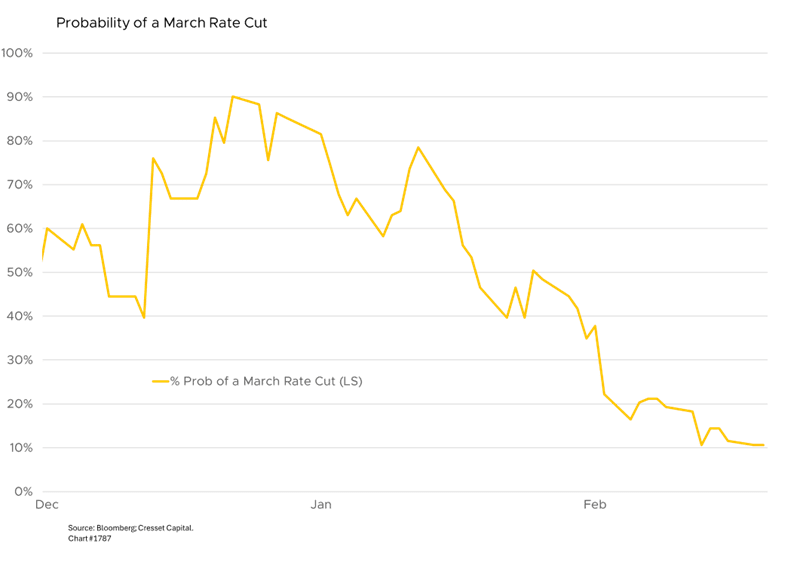

2.22.2024 2024: the year when Jay Powell and the Federal Reserve were expected to slash overnight interest rates in response to lower inflation and weaker demand. Bond investors anticipated six rate cuts this year, with a March kick-off. But the market has had to dial back its optimism in the face of hotter inflation readings and resilient employment. The probability of a March rate cut slid from 90 per cent at the end of last year to 10 per cent today, as the 10-year Treasury yield spiked from 3.8 per cent to 4.3 per cent. “Higher for longer” has become the market rubric. Private credit is an interesting way to hedge this scenario.

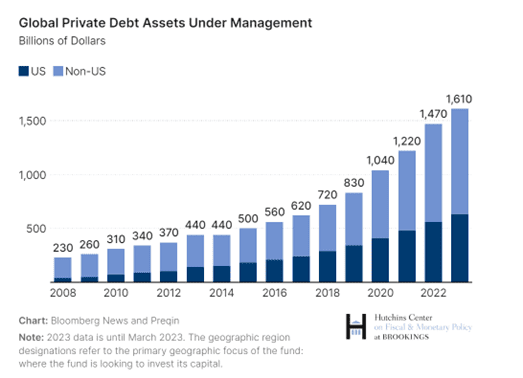

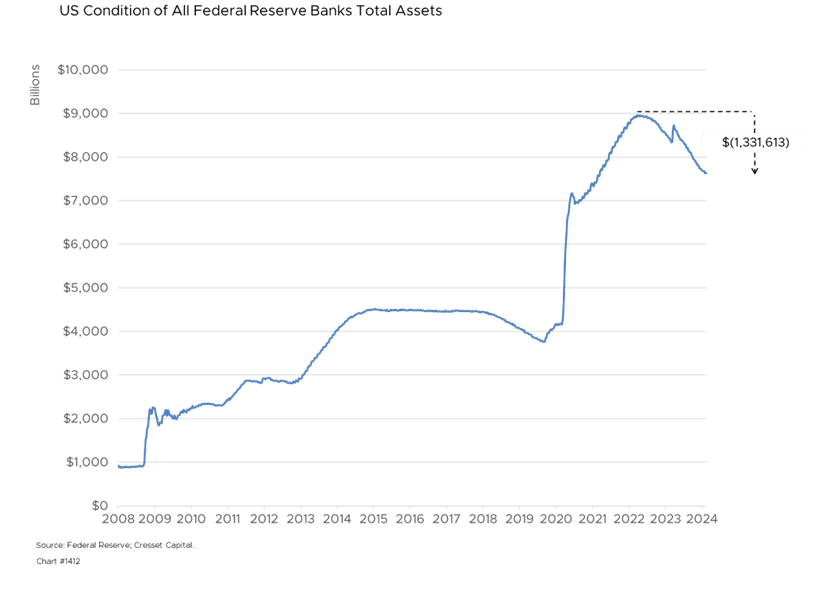

Also known as direct lending, private credit represents loans made by private partnerships, often to small and mid-sized businesses. Most of the loans carry floating interest rates that reset quarterly. The market for direct lending has been growing rapidly, reaching over $1.6 trillion in assets under management globally as of early 2023. Its growth is a function of interest rates – with overnight rates at levels not seen in nearly 20 years – and a pullback in bank lending. Private credit has expanded as banks pulled back on lending following the 2008 financial crisis and increased regulatory scrutiny. This created an opportunity for alternative lenders to step in and provide financing. Most recently, bank balance sheets are about $1.3 trillion smaller than they were two years ago, paving the way for private lenders to gain share.

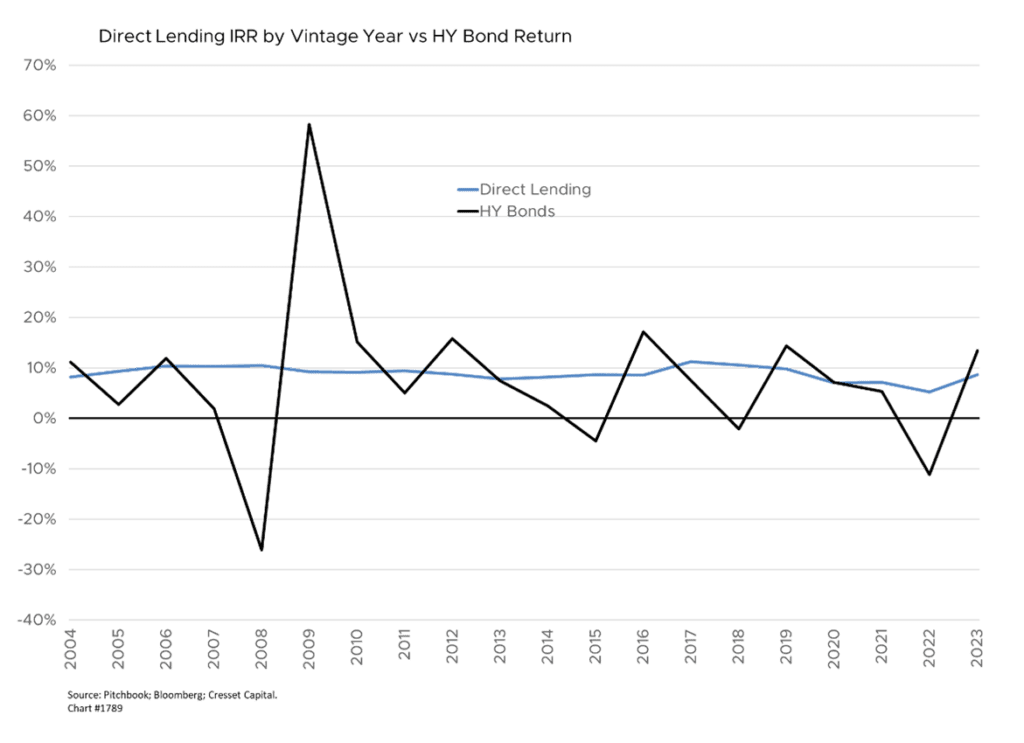

Private credit is appealing to investors searching for yield in today’s rate environment, especially if monetary policymakers keep short-term rates elevated. Its illiquidity premium offers higher returns compared to government and corporate bonds, which is attractive to pension funds, endowments, foundations, family offices, and high-net-worth individuals. With overnight rates above five per cent and spreads approaching six per cent, gross yields in today’s direct lending marketplace are in the double digits. According to Pitchbook data, median annual returns have averaged about nine per cent over the last 20 years – although it should be noted that direct lending returns are derived from interest income, which is taxed at an ordinary income tax rate for individual investors. From a regulatory standpoint, private credit funds are less leveraged than banks and their longer-term, locked-up structure makes them less susceptible to destabilizing mass withdrawals, making systemic risks significantly lower.

Bottom Line: Direct lending provides an alternative source of financing for small and mid-sized businesses that have limited access to traditional lending, offering compelling yields to investors willing to give up daily liquidity. With banks stepping back from middle-market lending, an ideal environment for private credit has emerged with enormous growth potential. Brookings, an American think tank, estimates direct lending assets could reach $3.5 trillion by 2028.