09.14.2023 The interest rate reset of 2022 weighed down stocks, bonds and virtually all other risk assets. We entered 2023 worried that higher rates would reverberate through the economy, as higher debt service expenses, along with higher wage costs, would crimp profits. While wages indeed rose, expanding 5.4 per cent year over year through February, interest expenses remained contained thanks to fixed-rate financing. What are the implications of the tsunami of refinancing heading toward all debt markets over the next few years?

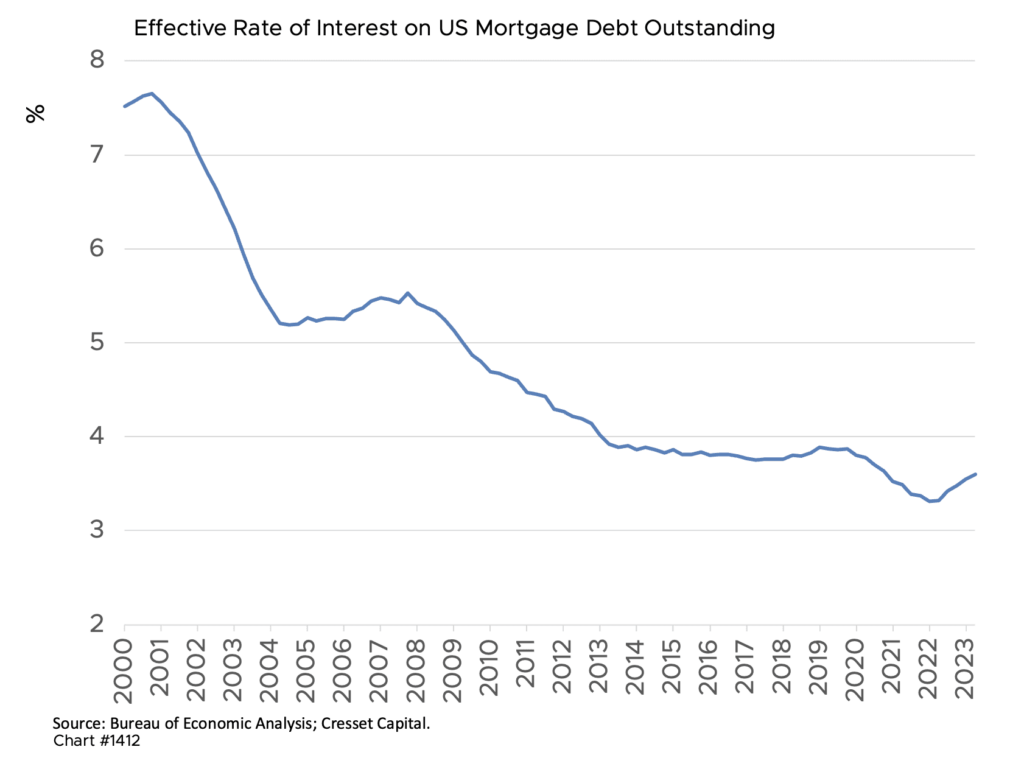

Nowhere is the fixed-rate financing phenomenon more on display than in America’s housing market where, by the middle of 2020, more than 90 per cent of new mortgages issued were fixed rate. Despite today’s 7.5 per cent conventional financing rate, the effective mortgage rate – the average rate most homeowners are currently paying – was 3.6 per cent through June, up a scant 0.3 per cent over the previous 12 months, according to the Bureau of Economic Analysis.

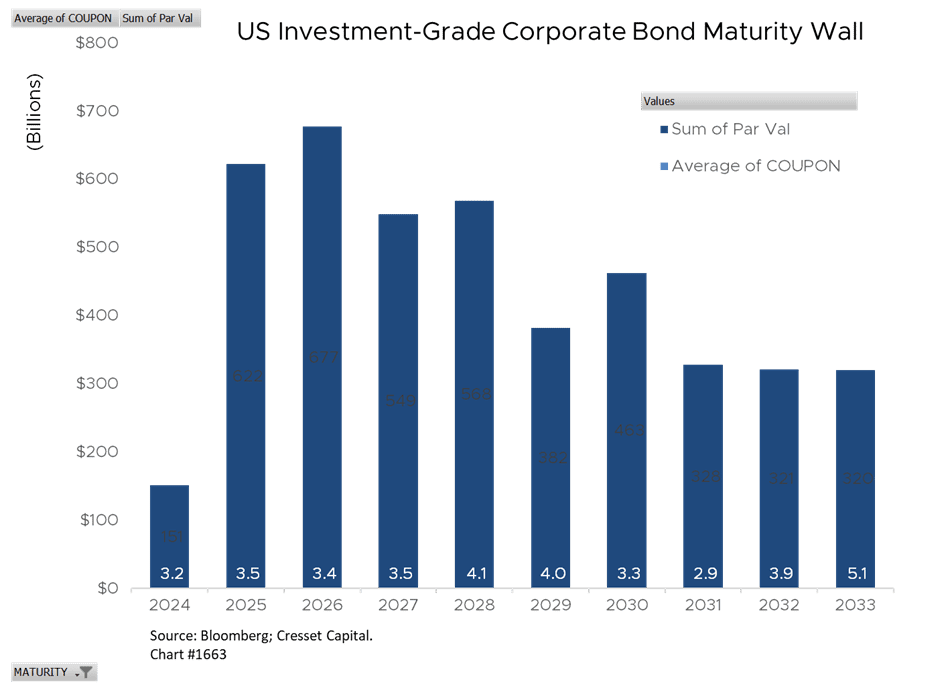

A similar phenomenon is at play in other areas of the fixed-income markets. Within the investment-grade corporate bond market, we estimate the effective rate corporate borrowers are paying is around 3.5 per cent even though today’s BBB financing rates are closer to six per cent. That said, there are $1.5 trillion investment-grade corporate bonds coming due over the next three years, representing a collective $39 billion of increased financing costs if current financing rates stay put.

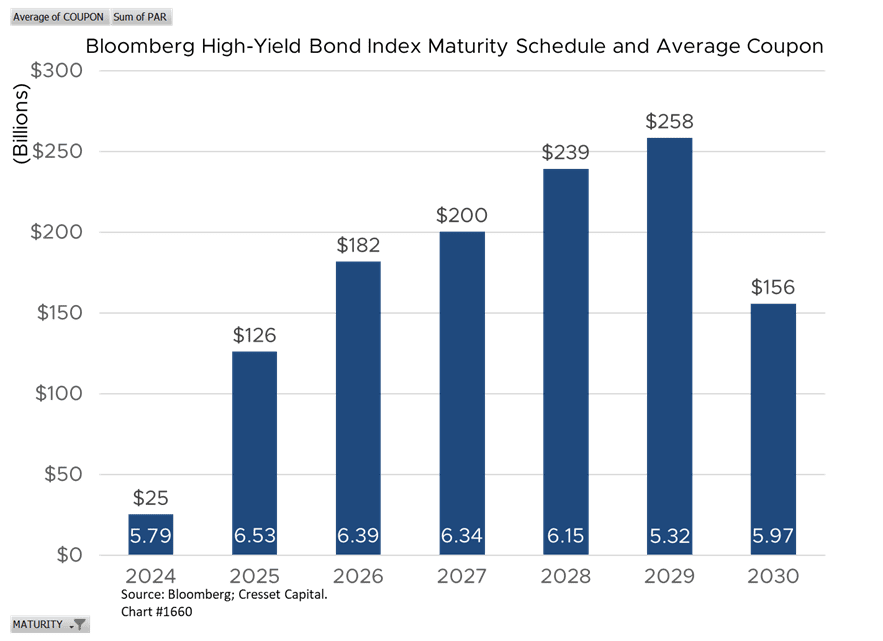

The corporate high-yield bond market, while smaller, is bracing for a profound impact as impending maturities come due. The current financing cost for lower-quality corporations is around 8.5 per cent, while the average coupon outstanding on existing debt is six per cent. With nearly $775 billion coming due over the next five years, we expect financing costs to rise by $19 billion in the interim. That’s more than a 40 per cent hike in financing costs for a collection of companies whose debt levels are already high relative to their assets.

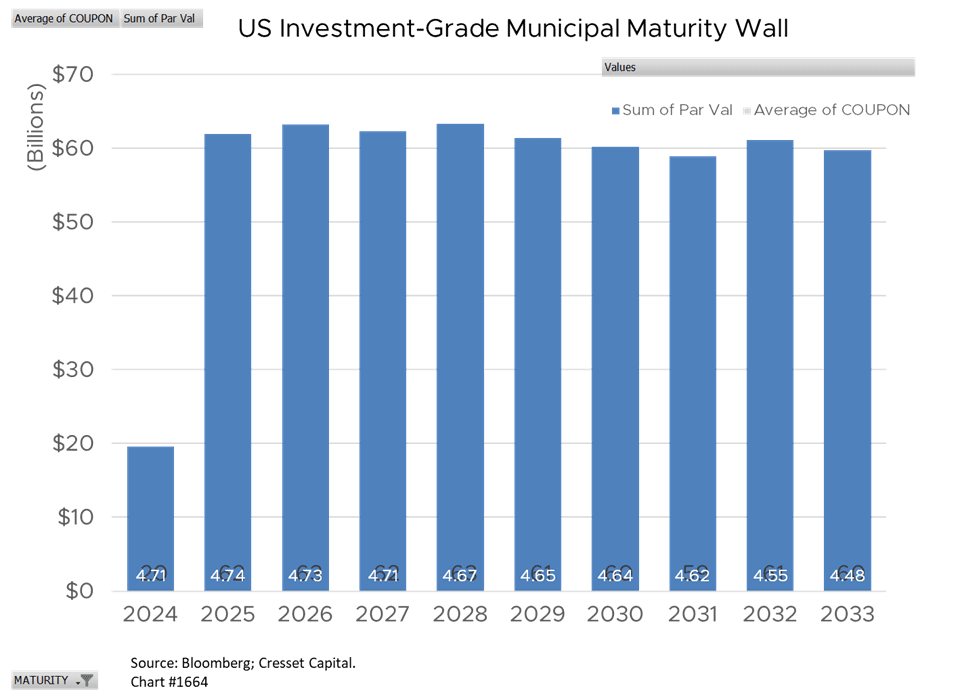

The municipal maturity wall is not severe, and refinancing is not expected to impair municipalities’ financial conditions. In fact, refinancing could potentially improve municipal financing costs. That’s because most muni debt is long term, and bonds with impending maturities were likely issued many years ago when interest rates were relatively high. Even though $144 billion of debt is due to mature over the next three years, the average coupon on debt outstanding is over 4.5 per cent. That’s higher than the 3.8 per cent average cost of capital among investment-grade municipal borrowers.

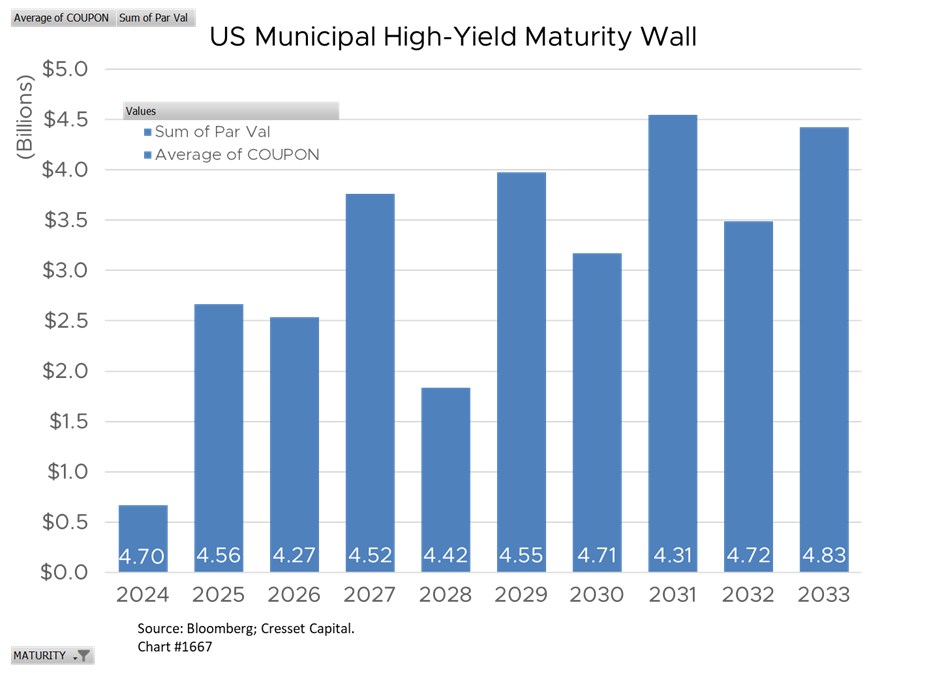

Even though municipal finances are relatively tenuous, the muni high-yield maturity wall does not pose the same threat as corporate high yield does. Like their higher-quality counterparts, municipal high-yield borrowers carry longer-term loans so that issues maturing over the next few years were originated when interest rates were higher. Like the rest of the municipal bond market, muni high-yield bonds on average carry coupons in excess of 4.5 per cent. While this is below the average 5.89 per cent prevailing yield in that space, the yield differential is substantially narrower than the differential among corporate bond borrowers.

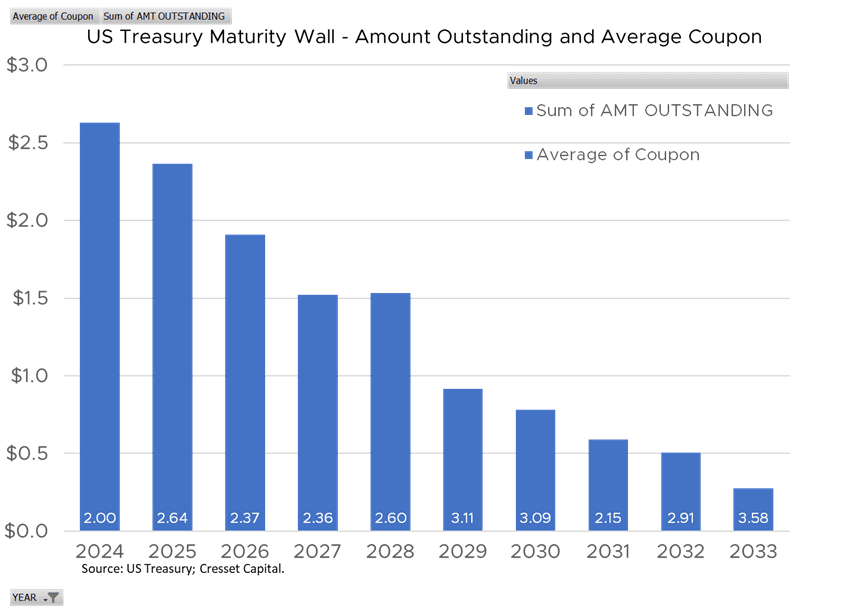

The US Treasury, the biggest borrower of all, faces a daunting maturity wall now that yields across the curve are consistently above four per cent. Unlike state and local issuers, the federal government relied on shorter-term financing rather than locking in relatively low rates for longer. As a result, the US Treasury maturity wall is front loaded, with more than $2.6 trillion of debt coming due next year carrying an average coupon of two per cent. Depending on where the Treasury chooses to issue new bonds next year, we estimate the incremental interest cost of refunding 2024 maturities will exceed $100 billion.

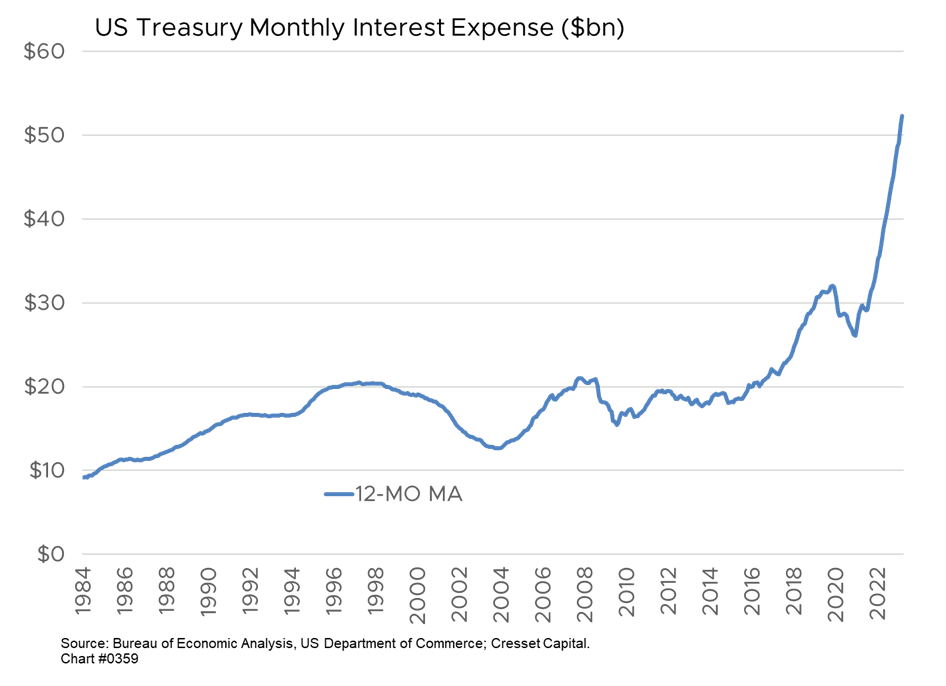

Higher interest rates are already having an impact on the government’s budget. Our nation’s trailing 12-month average monthly interest expense has spiked to $52.3 billion. That’s nearly double our average monthly interest expense since March 2021, according to Bureau of Economic Analysis data. This unfortunate upward trend will undoubtedly continue.

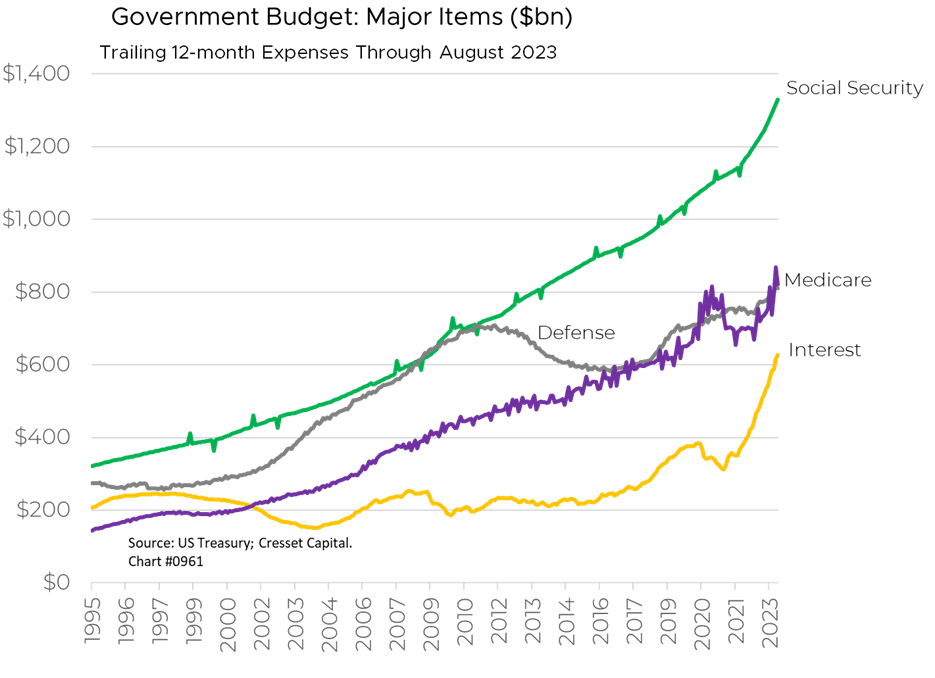

At $628 billion over the last 12 months through July, interest expense is quickly becoming a major spending item, closing in on Medicare, at $822 billion, and defense, at $810 billion. This is a troubling prospect as we approach federal budget negotiations this month.

Bottom Line: The transition to higher borrowing costs, while not an immediate threat, presents a steady headwind to corporate America over the next several years, with weaker, more highly leveraged companies and sectors bearing the brunt of it. The municipal market, meanwhile, will largely steer clear of the income statement stress, thanks to largely long-dated funding. The interest rate transition should be gradual enough to not pressure the economy overall. Nonetheless, we reiterate our quality bias for both stocks and bonds as rates gradually normalize throughout the system.

That said, the US federal government presents a unique challenge, and it’s one we’ve been wringing our hands over for decades. However, at a time when governance is in absentia, today’s impending budget stalemate creates a near-term market challenge that ratings agency Fitch referenced in its recent report downgrading US debt. As long as we own the keys to the currency printing press, we have the ability to repay our obligations. Our willingness to pay may be another matter.