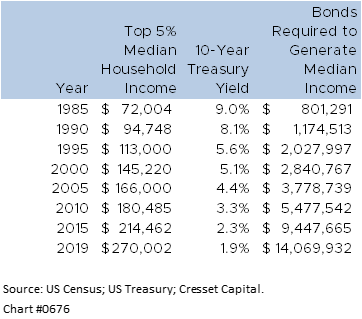

07.28.2021: Generating income in today’s market can seem as futile as “trick-or-treating” the morning after Halloween. Gone are the days when you can simply buy a 10 per cent bond and retire. In 2000, median household income among the top 5 per cent was $145,000, according to US Census Bureau data. That year, the 10-year Treasury note yielded 5.1 per cent, according to Treasury data, which means $2.8 million of Treasury notes would have succeeded in “locking in” $145,000 for 10 years. By 2010, top 5 per cent median household income rose to $180,000 and yields fell to 3.3 per cent, suggesting it took $5.5 million in notes to achieve the same income feat. As of the end of 2019, it would have taken over $14 million in 10-year Treasury notes to do so.

Over the last 40 years, household incomes have been rising with inflation while yields have been falling, making it increasingly difficult for savers to maintain a predictable retirement income stream. In 2000, 10-year Treasuries held a four per cent yield advantage over future expected inflation rate. Nowadays, the benchmark note yields about one percent below expected 10-year inflation and about four percentage points below current inflation. Not only are yields falling, but they’re also falling faster than inflation, leaving bond holders with negative “real” yields. That means would-be retirees would not only have to commit copious amounts of capital to generate lifestyle income, but the yields available today no longer assure their future income keeps up with their future expenses.

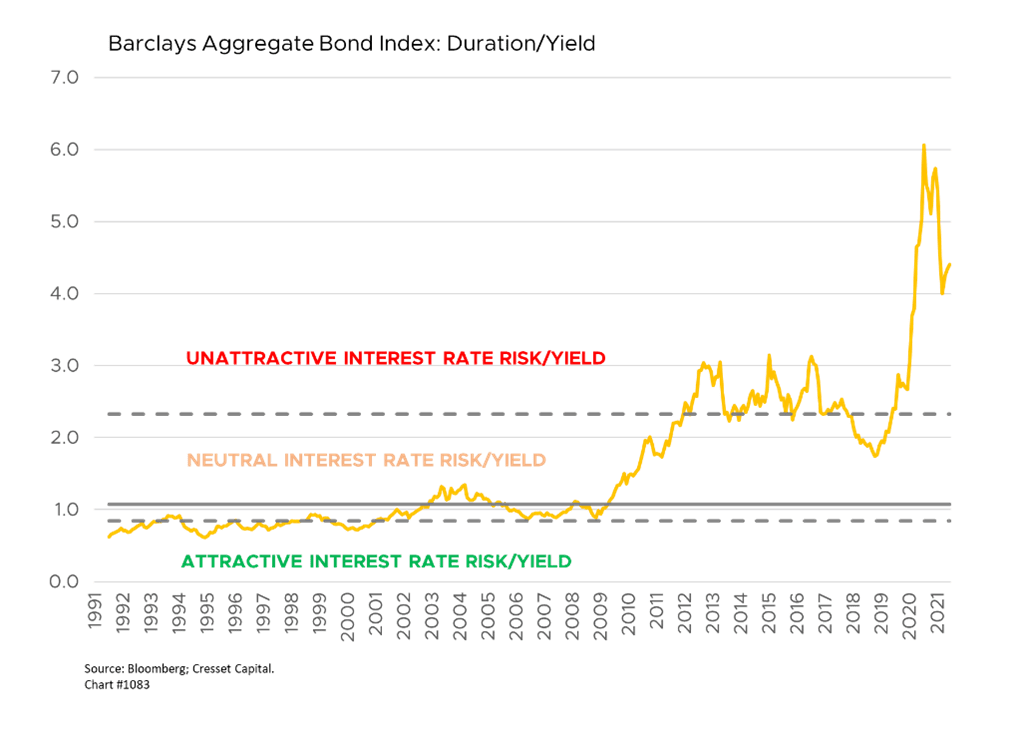

Faced with the prospect of penurious yields, investors have been, in recent years, increasingly willing to shoulder new risks to meet their income needs. Maturity risk is one of these. Longer-maturity bonds usually carry higher yields to compensate investors for the longer holding period and relatively higher price volatility. While the yield differential between 3-month bills and 10-year notes is positive, at 1.2 per cent, it’s situated at the midpoint of its historical range. When adjusted for duration, or price volatility (risk), intermediate bond yields (returns) are unattractive by historical standards.

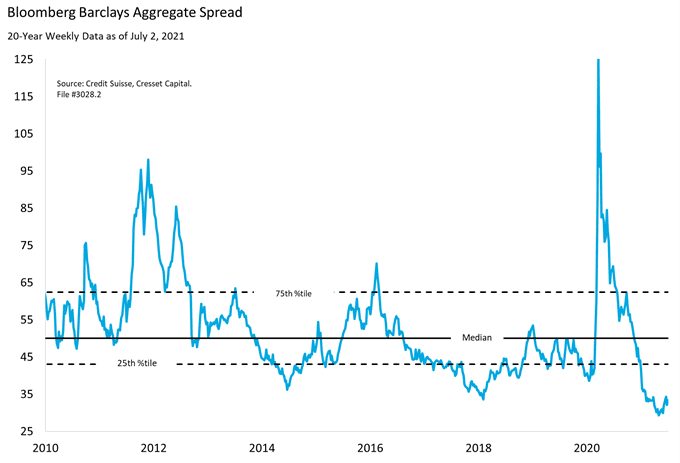

Investors can accept credit risk in exchange for higher yield. As investors move away from Treasuries to corporate and “junk” bonds, expected yields rise as the possibility of not getting paid back increases. The yield differential, or credit spread, measures the yield premium bondholders require to extend credit to lower-quality borrowers. The Barclays Aggregate Bond Index of investment-grade securities is currently yielding about .33 percentage points above the Treasury market, representing its narrowest yield advantage in over 20 years and reflecting a feeding frenzy by yield-starved investors. While the fundamental backdrop supports credit risk-taking, the credit yield premium seems hardly worth it.

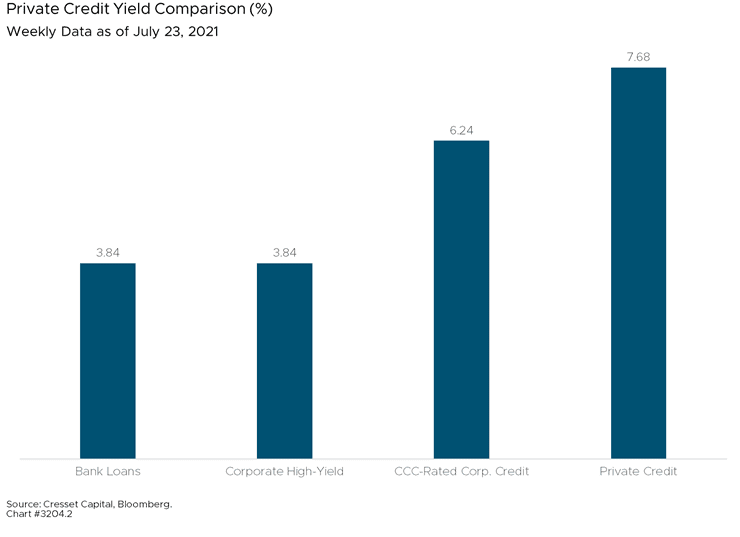

Taking on illiquidity risk – being willing to hold income investments through maturity – remains one of the best ways to capture incremental yield in today’s marketplace. Private credit comprises direct loans to companies and individuals through private transactions. Unlike publicly traded bonds, direct loans generally can’t be redeemed prior to maturity, although maturities are usually within five years. Direct lending programs are among the most common private credit strategies, although other credit strategies include litigation finance, royalty finance and life insurance settlements. Like their high-yield counterparts, private credit spreads have narrowed recently, although private yield spreads remain compelling. The diverse nature of private credit offers investors yields from a variety of sources that don’t ebb and flow with credit conditions. For example, music royalties pay holders every time a song in the portfolio is played. While songs like “White Christmas” may be seasonal, it probably won’t be played any less during a recession.

We at Cresset have expertise in identifying and accessing a wide variety of private credit opportunities. Feel free to reach out to us if we can be of assistance.