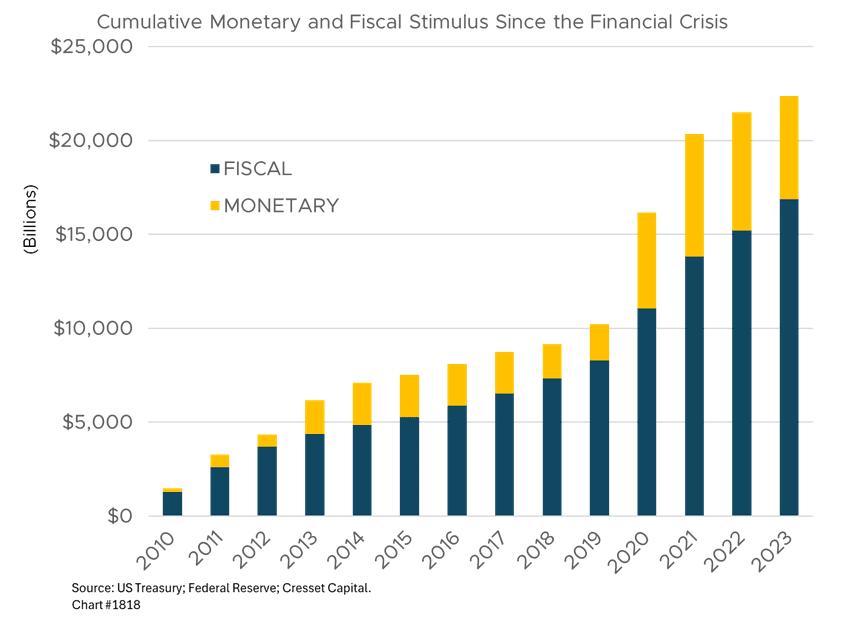

5.22.2024 Since the financial crisis, US fiscal and monetary policymakers have infused the economy and markets with unprecedented liquidity, adding collectively more than $22 trillion, with more than half of that having been thrown in since the pandemic. That figure does not include the stimulative effect of holding interest rates between two and three percentage points below fair value for 12 years. We estimate that policy in effect chipped in to the economy and markets over one trillion dollars annually. This cavalcade of cash helped grow the economy, fueled inflation to a level not seen in 40 years, and pumped up the value of assets from equities to housing to cryptocurrencies. Which begs the question: Are we in a bubble?

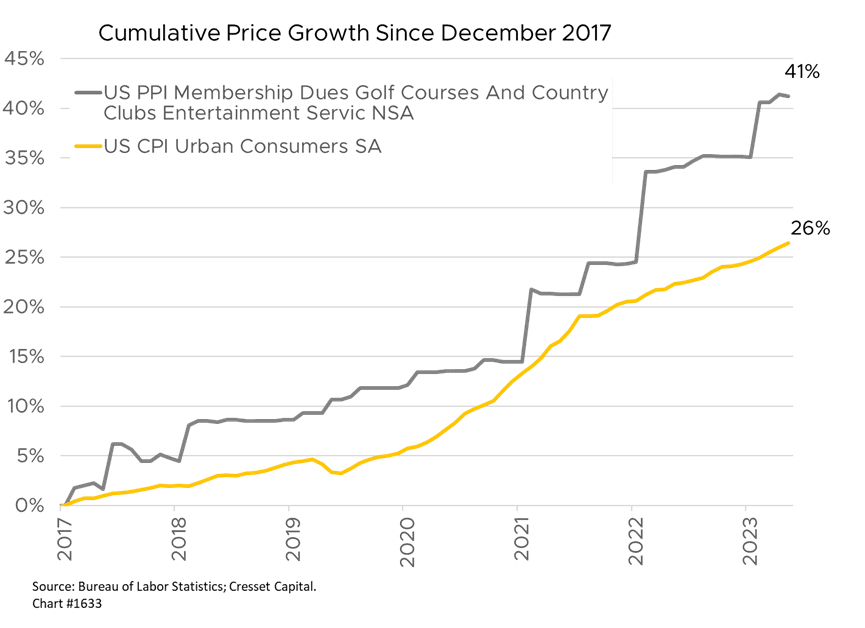

Potential for an “everything, everywhere bubble” driven by excessive liquidity, speculation, and irrational exuberance – particularly optimism around artificial intelligence (AI) – is possible. Big tech companies are engaged in a trillion-dollar AI arms race, investing heavily in infrastructure and foundational AI models. This capex splurge could be one example of excess driven by exuberance and could lead to overcapacity and diminished returns. Famed value investor and Warren Buffet mentor Benjamin Graham (née Benjamin Grossbaum) asserted, “In a speculative market, what counts is imagination, not analysis.” Imagination has been the fuel powering cryptocurrency’s rise. Anecdotal evidence supports the view that excess liquidity has fueled market speculation and price increases across the economy, particularly among some of the most discretionary purchases. As equity markets hit new highs, country club costs are surging and meme stocks are on the rise again. Since the end of 2018, the cost of playing golf at public and private golf courses has surged more than 40 per cent, nearly twice the rate of inflation overall.

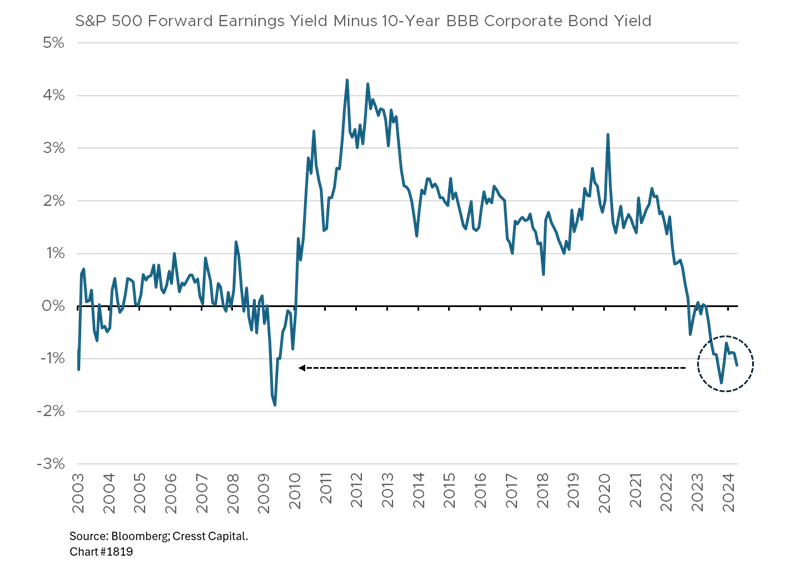

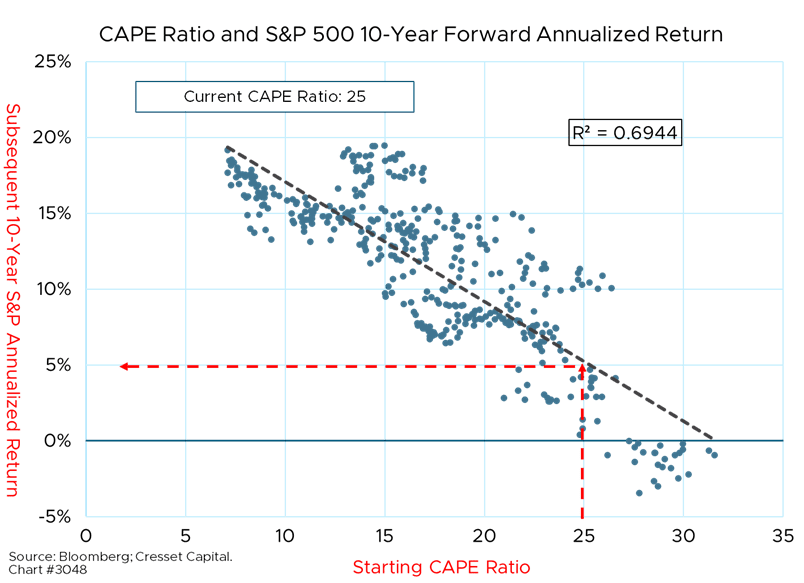

Even though interest rates normalized in 2022 as the result of Fed rate hikes, monetary and fiscal stimulus are still in play even though our nation’s unemployment rate, at 3.9 per cent, is among the lowest in history. Meanwhile, US national debt has ballooned to $34.6 trillion due to constant wars and spending. The government is, in effect, implementing Modern Monetary Theory (MMT) by printing money to finance deficits, leading to asset price inflation across the board. US equity market valuations are stretched relative to bonds. The 10-year, BBB-rated corporate bond yield is a good proxy for the S&P 500’s forward earnings yield (the reciprocal of its forward PE ratio), the cost of capital for most firms in the Index. After spending most of the time since the financial crisis comfortably higher than its corporate bond counterpart, thanks to quantitative easing, the S&P’s earnings yield has slipped below the corporate bond yield and now sits at its lowest point in nearly 15 years. While valuation is not a timing tool, it does point to diminished returns over a 10-year investment horizon.

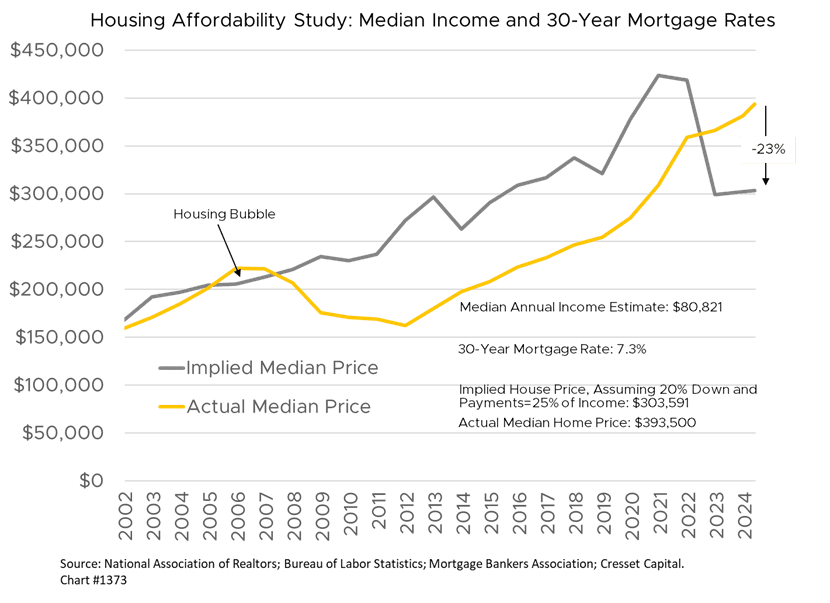

Real estate, both commercial and residential, appears to have not fully adjusted to normalized bond yields. Multi-family cap rates, which rose from 4.5 per cent to 5.7 per cent in early 2022, have not risen to the same degree as financing costs. In early 2022, apartment building cap rates were 2.3 percentage points higher than commercial mortgage-backed security (CMBS) yields; that advantage has narrowed to 0.3 per cent. Single-family properties are particularly stretched based on Cresset’s housing fair value model, which uses median household income and current mortgage rates to derive an implied median home price. Between 2009 and 2022, our median price estimate was substantially higher than the actual median home price, thanks to artificially low mortgage rates. Since interest rate normalization in 2022, fair value plunged while home prices rose, leaving our median home price estimate at $303,591, more than 20 per cent below the actual median home price of $393,500. It should be noted that at the peak of the housing bubble, our median home price estimate was seven per cent below the actual home price median.

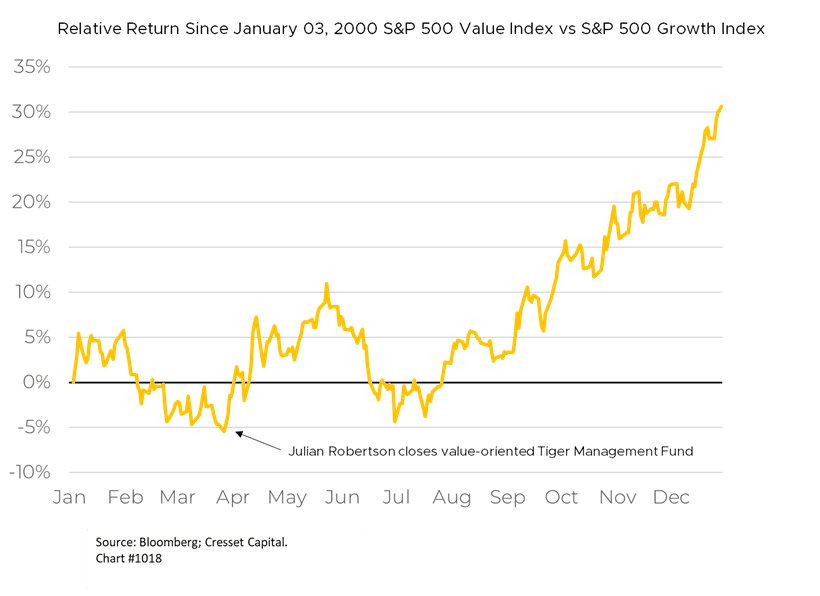

Rising liquidity and enthusiasm are prompting bearish investors and strategists to throw in the towel and raise their S&P 500 targets. In what could be a watershed event, Morgan Stanley Chief Strategist Michael Wilson – one of last year’s most prominent bears – who forecasted a 15 per cent decline in 2024, recently whipsawed and turned positive on the outlook for US equities. While Wilson’s whipsaw might not be a watershed event, value investor Julian Robertson shuttered his famed Tiger Management in March 2000, after years of trailing a growth market with a value strategy, at the peak of the tech bubble and the relative bottom of value investing.

It should also be noted that valuation might indicate excess, but history has shown that expensive markets can remain expensive. The relationship between valuations and short-term return is random over the long run, but expensive markets crimp returns longer term. The relationship between the S&P 500’s beginning cyclically adjusted price-earnings (CAPE) ratio accounts for nearly 70 per cent over the variation (r-squared) in the market’s 10-year subsequent annualized return. The S&P 500’s current CAPE ratio of 25x implies a 10-year annualized return of 5-6 per cent. That’s in line with the pre-tax equivalent yield of 10-year, BBB corporate bonds and municipals.

Deflating an asset bubble often requires a catalyst. In 2000, it was Fed tightening that popped the tech bubble. Worried about the impact of Y2K, then-Chairman Alan Greenspan held off raising rates until he was certain the lights would turn on again after the turn of the millennium. In 2008, the Lehman default triggered widespread selling caused by concern that the underpinnings of the financial markets were broken. Today, the widely watched potential catalysts include: a resurgence of inflation that would foster Fed tightening and higher rates; a commercial real estate value reset that impairs regional bank balance sheets; a US debt overhang prompting bond market “vigilantes” to hike real interest rates; geopolitical shocks; and a contested 2024 US presidential election. The timing and impact of potential catalysts are uncertain, yet each of them bears watching.

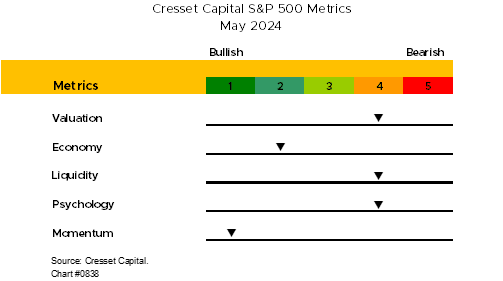

Bottom Line: Years of monetary and fiscal largess have filtered their way into our economy and markets, boosting prices and asset values. A correction in asset values has the potential to impact not only investors but also their lenders and the broader economy, depending on the catalyst, its magnitude and velocity. While the Federal Reserve has adequate flexibility to ease and tighten financial conditions while the US dollar remains a fiat currency, the financial flexibility afforded to US fiscal authorities, has diminished given today’s interest expense burden and its projected growth. Momentum might carry markets higher in the near term, although the longer-term outlook appears more challenged based on historical valuations, rising risks, and the potential for an unwind of crowded speculative positioning. We recommend a quality-oriented approach to both equity and credit and remain on the lookout for any deterioration in liquidity or momentum as an indication to reduce risk.