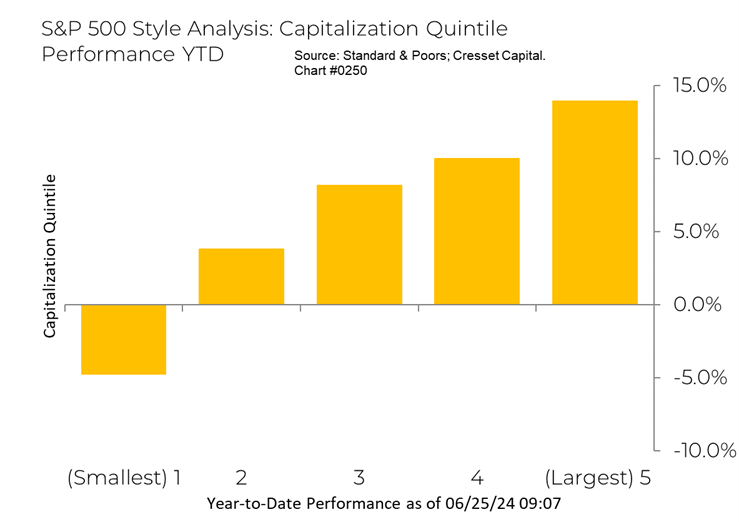

06.26.2024 The S&P 500 is on track to deliver a strongly positive performance for the first six months of the year, fueled by a rally in the market’s largest names. Dividing the 500 Index stocks by capitalization quintiles shows a steady stairstep pattern of performance: the larger the stock, the better it did. The 100 stocks with the largest market caps gained nearly 14 per cent on average during the first half, while the smallest 100 stocks fell nearly five per cent on average.

Much of the divergence is attributable to a “higher for longer” interest rate environment. Investors reckon that mega-cap tech companies – thanks to their ability to generate cash – are less reliant on borrowing and, those companies that need to borrow have much easier access to capital than do their smaller brethren. So, where are markets headed in the second half of 2024?

S&P 500 Outlook

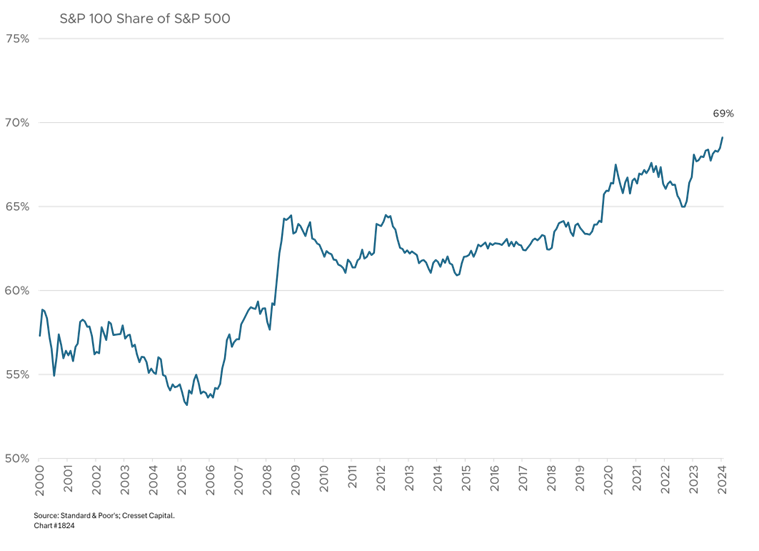

Thanks to the way the S&P 500 is constructed – as a capitalization-weighted index – it gives more weight to the largest stocks in the index. While S&P investors own a basket of 500 companies, in effect they’ve been betting on just a handful of names lately. The shares of AI chipmaker Nvidia (NVDA) have surged more than 138 per cent higher so far this year. Owing to its size, NVDA represents nearly seven per cent of the S&P 500 and over the past two years has accounted for 45 per cent of the Index’s daily price fluctuation. Moreover, NVDA and the S&P 500 advanced and declined in unison nearly 75 per cent of trading days over the last two years.

The S&P 100, representing the largest 100 US large caps, now accounts for nearly 70 per cent of the S&P 500’s market capitalization, up from about 55 per cent 20 years ago. That means that the market’s direction will have a lot to do with the futures of its top companies.

AI Enthusiasm

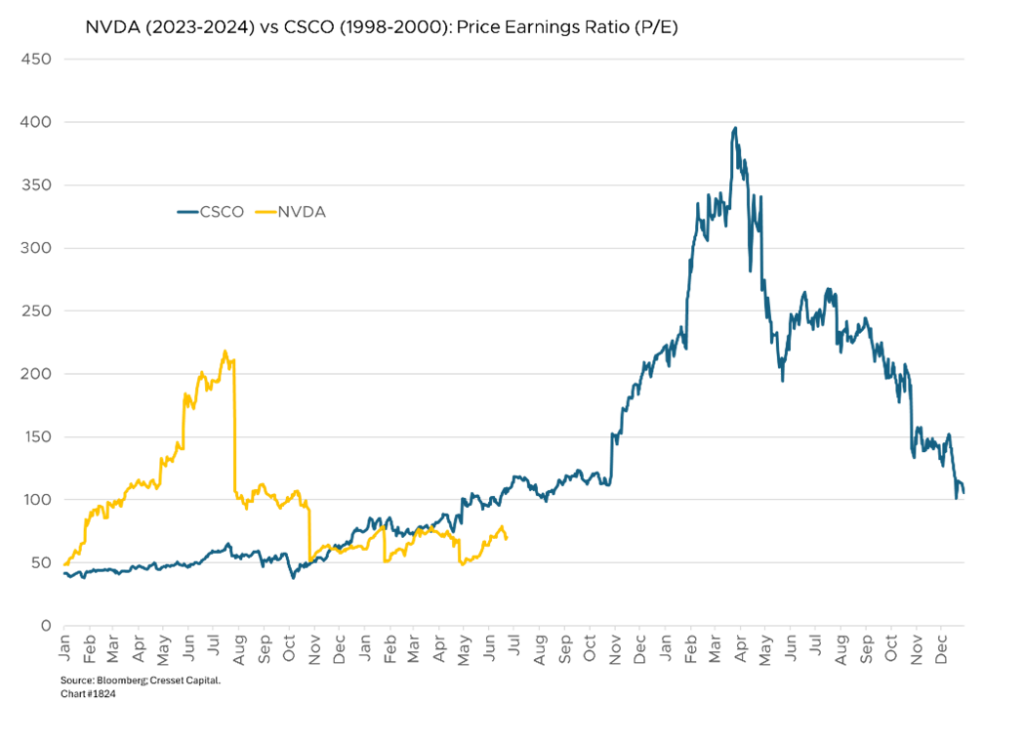

Thanks to AI enthusiasm, Nvidia – while not as expensive as internet server company Cisco was during the internet boom – is arguably expensive relative to the rest of today’s market, and could potentially pull back on profit taking later this year. Another possible victim of its own success, the S&P 500 Index, is expensive relative to earnings and dividend growth when looked at through the lens of bonds.

The 10-year, BBB corporate bond yield, a good proxy for the market’s forward price/earnings ratio (PE), implies a forward PE multiple of about 17x, yet the S&P is trading at a forward PE closer to 21x. Meanwhile, the market advanced against a backdrop of higher interest rates this year even though earnings expectations have remained largely unchanged. However, the average stock in the S&P is more fairly priced and the “S&P 495” could lead the way higher in the second half.

On average, S&P 500 companies are trading at about 17x next year’s earnings, which is more closely aligned to the bond market. Remarkably, more than half of the S&P 500’s constituents are trading more than 20 per cent below their all-time highs.

Broadening of US Equity Markets

We expect US equity markets to broaden later this year as the possibility of lower rates comes into focus. That means high-quality companies, particularly those with persistent dividend growth, will likely continue to lead their lower-quality counterparts in an incremental restrictive borrowing environment. While we expect lower short-term rates, real rates, the spread over inflation, will remain high.

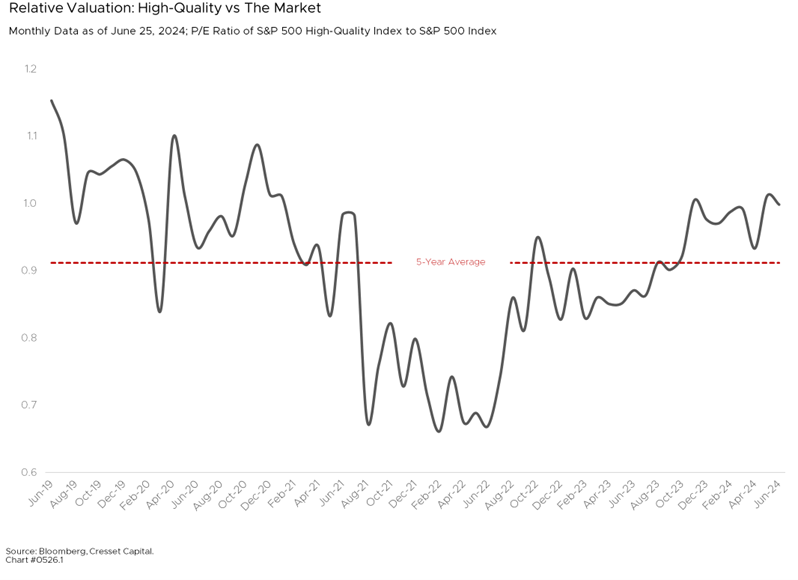

Year to date, the S&P “High-Quality Index” has outperformed the S&P “Low-Quality Index” by nearly 20%, as high borrowing costs are driving a wedge between companies generating favorable cash flow and those relying on debt financing. Despite their outperformance, quality companies are still only trading at a slight premium to the S&P 500 and below their pre-pandemic relative valuation level. Quality small caps would also benefit from a broadening market, as the bar for outperforming analysts’ earnings estimates is low in today’s environment. We also expect the dollar to remain strong, representing another positive for small companies, particularly those firms that import their goods and sell them domestically.

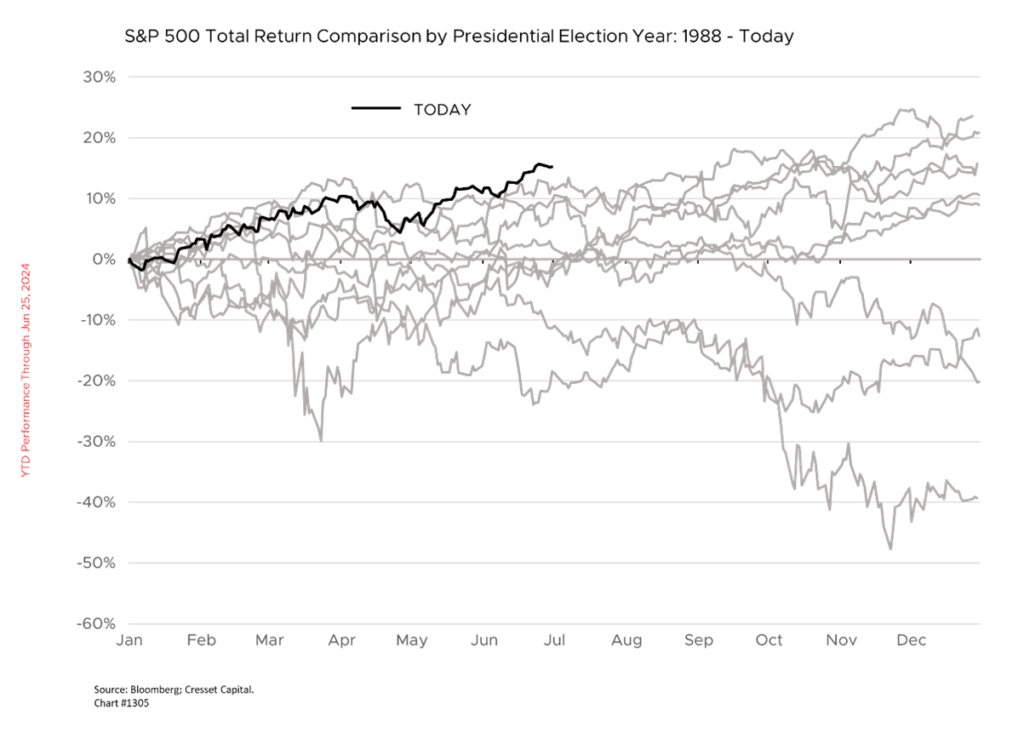

Several other factors should be considered as we enter the back half of the year, not the least of which is the presidential election. History suggests stock markets are quiescent in election years as incumbents try to create a favorable financial market backdrop. Over the last 10 election years dating back to 1988, the S&P 500 gained ground in six of them with an average return in the mid-teens. Of the three negative election years (2000, 2008 and 2016), all three were negative at this point in the year. In fact, 2024 has been the best-performing election year at this point in the cycle.

We also expect easing interest rates to provide a risk-taking tailwind. Early evidence suggests that households are pulling back on spending, which will help drive inflation and interest rates lower later this year. Americans have whittled down their pandemic savings and have increasingly relied on plastic to meet their spending needs. That’s unsustainable. Meanwhile, retailers like Walmart and Target are already cutting prices on thousands of goods to address weakening demand.

Bottom Line

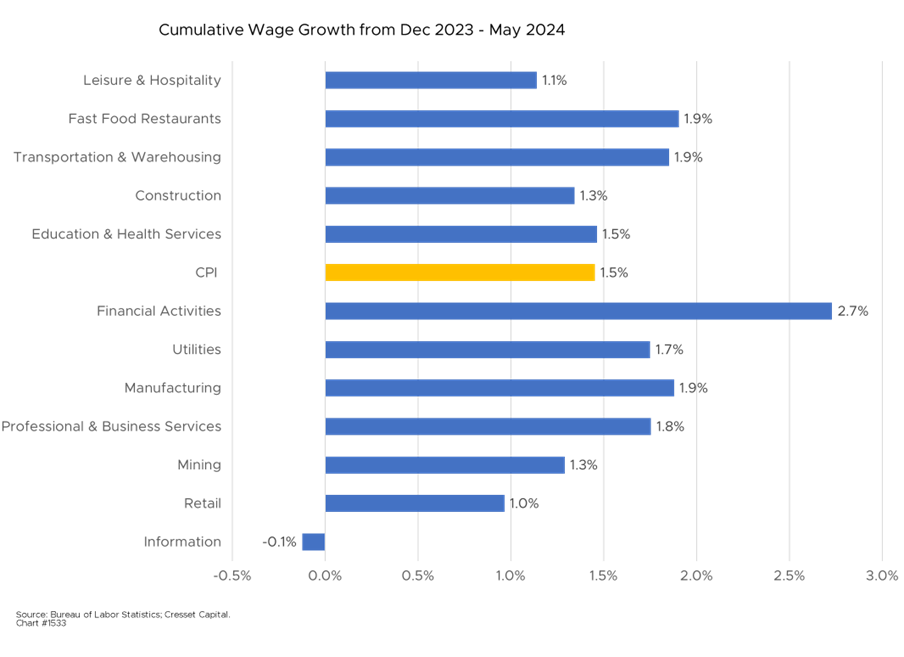

We expect markets to broaden as investors sense rate cuts on the horizon. While the Fed is currently satisfied with standing pat on monetary policy, we believe the future path of interest rates will depend on “wealth effect” contributors, like the housing market, job market and the stock market. Housing affordability is lower today than it was during the 2006 housing bubble, although we expect prices to stay high through the election. We are also closely monitoring the job market. Job growth and wages have been strong, and all but one sector has enjoyed robust wage growth this year. However, an increasing number of industry sectors are seeing wage growth fall below the inflation rate. Leisure and hospitality, the hottest job sector post-pandemic, has seen wage growth fall meaningfully below the rate of inflation. We expect positive yet slowing wage growth, helping justify lower interest rates and broader equity participation.

For weekly stock market updates, subscribe to Market Updates.