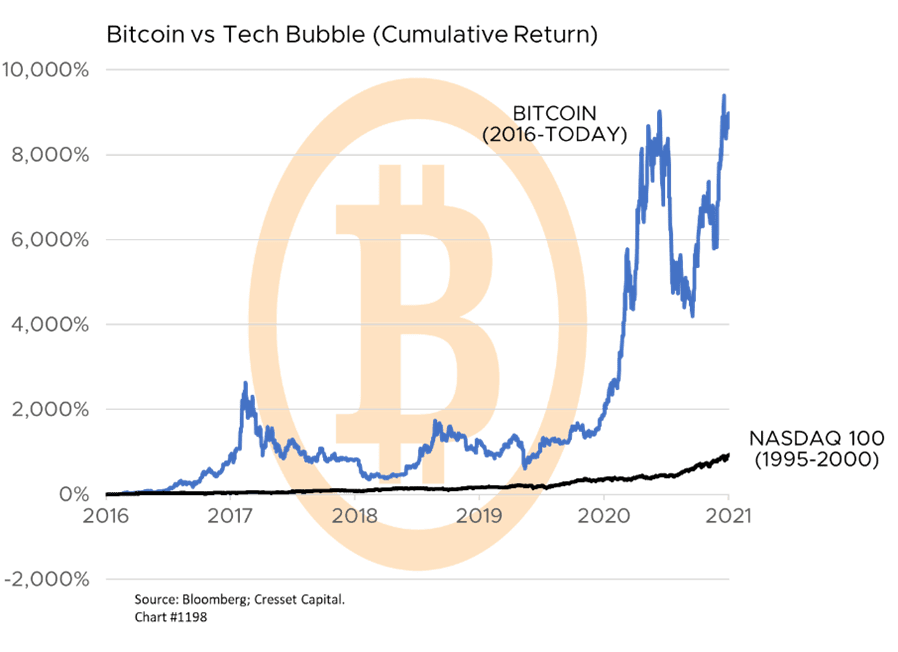

11.05.2021: With $2 trillion in market value and 200 million users, digital currency is gaining financial market legitimacy. Bitcoin, the first and largest cryptocurrency, just hit an all-time high on the recent launch of two bitcoin ETFs. The digital currency has surged 50 per cent since September. Investors greeted the ProShares Bitcoin Strategy ETF (ticker: BITO) launch a couple of weeks ago with huge fanfare, pouring a record $1.1 billion into the fund in two days, according to Barron’s. Days later, Valkyrie Bitcoin Strategy (ticker: BTF), another ETF, was unleashed. These two funds are backed not by bitcoins, but by bitcoin futures, allowing them to pass regulatory muster.

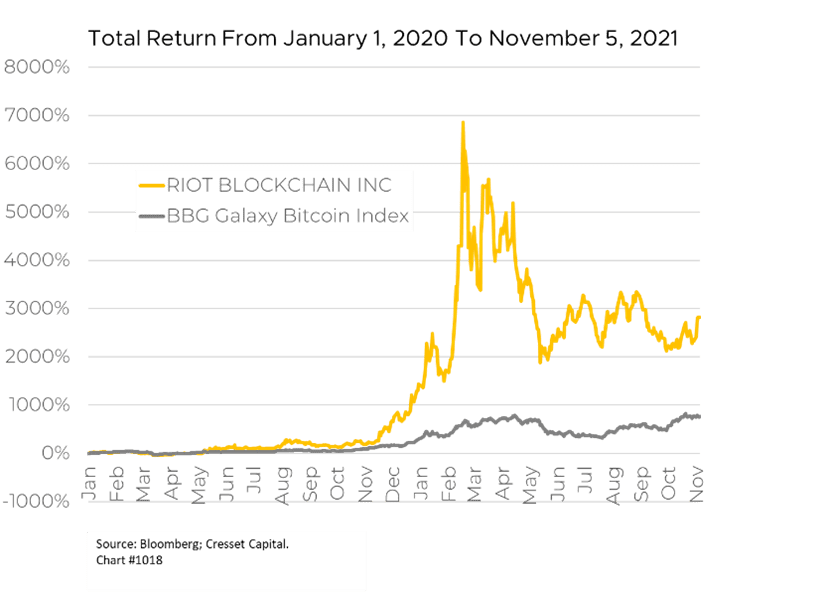

Wall Street can now celebrate the incipient democratization of cryptocurrencies. Bitcoin ETFs, the logic goes, can be seamlessly integrated into a broader portfolio, sitting alongside other, traditional stock and bond ETFs. Trading commission free, bitcoin ETFs offer investors cheaper and simpler access to the digital coins. Previously, investors had a handful of options for purchasing bitcoins directly, but they were costly. Would-be cryptocurrency holders could have bought crypto coins directly with trading apps such as Coinbase, a publicly traded coin exchange, which charges commissions up to 4 per cent. Grayscale Bitcoin Trust (ticker: GBTC) or Bitwise Crypto 10 Index Fund (ticker: BITW), both closed-end funds, charge high management fees. As an alternative, investors could have also bought shares in public companies that own cryptocurrencies and blockchain businesses, like RIOT Blockchain (ticker: RIOT), a current holding in Cresset’s Fintech Thematic Strategy. Related equity, like RIOT, could be a better way to gain exposure to underlying crypto markets than through the futures market, which carries unique risks.

Wall Street can now celebrate the incipient democratization of cryptocurrencies. Bitcoin ETFs, the logic goes, can be seamlessly integrated into a broader portfolio, sitting alongside other, traditional stock and bond ETFs. Trading commission free, bitcoin ETFs offer investors cheaper and simpler access to the digital coins. Previously, investors had a handful of options for purchasing bitcoins directly, but they were costly. Would-be cryptocurrency holders could have bought crypto coins directly with trading apps such as Coinbase, a publicly traded coin exchange, which charges commissions up to 4 per cent. Grayscale Bitcoin Trust (ticker: GBTC) or Bitwise Crypto 10 Index Fund (ticker: BITW), both closed-end funds, charge high management fees. As an alternative, investors could have also bought shares in public companies that own cryptocurrencies and blockchain businesses, like RIOT Blockchain (ticker: RIOT), a current holding in Cresset’s Fintech Thematic Strategy. Related equity, like RIOT, could be a better way to gain exposure to underlying crypto markets than through the futures market, which carries unique risks.

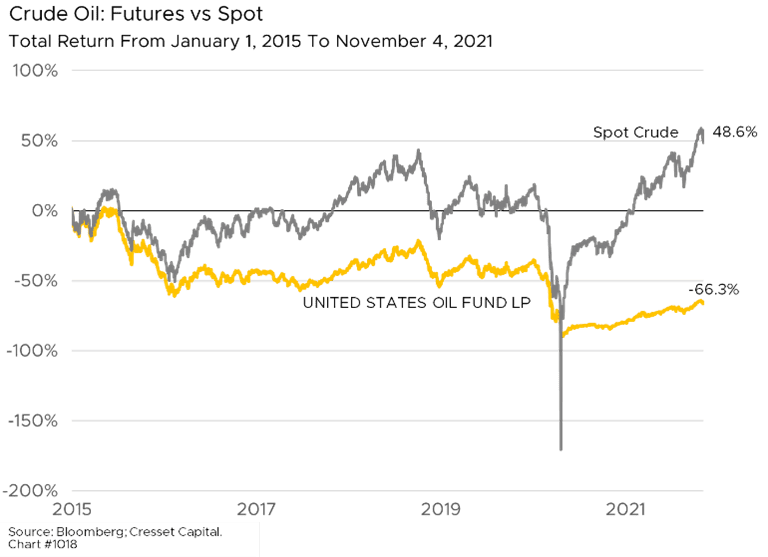

Futures ETF holders are not guaranteed to match cryptocurrency returns over longer time periods. That’s because futures-oriented funds continually roll futures contracts as old ones expire, leaving the possibility of trailing the spot price performance. Bitcoin futures, for example, are in contango, meaning they’re more expensive in future months relative to spot prices, resulting in “negative roll yields” as futures converge toward spot. Negative roll yield erodes longer-term returns. Take for instance the futures-oriented United States Oil Fund (ticker: USO), which has fallen woefully behind oil price returns due to its reliance on rolling futures contracts. The fund suffered a 44 per cent plunge in April 2020 when crude prices briefly went negative.

While front-month futures tend to track spot prices closely, longer-dated contracts can vary, creating a headwind for fund performance. Trading costs, taxes and position limitations could also weigh on futures-related strategies. Meanwhile, regulators are standing by. Washington’s securities laws enacted in the 1930s and 1940s never envisioned 21st century DeFi, decentralized finance. While there’s no bipartisan consensus on how to regulate cryptocurrencies, investors anticipate regulations will be imposed in the not-too-distant future. In the extreme, China, viewing bitcoin as a threat to its sovereignty, has banned all commercial crypto transactions and is promoting the digital yuan instead.

Cryptocurrencies have been useful in the emerging world, where local currencies have had a history of instability. The Asian Contagion of 1997 began with the Thai Baht losing nearly 40 per cent of its value in response to the local government’s decision to no longer peg the currency to the dollar. However, if the point of holding bitcoin is doomsday protection, synthetic strategies that replicate the cryptocurrency’s performance probably won’t offer Armageddon insurance, as we have described above. We therefore recommend holding cryptocurrency directly if you want it in your portfolio.