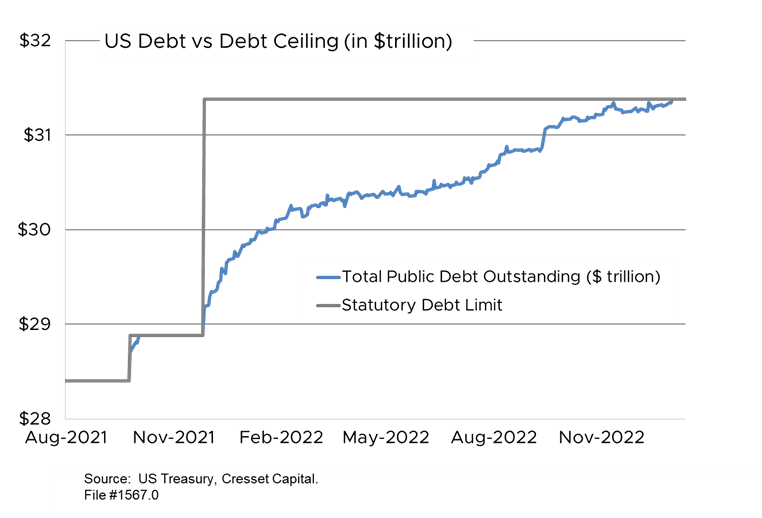

03.01.23 Last month, the US bumped up against its $31.4 trillion debt ceiling, prompting the Treasury Department to invoke “extraordinary measures” to maintain our country’s solvency. It is expected that Treasury will be able to kick the can down the road until sometime in July before Treasury Secretary Yellen’s spinning plates begin to wobble and fall. As Congress and the President brace for what promises to be contentious debt ceiling negotiations, the legislative acrimony of 2011 could serve as a useful guide to navigating today’s choppy waters. Back then, Tea Party Republicans used their legislative power to call for spending cuts in exchange for their nod on the debt limit. This time around, will Congress flirt dangerously with default, or will cooler heads prevail?

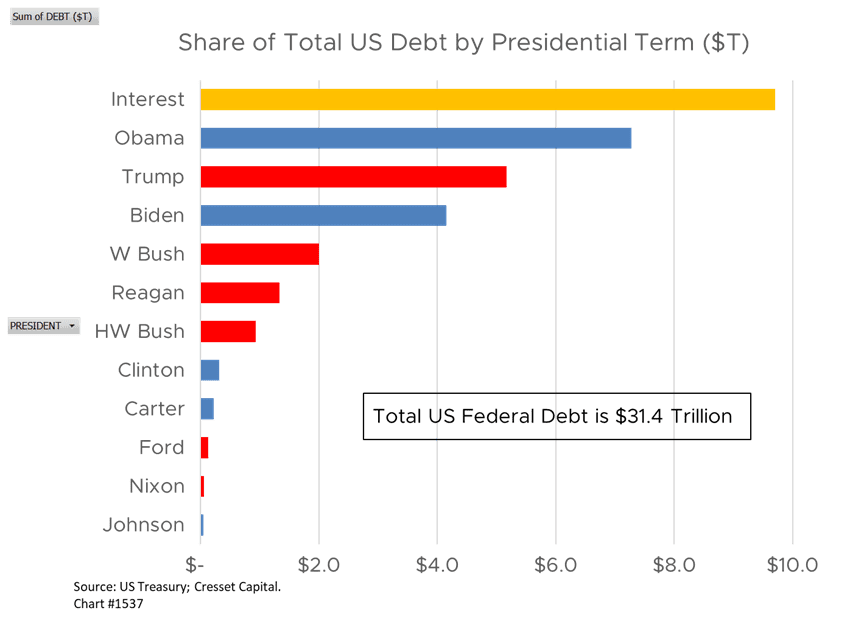

You can blame the financial crisis and the pandemic for the current state of affairs, but the fact is that with just one brief exception in the late 1990s – when the Clinton administration ran a budget surplus – American presidents have been heaping red ink onto our sovereign debt load since the early 1960s. President Obama holds the dubious distinction of being America’s biggest debt contributor, thanks to the financial crisis and Obamacare. It should be noted that he achieved that distinction over a period of eight years in office. President Trump, the runner up at $5.2 trillion, captured second place over a single term. President Biden has hit $4 trillion with only three years under his belt. The total accumulation of federal budget deficits since 1963 is slightly more than $21 trillion, and nearly one-third of America’s debt obligation, or $9.7 trillion, was the accumulation of interest during that period.

While only one in four current House members was seated in Congress during the 2011 fight, two players on today’s political stage were knee deep in the 2011 debt limit turmoil that resulted in the downgrade of US Treasury debt – Joe Biden and Jerome Powell. Then-Vice President Biden led bipartisan talks which paved the way to lifting the borrowing limit by $2.4 trillion in exchange for $917 billion in federal spending cuts, according to The Wall Street Journal. Fed Chairman Powell, an ex-Carlyle banker and a relatively anonymous Treasury official, helped persuade Republican House members of the gravity of a debt default. The fact that he was a Republican afforded credibility to his pleas among lawmakers.

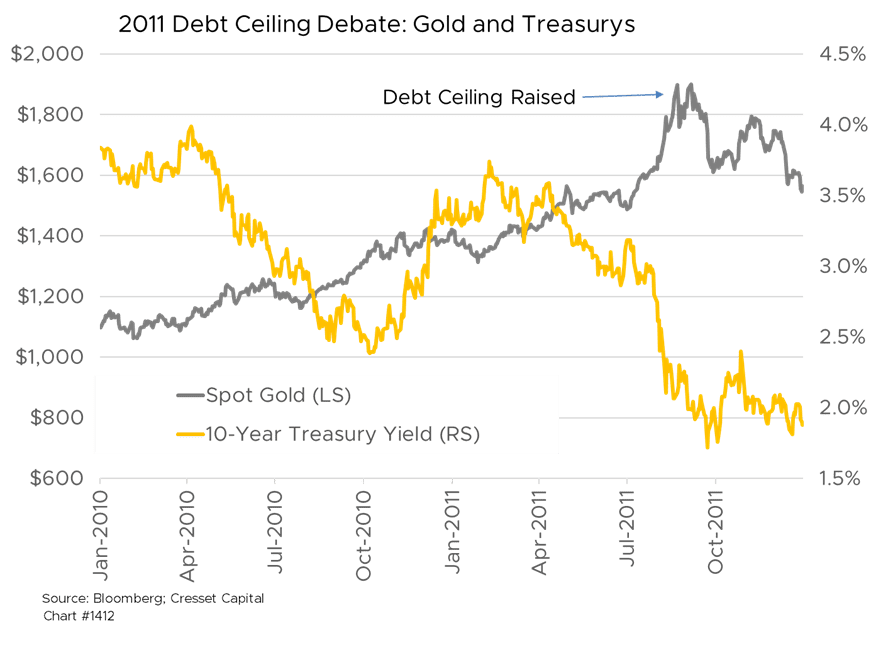

Raising the 2011 debt limit came down to the wire, and not before nervous investors sold equities and bought up bonds and gold. Between July and September, the 10-year Treasury yield cascaded to two per cent from three per cent in the three months leading up to the deal while the S&P 500 plunged nearly 18 per cent before recovering. Gold, meanwhile, surged from $1,500 to $1,900 as tensions flared.

Chairman Powell will be heading to Capitol Hill next week where he will undoubtedly warn lawmakers who, like their 2011 predecessors, are angling for massive spending cuts, of the perils of flirting with a debt default. President Biden, meanwhile, understands the give and take of legislative negotiation. We expect the President will concede to spending cuts this time, too. Remember, sovereign credit ratings are not just the result of a country’s ability to pay its debt, but its willingness to meet its financial obligations. We expect cooler heads will prevail.