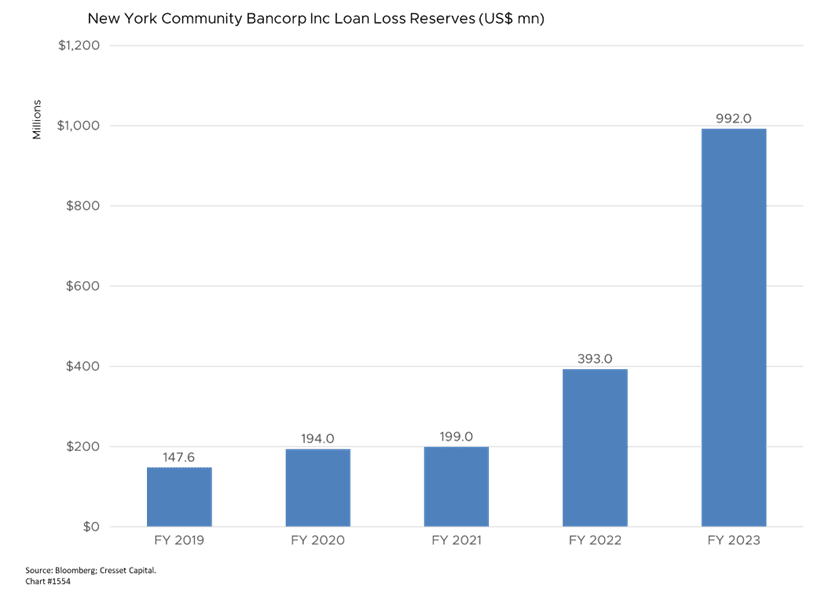

2.9.2024 The commercial real estate (CRE) market, particularly office buildings, is under severe strain and property values have declined sharply. The brewing distress bubbled over last week when New York Community Bancorp, a regional bank with over $100 billion in assets, set aside nearly $1 billion for potential losses on property loans and slashing its dividend 40 per cent. The bank’s market value was promptly cut in half as the news revived worries about the kind of contagion into the banking system seen during the 2008 financial crisis. Should we be worried now?

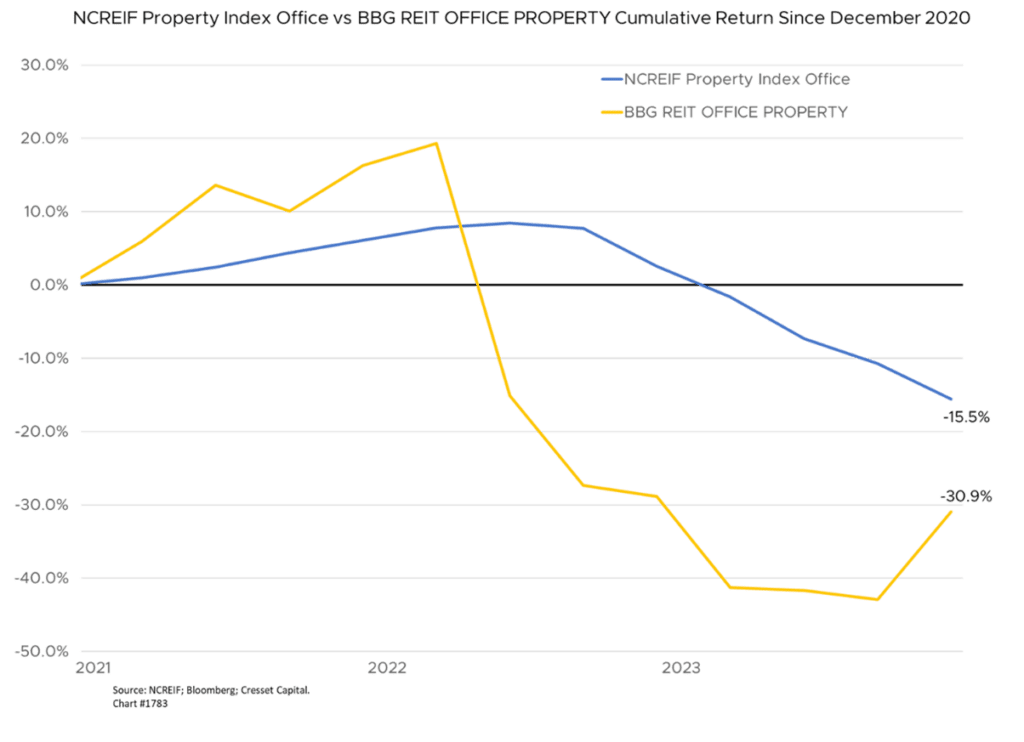

Several factors are contributing to the stress. Higher interest rates have translated into lower valuations for all commercial properties. As yields rise with higher rates, property prices fall in order for returns to maintain their comparable advantage. While some holders have done a better job than others in recognizing the impact rates have had on valuations, lower valuations have wiped out equity for many highly leveraged landlords. Since the end of 2020, private property values for US office buildings have declined by more than 15 per cent, according to the National Council of Real Estate Fiduciaries (NCREIF). That’s about half of the valuation downdraft office REITs have suffered in the interim. While REIT valuations reflect a knee-jerk reaction from petulant shareholders, we believe the proper office market valuation is somewhere between the two.

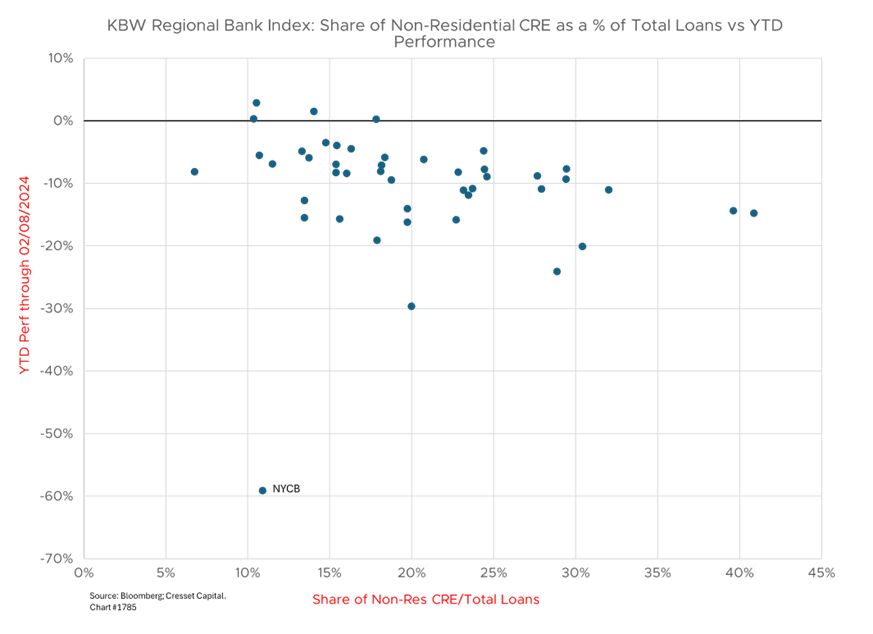

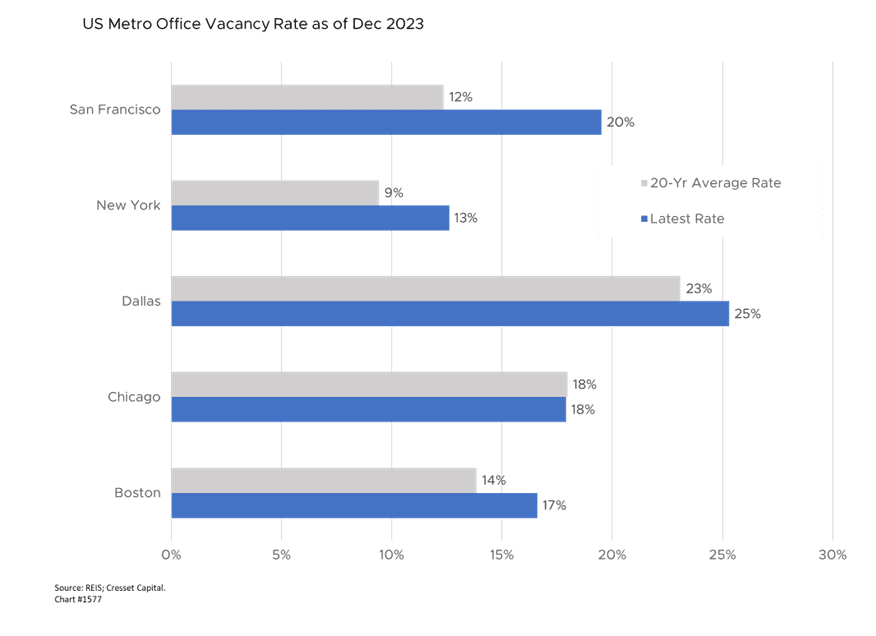

Lower occupancy is severely affecting revenues, especially for offices, as remote and hybrid work reduces demand for space. The downtowns of major cities like New York and San Francisco have been hit hardest, with record-high vacancy rates. Because of lower rents and higher vacancies many landlords are struggling to refinance maturing mortgages. A record $541 billion in CRE debt matured in 2023, and this will rise to over $2 trillion through 2027. So far most have been repaid or extended, but that is getting harder. Investors are concerned that office sector distress could threaten regional banks with heavy real estate loan exposure.

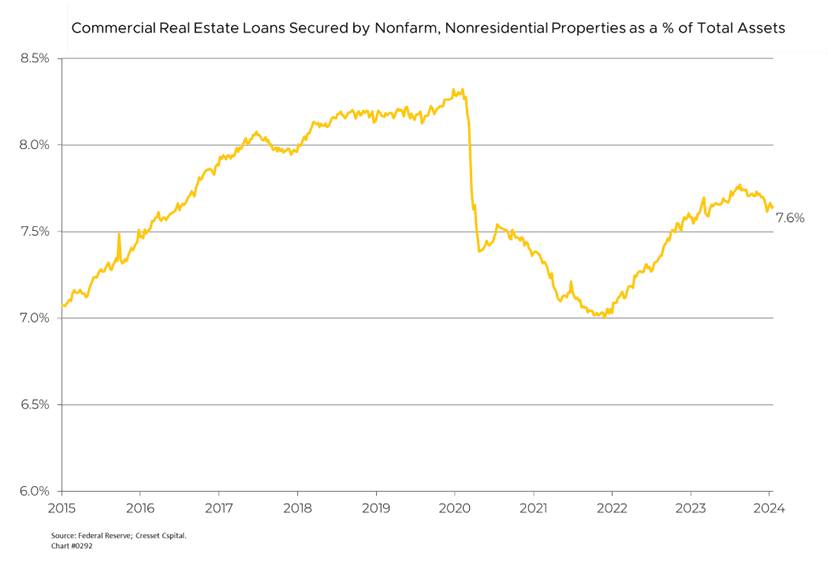

The heightened concern could be valid for specific banks, but non-residential commercial real estate represents less than 10 per cent of total assets at US banks. We believe losses can be absorbed this time without triggering a banking crisis. Fed interventions in 2023 to support troubled banks have contained the threat of deposit runs against a backdrop of massive rate hikes. We believe today’s property woes will play out slowly, given lengthy loan and lease terms. Moreover, values could still recover if rates decline as expected later this year. Thus far, office sector risks appear to be concentrated in the downtown areas of major cities. International banks tend to lend more into top-tier metro office markets like New York, which are exposed to the worst demand drops from remote work. Meanwhile, suburban offices, a sector favored by smaller regionals, are in better fundamental shape.

Bottom Line: Commercial real estate valuations, most notably office, have not fully reflected higher borrowing rates. However, banks are not interested in foreclosing and are willing to be patient. The good news is the Fed is in the process of lowering the benchmark rate, easing the burden on borrowers. It is fully aware of the risk that commercial real estate plays among the regional banks and will take steps to reduce rates even further to help restore real estate asset values. Struggling property owners could further challenge a handful of vulnerable regional banks. But for now, the slow-moving downturn appears unlikely to critically destabilize the broader financial system. Opportunities in distressed properties, both on the debt and equity sides, may present themselves to well-capitalized, patient investors.