As we peer out into 2022 through Cresset’s Macro Investment Strategy lens, we see slower growth, lower inflation, tighter financial conditions and modest equity returns. We highlight five themes to watch as we traverse the new year.

Reversion to Trend Growth

The combination of central bank tightening and comparatively little in fiscal spending programs this year will likely push US real growth and inflation downward toward two per cent by year end. Because the developed world economy has grown accustomed to borrowing rates pegged substantially below the inflation rate, any narrowing between interest rates and the inflation rate (higher real rates), will inhibit borrowing and growth during the course of the year.

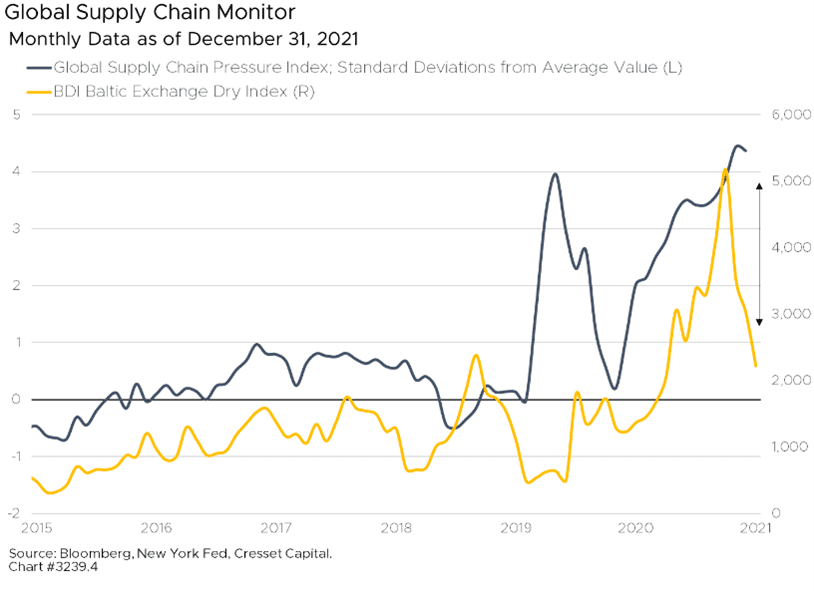

Global supply chain tensions, one of the biggest contributors of high goods prices last year, are easing. The New York Fed’s Global Supply Chain Pressure Index has tended to track Baltic shipping rates, which have fallen precipitously over the last few weeks. Moreover, a diminishing share of imports are represented by final sales; in fact, a sizable portion of imports end up in business inventory. This trend carries two implications. First, it appears a good deal of the demand for imported goods was likely double ordering, which exaggerated true demand. Second, an outsized overhang of inventory could weigh on future imports as demand would be satisfied from existing stock.

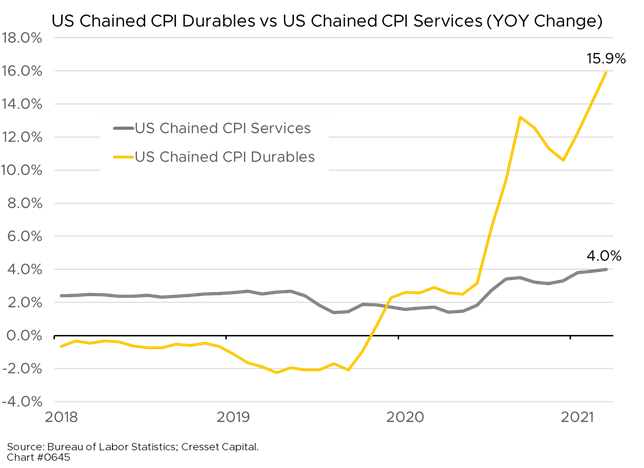

We also expect easing price pressure as consumers shift their spending from goods to services. Pandemic lockdowns forced households to channel most of their spending toward goods, like appliances, cars and furniture, and away from services, like dining out, entertainment and travel. As a result, goods prices have risen much faster than those of services. According to the Bureau of Labor Statistics, durable goods prices rose 15.9 per cent over the 12 months ended in December. The price of services, meanwhile, rose 4.0 per cent over the same period. We expect the shift in demand from goods to services will naturally ease price pressure.

Tighter Financial Conditions

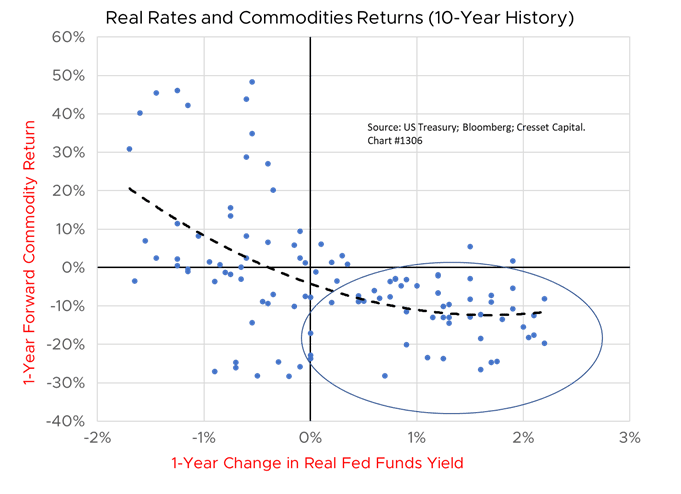

Only one week into the new year we’re already off to a rocky start. Hawkish Fed comments are weighing on the bond market, pushing yields higher and exerting downward pressure on bond prices. Last week, the 10-year Treasury bond fell 4.2 per cent, representing its worst weekly showing since 1980. The 30-year bond plunged more than 9 per cent, suffering its worst weekly shellacking since 1973. The bond market is currently anticipating three or four overnight rate hikes in 2022. We expect a natural slowdown in growth and inflation will necessitate two, perhaps three, rate hikes this year. Either way, with overnight rates rising and the inflation rate falling, “real” rates (interest rates adjusted for inflation) will be on the rise, making the cost of capital more expensive. Tighter financial conditions raise the bar on risk taking, since the incremental cost of sitting in cash becomes a bit more palatable. Higher capital costs could weigh on industrial commodities, including energy, this year. Modest tightening makes sense in a world fueled by historically easy monetary policies, and we expect credit conditions to remain healthy even considering likely future Fed actions. However, we will be monitoring credit spreads – the yield premium lenders require to extend loans to investment grade borrowers – as an overall barometer of risk taking.

China’s Balancing Act

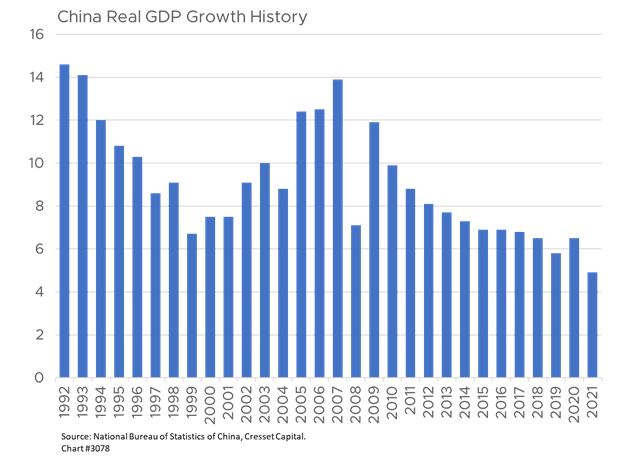

China’s role as global growth catalyst is changing. Since the early 1990s, China’s push to enter the global supply chain spurred worldwide demand in commodities and fostered manufacturing. Beginning in 1992, China’s economy grew at over 14 per cent annually but the effort to become the world’s second-largest economy is now weighing heavily on its domestic growth. Having built much of its growth on the back of debt-financed real estate construction, Beijing now faces a price bubble, particularly in residential real estate. Like the US housing bubble of 2008, nearly 70 per cent of Chinese households own a home, representing about 90 per cent of household net worth. We’re not worried about a Chinese financial crisis, however, since Beijing controls the banks – but we do expect China’s growth to slow.

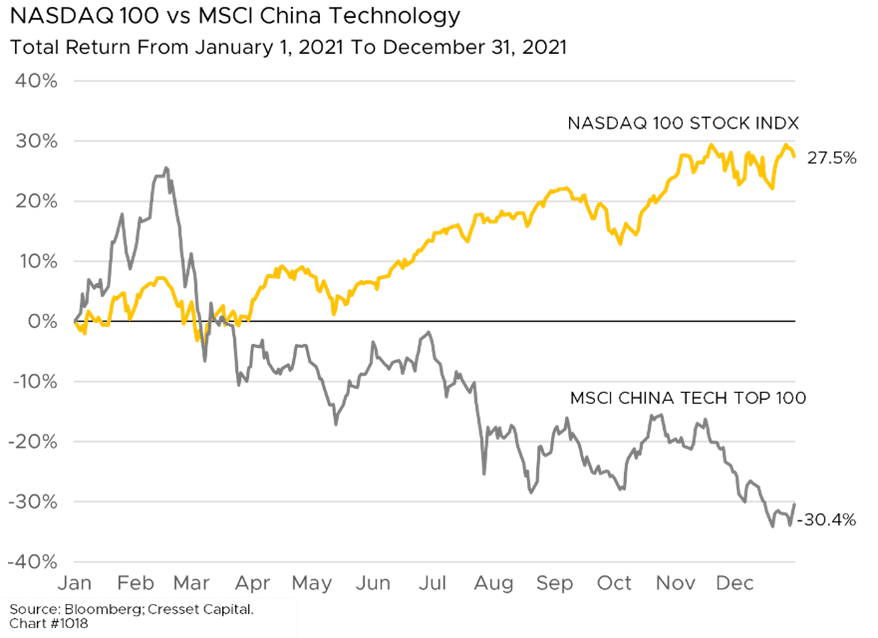

Additionally, President Xi’s “common prosperity” initiatives have imposed sweeping regulations on economic sectors like social media, tutoring and technology, which leaders believe create inequality or unfairness. Alibaba Group Chairman Jack Ma was singled out, for example, for accumulating excessive wealth. Although these initiatives may be consistent with Communist principles, such free-market constraints represent another growth headwind for China.

A third factor creating growth impediments is China’s zero-tolerance COVID policies. Leadership is sensitive to addressing the infection after having been criticized for their early opacity. We also know that Sinovax, China’s home-grown COVID vaccine, is not as effective as its Western counterparts. However, shuttering cities and closing borders is a third factor that will weigh on China’s growth this year.

Macro Forces Driving Markets

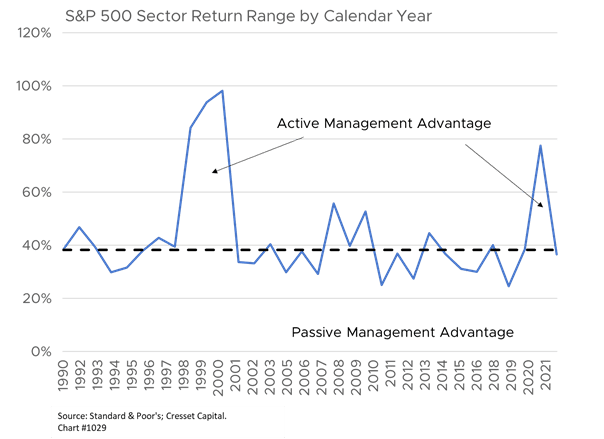

The pandemic of 2020 created a unique opportunity for active management, as lockdowns created clear winners and losers. Take the example of Netflix vs Disney that year. While these two companies were rivals in family entertainment, in a COVID environment Netflix’s streaming platform was much better positioned than were Disney’s theme parks. Notwithstanding Disney’s pivot to streaming, Netflix returned a whopping 67 per cent in 2020, nearly triple Disney’s showing that year. Underscoring the gap, there was a 77 per cent difference between the best-performing sector, tech, and the worst-performing sector, energy, in 2020, creating a large opportunity to identify winners and losers. That gap closed in 2021, leaving little room for active managers, particularly among US large caps. In fact, among the largest 50 US large-cap mutual funds, representing $1.7 trillion in assets, only two were able to outpace the S&P 500 last year. We expect active managers in most markets will struggle to outperform their benchmarks in 2022 as macro factors, not individual securities, drive returns this year. From that perspective, we believe there could be active management opportunities in US small caps, where nearly 12 per cent of the Russell 2000 Index is rated below investment grade, and emerging market equities, where China represents nearly one-third of the index.

Risks to the Outlook

We have identified several risks to our forecast that would prompt us to shift our strategy. We’re continually on the lookout for geopolitical unrest, both home and abroad. Border conflicts between Russia and Ukraine or China and Taiwan are the most visible risks on the geopolitical landscape. Action on either front would prompt a risk reassessment.

Another area of concern is the potential for a higher trajectory of interest rates. Persistent inflation requiring more forceful Federal Reserve action would also prompt a risk reassessment, since interest rates underpin asset valuation. While our base-case scenario anticipates little change in valuations, higher interest rates could compress price-earnings ratios, undermining any earnings expansion.

A third area of concern is China’s economy. We’re anticipating a gradual slowing, and we expect Beijing to engineer a soft landing with a blend of stimulus and restraint. However, given China’s size, a meaningful slowdown or severe recession would undoubtedly impact the global economy.

Lastly, COVID continues to be an uncertain risk, as evidenced by the emergence of variants Delta and Omicron last year. Since global immunity is not feasible, the possibility of future variants remains a risk.

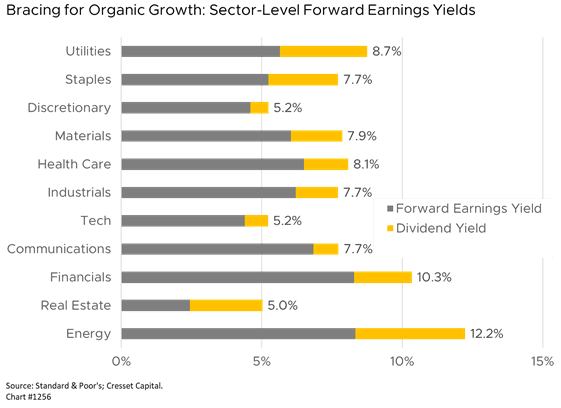

Given the environment we envision, we believe organic earnings yield and dividend yield will lead growth markets incrementally higher this year. Value-oriented sectors hold the best promise in a year where valuations will likely not expand. We believe financials, health care, industrials and utilities could outpace technology and consumer discretionary this year. Similarly, we believe international developed markets are favorably positioned to catch up with US markets as growth and inflation trend lower on the back of tighter financial conditions.

We plan to extend maturities within our income strategy as yield move incrementally higher this year. Additionally, we will continue to look for interesting income opportunities within private credit, since the illiquidity premium remains robust.

We wish you a Happy and Healthy New Year. Please do not hesitate to reach out to us if we can be of assistance in navigating 2022.