Key Observations

- Q1 earnings growth reached 12.8%, exceeding expectations.

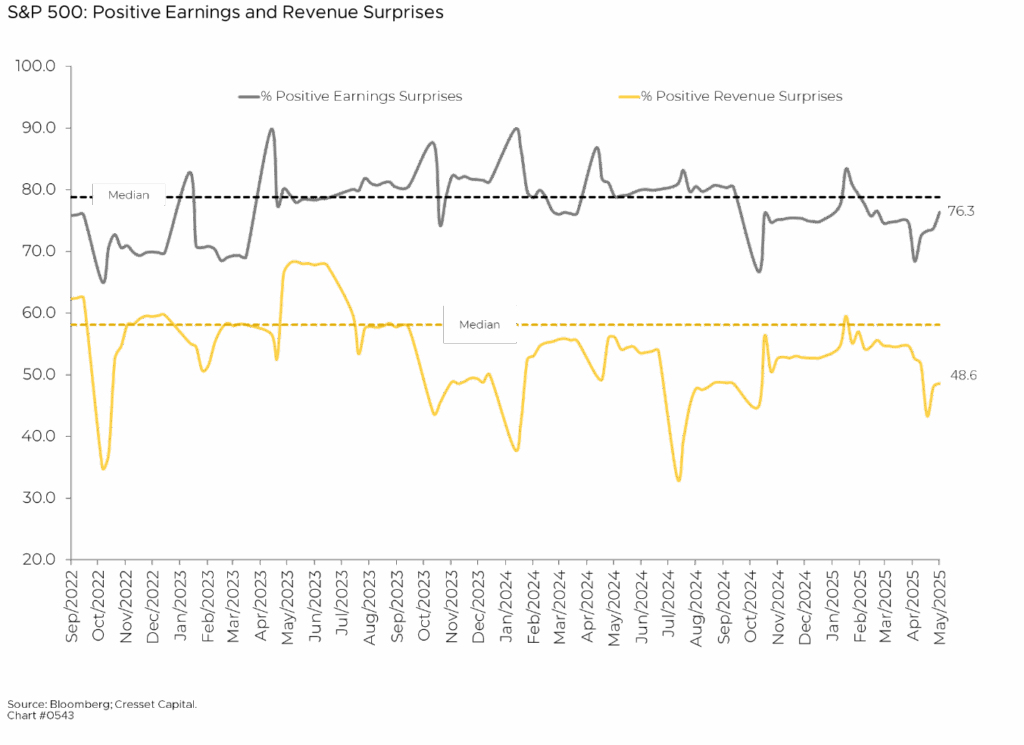

- Sales surprises were less impressive, with the highest miss rate since 2020.

- Cautious management guidance points to rising trade and tariff uncertainty.

- Valuations remain elevated, with the S&P 500 trading ~15% above fair value.

The S&P 500 Index has shown remarkable resilience against a backdrop of market volatility and economic uncertainty in the aftermath of the April 2nd (“Liberation Day”) tariff announcements. After initially dropping sharply, the market clawed its way back, with the S&P 500 down just 3.5% year-to-date through the close on May 5th, bolstered by a nine-day winning streak, its longest since 2004.

The first-quarter earnings season has demonstrated stronger-than-expected performance. Of the 358 companies in the S&P 500 that have reported first-quarter earnings thus far, year-over-year earnings growth has reached 12.8%, substantially above the 7.2% projected at the quarter’s end. More than three-quarters of these companies beat earnings per share (EPS) expectations, only slightly below the index’s historical median. The blended first-quarter revenue growth rate reported thus far is 4.8%, slightly above pre-season expectations of 4.4%. Despite these positive headlines, beneath these numbers lie concerning trends: only 48% of companies have beaten sales estimates versus a longer-term median of 58.1%, while 32% have reported lower-than-expected sales results, the highest miss rate since the first quarter of 2020.

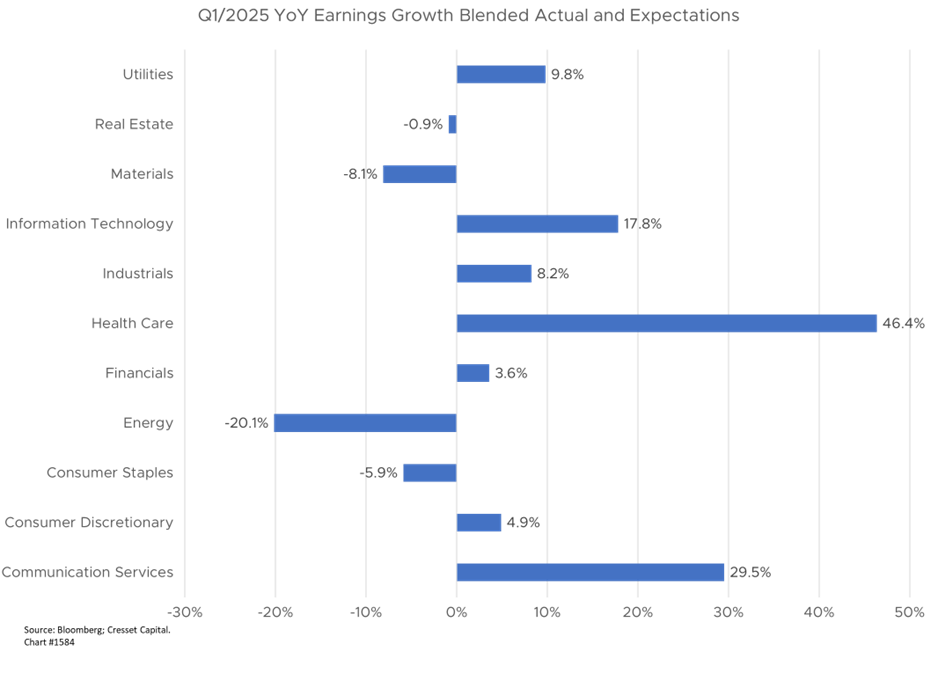

Sector Standouts and Struggles

The strengths and weaknesses in the quarter varied across sectors. Year-over-year earnings grew 46% for Healthcare, rose 20% in Communication Services, and advanced 17% in Information Technology. In contrast, the Energy, Consumer Staples, and Materials sectors experienced profit contractions. Energy suffered a 20% pullback in profit growth, driven by weaker crude oil prices, which fell by $5 from $75 to $70 per barrel during the quarter.

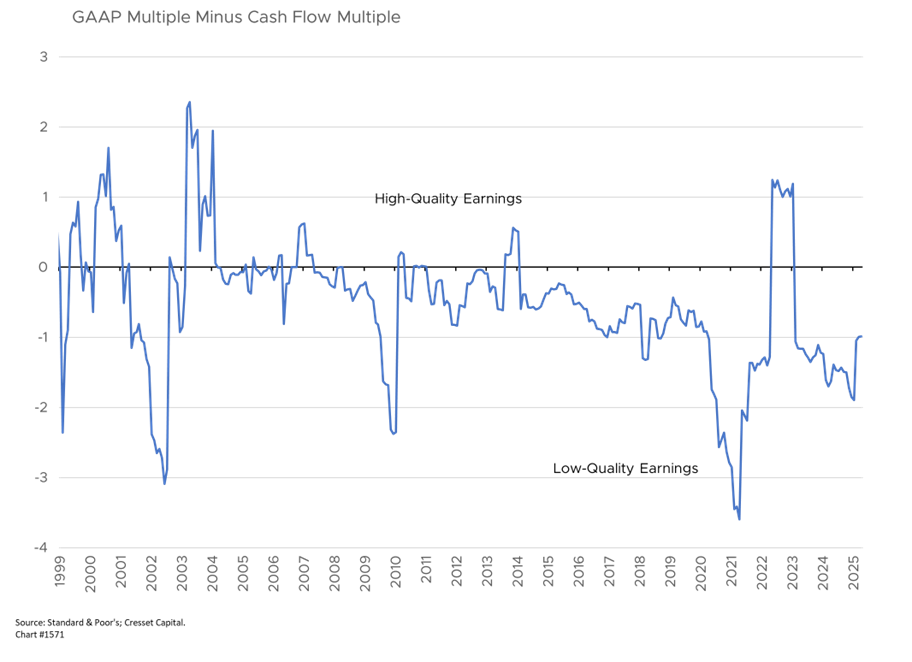

Earnings Quality: Emerging Concerns

Heightening our concern about the sustainability of earnings growth over the next year, fewer S&P 500 companies improved their accounting quality this quarter compared to previous periods. Accounting quality, defined as the alignment between reported earnings and cash flow, was especially weak among companies beating earnings forecasts, according to Bloomberg Intelligence. Only 34% of companies that exceeded EPS estimates also managed to improve accounting quality, down from 44% in the previous quarter. This signals that companies may be using more aggressive accounting techniques to support positive earnings surprises. Comparing companies’ GAAP multiple to their cash flow multiple suggests earnings quality has been steadily deteriorating over the last decade.

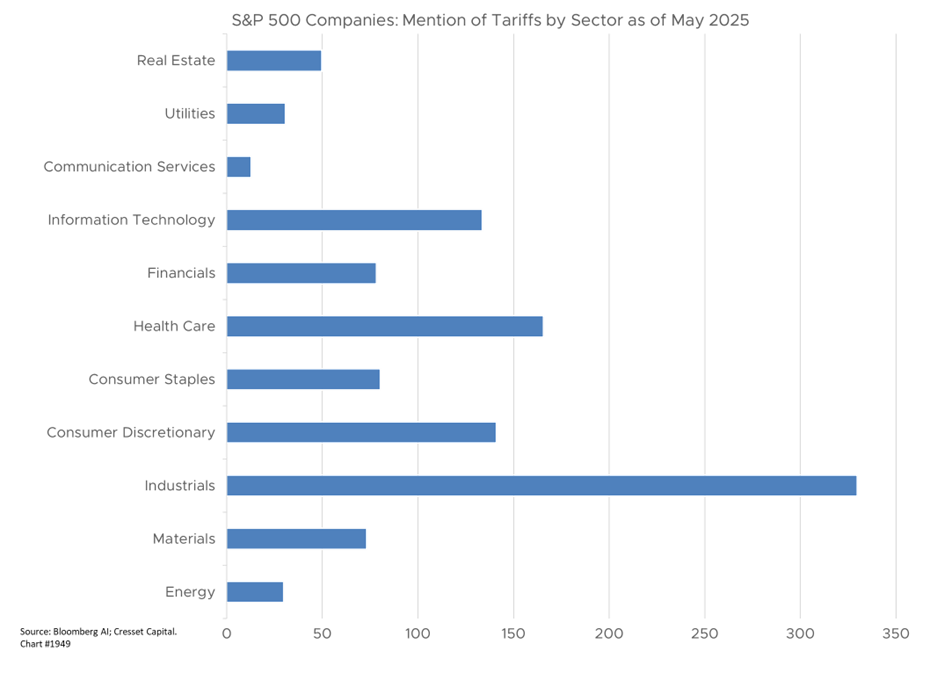

Management Guidance: Navigating Trade Uncertainty

Investors have largely shrugged off first-quarter earnings as yesterday’s news. Forward guidance, meanwhile, against a backdrop of trade uncertainty, is paramount. Not surprisingly, management guidance has been notably cautious, with industries like autos and airlines withdrawing their forward guidance altogether. A record-high 38% of S&P 500 companies have issued negative EPS guidance, while only 15% have provided positive guidance, representing the largest negative spread in records dating back to the financial crisis, according to Bloomberg.

Many companies are specifically addressing tariff impacts, with 51 S&P 500 companies issuing statements about 2025 earnings related to tariffs. Nine companies have used phrases like “not reaffirm,” or “reaffirm excluding tariffs,” in their guidance, reflecting the uncertainty. There have been more than 1,100 mentions of tariffs in company transcripts over the last three months, with more than a quarter concentrated among industrial companies, a sector most directly affected by trade tariffs.

Market Reactions and Investor Sentiment

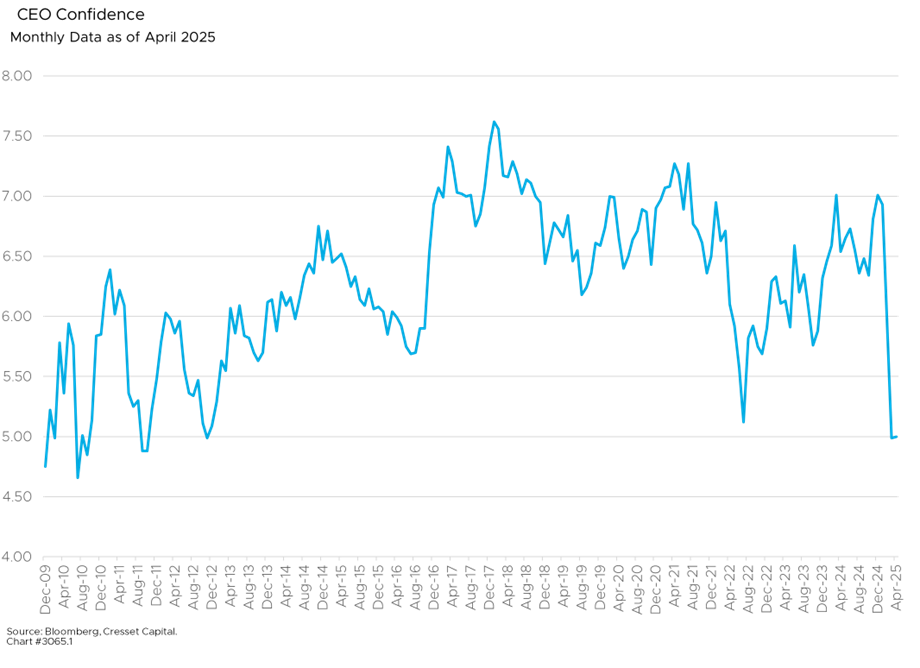

As reflected by the CEO Confidence Index, company management sentiment on earnings calls has shown the largest quarter-over-quarter drop since Russia’s invasion of Ukraine, highlighting growing concerns about trade tensions. Stock market reactions to earnings have been particularly severe for companies missing expectations, with those missing EPS forecasts seeing an average 4.28% relative decline, its worst average reaction since 2017.

Looking Ahead: Market Expectations

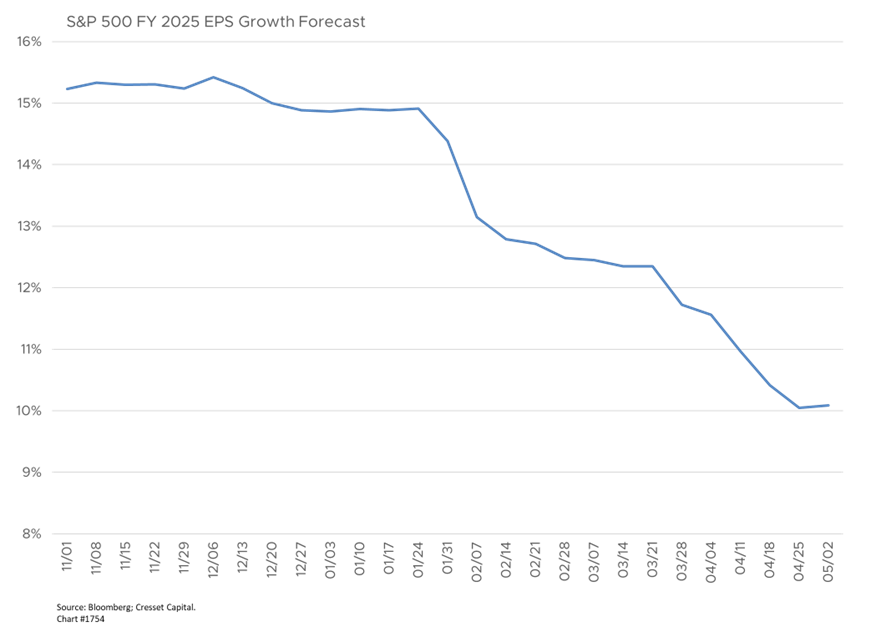

Nonetheless, full-year 2025 projections remain surprisingly sanguine, with earnings growth of 10.1% and revenue growth of 5.0%. While 2025 full-year estimates have fallen from 15% growth at the beginning of the year, profit growth expectations have only slipped between one and two percentage points since tariffs were announced in April. We believe this lack of movement is due to the uncertainty around any trade deals that may be made during the 90-day negotiation window, which will close in late July. We expect profit growth expectations to shrink further if tariffs remain in place.

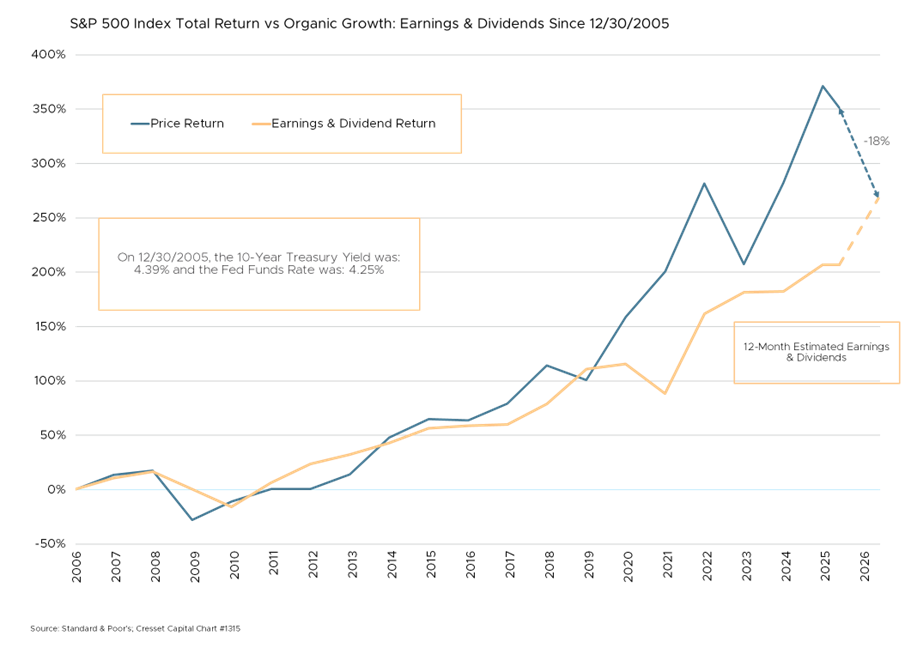

From a valuation perspective, despite the modest negative return in the market this year, the forward 12-month P/E ratio for the S&P 500 remains elevated at 20.2x, which is above both its 5-year average (19.9x) and its 10-year average (18.3x). The S&P 500’s net profit margin for Q1 2025 was 12.7%, modestly higher than the previous quarter’s 12.6% and the year-ago figure of 11.8%. Putting it all together, we believe the S&P 500 remains more than 15% above fair value, assuming investors’ expectations for profit growth are met this year.

Bottom Line:

While first-quarter earnings have broadly exceeded expectations, significant concerns remain about future growth amid trade uncertainty. The divergence between positive current results and cautious forward guidance underscores the market’s precarious position as it navigates the potential economic impact of tariffs in coming quarters. Given the recency of the trade tariff announcement, there’s little hard economic data to digest. We will be looking for these economic data points in the coming months to offer more clues. In the meantime, uncertainty calls for diversification. Not all markets are as expensive as U.S. large caps.