Family Office Guide / What Is a Trust?

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.

Managing Director & Vice President, Cresset Trust Company

Managing Director & Vice President, Cresset Trust Company

17 minute read

A trust is a legal arrangement that allows individuals to transfer assets across generations while creating guidelines over how and when those assets are distributed. Trusts can offer benefits like privacy, asset protection, and flexible wealth transfer options. In other words, trusts give you a safe way to pass your wealth to your family members, while also potentially providing tax benefits. Below, we will go over a typical trust structure and compare various types of trusts, before providing insight into how to start the process of trust planning and how a family office can support you.

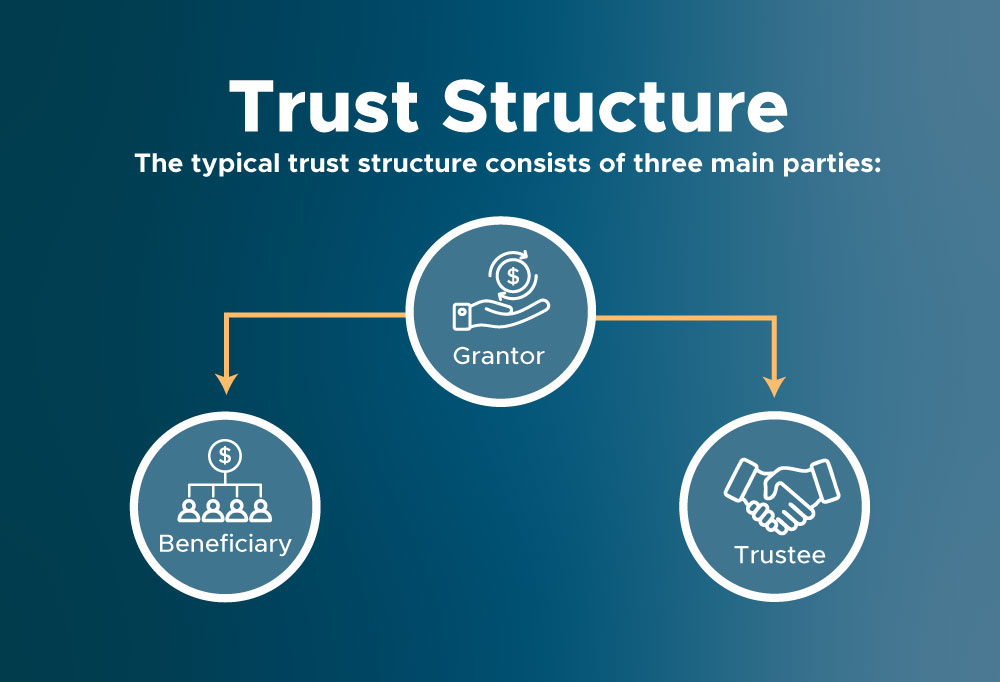

Although there are many different trusts available, they all have the same basic structure:

The typical trust structure consists of three main parties:

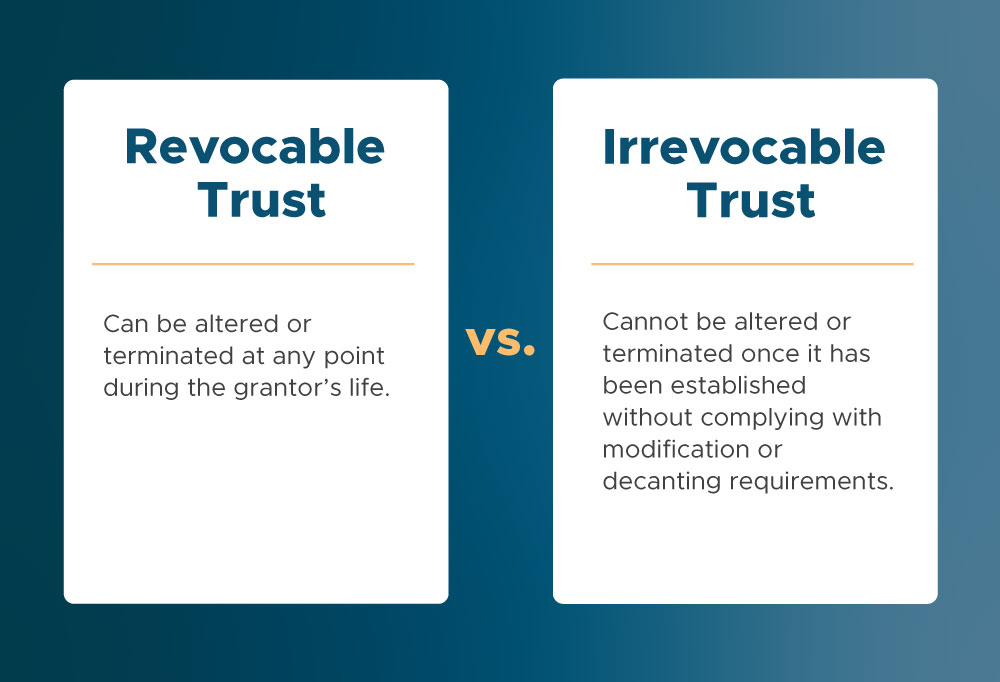

While there are many types of trusts, they fall into two broad categories: revocable and irrevocable. Each type has benefits, with the main difference being the level of control the grantor retains once the trust is established.

Below you will find the basic details of some the most common trust types and trust related terminology you may hear referenced:

| Type of Trust | Overview |

|---|---|

| Marital Trusts (sometimes referred to as an “A” Trust) | An irrevocable trust in which one spouse (the grantor) creates the trust for the other spouse’s benefit, and all income is automatically paid to the surviving spouse. This type of trust passes to the surviving spouse estate tax free at the time of the first spouse’s death but is subject to estate tax at the surviving spouse’s death. |

| Bypass Trust (sometimes referred to as the Family Trust, “B Trust” or Credit Shelter Trust) | Bypass trusts are either established via a last will and testament or a revocable trust upon the grantor’s death. These trusts can be funded using the maximum remaining federal or state estate tax exemptions reducing or eliminating estate tax liability on the second death. |

| SLAT (Spousal Lifetime Access Trust) | A SLAT trust is an irrevocable grantor trust that allows a spouse access to assets as a beneficiary while keeping them out of the grantor’s taxable estate. SLATs are often also GST exempt and dynastic in design. |

| Charitable Trust | Designed to pass assets to a certain charity, or to divide assets between charities and beneficiaries. The grantor can donate assets and receive any tax benefits. These trusts both support philanthropic goals and reduce estate and income taxes. There are different kinds of charitable trusts, so be sure to discuss their distinct benefits with your team. |

| Dynasty Trust | Dynasty trusts are designed to benefit several generations in jurisdictions that allow for long term or perpetual trusts, minimizing estate tax over time. These can be any irrevocable trust, but one that is allowed to last in perpetuity based on the state law governing it. These may be exempt from generation skipping transfer taxes (GSTT), which means no generation will pay estate taxes on the assets as long as it is in existence, which could theoretically be forever. |

| Generation-Skipping Exempt Trust (GST) | GST trusts are designed to benefit possible skip generations, such as grandchildren, and to avoid the taxation that would occur if the assets were passed directly to the grantor’s children or grandchildren. Many irrevocable trusts are designed to be GST exempt trusts. |

| Grantor Retained Annuity Trust (GRAT) | A GRAT is an irrevocable trust where the grantor retains payments valued at the total initial trust property (or virtually all) over a period of years as an annuity. GRATs are commonly structured to last two or three years but can be longer. The annuity amount can be in equal shares over the term of years or can increase by up to 20% per year. Any growth of the initial principal value, over a prescribed interest rate, passes to beneficiaries (or a trust) estate tax-free. This technique works best with high growth assets, and low-interest rate environments. GRATs are not GST exempt trusts. |

| Irrevocable Life Insurance Trust (ILIT) | An irrevocable trust holding a life insurance policy for a beneficiary. When the grantor passes, the death benefit is paid into the trust and will be distributed based on the trust’s terms. If structured correctly, ILITs keep the insurance proceeds out of the grantor’s taxable estate. |

| Special Needs or Supplemental Needs Trust | These are carefully drafted trusts that provide for the medical needs or daily care of a special needs relative without impacting any government benefits the relative receives. |

| Spendthrift Trust | These trusts are designed to prevent misuse or overspending by the beneficiary by limiting control over the assets. The trust will include provisions that prevent the beneficiary from accessing the principal, and in turn prevent creditors from claiming it. Most, if not all, trusts should be designed to be Spendthrift Trusts. |

| Testamentary Trust | A trust established by a will or revocable trust that only takes effect after the grantor’s death. It is used to manage the assets of the deceased and becomes irrevocable upon their death. |

| Qualified Personal Residence Trust (QPRT) | An irrevocable trust that allows the grantor to transfer a personal residence to it (or a portion of one). The trust sets a term of years where it is still includible in the grantor's estate and the grantor has use of it, but then after that term it belongs to the remainder beneficiaries. Any use after that point must pay fair market rent and have a rental agreement. The value of the property contributed is discounted some based on current prescribed rates and actuarial data around the grantor's lifespan. The greater the rates and less likely the grantor is to survive the term, the more discount is applied to the gift. |

Marital trusts and family trusts are easy to confuse, since both benefit immediate family members and offer asset protection alongside tax advantages. However, their purposes are distinct. A marital trust serves primarily to support the surviving spouse, ensuring that they have access to income and assets during their lifetime, as well as deferring any estate tax on those assets until the second death. A family trust benefits the larger family lineage, safeguarding wealth for future generations and is largely used to capture remaining federal or state estate tax exemptions.

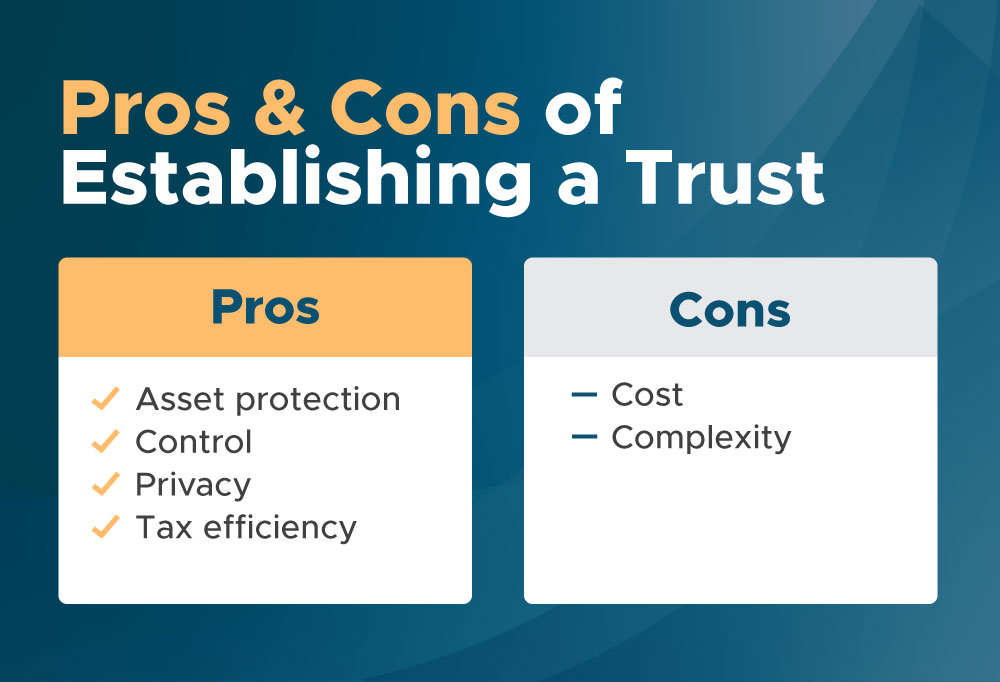

As you consider whether to establish a trust for your family, consider the following pros and cons:

Pros:

Cons:

While the basic trust structure—grantor, trustee, and beneficiaries—will remain consistent across scenarios, we can illustrate how these roles might function in practice by considering the following example:

A married couple might establish a revocable trust, appointing themselves as trustees and their children as beneficiaries. A trust document specifies that upon the couple’s passing, each child will receive an equal share of the assets in the trust. In this example, the grantors (the couple) also serve as the trustees, managing the trust during their lifetime. Alternatively, the couple could appoint an external trustee to oversee the trust’s administration, such as a trusted family member or professional trustee.

Creating a trust for your family involves several key steps, each crucial to establishing a trust that will meet your estate planning goals. To establish a trust, follow these basic steps:

Setting up a trust may seem like a daunting task but breaking it down into steps can simplify the process. To further assist you as you begin estate planning, we have compiled a helpful estate planning checklist to guide you through the preparation for generational wealth transfer.

A family office provides valuable assistance not only with discussing and helping to establish a trust but managing it effectively. Opting for a family office to assist with your trust needs offers several key benefits, such:

By understanding the different types of trusts, families can make informed decisions that align with their financial goals. However, it can be a difficult decision to make on your own. Learn more about our trust services and how we can help establish and manage a trust or trusts tailored to your needs.

By providing your email address, you consent to receive messages from Cresset regarding our services. View our Privacy Policy.