Family Office Guide / Private Wealth Management / Ultra-High-Net-Worth Wealth Management Firm

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.

10 minute read

Choosing who to trust with your family’s financial well-being might feel like a monumental task. After all, your wealth management team is here to help you not only grow your wealth, but also protect and enhance your lifestyle and legacy. As an individual’s wealth grows, wealth management strategies become increasingly important and increasingly complex. For individuals or households with ultra-high-net-worth (UHNW), the stakes are even higher. Choosing the right ultra-high-net-worth wealth management strategy is essential not only for reaching financial goals, but for safeguarding your financial future.

This article will help you explore your options so that you can make an informed decision to support your goals and preserve your wealth for future generations. Whether you are considering a management firm, a specialized advisor, or an ultra-high-net-worth family office, it is essential to understand what each of these options brings to the table. Wealth management for UHNW individuals and families does not need to be stressful, and with the right guidance, you can navigate your many options with confidence.

Ultra-high-net-worth wealth management is an umbrella term for the various aspects of financial planning and management that ultra-high-net-worth individuals and households need to consider. Significant wealth requires greater attention to detail and sophisticated planning. Therefore, involving professionals can make life easier and help you to reach your financial goals more efficiently. UHNW wealth management can involve the following:

These are some of the many financial considerations UHNW individuals need to be aware of, and the specific requirements of each should factor into what wealth management route you decide to take.

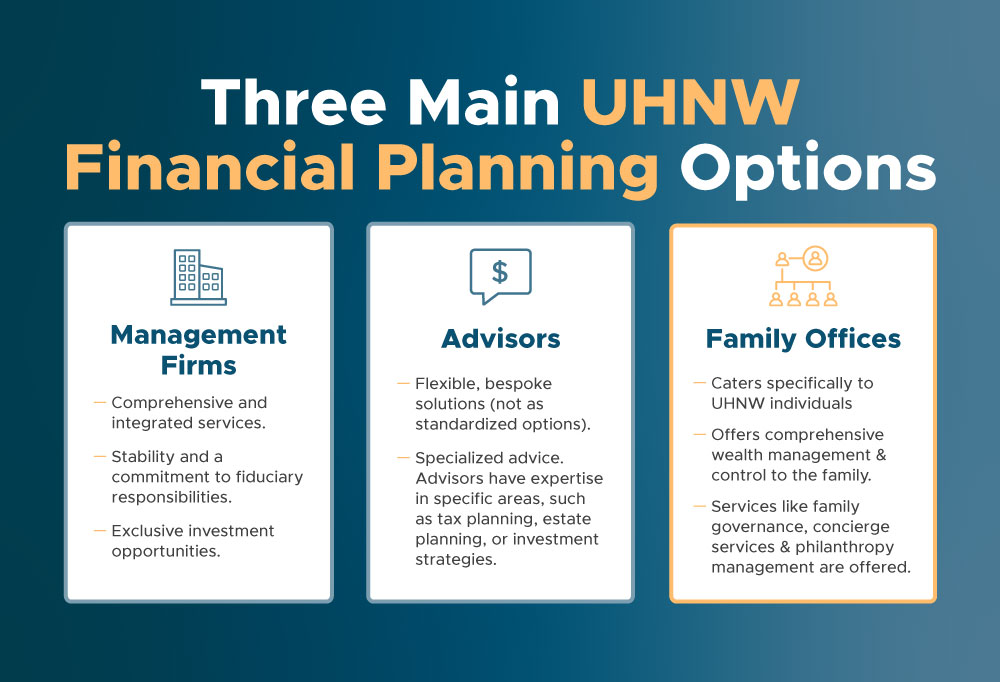

Here, we’ll cover the three main UHNW financial planning options:

Choosing the right option will depend on your family’s financial goals and the type of relationship you would like to have with your wealth management team. Before we discuss how to choose the right route for you and your family, let’s take a closer look at the differences between each option.

UHNW management firms offer a wide range of ultra-high-net-worth financial planning services. Ultra-high-net-worth wealth management firms provide access to a team of finance professionals in various disciplines, so that all your financial needs can be found under one roof. The best wealth management firms for ultra-high-net-worth individuals and families will offer the following:

However, they may lack the personalization that a smaller firm or an individual UHNW financial advisor can provide.

If you’re looking for highly personalized and tailored advice, then it is worth considering how an ultra-high-net-worth financial advisor can support your needs. Ultra-high-net-worth advisors can provide:

If you value flexibility and close working relationships, then the right choice for you might be a UHNW financial advisor, or a family office.

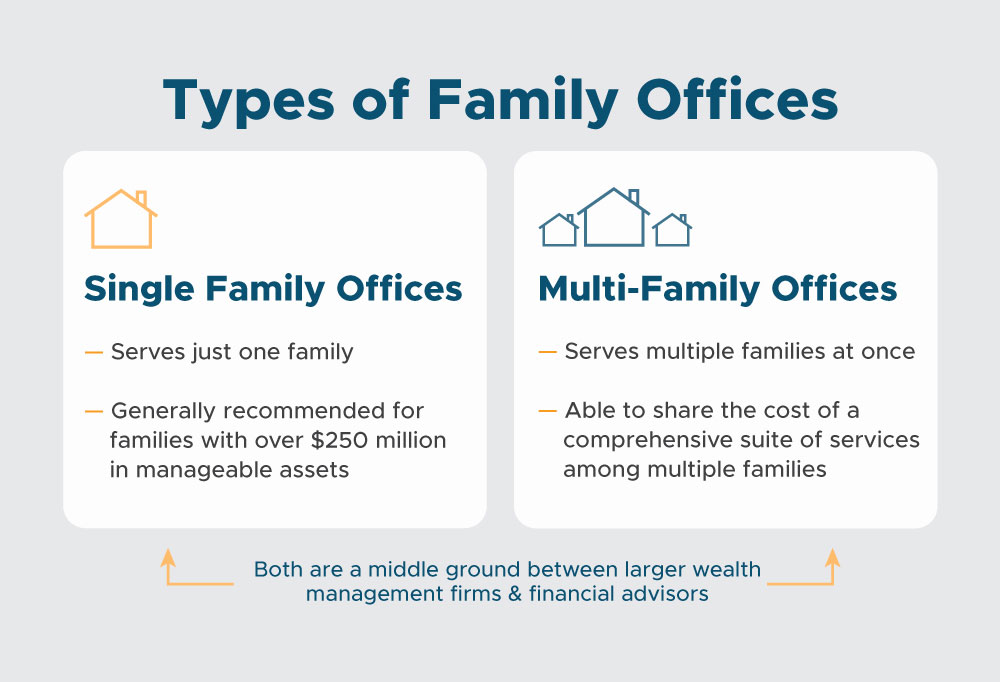

In some ways, they offer a middle ground between a larger wealth management firm and a financial advisor: comprehensive services alongside a flexible, tailored approach. When looking into ultra-high-net-worth family offices, you will come across these two types:

Choosing the right path for you and your family may feel overwhelming, but we are here to help. Here are some key factors to consider:

Look at the track records of firms you are considering. Do they have experience with UHNW financial planning, specifically with families and individuals with comparable wealth levels to you and your family? Along similar lines, do they have access to top talent? You want to make sure that you feel confident in the people managing your wealth, and that their specializations match your needs.

How comprehensive would you like the offerings to be? How tailored would you like the approach? Be sure to examine what ultra-high-net-worth services are offered and how they align with your financial goals.

Choosing the right UHNW wealth management plan is not only a personal choice, it is essential for reaching your financial goals and maintaining the health of your legacy. Whether you would like the broad, one-stop-shop approach of a large wealth management firm, the personal advice of a trusted advisor, or the variety, control, and personalization of a family office, working with professionals can help grow your wealth over time and simplify the ever-changing world of ultra-high-net-worth wealth management.

For more personal assistance choosing the right ultra-high-net-worth wealth management strategy for you, request an introduction today.

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.