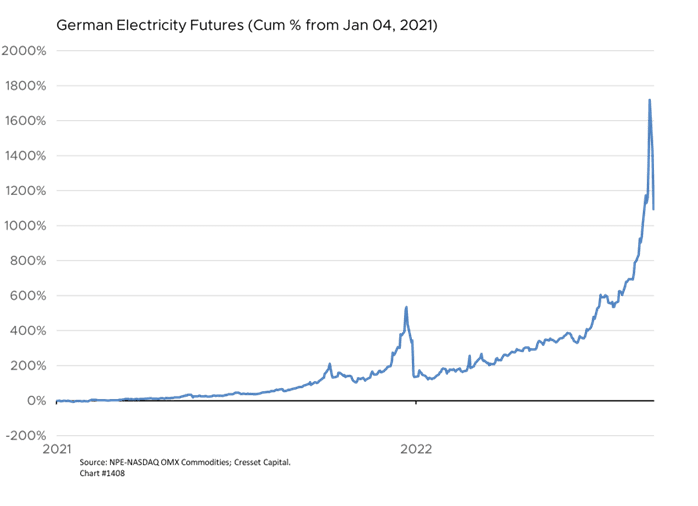

09.01.22 Labor Day marks the end of summer in the US. But families head home from the beach, kids go back to school and the summer heat gives way to cooler weather at this time of year in Europe, too. And the prospect of a cold winter lays bare Europe’s energy vulnerability, which fell victim to unforeseen events even before Putin’s Ukraine incursion. Last year’s unusually cold winter boosted energy demand across the continent, which coincided with unusually low wind speed and cut output from Europe’s many wind turbines. Electricity prices tripled toward the end of 2021. Months later, Vladimir Putin invaded Ukraine and weaponized natural gas supplies in retaliation to sanctions.

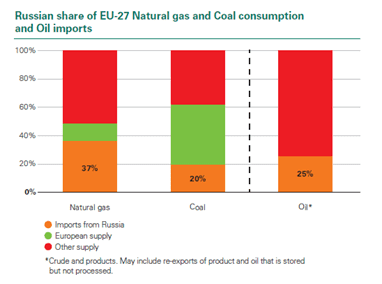

Russia has become one of the world’s biggest exporters of gas and, thanks to the Nord Stream 1 & 2 pipelines, Europe is its largest customer. Russia supplies nearly 40 per cent of Europe’s gas, 20 per cent of its coal and 25 per cent of its oil imports. Germany has become increasingly dependent on Russian gas as the region’s coal and nuclear facilities have shuttered. Europe’s lawmakers are scrambling to formulate a plan to wean the region away from Russian energy. In a plan formulated earlier this year, Europe’s lawmakers agreed to ban Russian coal imports, phase out Russian oil and reduce Russian gas imports by two-thirds. While Russia is hoping to pressure EU leaders by throttling gas deliveries, Germany is busy filling gas storage facilities. It’s a race against both time and temperatures.

EU members have earmarked about 280 billion Euros in tax cuts and subsidies to ease the pain. But governments giving priority to energy supplies for residential customers, risk inflicting lasting damage on domestic industries. For now, German officials have limited outdoor lighting for buildings and billboards and lowered indoor temperatures to no more than 66 degrees in commercial buildings this winter in the hope of meeting the EU’s 15 per cent voluntary demand reduction target. Fertilizer plants, heavy users of natural gas, are operating below capacity, threating crop yields and food prices. UK household energy bills are set to skyrocket in October after a cap on costs is lifted, forcing millions of people to cut back. The average UK household’s monthly energy bill is likely to rise to about $355, more than three times what it was a year ago, according to The Economist. Household energy bills could rise again in January.

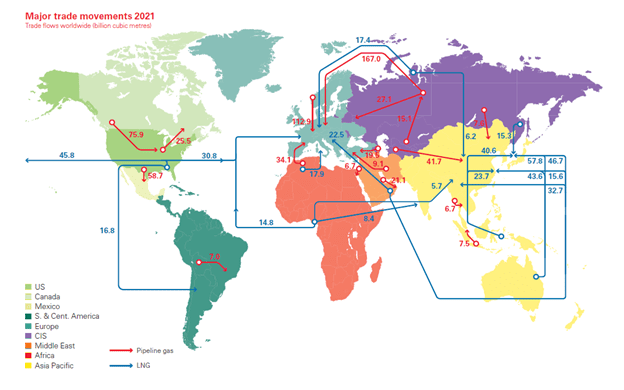

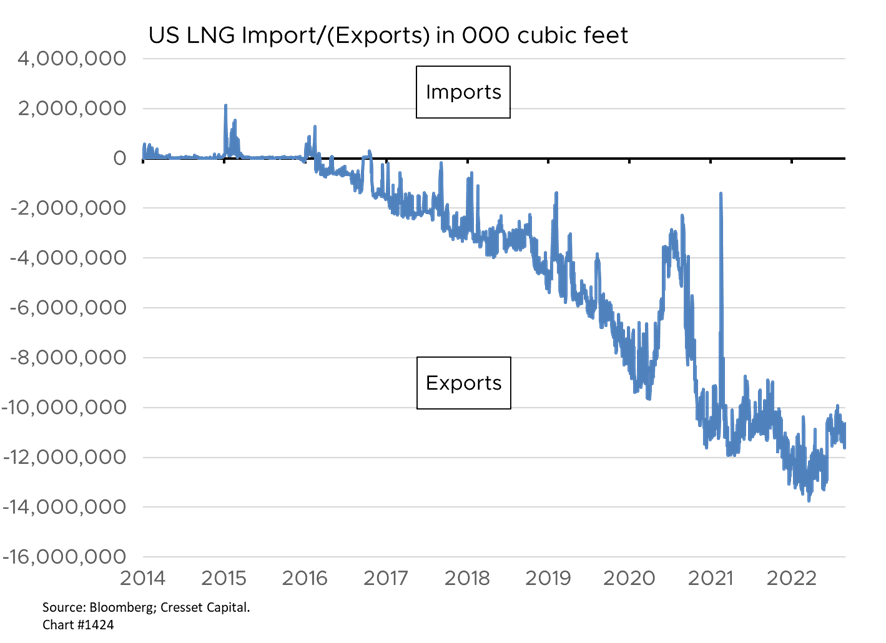

Putin and his proxies are limiting gas flows through two primary pipelines. Importing liquid natural gas is an alternative to Nord Stream imports, but not a panacea. Producers, including the US, liquify natural gas by cooling it to -260 degrees Fahrenheit and pump it into refrigerated ships. Unfortunately, the EU is not positioned to simply swap Russian gas for LNG. According to British Petroleum’s research, even though the US is one of the world’s biggest exporters of LNG, to the tune of roughly 100 billion cubic meters (BCN) in 2021, only about 15 BCM found its way to Europe. By comparison, Russia last year delivered 167 BCM of natural gas to Europe through its pipelines. Even if America were to dedicate its entire LNG production to Europe, it would replace just a little more than half of Russia’s current supply. Global LNG production, including the US, Qatar and Australia, will total slightly more than 200 BCM this year. A current tug of war between Europe and Asia has pushed LNG prices skyward.

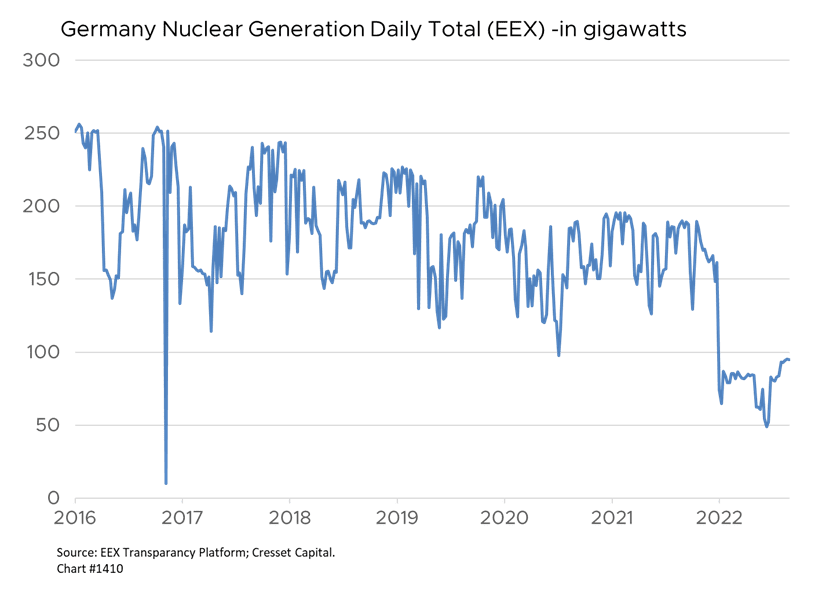

Germany, Europe’s biggest gas consumer, is building several LNG import facilities, despite its goal of abandoning fossil fuels by 2035. Additionally, the country intends to keep its three nuclear power facilities operational even thought they had planned to decommission them by the end of 2021. Fully operational, Germany’s nuclear power plants would satisfy about one-third of the country’s power grid consumption.

Germany’s largest companies have responded by modifying their fuel sources, firing up mothballed coal plants and shifting the manufacture of some products abroad. BASF, the country’s largest chemical company, switched to oil from gas to generate the power and steam used in their European operations. The company will also be scaling back its ammonia production, a key ingredient in fertilizer and plastics, and will source ammonia from foreign suppliers.

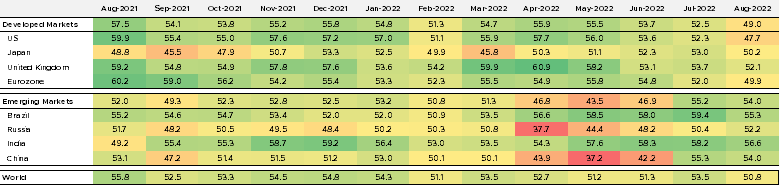

The German economy has remained relatively robust in the face of current circumstances. The country’s goods and services indicators are flat, slipping fractionally below 50, the growth/contraction delineation level. Though chances are rising, recession probability models still have the likelihood of an economic pullback in the Eurozone next year at around 50-50.

Europe faces not only higher energy bills this winter, but a real prospect of shortages that could shut down cross-border energy flows. Norway is already considering such a move. It’s difficult to model the amount of demand destruction high energy prices will bring, but we suspect the looming power emergency will be more difficult than policymakers are currently characterizing, with most of the brunt to be borne by the industrial sector. In their extreme, energy shortages could lead to social unrest. Though Mr. Putin would relish such a prospect, we believe such a scenario is remote.