By Jack Ablin, Chief Investment Officer. Subscribe for weekly market updates.

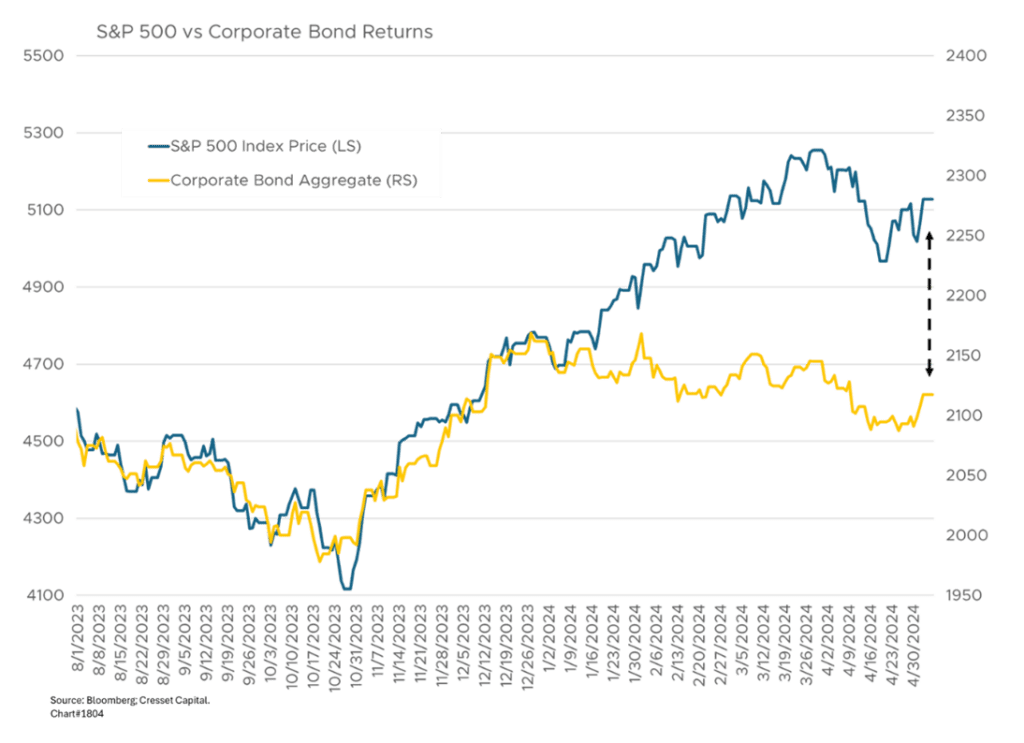

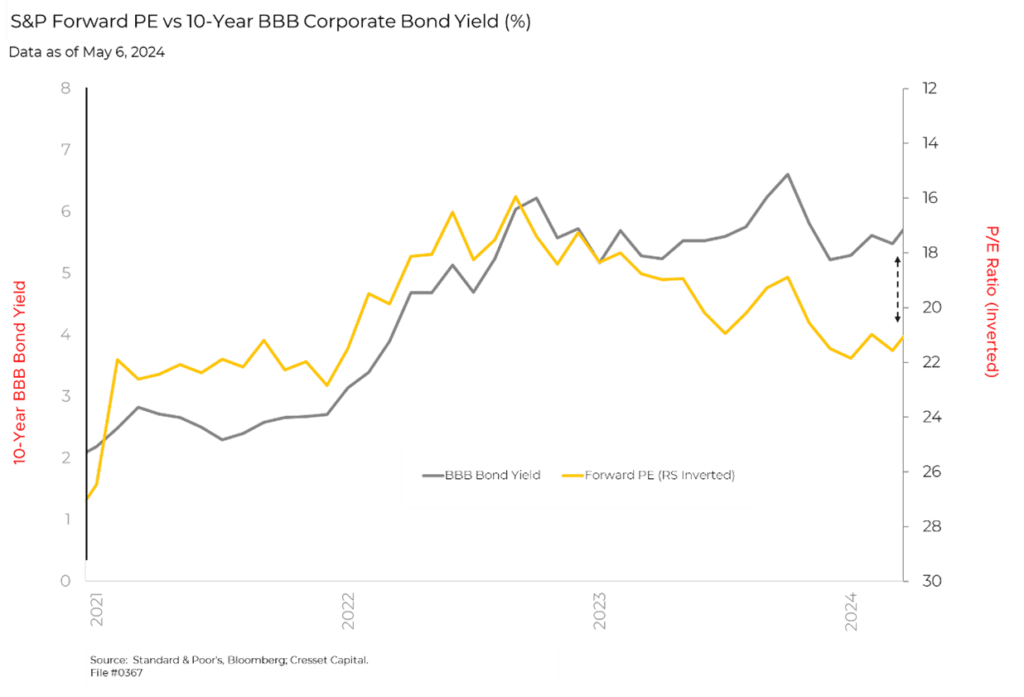

5.8.2024 The S&P 500’s value is a function of earnings and market multiple; in other words, how many times earnings investors are willing to pay for owning equities. While there are many ways to forecast earnings – bottom up, top down or something else – the market multiple is a function of interest rates. Historically, the 10-year, BBB corporate bond yield has been a good proxy for the market multiple. That’s because the market’s earnings yield, which tends to move together with the corporate rate, is the reciprocal of the price-earnings (P/E) ratio. It’s also why stock and bond prices tend to move in tandem over the short term. Yet, since the beginning of 2024, the S&P 500 has advanced against a backdrop of higher interest rates. The yield on the 10-year note is 4.5 per cent, about 0.6 per cent higher for the year. What does this tell us about the market’s valuation, and how do we put that metric into perspective?

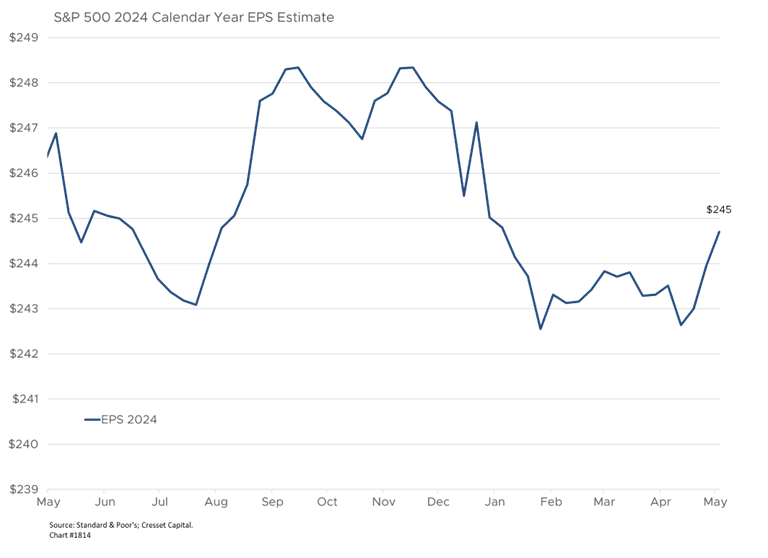

At the same time, 2024 earnings expectations have remained unchanged. Investors are anticipating S&P 500 earnings per share (EPS) of $245 for the year. While it has improved in recent weeks, it’s unchanged from the beginning of the year. That puts the market multiple at around 21x, or a 4.8 per cent earnings yield.

The problem is that the 10-year, BBB corporate bond currently yields 5.9 per cent, which implies a market P/E of 17x. An EPS of $245 implies an S&P 500 Index at 4,165 – about 20 per cent below its current level.

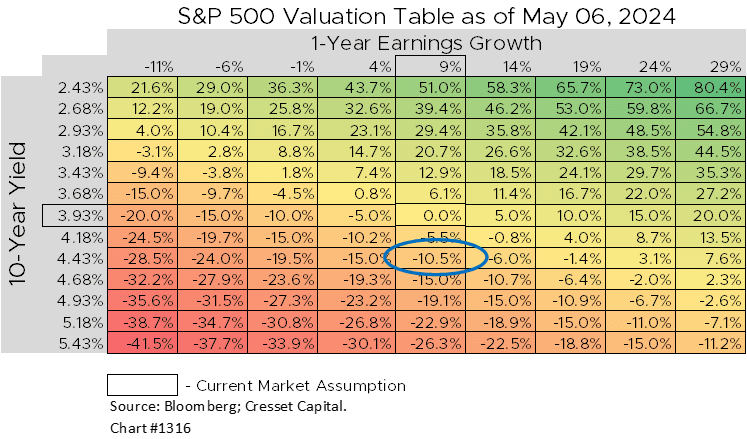

Cresset’s S&P valuation table, constructed at the beginning of the year, confirms that view. At the outset of 2024, the 10-year Treasury yield was 3.9 per cent and earnings were expected to grow by nine per cent. Fast forward to today: earnings are still expected to grow by nine per cent, but the 10-year yield is at 4.48 per cent, which suggests a 10 per cent pullback. Add the S&P’s eight per cent advance year to date, and the 18 per cent overvaluation is consistent.

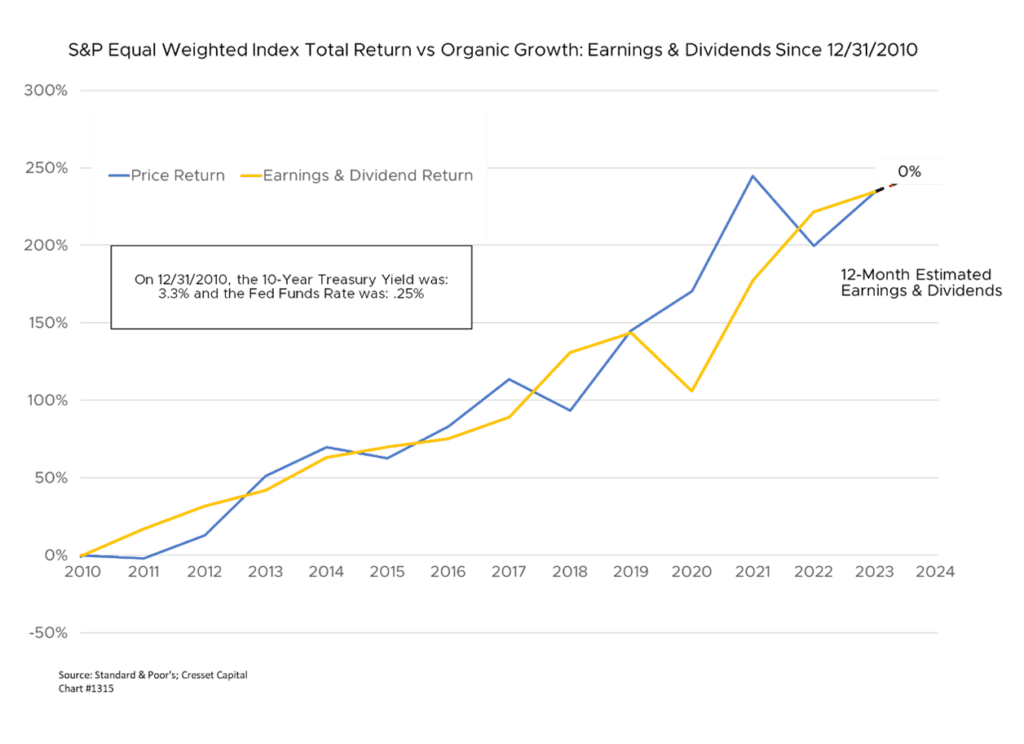

Before we flap our arms and hit the “sell” button, it should be noted that not all stocks in the market are expensive. In fact, most stocks in the S&P 500 are fairly priced. While the S&P is trading at 21x projected earnings, without its five largest constituents – Microsoft, Apple, NVIDIA, Amazon and Meta – the S&P 495 trades at a more palatable P/E of 19x. Moreover, the average stock trades at 18x forward earnings. The S&P 500 Equal Weight Index has risen in line with its cumulative earnings and dividends since 2010, according to our analysis.

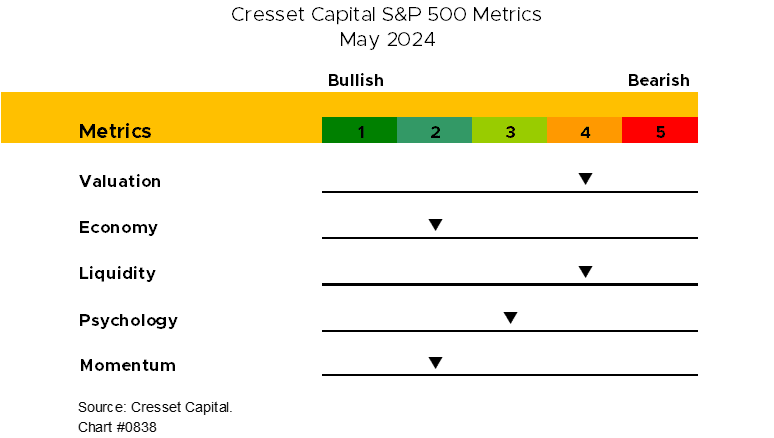

Bottom Line: The S&P, on a capitalization-weighted perspective, is expensive. However, most of the overvaluation is concentrated in a handful of high-quality, mega-cap technology companies, many of which could benefit from innovations in artificial intelligence. Underneath the surface, the average S&P 500 constituent is fairly priced. It should also be noted that valuation is not a timing tool. Valuation is only one metric in a mosaic that we continuously track to gauge the market, which also includes the economic backdrop, liquidity, psychology, and momentum. From that perspective, we hold a neutral view of equities.