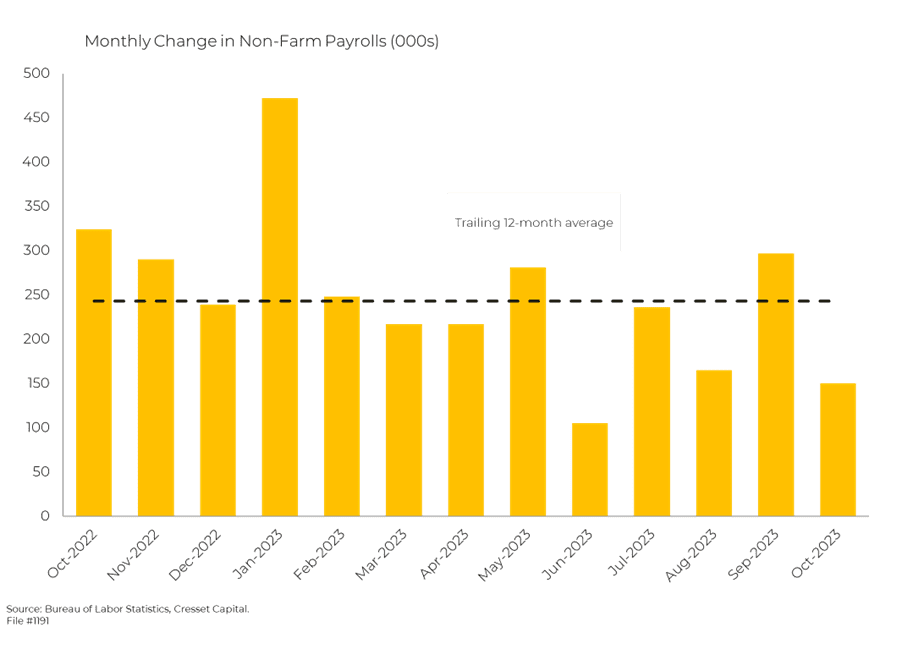

11.08.2023 Anticipation of the end of the Fed’s tightening cycle, spurred by a weaker-than-expected jobs report, sparked investors to hit the “buy” button last week. This resulted in an abrupt reversal in the upward trajectory of intermediate Treasury yields. The Federal Open Market Committee earlier in the week voted to hold interest rates steady at a 22-year high for a second consecutive meeting. Investors celebrated the prospect of a soft-landing scenario: a favorable blend of lower inflation, resilient corporate profits, slowing growth, and no recession going into 2024. The benchmark rate, which peaked at five per cent in mid-October, cascaded 0.4 percentage points over five trading days – the steepest drop in the weekly rate since March – ushering in the best weekly equity market performance since November 2022. Is this all too good to be true?

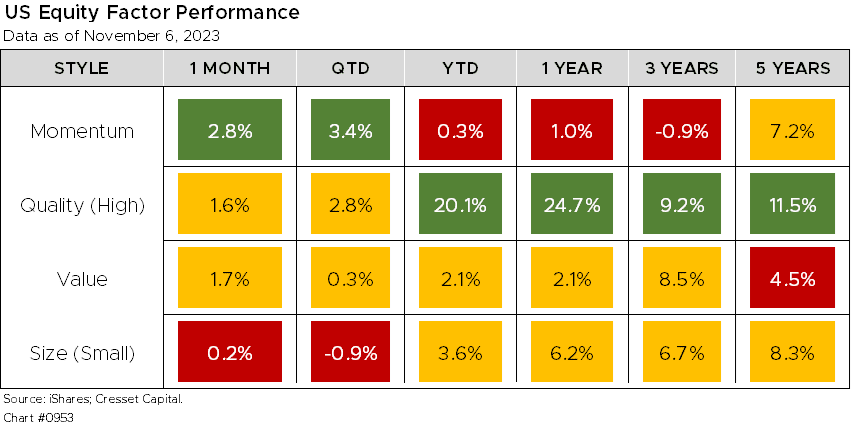

Equity markets surged, with small caps leading the way higher with a more than six per cent jump. The Russell 2000 Index of small-cap stocks had fallen more than 18 per cent in recent weeks. Real estate investment trusts were among the biggest beneficiaries, gaining more than eight per cent for the first week of November. The dollar reversed its climb for the year, falling more than one per cent and providing a tailwind to international and emerging markets equities. The average stock in the S&P 500, which was under water going into November, outpaced the tech-heavy capitalization-weighted index fractionally for the week, leaving the equal-weighted index in positive territory for the year. The prospect of lower financing costs favors lower-quality, momentum stocks rather than the high-quality stocks of companies carrying little debt. The momentum factor has taken the performance lead in recent weeks.

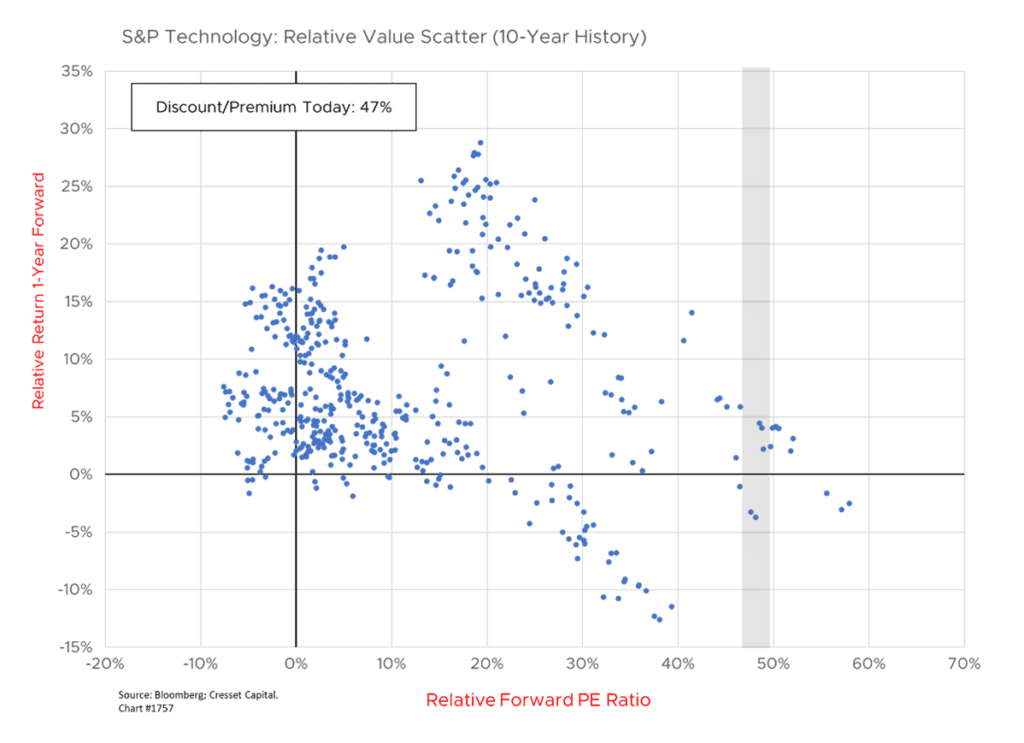

Notwithstanding the market’s recent reversal, this year’s remarkable performance has left the market’s largest tech stocks vulnerable, as investors worry about future profits. Earnings reports from Alphabet, Meta and Apple were met with widespread selling. While the market selloff improved their valuations, tech behemoths nonetheless remain fully valued and future earnings growth expectations could be in doubt. The S&P tech sector trades at a high, but not unheard of, 47 per cent forward P/E premium to the S&P 500. Historically, tech has had a tough time outperforming the market over the subsequent 12 months at such wide valuation differentials. Last year at this time, the tech sector traded at a more normal 25 per cent valuation premium, leading to a 25 per cent outperformance.

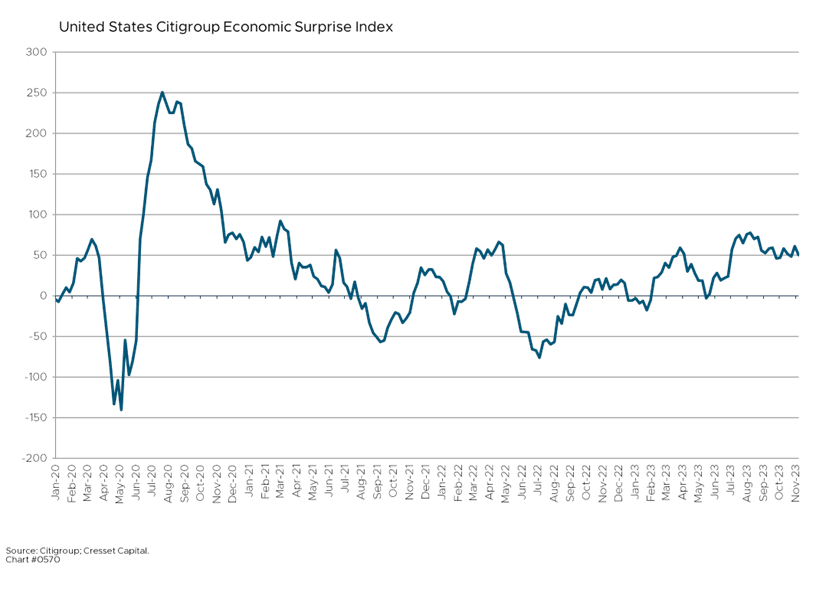

While investors are preparing to celebrate next year’s soft landing, economic data doesn’t appear to be cooperating. Some investors worry that the outlook fueling last week’s reversal might be too rosy. The benchmark Treasury yield has snapped back toward 4.5 per cent, but it remains a half-point higher than the start of August. In spite of a slower jobs report, economic data continues to surprise economists to the upside, suggesting expectations of an impending slowdown could be premature. Consumer spending last month busted through economists’ expectations, fueled by discretionary spending, like dining out and travel. The Citigroup Economic Surprise Index, which measures reported data vs forecast data, continues to trend higher from its June 2022 low; however, the Surprise Index looks backward rather than forward.

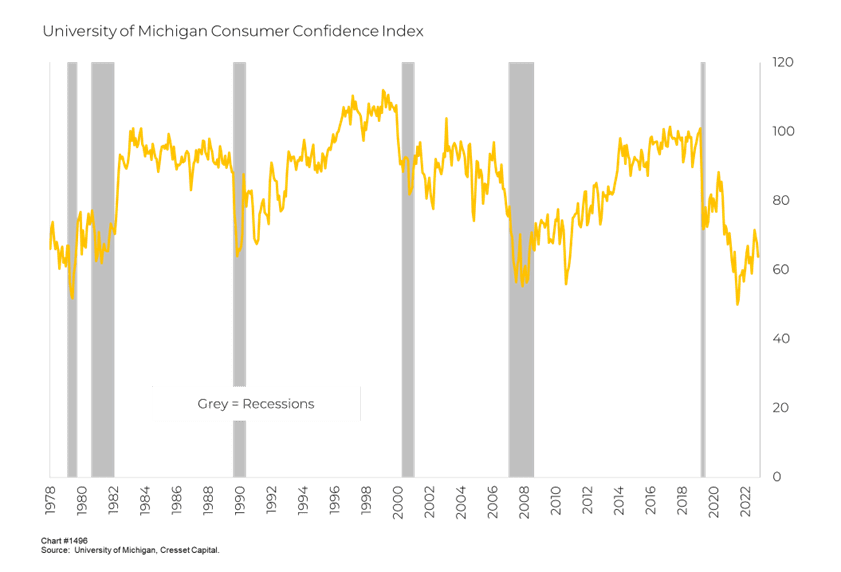

Looking ahead, we see growing evidence that consumer spending, the largest contributor to domestic growth, is already in the process of slowing. Recreation spending, after exploding once households emerged from the COVID lockdowns in 2021 and 2022, has rolled over in recent months. Spending on recreation services, like tickets to sporting events and concerts, is up 1.4 per cent this year, trailing overall spending, which is 2.5 per cent higher. A recent New York Times/Sienna College poll, showing Donald Trump leading Joe Biden in several swing states, points to voters’ dissatisfaction with the economy fueling their frustration with Joe. More than half of voters surveyed said the economy is in poor shape, despite record-low unemployment and widespread pay increases. Many believe the country is heading down the wrong track, perhaps reflecting broader dissatisfaction. It should be noted that personal income growth has trailed personal spending growth for five of the last six months, pushing shoppers to lean more heavily on credit cards. At nearly $1.3 trillion, credit card balances have ballooned nearly 10 per cent over the past year to an all-time high. Delinquencies are now beginning to rise. Perhaps it’s no wonder that consumer confidence has fallen toward recession-like levels.

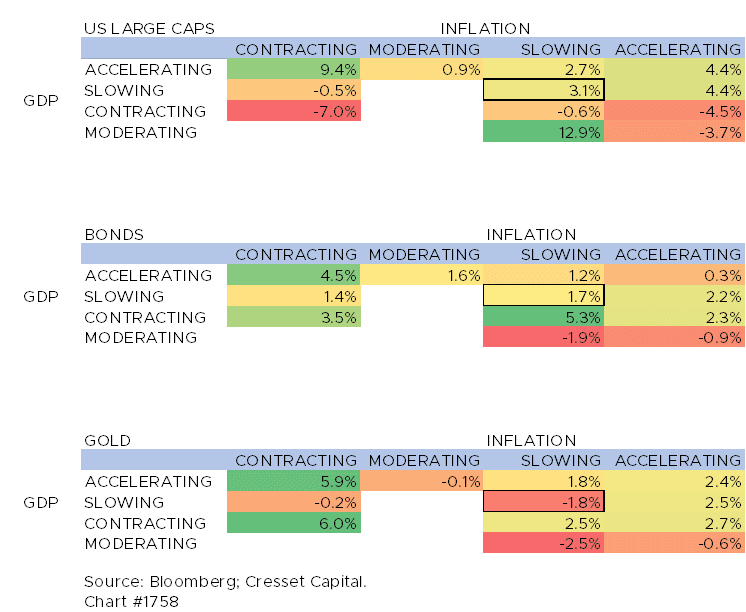

Bottom Line: We believe investors’ enthusiasm is well founded. Economic activity is slowing and that’s pushing inflation figures lower. Which investments do best in a “soft landing” scenario? We analyzed data as far back as 1974 and categorized quarterly GDP and CPI readings into “accelerating” (positive and higher than the previous quarter), “slowing” (positive, but lower than the previous quarter), “moderating” (negative, but higher than the previous quarter), and “contracting” (negative and worse than the previous quarter). The best average return when the economy and inflation are both slowing comes from US large caps at 3.1 per cent, which outpaced bonds (1.7 per cent) and gold, a proxy for commodities (-1.8%).