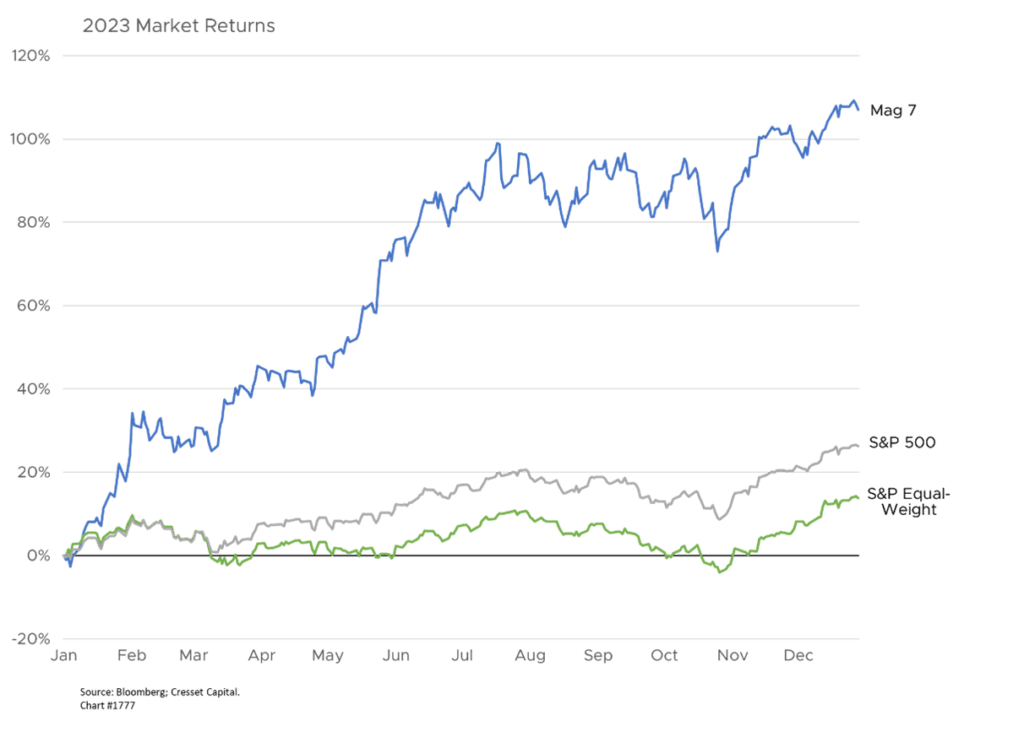

01.03.2024 Happy New Year! As we close the books on 2023 and consider the prospects for 2024, let’s look back at last year’s markets for insights and perspective. Last year was a surprise on many fronts. No one, including us, expected the S&P 500 to deliver a 26 per cent return (we called for mid-single-digit gains). The “Magnificent Seven” – the top seven tech stocks comprising more than one-quarter of the capitalization-weighted index – surged 107 per cent last year, and contributed more than two-thirds of the S&P 500’s return. This performance was fueled in large part by multiple expansion rather than by revenue or earnings growth (except perhaps for Nvidia). The average stock, meanwhile, advanced more than 13 per cent in the interim, leaving what we argue was a narrow market, with fewer than 30 per cent of constituent stocks outpacing the Index, the lowest participation reading since the late 1990s. But what happened in 2023 tells only part of the story.

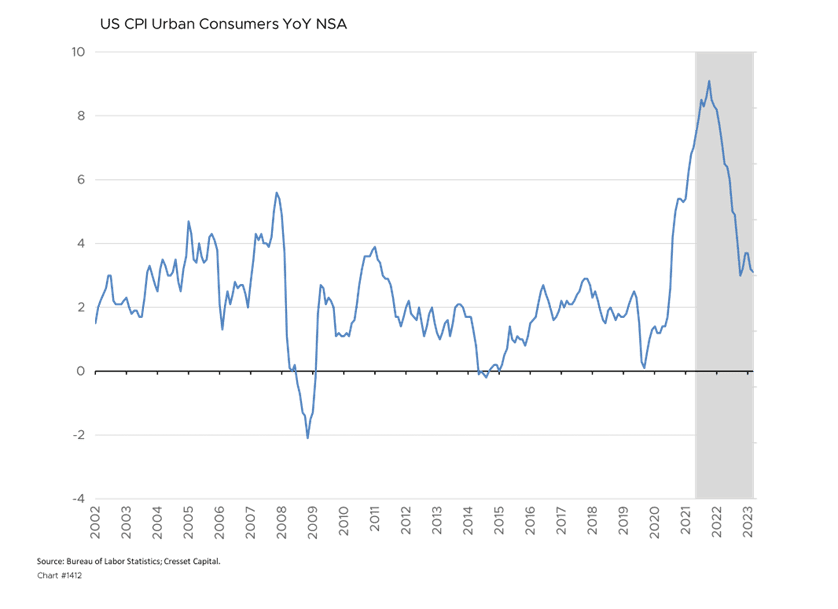

Before we conclude that mega-cap tech is the only game in town, we should take a two-year perspective and evaluate 2023’s bull market together with 2022’s bear market to get a more complete picture. Over that two-year span, the economy and financial markets bore witness to an abrupt reversal in interest rate and inflation trends that had been in place for more than a decade. Inflation, which had remained quiescently below three per cent since 2011, spiked in late 2021 and breached nine per cent year over year by June 2022, an inflation rate not seen since the 1980s. At this point, the critical pricing indicator has remained persistently above three per cent for 32 consecutive months, although we expect inflation pressure to ease in 2024.

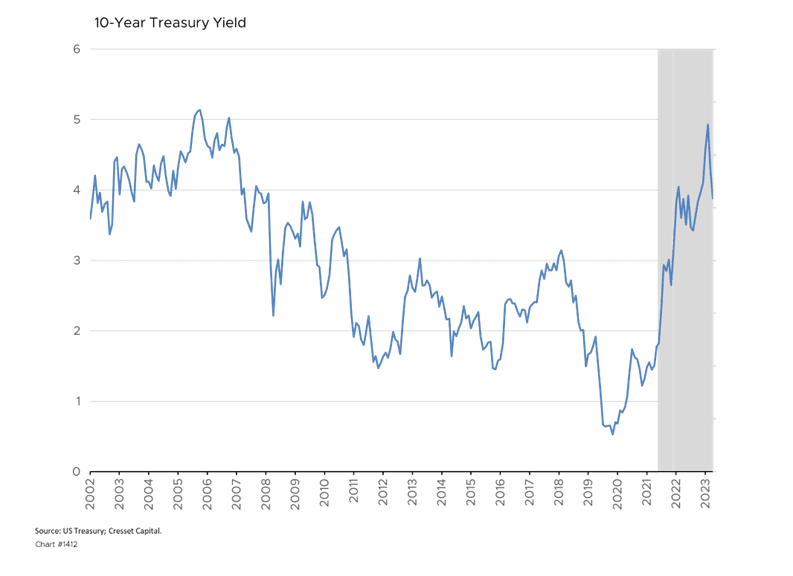

Unprecedented inflation led to an uncharacteristically aggressive Fed. The US monetary authority hiked interest rates with an aggressiveness not seen in over 40 years, causing the rest of the yield curve to rise in tandem. The yield on the 10-year note, a critical input to equity market multiples, began 2022 at around two per cent and spiked toward five per cent last year before retreating. All told, the two-year span saw the 10-year yield double to a rate not seen since 2007.

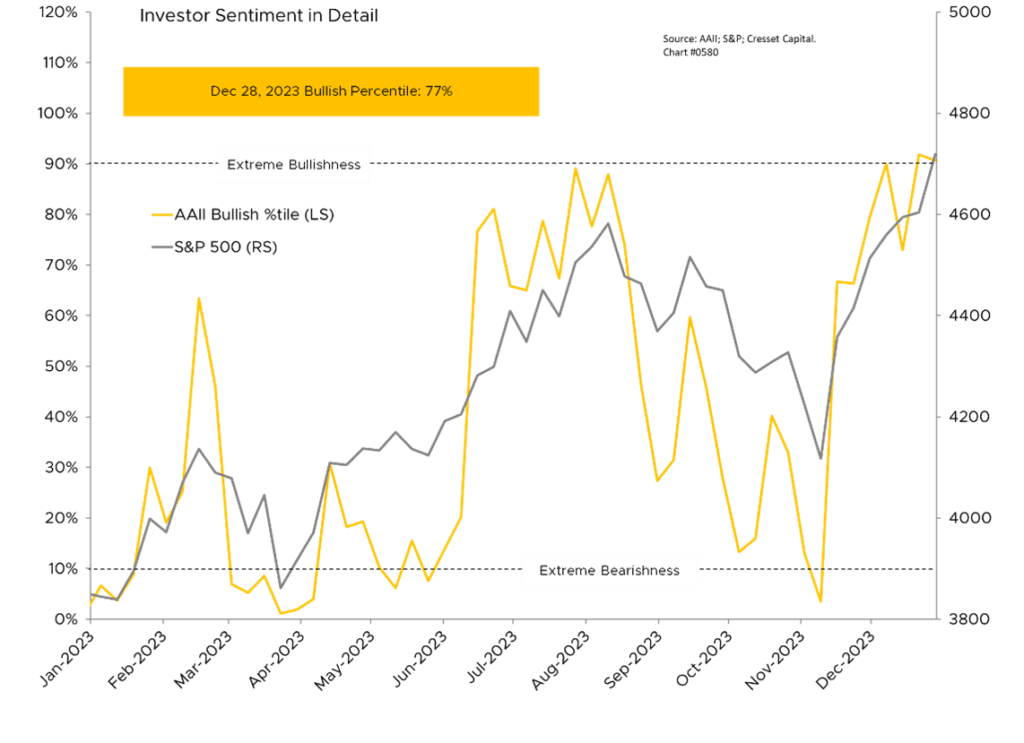

Shifting fundamentals and massive drawdowns in 2022 led to emotionally charged markets, particularly in 2023. Widespread bearishness enveloped the investment community at the outset of the year after suffering double-digit declines in both bonds and stocks. The S&P 500, however, promptly rallied nearly nine per cent from January 1 through the beginning of February, leading to a surge in bullishness. But an emerging banking crisis culminating in the failure of Silicon Valley Bank by the middle of March drove the blue-chip index down 7.5 per cent from its February peak and bullishness, like SVB bank deposits, disappeared. Investors remained decidedly bearish for most of March and April, setting the stage for a 16+ per cent rally between the end of March and July. The market’s advance caught investors’ attention, and bears reemerged by the beginning of August, prompting an eight per cent pullback between August and October. By the beginning of November, bullishness sat at the third percentile of its historical range. Like a coiled spring, US large caps surged nine per cent in November and December, fueling a bullish resurgence to close the year.

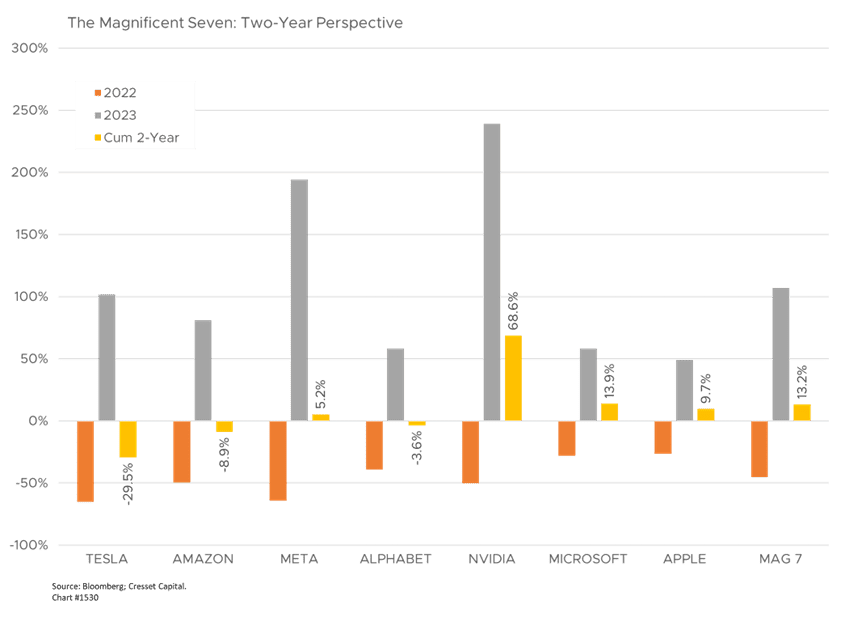

Combining 2022 and 2023, the S&P 500 returned a cumulative 3.1 per cent, falling 18.1 per cent in 2022 before bouncing back 26 per cent last year. The Magnificent Seven, meanwhile, delivered a 13 per cent combined return after plunging more than 45 per cent in 2022. It’s interesting to note that three of the Magnificent Seven ended the two-year span underwater, with Tesla losing nearly 30 per cent cumulatively. Only AI darling Nvidia, which surged more than 300 per cent last year, ended 2022-2023 on solid footing.

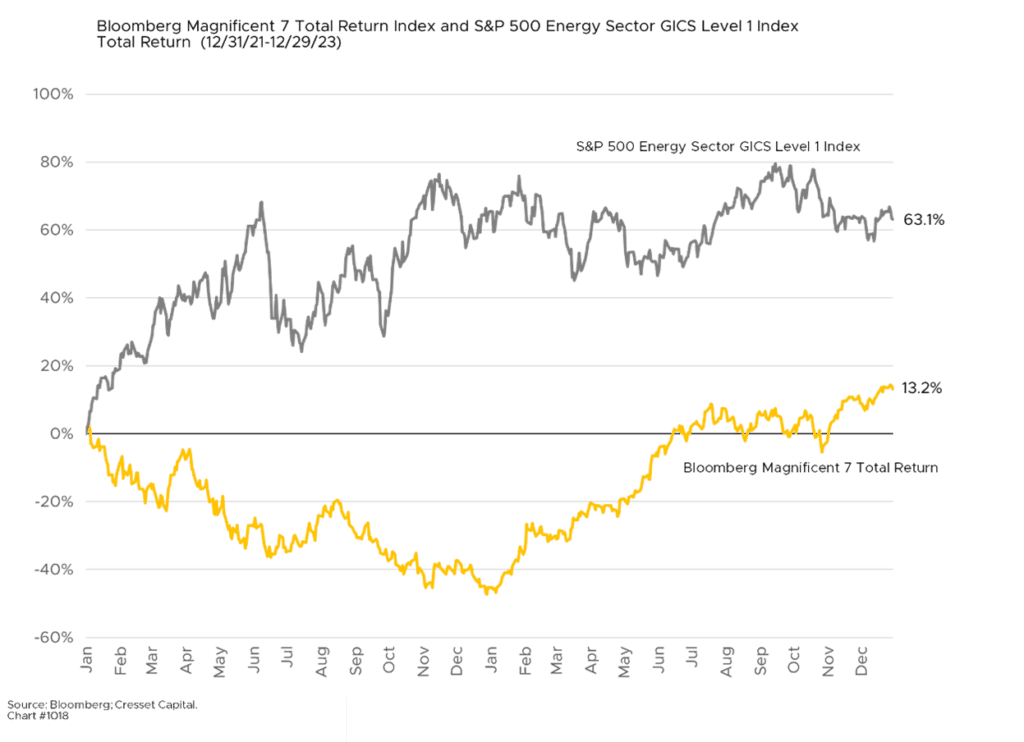

Compared to other markets, mega-cap tech did relatively well, but not as well as 2023 might have suggested. In fact, the Magnificent Seven matched the returns of the broader technology sector over the 24-month span. The biggest winner over the last two years wasn’t Big Tech but rather the energy sector, which surged more than 63 per cent, although most of its return was front-loaded in 2022. Energy shares limped in 2023, losing 1.4 per cent for the year.

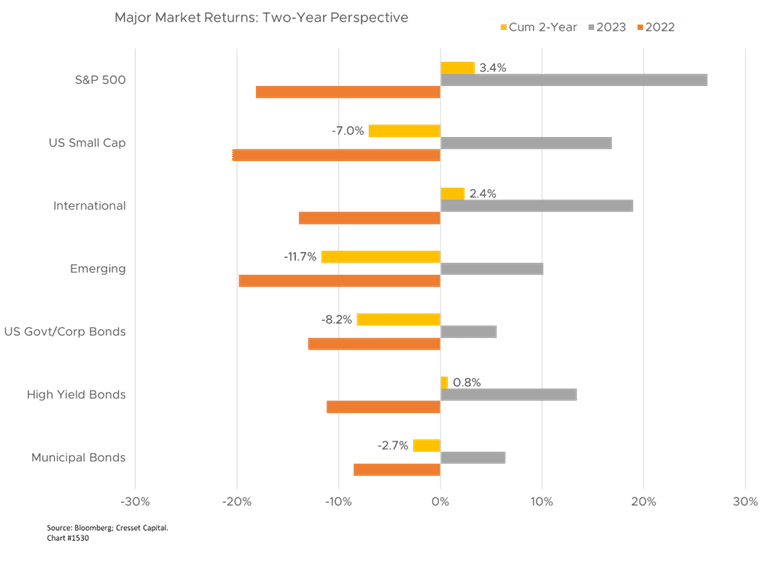

Among major markets over the last two years, US large caps topped the total return totem pole with a 3.4 per cent advance, outpacing international markets by a scant one percentage point. Other equity markets, most notably small caps and emerging markets, gave up seven per cent and 12 per cent respectively. Bonds, suffering from the unprecedented spike in interest rates, lost ground over the two-year span with high-yield bonds the exception, eking out a fractional gain.

Bottom Line: In many respects, 2022 and 2023 were mirror images, with a bear market-sized drawdown followed by a bull market rally. Putting both years together suggests that diversification still matters, since the cumulative return differential was substantially narrower than each year would have implied individually. The second takeaway is to expect the unexpected. While annual forecasts, like ours, are built on a foundation of rational sensibilities, substantiated with a bevy of facts and statistics, markets and economies rarely play out that way. Patience, and sticking with a solid game plan, are required to navigate the vagaries of the near term. In the meantime, I think American boxer Mike Tyson said it best: “Everyone has a plan ‘til they get punched in the mouth.”