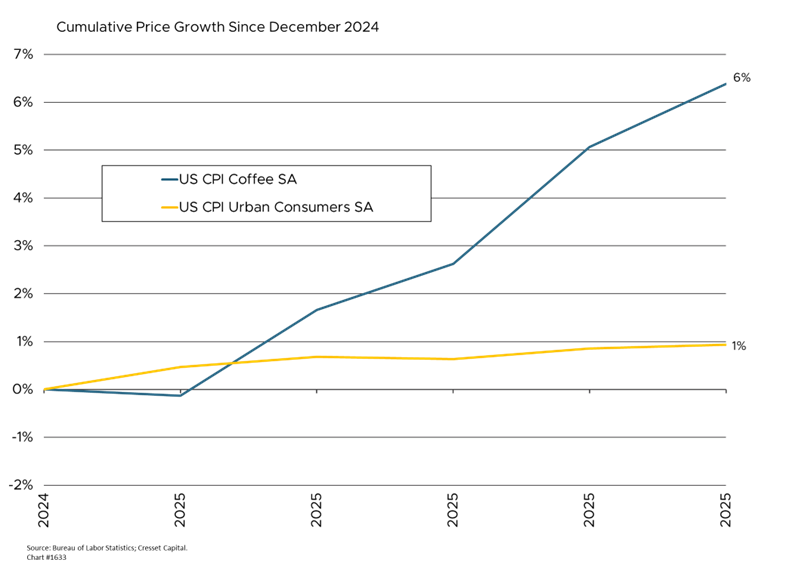

Analysts estimate that tariffs have raised American consumer prices by approximately 0.2 percentage points. Some categories face extreme burdens. Electric personal-care appliances from China hit 59 per cent effective rates in late April. Offsetting the impact to consumers, U.S. tariff revenue surged almost fourfold to a record $24.2 billion in May, while Chinese imports fell 43 per cent over the last 12 months.

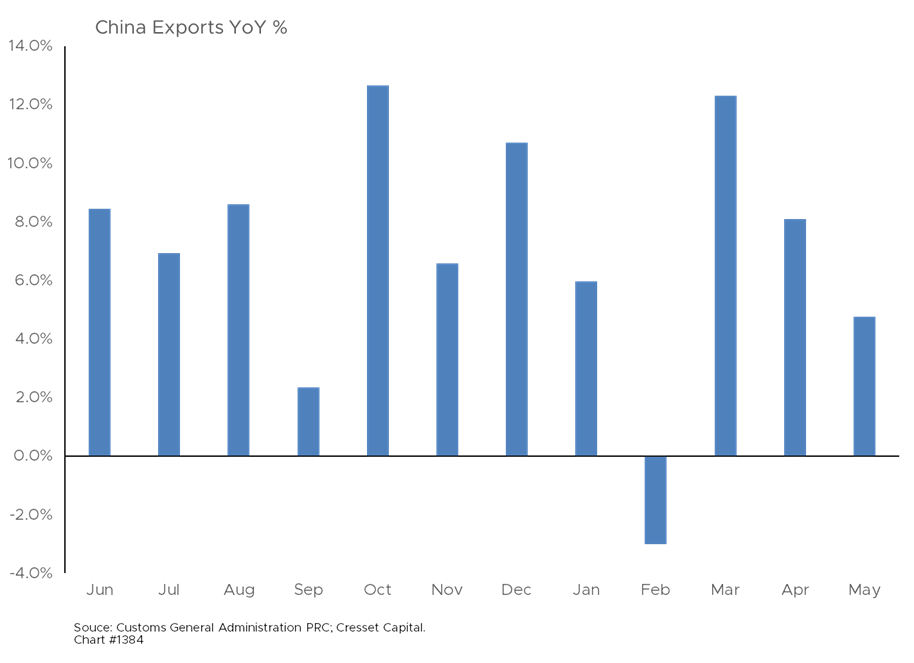

Notwithstanding sharp drops in U.S.-China trade, China’s overall exports are up 4.8 per cent year over year as the country redirects trade flows to other regions including Africa, Canada, ASEAN countries, and India.

The automotive industry has been caught in the tariff tiff crosshairs, and Mercedes-Benz exemplifies the industry’s challenges. The company reported global sales falling nine per cent in Q2, with U.S. revenues down 12 per cent and Chinese sales plunging 19 per cent as the company’s Alabama-built SUVs face both U.S. tariffs on Chinese goods and Beijing’s retaliatory 10 per cent levy on American-made vehicles. Mercedes’ EV sales declined 24 per cent, highlighting broader Western automaker struggles in China’s BYD-dominated electric vehicle market.

U.S. Equities Resilient Despite Tariff Tensions, but Currency Markets More Sensitive

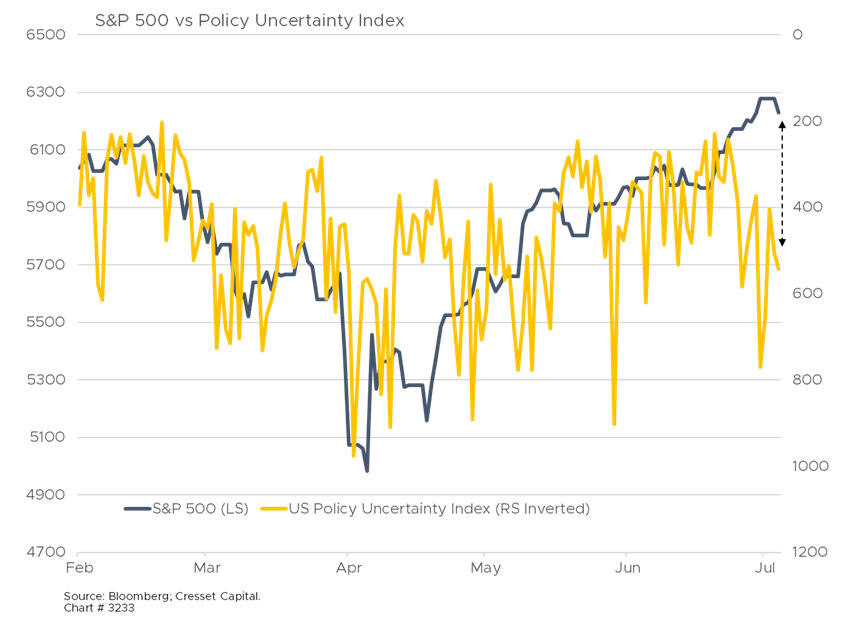

Despite the trade tensions, U.S. equity markets have shown resilience, with the S&P 500 hitting new highs as investors downplay trade risks after several instances of administration pullbacks. While the S&P traded in tandem with U.S. policy uncertainty through April, since the beginning of May equity investors have shrugged off troubling tariff news.

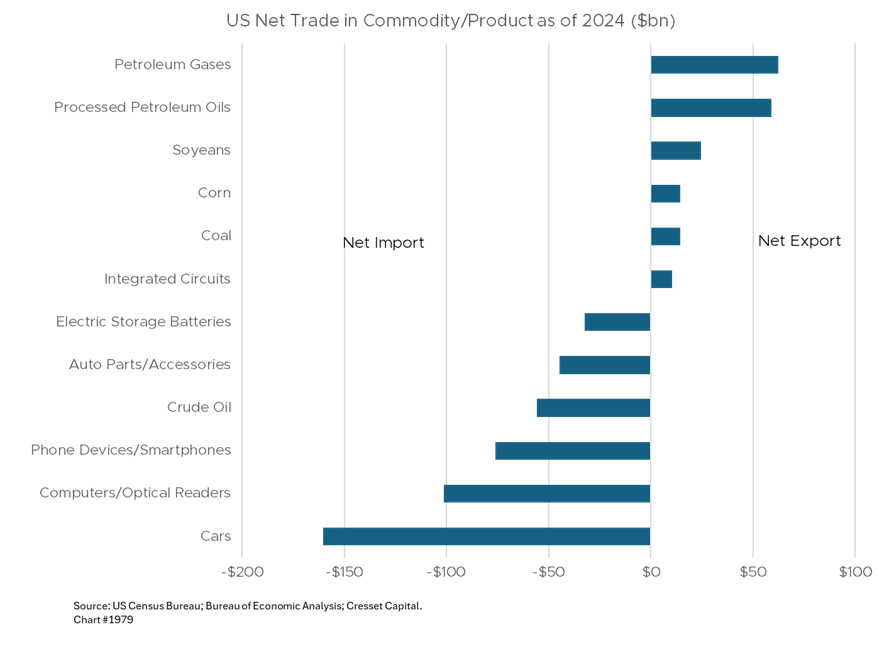

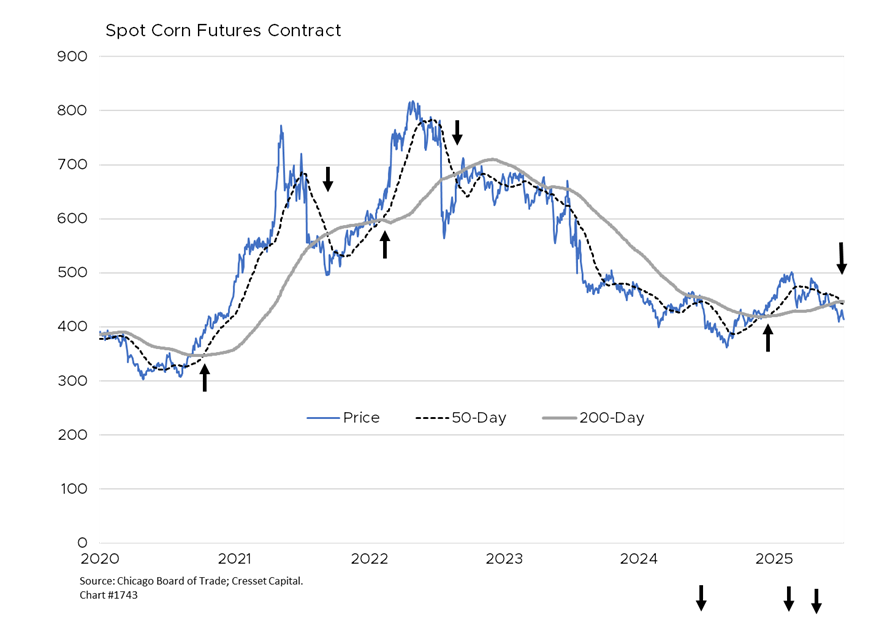

Currency markets have reacted more dramatically. The dollar has rebounded 0.5 per cent against major currencies in recent days, while the Australian and New Zealand dollars fell roughly one per cent due to their strong China trade relationships. However, the greenback is off to its worst start to the year in 50 years, as tariffs tend to raise prices on importers and foment disinflation among exports. The United States is the world’s largest exporter of corn, and prices fell below $4/bushel for the first time since October as farmers struggle with unsold exports.

Biggest Uncertainties for Pharma, Semiconductors, Lumber . . . and China

Looking ahead, ongoing tariff negotiations pose the biggest uncertainties to several industries: pharmaceuticals, as Ireland is a manufacturing hub; semiconductors, sourcing from Taiwan and South Korea; and lumber, affecting Canada. These industry-specific duties complicate bilateral negotiations as they target core economic sectors of major trading partners.

Meanwhile, the U.S.-China trade relationship remains tenuous, with unresolved structural issues. While China reclassified fentanyl precursors as illegal, potentially reducing some tariffs, the White House has maintained export controls on advanced chips and other technology. Trump’s planned September visit to China following Xi Jinping’s invitation could de-escalate tensions.

The World Bank and OECD have downgraded their global growth forecasts due in large part to escalating tariffs. Already, price impacts can be seen in toys, bananas, coffee and some large electrical appliances. Steel tariffs are raising costs on U.S. manufacturers and consumers, while offering domestic steel producers an opportunity to raise their prices in tandem.

Bottom Line:

Trade tariffs are, in effect, a consumption tax that tends to put downward pressure on growth and upward pressure on the prices of imported goods. Higher input costs will tend to crimp profit margins with increased tax collections providing an incremental offset. Exporters will feel deflation pressure as inventories mount. Here at home, we expect higher prices for automobiles and smart phones and lower prices on agricultural commodities, like corn, soybeans and natural gas.