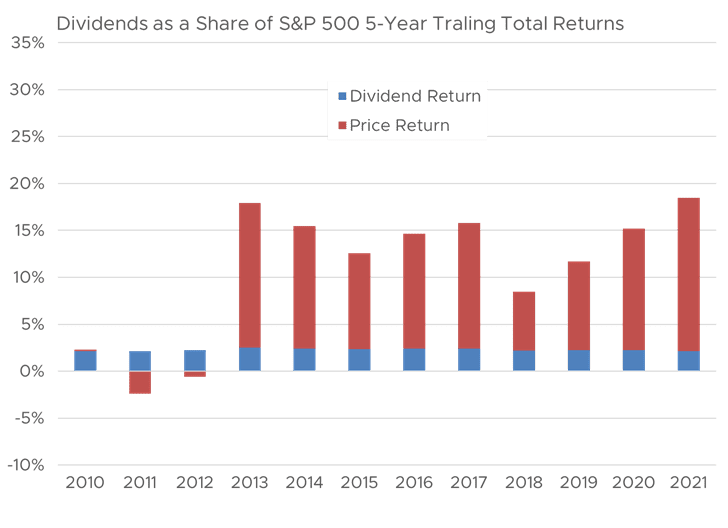

09.07.22 Dividends, an underappreciated equity market attribute, are finally getting the attention they deserve. If you were asked to picture a typical dividend investor, you would probably conjure an elderly widow or widower. Dividends have been eclipsed by outsized equity market gains in recent years due to the easy monetary policy of the last decade. The S&P 500 delivered an eye-popping 18.5 percent annualized return for the five years ending in 2021, only 2.1 percentage points of which could be attributed to dividend payouts. But now that monetary policy is tightening, dividends are taking center stage again.

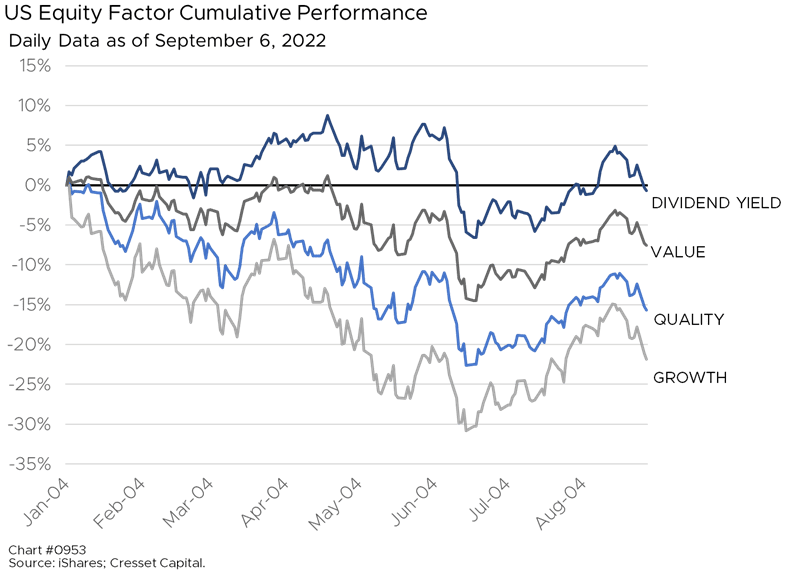

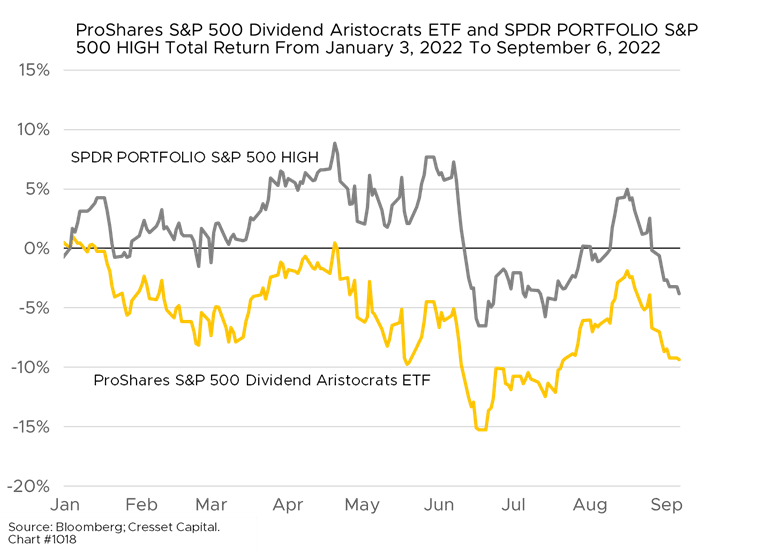

In a year in which growth stocks have lost nearly one-quarter of their value, dividend-focused equities are essentially flat. This is because investors reckon that dividends offer a modicum of certainty in an otherwise uncertain investing environment.

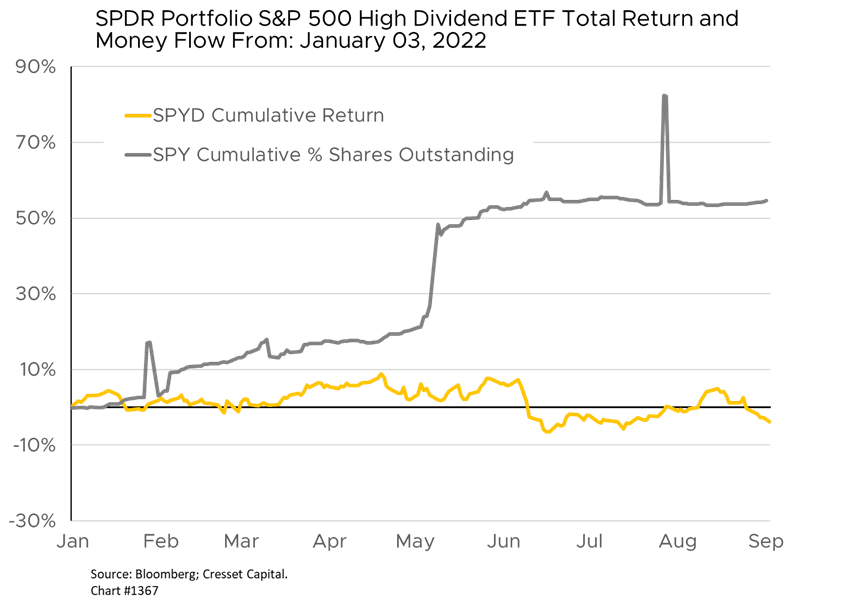

High-dividend equities have attracted assets as investors seek stability. The SPDR S&P 500 High-Dividend ETF (ticker: SPYD) has enjoyed massive shareholder inflows this year, as its shares outstanding have expanded by more than half. The fund’s dividend yield is over four per cent. However, reaching for dividend yield in an environment in which the Federal Reserve is engineering an economic slowdown, or perhaps a recession, could pressure companies paying high dividends to cut their payouts. That’s because stocks offering high dividend yields may not necessarily be offering big earnings payouts; instead, their yields could be high because their stock prices got crushed, and a dividend cut may be in the offing.

While their yields aren’t as juicy, dividend growers, on the other hand, have a track record of maintaining or raising their dividends over time. This discipline requires sufficient and predictable cash flow, which is often paired with high-quality balance sheets. These companies have the best chance at offering a modicum of predictability. Due to their lower allocation to energy shares, dividend growers have underperformed dividend payers this year. Consumer staples, a relatively defensive sector, represents more than one-third of dividend growers.

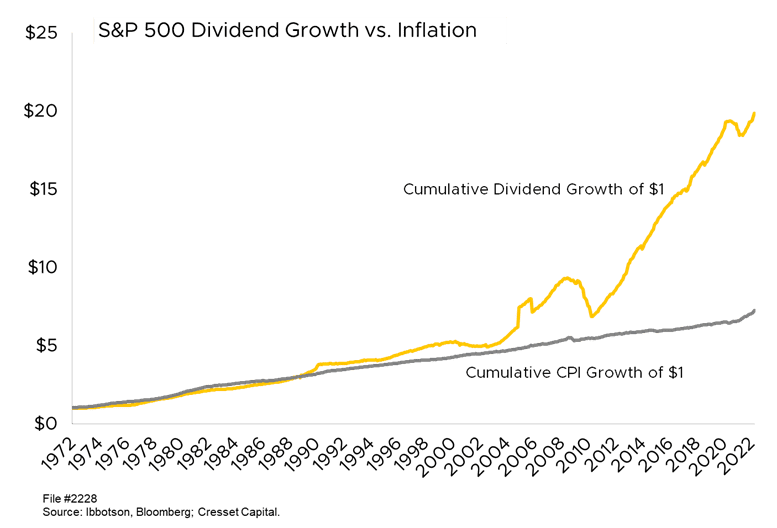

Bottom Line: Equity dividends have a long track record of growing income faster than inflation. For those investors interested in relatively stodgy, yet predicable, income, a quality dividend portfolio demands a closer look