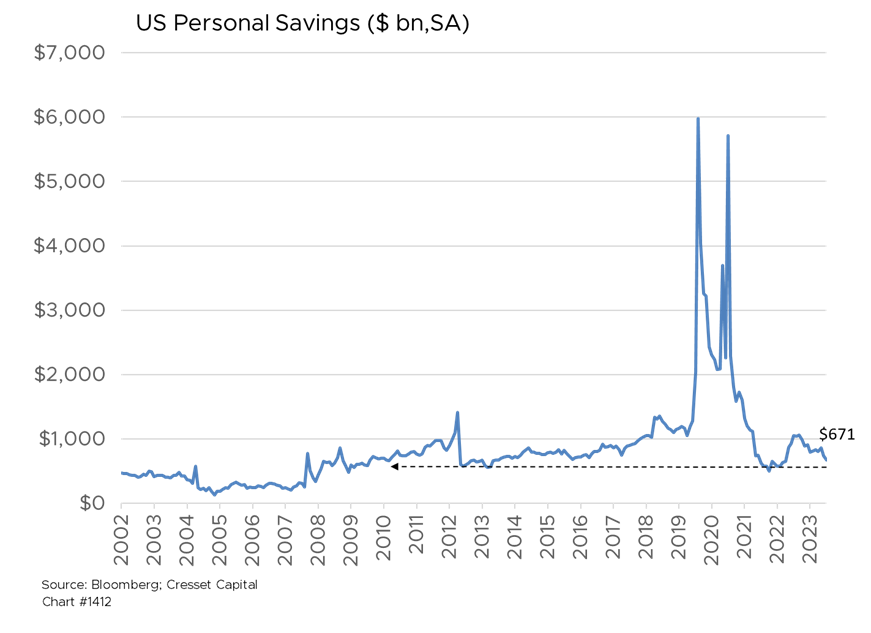

5.30.2024 It’s been more than four years since the COVID-19 outbreak and worldwide shutdown, which drove a wedge between winning and losing industries. For example, while cruise lines suffered, streaming companies flourished. Most US households, however, fared reasonably well, thanks to monetary and fiscal largess. Thanks to a cascade of government cash, personal savings swelled to $6 trillion, more than ten times its historical median. Now that the savings stockpile has dwindled, American households are facing a similar divide.

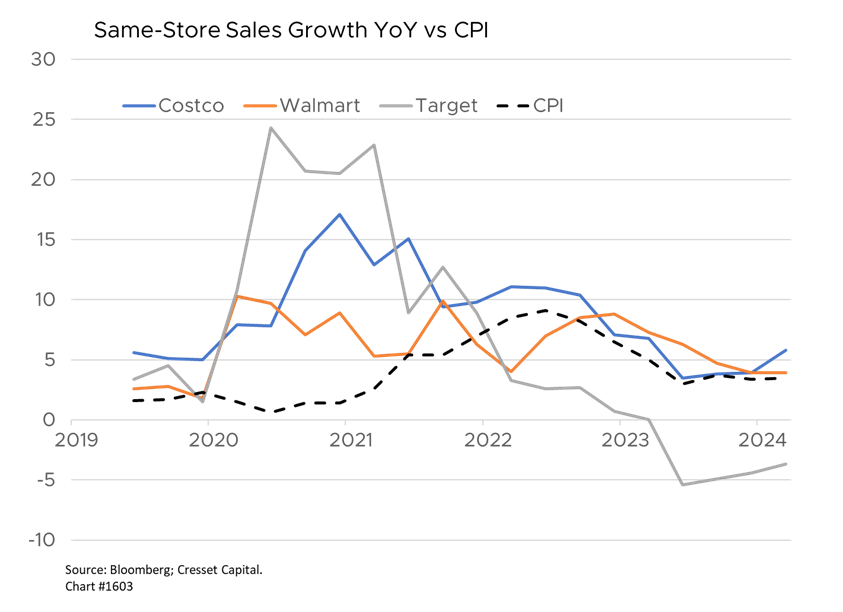

The biggest division splits high- and low-income households. JPMorgan’s analysis of its customers’ data leads it to conclude the US is in a “selective recession”: over 70 per cent of their low-income consumers are struggling to make ends meet due to persistent inflation, while their upper-income consumers are faring better. This divergence is prompting major retailers like Target and Walmart to cut prices on thousands of items as the economic stress weighing on middle-income households is crimping their sales growth. Target reported its fourth consecutive quarter of comparable sales declines, citing lower discretionary spending. Post-pandemic sales growth at Walmart and Costco has matched the increase in the consumer price index, suggesting that revenue growth was fueled by price increases, not volume growth. Sales growth at Target has plunged, implying the discount retailer lost market share. Walmart recently reported that it’s benefitting from more sales to customers in households with incomes over $100,000. Other retailers, like Rue21 and 99 Cents Only Stores, which cater exclusively to budget-conscious shoppers, have filed for bankruptcy.

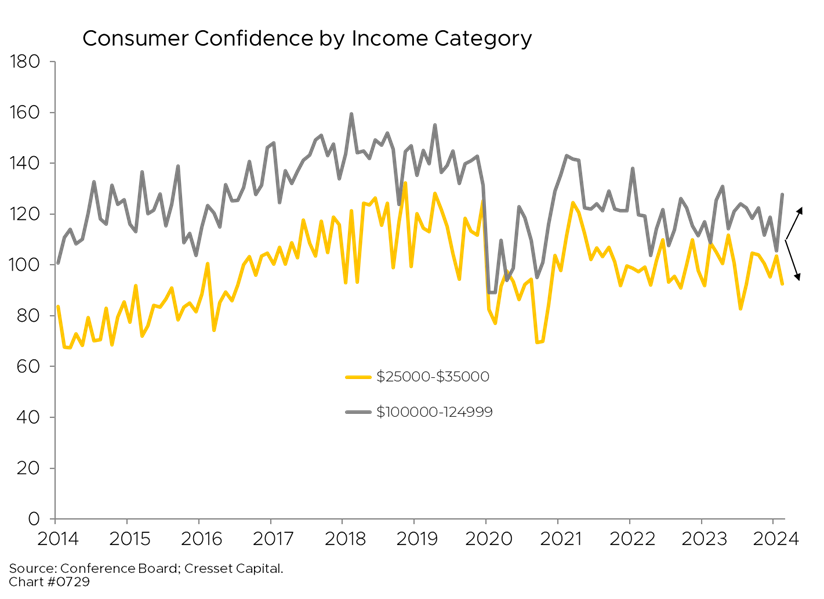

Consumer confidence data by income category underscores the incipient division between households. While the overall index rose for the first time since January, the split between income categories is widening, with confidence among households earning between $100,000-$125,000 rising to its highest level in a year, while confidence among households earning between $25,000 and $35,000 falling to its lowest level since November. Accumulated price increases in groceries and at the gas pump over the last few years are straining household budgets, particularly for low and middle-income families. Many Americans believe their income isn’t keeping up with the cost of living, with food and groceries having the greatest impact on their economic views. While policymakers focus on the change in inflation, households have longer memories – they’re focused instead on the price level, and prices are nonetheless higher even though they’re no longer rising as fast.

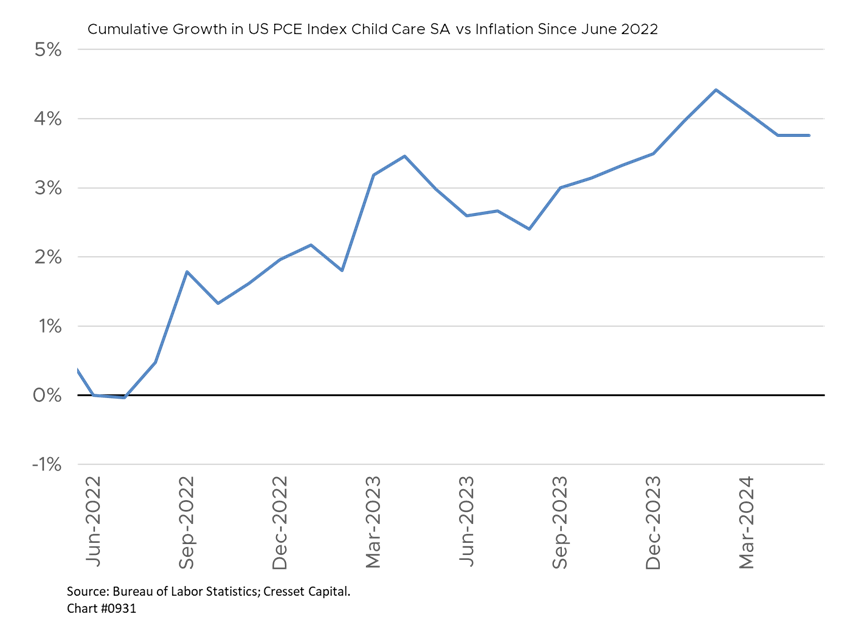

Childcare costs are another flash point, and not only for lower-income parents with young children. A recent Fed survey found that the share of parents living with children under the age of 18 “doing alright financially” slipped from 69 to 64 per cent in 2022. A growing share of households with young children reported paying nearly as much for childcare as they did for housing, according to the The Wall Street Journal. Childcare costs have significantly outpaced the inflation rate since mid-2022, eating into household budgets.

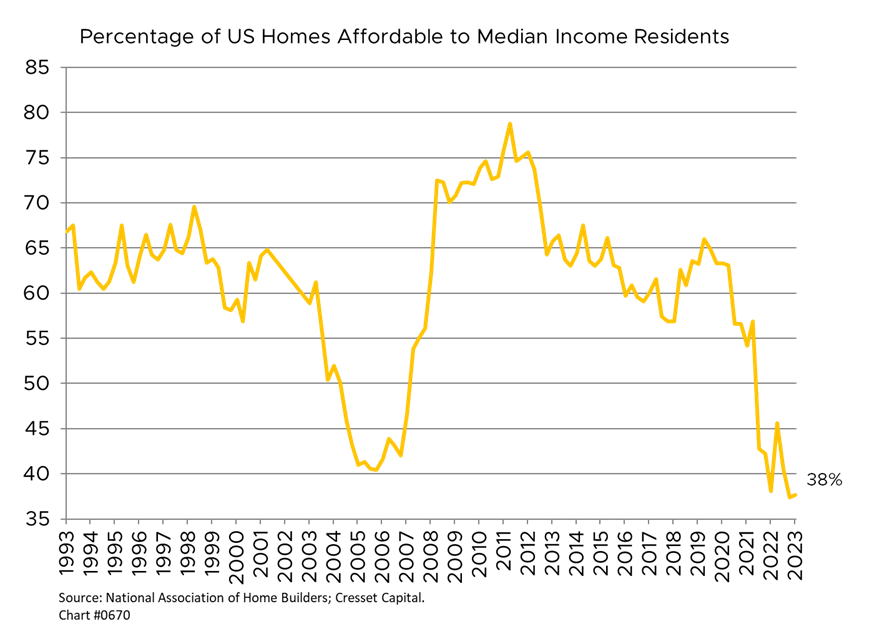

Recent consumer surveys also show a growing divide between Americans who own their own homes and renters. Thanks to the proliferation of fixed-rate mortgages, most existing homeowners were insulated from the recent rise in interest rates. The effective rate on mortgage balances outstanding is 3.8 per cent. That’s well below today’s 7.4 per cent prevailing interest rate on 30-year fixed-rate mortgages, according to Bankrate.com. Renters, meanwhile, were forced to cough up higher annual lease payments. Rents have risen more than 20 per cent since 2020, according to the Bureau of Economic Analysis. With low-rate borrowers settled in their homes, the supply of homes for sale is low and prices are high, making housing less affordable. Housing affordability has sunk below the level it hit in the 2005-2006 housing heyday. A recent University of Michigan survey confirms that view, indicating the worst homebuying sentiment in history, according to its respondents.

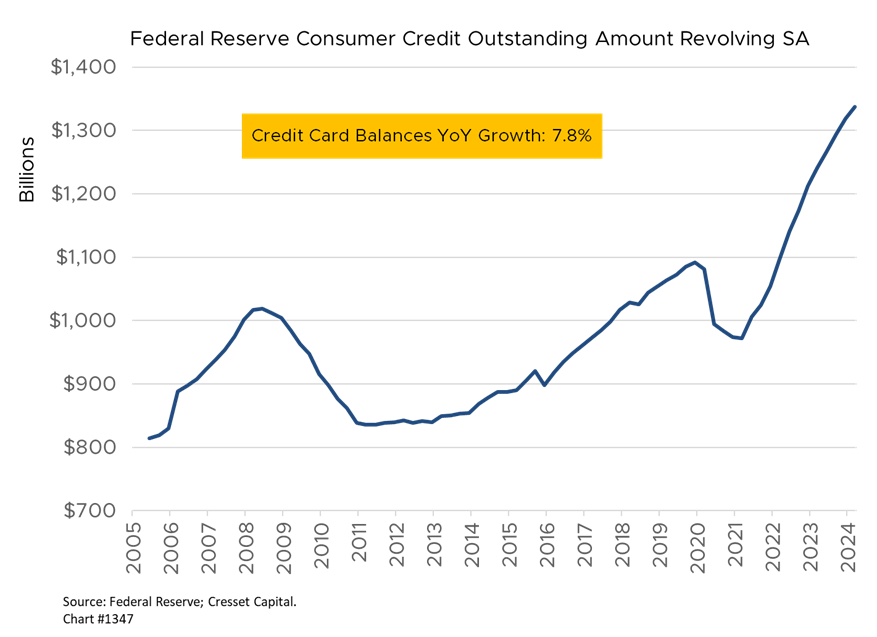

As households’ collective cache of cash has been spent down, consumers are turning to plastic to meet current spending needs. America’s collective credit card balance reached $1.3 trillion in March, according to Federal Reserve data. That’s a 7.8 per cent increase over the last 12 months. Delinquencies, however, remain low by historical standards, as only about 1.3 per cent of card balances are more than 30 days past due. That’s down from 2 per cent as recently as 2014.

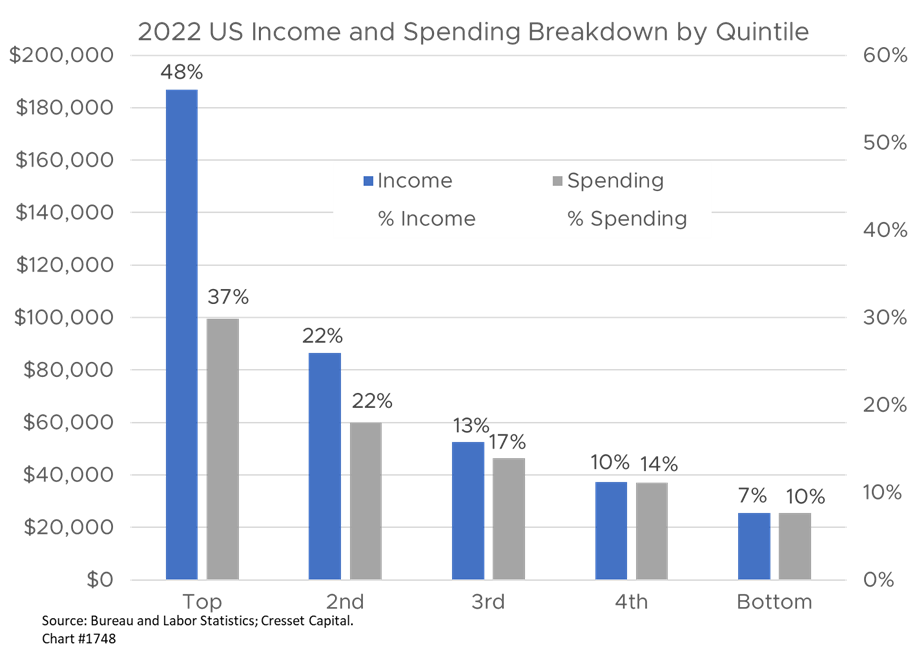

Bottom Line: The US economy in 2024 is strong, although there’s a growing divide between household segments. While the bifurcation presents challenges for businesses, policymakers, and political leaders, we note that the highest 20 per cent of households by income account for nearly 40 per cent of spending overall and likely the majority of discretionary spending, according to the Bureau of Labor Statistics. High-end American households are benefiting from a robust job market, high housing values and equity markets near all-time highs. We expect consumer spending, particularly discretionary spending, to likely continue apace until we see meaningful deterioration in the jobs, housing, or equity markets – the prospect for any of which is unlikely in an election year.