05.04.22 The S&P 500 has shed about 12% of its value this year, led by a drubbing of some of the market’s most recognizable names. Meta, the company formerly known as Facebook, is off nearly 40% and Netflix, America’s entertainment during the lockdown, is 70% smaller than its former self last year. These same stocks that helped boost the market more than 28% last year as Apple expanded 33% while Alphabet surged over 65%.

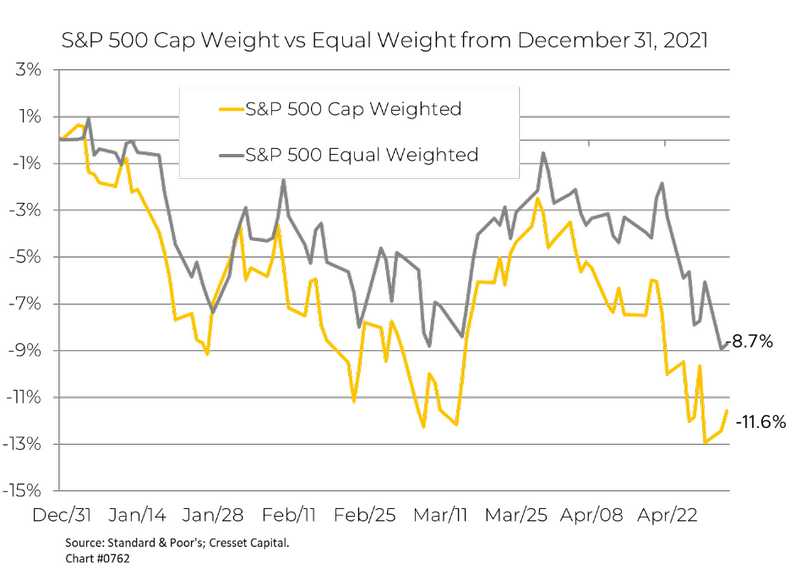

Thanks to the construction of the S&P 500, larger companies are held in greater proportion, the six largest stocks in the index, Apple, Microsoft, Amazon, Tesla, Alphabet and Meta account for nearly a quarter of the S&P 500’s market value. That means that the S&P 500 index performance is heavily influenced by what happens at the top. Thanks to their growth, the performance of the largest stocks in the market are heavily influenced by interest rates. Lower interest rates helped boost their performance in years past, while higher interest rates are hurting them now. The average stock in the S&P 500 is off about 8% this year, about four percentage points better than the index.

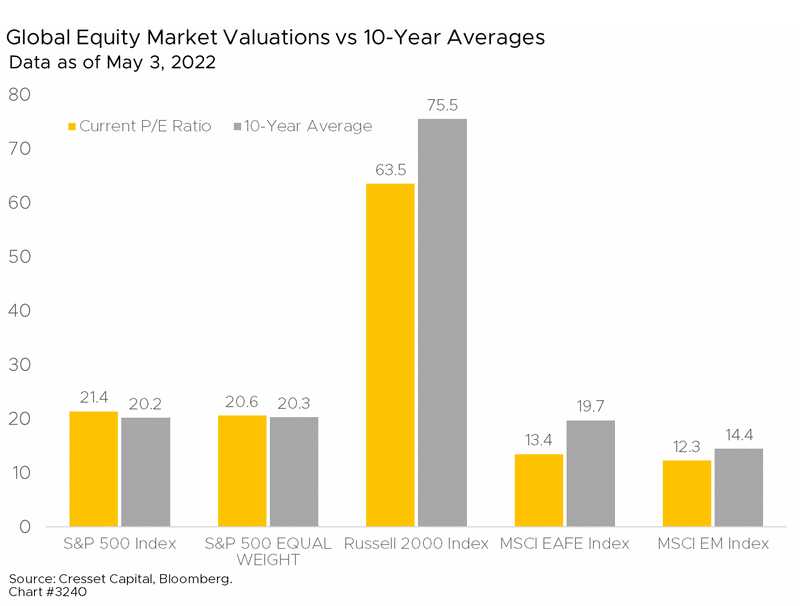

From a valuation perspective, the average S&P 500 stock is closer to its longer-term valuation than the capital-weighted index. At 20.6 times earnings, the equal-weighted S&P 500 is slightly more elevated than its 10-year average multiple, while the index is more than one full turn higher than its historical average.

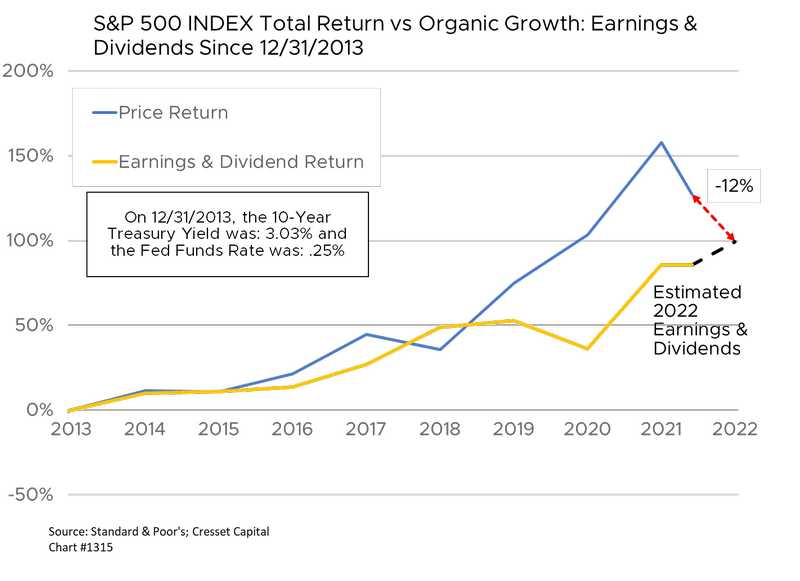

Blame aggressively bullish Fed policy, the cumulative return of the S&P 500 over the last few years outpaced earnings and dividend growth, as investors were increasingly willing to pay more for a dollar of earnings against a backdrop of exceedingly low interest rates. We estimate that the index would need to decline by about 12 percentage points to reconnect with analysts’ cumulative earnings and dividend target at year-end 2022. An overly aggressive Federal Reserve could accelerate a convergence.

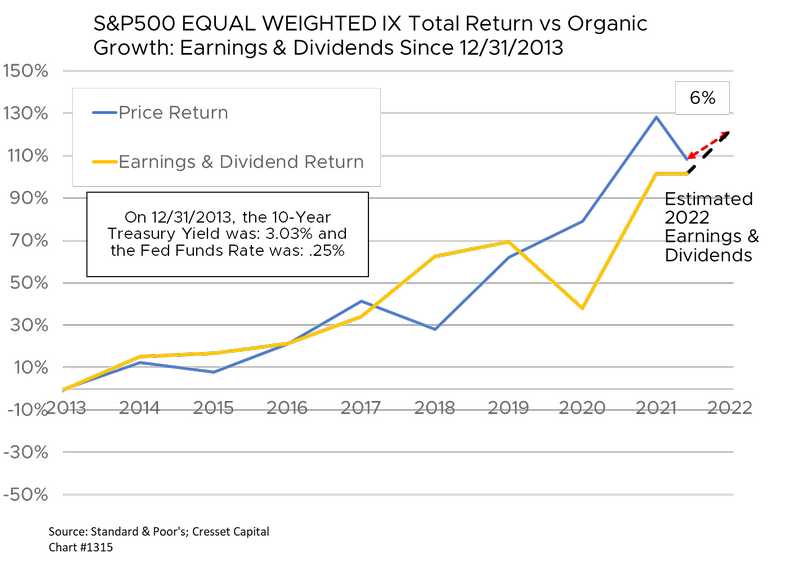

The average stock, however, is better positioned from that perspective. That’s because this year’s pullback has helped the equal-weighted index more closely align with its cumulative earnings and dividend growth. The average stock has six percent upside from here through the end of the year.

Bottom line: Investors need not run away from equities, they just need to be more particular.