Family Office Guide / Exit Planning

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.

19 minute read

As a high- or ultra-high-net-worth individual, entrepreneur, or owner of a privately held business, at some point you have likely asked yourself, “should I sell my business, and what is the best way to do so?” Whether you are considering retirement, passing your business to the next generation, or selling the business to maximize value, planning is necessary to ensure a smooth and successful transition. Effective business exit planning is more than just knowing when to leave; it requires a comprehensive strategy that aligns with your long-term goals and prioritizes the successful future of the business.

This guide will walk you through the essential concepts of exit planning, including how to successfully plan for selling a business and how to build the right team to help you along the way. By defining terms and exploring strategies, we will help you prepare for a successful business exit, whether your goal is selling the business or transferring ownership.

In essence, exit planning consists of preparing both yourself and your business for a smooth transition of ownership, which could involve selling the business, passing it down to heirs, liquidation, or other exit strategies. Business exit planning aims to not only maximize the value of the business at the time of exit, but also to make sure that the transition aligns with your financial goals. Effective exit planning may require professional assistance since developing a strategic exit plan will require a strong understanding of tax implications, legal considerations, and financial structuring.

Below, we’ll define some commonly used terms. While these tend to be used synonymously, we will help you understand the nuances of each.

An exit strategy is a critical component of exit planning that outlines the specific steps and decisions required for a successful business departure. Consider it a roadmap that details the specific exit method, whether through sale, merger, or succession.

While the terms “exit planning” and “exit strategy” are often used interchangeably, these terms refer to related but distinct concepts. Exit planning encompasses the entire process of preparing for a business exit, including initial goal-setting and post-exit considerations. In contrast, a business exit strategy is just one aspect of the comprehensive exit planning process. It specifies how the exit will be carried out. One way to consider these terms is that exit planning is the overarching blueprint, while the exit strategy is the detailed construction plan that brings the blueprint to life.

Liquidity planning, exit strategy, and pre-transaction planning, which we will cover next, are all synonymous in many ways. However, liquidity planning generally refers to making sure that sufficient cash or easily convertible assets are available to facilitate a smooth exit. Liquidity planning may involve strategies to free up capital within the business and ensure that the owner has access to sufficient funds post-exit. Liquidity planning is necessary to succeed in exit planning because you will need to have resources available to manage any unexpected challenges that may arise during the exit process.

While it does essentially share a definition with liquidity planning and exit planning, pre-transaction planning frequently refers to the process of preparing the business for sale or transfer well before the transition takes place. Key pre-transaction activities include conducting thorough financial audits, implementing operational improvements, legal structuring, and any other actions to enhance the value of the business and its attractiveness to buyers or successors. Like liquidity planning, pre-transaction planning makes sure that the business is positioned favorably for a successful exit.

While exit planning strategies will be distinct to your business and situation, a typical exit plan involves certain key steps that begin with having a clear understanding of your goals and objectives. Are you aiming to maximize financial returns? Ensure the business is successful long-term? Or are you looking to smoothly transition ownership to an heir? Once your goals are established, you will need to define an exit plan with strategies tailored to achieve them.

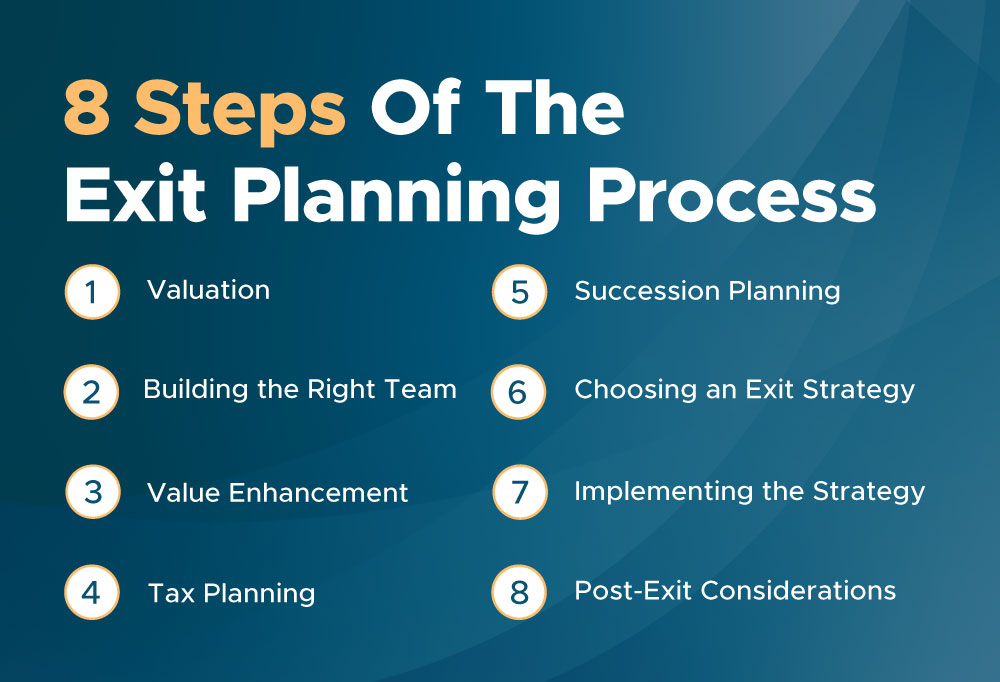

The exit planning process typically begins with a comprehensive evaluation of the current state of the business, including its overall financial health, market position, and operational efficiency. From there, the process involves the following steps:

These are broad steps, and each can be broken down even further. While they may seem daunting, establishing the right team will go a long way towards simplifying and optimizing the process.

Assembling the right team is critical to achieving a successful business exit and may be the most important step in the exit planning process. Your team should consist of trusted financial advisors, tax professionals, legal experts, and business consultants. An exit planning advisor serves as a single point of contact as you navigate the intricacies of exit planning and will help you and your team make sure that every facet is managed with precision and expertise. For high- and ultra-high-net-worth individuals, you may want to consider partnering with a family office, as they provide a comprehensive suite of services that integrate all aspects of the exit process, from the initial planning phase to final execution.

As discussed above, exit strategies are the specific approaches you can take to leave your business. They will vary depending on your goals, the nature of your business, and the broader market environment. When choosing a strategy, personal and financial objectives must be prioritized so that the exit maximizes value for you and minimizes potential risks. Strategic moves such as tax optimization, estate structuring, and legacy planning may come into play depending on your goals – whether they include structuring your legacy, ensuring a smooth transition, or maximizing financial returns.

The strategies and end goals will differ for everyone. For some, passing the business down to the next generation may be the top priority, while others may seek to sell the business at peak value to diversify their assets or focus on philanthropy. Understanding these nuances and your own goals is crucial for crafting an exit strategy that is tailored to your unique aspirations.

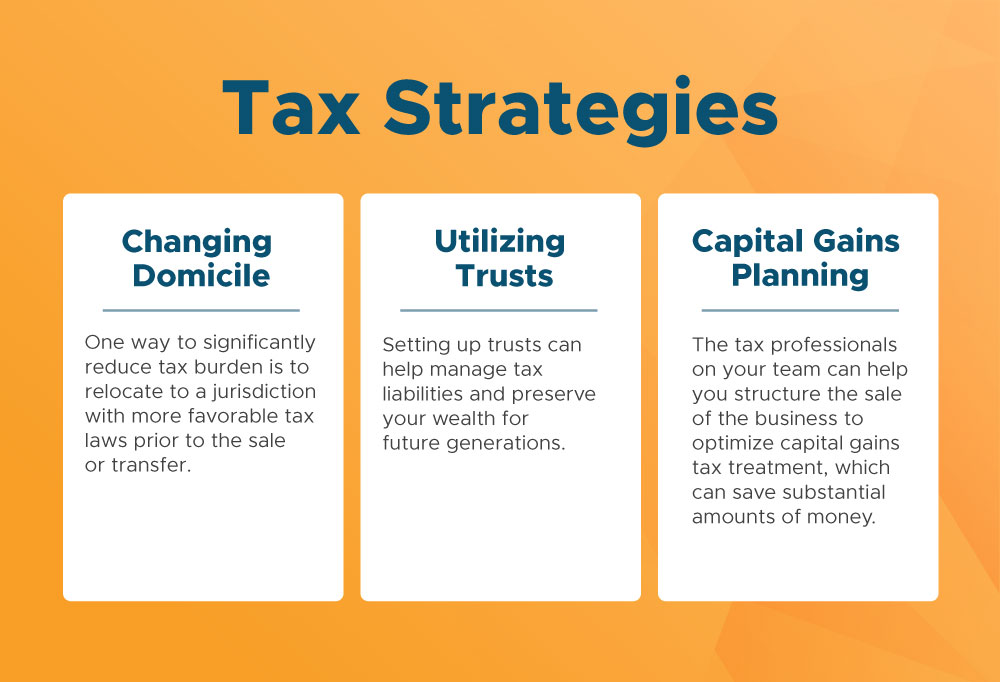

The way an exit is structured can have significant tax implications, which means tax strategies play a critical role in successful exit planning. Some common tax strategies include:

Structuring your estate is a critical element of estate planning, particularly for individuals with high- or ultra-high-net-worth. The process involves organizing your assets – including any businesses – in a manner that aligns with long-term objectives. You will want to structure your estate before selling your business, as timing will have a major impact on the size of your estate. Given the complexities associated with large estates, consulting experts with a deep understanding of the intricacies of estate structuring will help safeguard your assets and efficiently transfer them to the next generation.

Naturally, exit strategies are going to be as varied as the business owners employing them. Still, for illustration purposes, let’s look at a basic exit strategy example. In this case, a business owner is looking to sell their business to a strategic buyer, with the goal of maximizing the sale price and minimizing tax liabilities. Their exit plan might include the following steps:

In this example, the business owner utilized a team of experts to craft and execute an exit strategy that successfully supported their personal and financial goals.

Perhaps you are already a successful entrepreneur with a mind for business. In that case, you may be wondering if it is worth it to employ a team, or if you can efficiently plan your exit on your own. However, selling a business is a multifaceted process that goes beyond simply finding a buyer. Instead, it involves a series of complex steps, each requiring in-depth knowledge and careful execution. For anyone selling a business, but especially UHNW individuals, enlisting professional advice is crucial for navigating these waters successfully. From valuation to negotiation, tax planning, legal considerations, and transitioning post-exit, a team of professionals can help guide you to make the right choices to achieve your goals.

A family office’s comprehensive, integrated solutions could be invaluable in supporting your exit plan. Leveraging the expertise of an exit planning advisor within the family office can help guide you and your family through the complex exit planning process. The exit planning advisor collaborates with a team of in-house professionals, including financial, legal, and tax experts, all of whom would be familiar with your unique financial circumstances.

A key advantage to the family office structure is its holistic, under-one-roof service model. Necessary expertise is centralized, which promotes streamlined coordination and efficient decision-making. The family office will also already have an in-depth understanding of your finances and values, making them uniquely suited to creating an exit plan that supports your broader wealth management strategy.

The personalized approach of a family office means that your exit plan is not just a transaction; instead, it is a strategic move that supports your family’s financial health and ongoing legacy.

Deciding when and how to exit a business is one of the most impactful decisions you can make for your financial future. It requires precise planning and execution to make sure that the exit not only aligns with but furthers your personal and financial goals. Fortunately, by understanding the key concepts of exit planning, leveraging the strategies discussed in this guide, and assembling a strong team to work alongside you, you can orchestrate a successful transition that secures your legacy and sets you up for your next chapter.

As you consider your options for exit planning, look into our top tips for selling your business. From here, we invite you to schedule a founder call for a personalized session in which our advisors will assist with defining your goals, answer your questions, and help you decide if a family office is the right choice for crafting a tailored approach to your exit plan.

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.

Chicago | Atlanta | Austin | Charlotte | Dallas | Denver | Greenwich | Houston | Kalamazoo | Los Angeles | Menlo Park | Minneapolis | Naples | Nashville | New York City | Phoenix | San Francisco | Santa Barbara | Sioux Falls | Tulsa | Washington D.C. | West Palm Beach

Cresset refers to Cresset Capital Management, and all its respective subsidiaries and affiliates. Cresset Asset Management, LLC, also conducts advisory business under the names of Cresset Sports & Entertainment, CH Investment Partners, and Cresset Capital. Cresset provides investment advisory, family office, and other services to individuals, families, and institutional clients. Cresset also provides investment advisory services to investment vehicles investing in private equity, real estate, and other investment opportunities. Cresset Asset Management, LLC is an SEC registered investment advisor. SEC registration does not imply any specific level of skill or training.