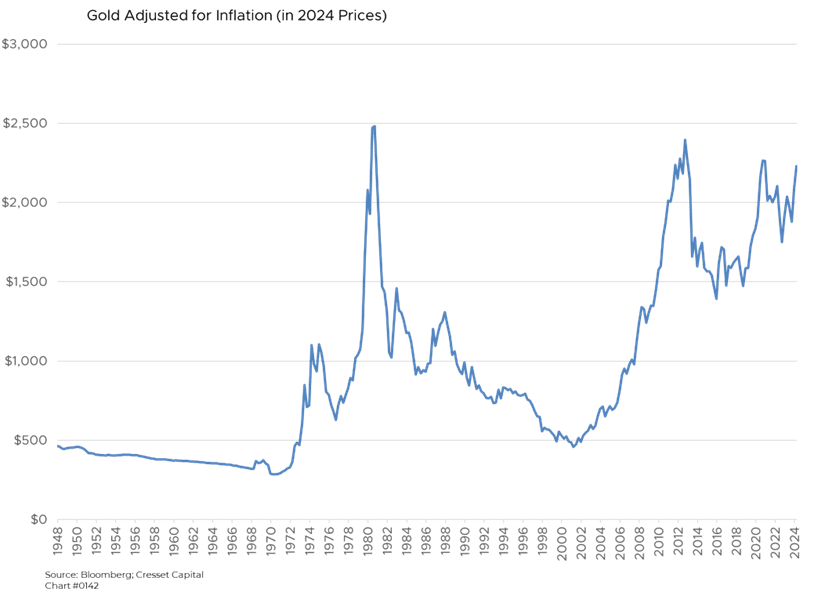

4.18.2024 Gold prices have surged to record highs in recent weeks, with June futures hitting $2,416 per troy ounce. The buying has been driven by a confluence of factors including geopolitical tensions, hopes for Federal Reserve monetary easing, Chinese economic concerns, and central bank buying. The rally arrived at a time when the precious metal faced fundamental challenges. Historically, gold is a store of value, an alternative currency that offers no yield, delivering a return equal to the inflation rate over time. Adjusted for inflation (in 2024 dollars), gold is approaching its all-time high of $2,500 set in 1980, a period in which the US was battling double-digit inflation.

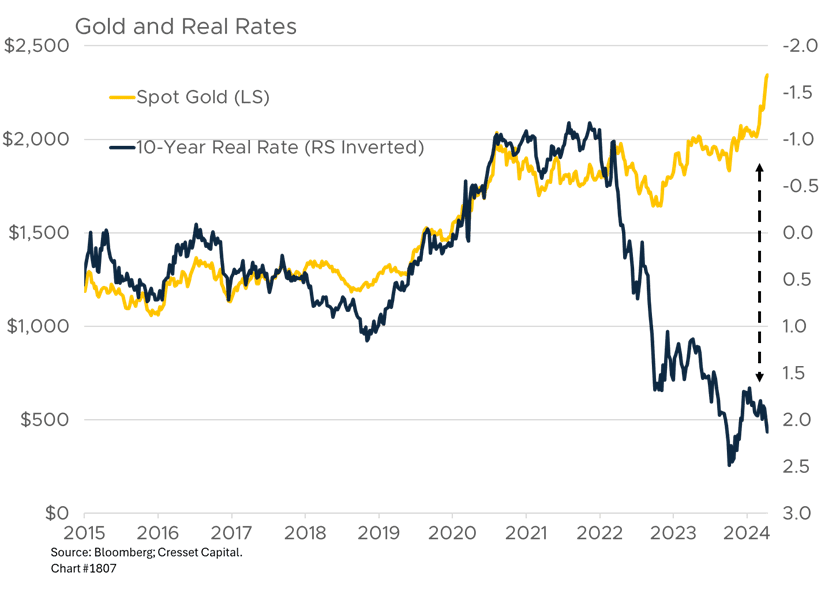

As an asset class gold normally competes with short-term financial assets, like Treasury bills. When bills offer yields below the inflation rate, as they did for more than a decade during the Fed’s quantitative easing program, gold rallied about 110 per cent – not bad for a currency. Since 2023, however, overnight rates have normalized, thanks to aggressive Fed tightening, and are now situated more than two percentage points over inflation, their highest real rate in 20 years. Since gold offers nothing over inflation, the advantage, arguably, should be with financial assets. Yet gold is rallying.

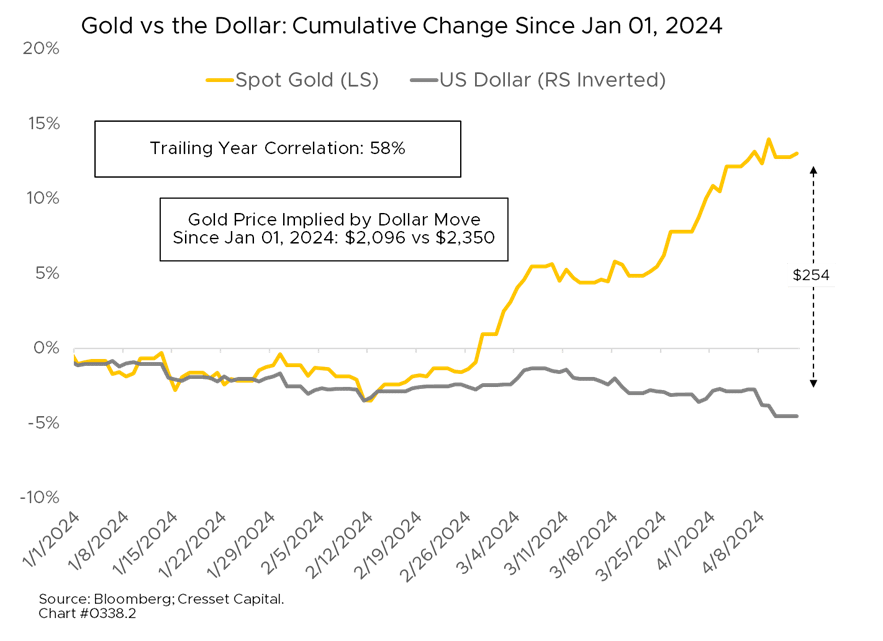

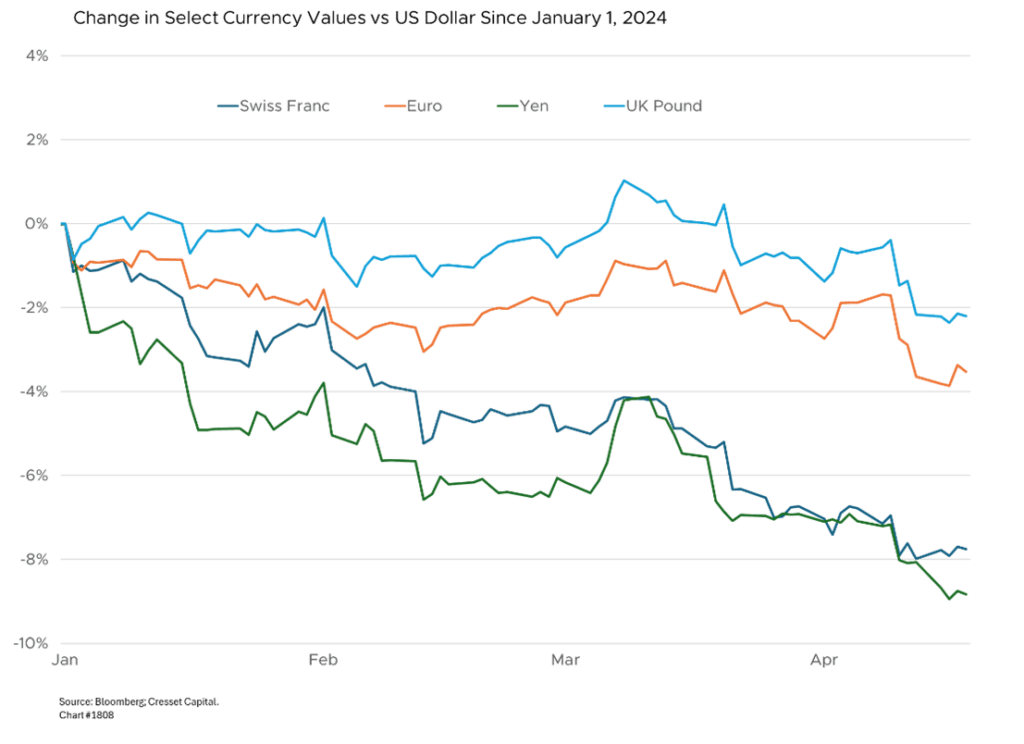

As an alternative currency, gold has historically taken its cue from the dollar, rallying into dollar weakness and sagging in the face of dollar strength. From that perspective, gold as a currency should be trading at about $2,000/oz, based on the strength of the dollar this year. The dollar, against a broad basket of currencies, is nearly five per cent higher this year, implying a five per cent pullback in the precious metal. Yet as of April 12 June gold futures hit an all-time high of $2,416.5/oz on the New York Mercantile Exchange, rallying over 14 per cent year to date. Let’s examine what the shiny metal could be telling us.

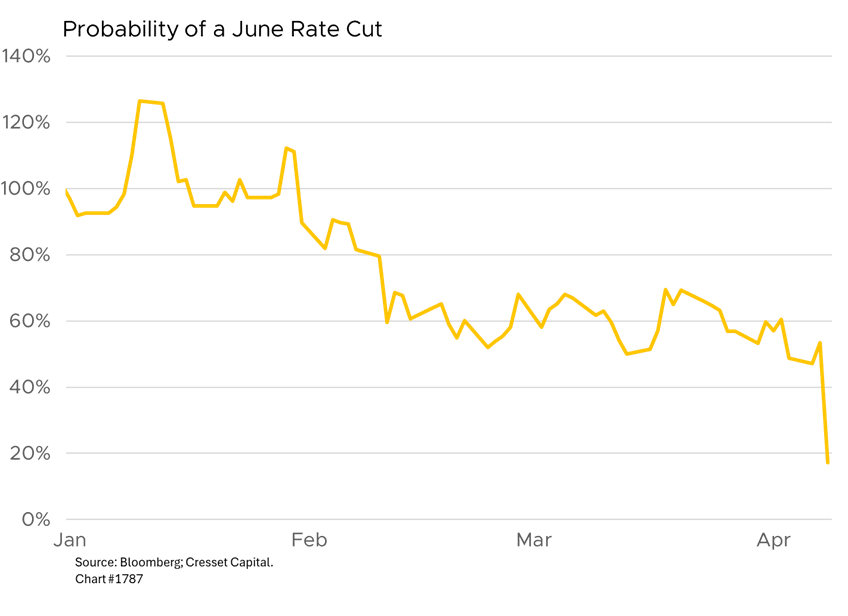

Markets are attributing the move to several factors. The most widely mentioned catalyst is expectations of rate cuts by the Federal Reserve later in 2024, which reduces the opportunity cost of holding gold. Investors are closely watching US inflation data and Fed meeting minutes for signals on monetary policy. In our view, the rate-cut view is implausible, since gold continued its upward trajectory even as Fed watchers slashed their rate-cut expectations. As we kicked off 2024, investors anticipated more than five rate cuts this year; that number has dwindled to one or two. The probability of a June rate cut collapsed to under 20 per cent, down from a near certainty on New Year’s Day.

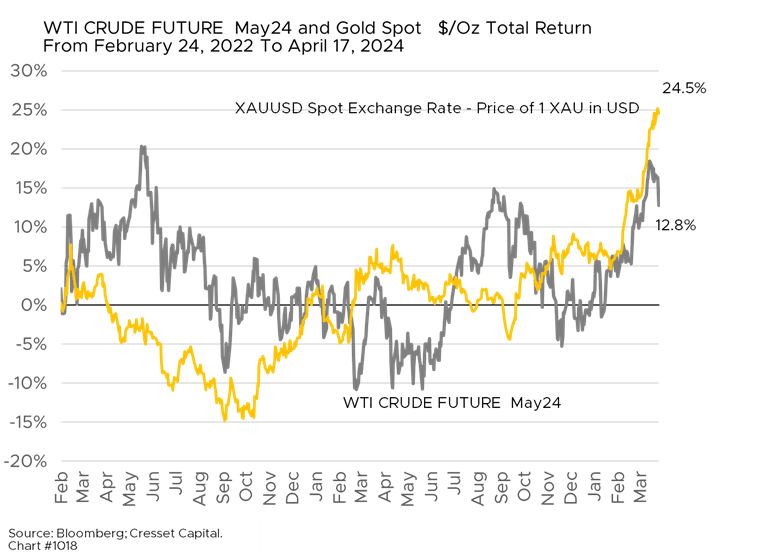

Gold is a haven asset in periods of uncertainty. Some market observers attribute increased demand for gold to geopolitical tensions in the Middle East and Ukraine. The haven argument is plausible since energy prices are also on the rise. Since February 24, 2022, the day Russia invaded Ukraine, gold and crude have moved in sympathy.

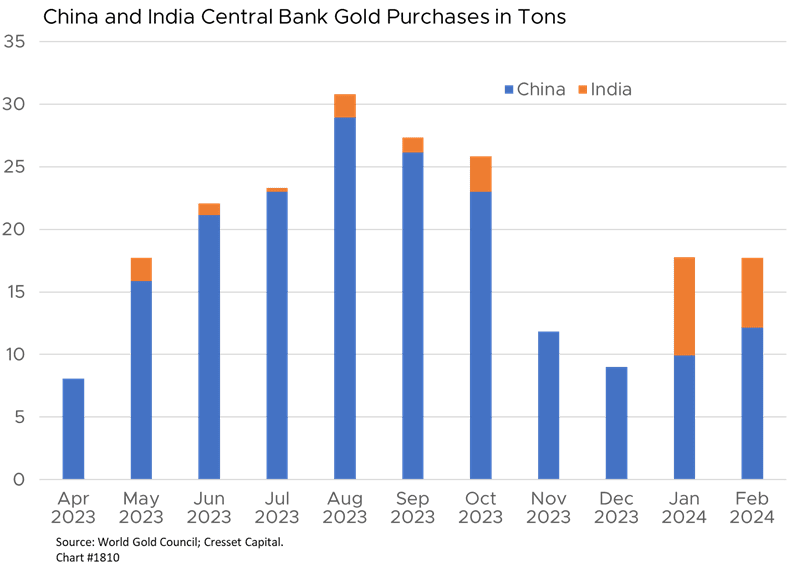

Strong physical demand from central banks and individual investors, especially in China and India, is also moving the price of gold. China, which has been diversifying away from dollar assets, are no longer big buyers of Treasurys. Central banks bought over 1,000 tons of gold in each of the last two years, the highest levels since the 1960s, likely to diversify reserves away from dollars.

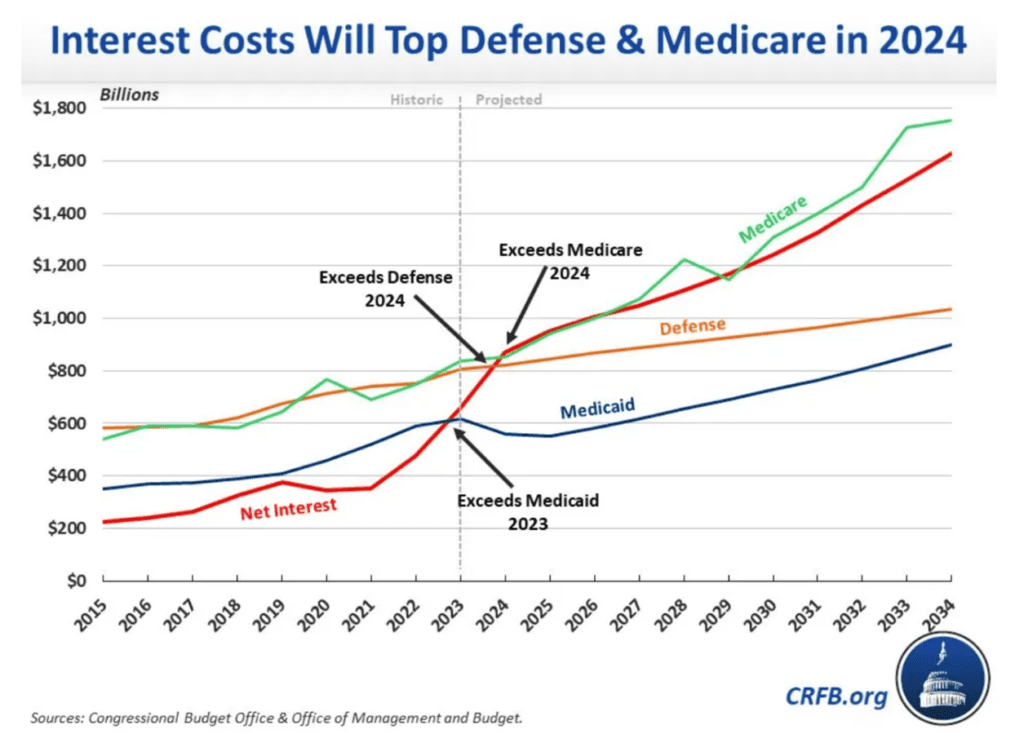

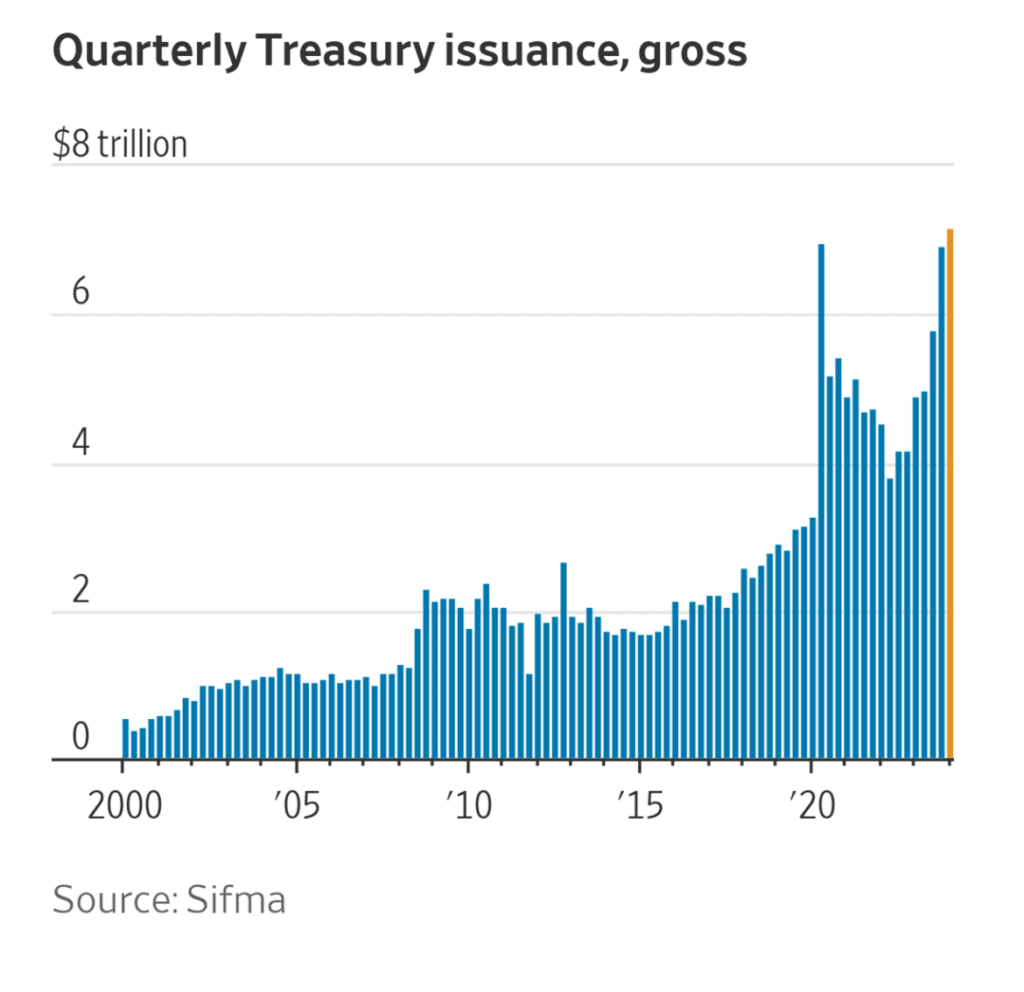

Concern over US fiscal deficits fueled by increased Treasury issuance could be driving gold higher. Treasury issuance has exploded since the pandemic, with the government selling $7.2 trillion of debt last quarter. Yellen & Co are poised to sell nearly $400 billion of bonds in May, according to The Wall Street Journal. That means the federal government interest expense is rising rapidly. In fact, interest payments will soon eclipse annual spending on defense and Medicare, according to the Committee for a Responsible Federal Budget.

In another indication that investors are souring on US government debt, Treasurys are becoming harder to sell, with recent auctions met with tepid demand due to worries over persistent inflation and expectations the Fed will keep rates higher for longer. Thanks to gaping fiscal deficits, more supply is on the way. The government is slated to issue another $386 billion in bonds in May to fund rising deficits. While outright failed auctions are unlikely, the glut of supply could exacerbate volatility in rates and rattle other markets.

Bottom Line: We believe the surprising rise in the price of gold is due to a combination of all the factors cited above. We’re somewhat skeptical that US fiscal profligacy is the metal’s primary driver, since the US dollar continues to strengthen against reserve currencies, like the Swiss franc, the Euro, and the Yen. The currency markets, which are many times larger than the gold market, appear to be more fixated on interest rate differentials than on the condition of the US balance sheet. The greenback has gained nearly eight per cent against the Swiss franc this year.

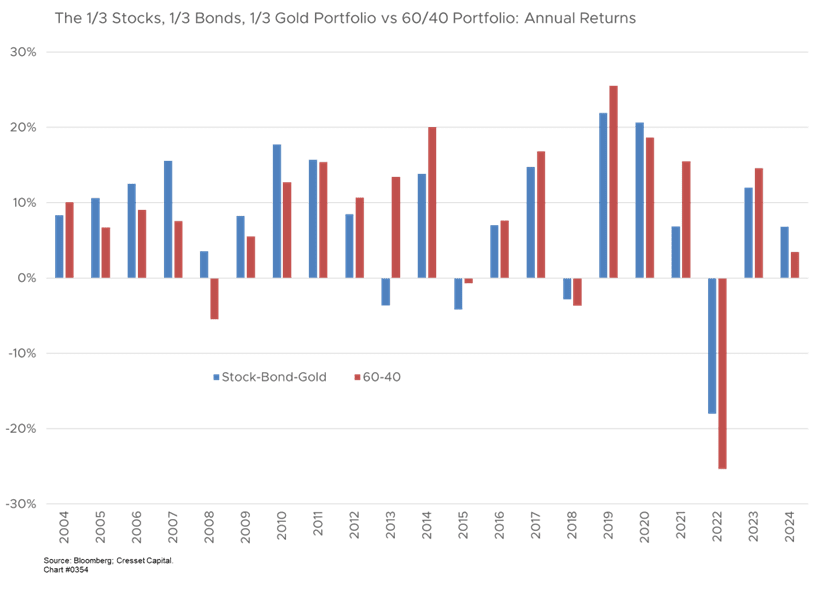

Over the long term, gold has delivered mixed results, badly trailing equities but outpacing inflation. Gold tends to act as a hedge against not just rising prices, but also broader fears and loss of confidence in institutions. With a contentious US election looming and simmering conflicts overseas, some investors appear to be seeking an allocation to gold as an apolitical store of value. History has shown that in a broad portfolio, gold serves as a diversifier. A portfolio comprising one-third each of stocks, bonds and gold outperformed a 60/40 portfolio in the three negative years over the last 20 years, actually gaining 3.5 per cent in 2008. While adding gold has dampened portfolio risk, it came at a cost. Over the last 10 years, the stocks/bonds/gold portfolio delivered an annualized 8.1 per cent annualized return versus 9.4 per cent for the 60/40 mix. Its standard deviation (volatility risk), however, was lower. How long gold’s run lasts likely depends on the trajectory of the war in Ukraine, the path of US interest rates and inflation, the dollar’s dominance, and the severity of any slowdown. But the precious metal adored by Cleopatra and Agamemnon as a store of value, and an enduring crisis hedge held by many throughout the years, suggests the rally has more room to run.