By Jack Ablin, Chief Investment Officer. Subscribe for weekly market updates.

Key Observations:

- Downgrade didn’t perturb investors, but does weigh on current budget negotiations

- Proposed tax cut extensions important rationale for Moody’s downgrade

- We believe the debt load can’t be reduced without budget surpluses

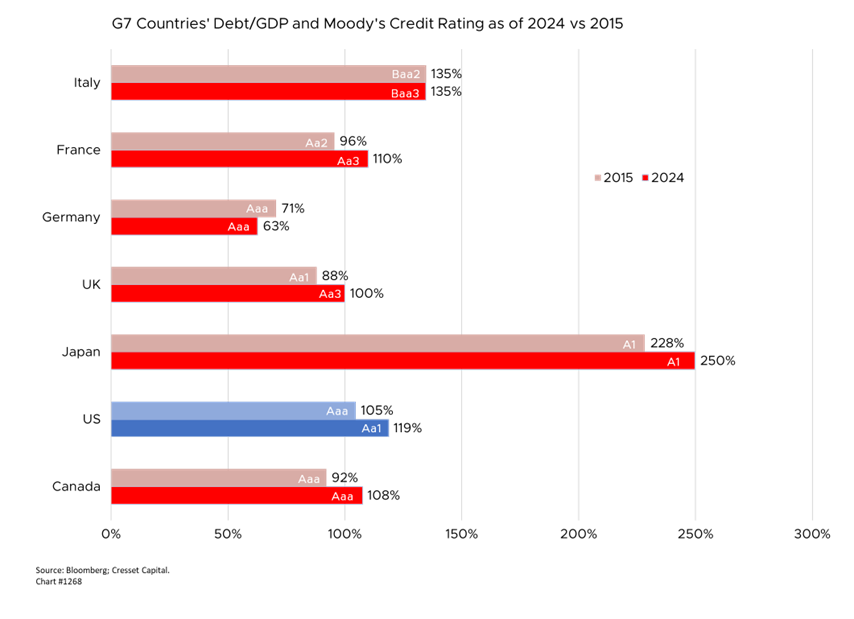

Moody’s has downgraded the United States’ credit rating from Aaa to Aa1, removing America’s last top-tier rating among the three major credit rating agencies. Similar downgrades were made by S&P in 2011 and Fitch in 2023. Among the top developed nations only Germany and Canada hold a Moody’s Aaa rating.

The company cited persistent large fiscal deficits and a growing debt burden as its primary reason behind the move. It also pointed to rising interest costs on government debt and the failure of successive administrations and Congress to address fiscal imbalances. Moody’s also highlighted projected worsening deficits as anticipated entitlement spending increases.

Proposed Tax Cut Extensions Important Rationale for Downgrade

The downgrade comes as the Trump administration is pushing for extensions to the 2017 tax cuts, which, according to the Committee for a Responsible Federal Budget (CRFB), could add $3-4 trillion to deficits over the next decade. Moody’s specifically mentioned these proposed tax extensions in its downgrade rationale, stating it doesn’t believe “material multi-year reductions in mandatory spending and deficits will result from current fiscal proposals.”

Downgrade no Surprise, Markets Not Perturbed

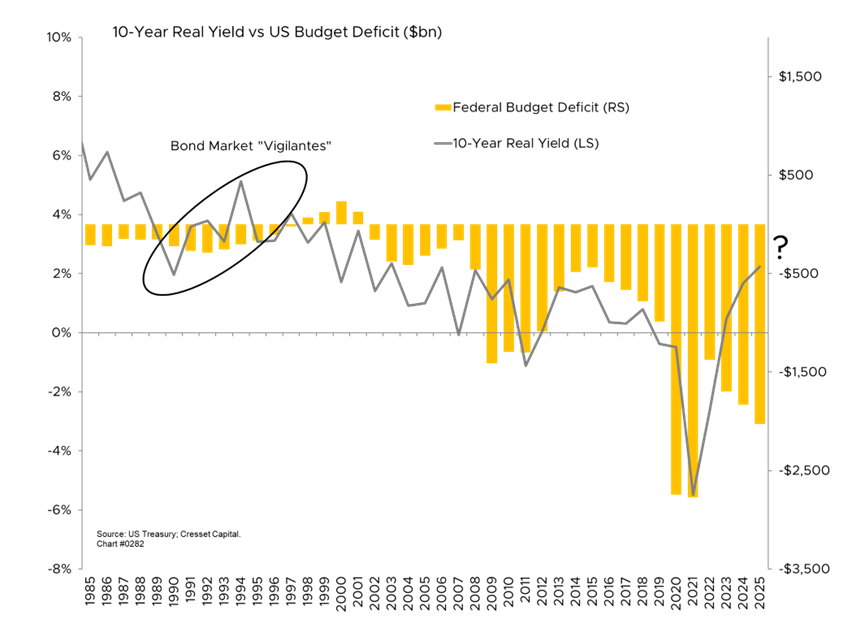

Notwithstanding the obtruding headline, the market reaction was muted, largely because the downgrade wasn’t a big surprise since S&P and Fitch had already knocked the US off its triple-A perch years ago with minimal market impact. Institutions modified their investment mandates after previous downgrades to allow continued holding of US debt, while bank regulators conveniently no longer differentiate between Aaa and Aa1 ratings when setting capital risk weights. For now, US debt remains the bedrock of the global financial system. But the Moody’s move represents a crack in that foundation.

Downgrade Doesn’t Negate Real US Strengths

Despite the downgrade, the US possesses significant economic strengths, including the dollar’s position as the global reserve currency. Nearly 90 per cent of global trade is transacted in US dollars. The US is the world’s largest economy, fueled by a diverse array of industries, from technological and medical innovation to leading food and energy production. The Federal Reserve, the world’s preeminent central bank, still commands effective monetary policy and independence.

Downgrade Does Weigh on Current Budget Negotiations

Despite investor insouciance, the country’s credit standing will weigh on lawmakers as they negotiate the current budget bill. According to initial Congressional Budget Office (CBO) estimates, the proposed package – which spans over one thousand pages – would increase budget deficits by about $3 trillion from 2025 through 2034. This would transpire via cutting taxes by approximately $4 trillion instead of letting current cuts expire, while generating about $1.6 trillion in spending reductions through changes to Medicaid, nutrition assistance and student loans. Proponents justify the plan by claiming economic growth will fill the deficit gap, but their projections appear overly optimistic.

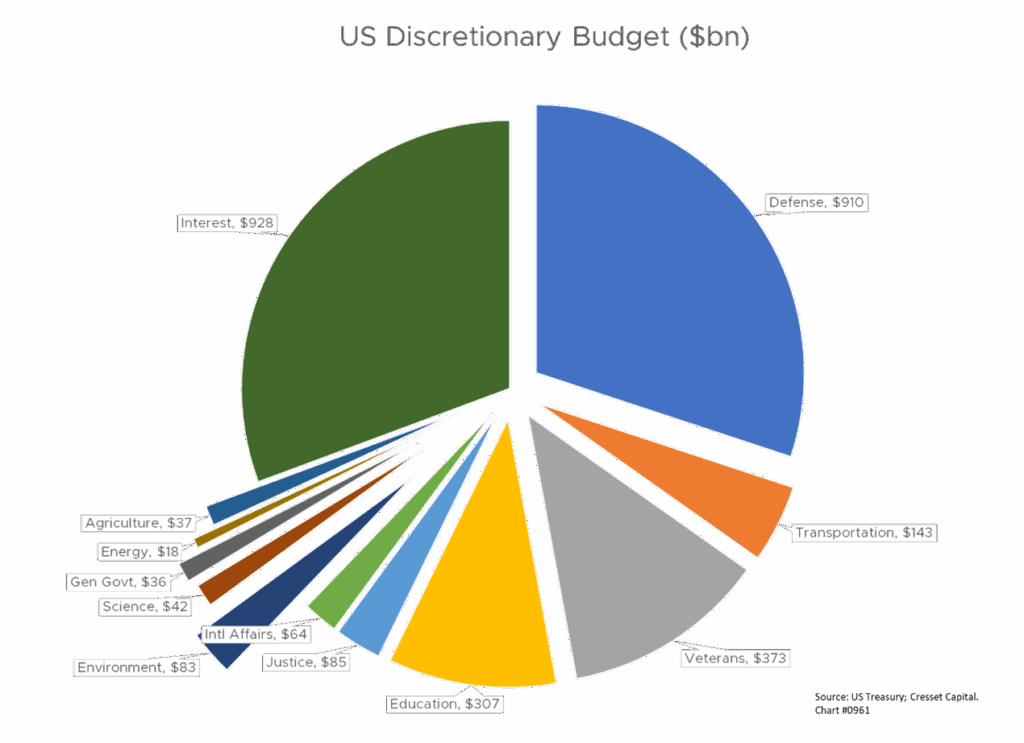

The CRFB warns the projected deficit increase likely underestimates the actual impact. A small group of Republican budget hawks, alarmed by the Moody’s downgrade, are arguing for deeper spending cuts. Tax collections last year represented about 17 per cent of GDP and spending accounted for 23 per cent of output, resulting in a $1.8 trillion deficit. History suggests that tax collections could rise to 20 per cent of GDP, or by about $900 billion, without creating disincentives. However, spending must be reined in by about $900 billion, or about 30 per cent of discretionary spending, to meet in the middle. That’s equivalent to what we spend on interest and defense.

Bottom Line:

Lawmakers must take action to begin to rectify the US fiscal imbalance. US Treasury debt stands at $37 trillion and interest payments consume nearly 15 per cent of federal spending, eclipsing defense expenditures. Assuming Treasury borrowing rates match nominal GDP, we conclude the US will not be able to shrink its debt load without budget surpluses. We estimate that the debt-to-GDP will rise to 250 per cent by 2034 if lawmakers do nothing. The Moody’s downgrade represents a significant symbolic shift in our fiscal standing. While most experts believe its immediate practical effects will be contained, it serves as a stark warning about America’s long-term fiscal trajectory unless meaningful budget reforms are implemented. Without them, US investors should brace for higher real interest rates and a weaker dollar, suggesting global portfolio diversification.