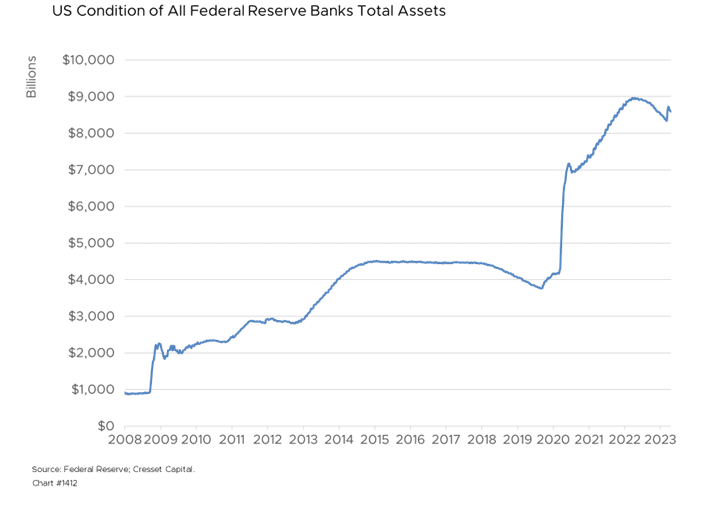

04.27.2023 Fourteen years of generously low interest rates ended when 2022 ushered in a new interest rate regime. Between 2009 and 2021, the overnight lending rate spent most of the period between two and four percentage points below the inflation rate, making borrowing decisions very easy. Banks were the biggest beneficiaries of the Fed’s generosity. Paying essentially nothing for deposits, bank balance sheets mushroomed. Between Q4/08 and Q1/22, US banks’ total assets expanded nine-fold, reaching $9 trillion. By Q1/22, when the Fed began its tightening program, the overnight rate was situated more than eight percentage points below the rate of inflation, representing its lowest real rate in history. The abrupt shift in monetary policy sent shockwaves throughout the banking system that are still resonating. What is the second-order impact of banking sector retrenchment?

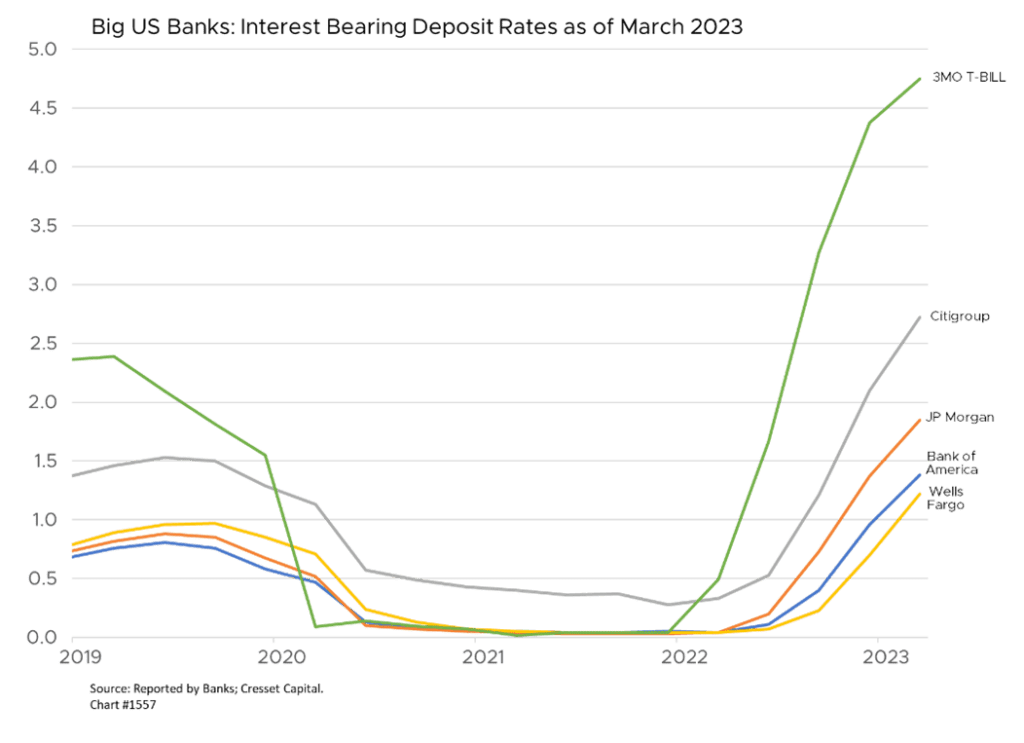

Chairman Powell’s program represented the steepest rate rise since 1980. Slow-moving deposit rates were unable to keep up with market interest rates, creating a problem for depositors. By March 2023, small, regional banks were hemorrhaging deposits. All told, depositors yanked more than $250 billion from smaller banks in March, forcing asset write downs and bank failures, most notably Silicon Valley Bank and Signature Bank.

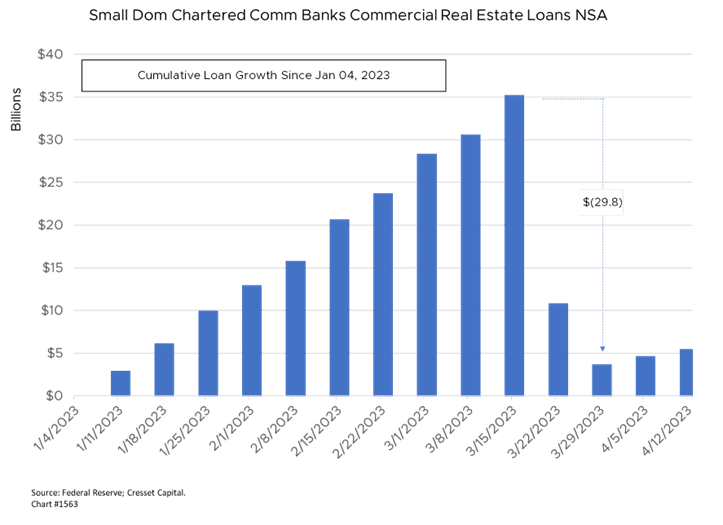

Banks reacted quickly by slashing their loan books. The number of commercial real estate (CRE) loans held by small and regional banks, representing 70 per cent of all bank CRE assets, plunged by nearly $30 billion in two weeks. Banks also tightened their underwriting standards, making loans they do originate more costly for borrowers. For now, the biggest issues bankers face surround funding, not credit quality. To date, bank assets remain relatively sound, although bankers are bracing for trouble. The largest banks are raising their loan loss reserves.

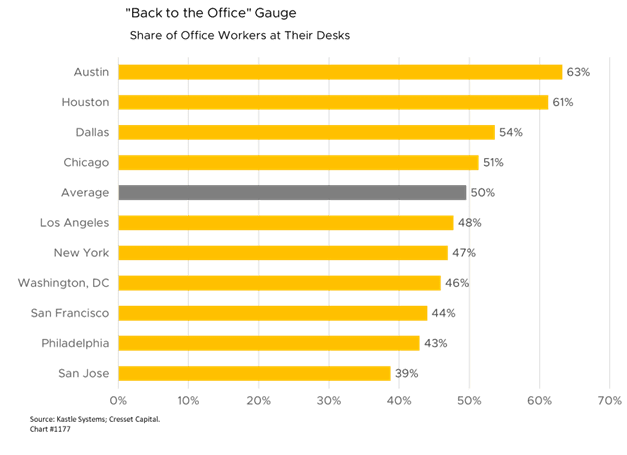

The commercial real estate sector is already feeling the impact of two converging trends: tighter liquidity and weaker fundamentals. The COVID lockdown altered the way Americans work and spend, particularly in metropolitan areas. At the same time, small and mid-sized banks have reduced the availability of credit, particularly for commercial real estate. The proliferation of remote work has had a profound impact on the office sector and on supporting real estate in the downtown business districts, like retail and convention hotels. We believe fundamentals in the office market will bifurcate as tenants upgrade their office space, leaving class “A” product fully occupied and class “B” and below bearing the brunt of vacancies. The share of office workers at their desks, as measured by security swipes, is about 50 per cent nationally, and is trending higher. Meanwhile, the multifamily, industrial, and resort hotel segments remain healthy as income streams are strong. Tighter credit conditions could crimp valuations, but will not likely be a catalyst for defaults.

Banks collectively account for just under half of CRE loan volume, with insurance companies, private lenders and commercial mortgage-backed securities accounting for the rest. Liquidity issues related to banking imbalances will be temporary, lasting 12 to 18 months. We expect deposit rates to catch up to market rates once the Fed pauses, likely in May, and overnight rates stabilize. Tighter credit conditions coupled with lower loan-to-value requirements will have a longer-term impact on the broad commercial real estate sector.

In the interim, the segment of CRE most vulnerable to retrenchment in the banking sector would be smaller, local projects with loan values below $20 million, including multifamily, retail, office and hotel whose loan balances are too small for money center banks, and whose loans don’t qualify for inclusion in commercial mortgage-backed securities. Distress will emerge among recently originated, highly leveraged projects whose loans need to be refinanced. We anticipate a swath of insolvency creating rescue opportunities at attractive cap rates for equity buyers over the next 12 to 18 months.

Bottom Line: The reduction of commercial real estate exposure among the banks has the potential to disrupt parts of the market that are already fundamentally challenged, like office and retail situated in downtown business districts. Additionally, projects that were funded over the last two or three years with low-rate financing and a high loan-to-value ratio could have difficulty refinancing without an equity infusion. The disruption could create opportunities for agile investors, but we don’t anticipate a seismic shift in commercial real estate.