01.17.2024 Eleven spot bitcoin exchange-traded funds (ETFs) were launched last week following SEC approval. Gary Gensler, SEC Chairman and crypto-critic, once called crypto the “Wild West” of investing, filled with looters, drug dealers and con artists, according to the New York Post. Nonetheless, bitcoin funds launched with about $33 billion in assets, thanks in large part to the conversion of the Greyscale Bitcoin Trust, a collective vehicle holding about $29 billion of the digital currency. The Trust charged shareholders a 1.5 per cent management fee, while many of the newly minted ETFs are touting no management fees at least initially. It is estimated that US-listed spot bitcoin ETFs could garner upwards of $15 billion of inflows this year and reach $50 billion within two years, according to Bloomberg reporting. So, how do these new bitcoin ETFs work?

While bitcoin futures ETFs have traded on exchanges for the last several years, spot bitcoin ETF shareholders do not own the cryptocurrency directly. Instead, they own shares of a fund that holds bitcoin, similar to other commodity funds. In exchange for the fund’s management fee, the fund manager is tasked with purchasing and safekeeping bitcoins on behalf of its investors.

While the ETF returns will mimic the ups and downs of the cryptocurrency, fundholders will not enjoy many of the original benefits of bitcoin. The archetypical cryptocurrency was originally developed as an alternative store of wealth, beyond the reach of governments. Moreover, bitcoin, like other cryptocurrencies, could be held anonymously, so transactions could be conducted in secret, beyond the watchful eye of regulators. Additionally, the electronic store of wealth could easily move with you across borders without detection – you could simply log into your wallet and access your holdings anywhere there’s an internet connection. Lastly, bitcoin, like currency, was designed as a medium of exchange. Owners could transact in cryptocurrency for purchases and sales of anything from a piece of pizza to piece of real estate.

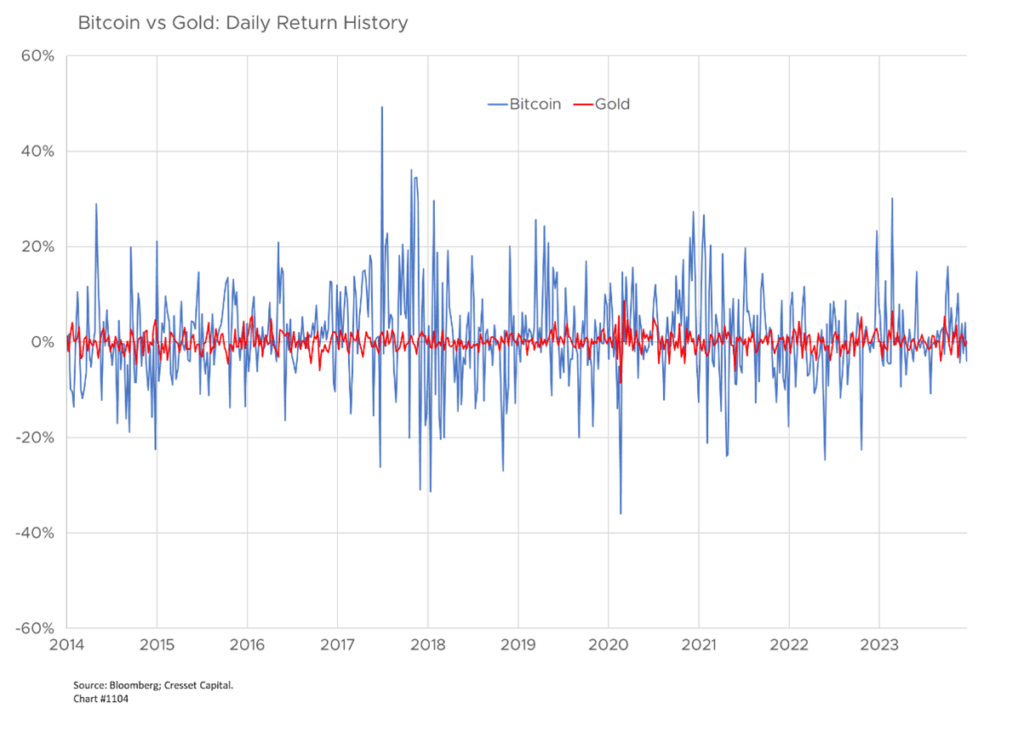

Unfortunately, those benefits are not available to bitcoin ETF holders. These ETFs will be closely regulated, holdings will be monitored, and purchase and sale transactions will be tracked by the IRS, so gains will be subject to taxation. As a registered security, bitcoin fund holdings cannot simply move across borders without attracting regulatory scrutiny. In many respects, bitcoin ETF investors will indirectly benefit from those features, the definition of a derivative. There’s a risk that with too many ETF holders, many of bitcoin’s underlying attributes disappear, leaving those holding the ETFs with little more than digital gold, with five times the volatility of the precious metal.

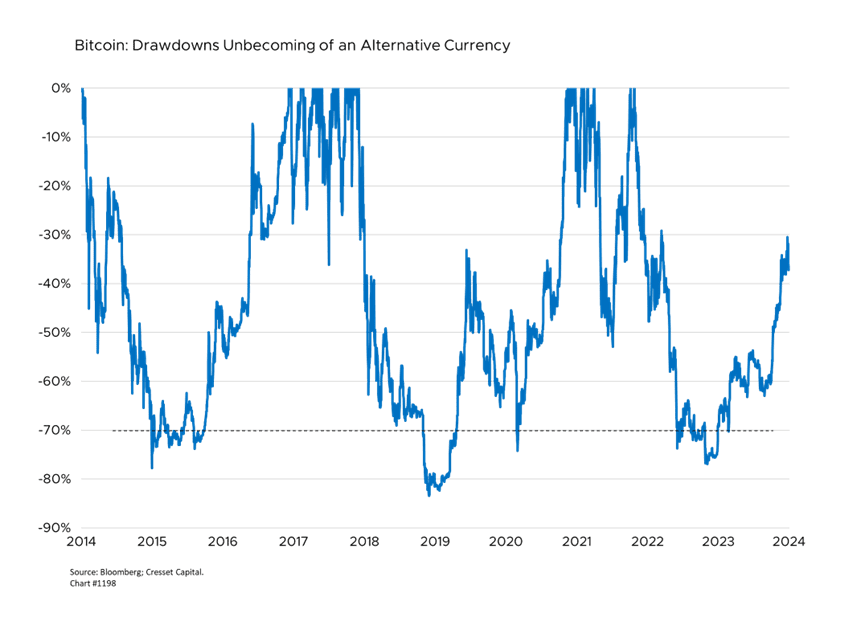

Bottom Line: Spot bitcoin ETF holders should view their investment as a speculation; holding a registered investment in the digital currency removes bitcoin’s benefit of anonymity. Also note that, as an asset class, bitcoin has done a poor job of hedging in equity downturns. The S&P 500 lost ground in two years over the last 10, and bitcoin didn’t protect investors. When the S&P slipped 4.4 per cent in 2018, bitcoin plunged nearly 74 per cent; in 2022, when the market slid more than 18 per cent, bitcoin collapsed more than 64 per cent. Bitcoin holders have suffered three 70+ per cent drawdowns over the last decade. In the near term, after the “buy the rumor, sell the news” effect, we anticipate bitcoin demand to increase as established, institutional players add the asset to their portfolio allocations.