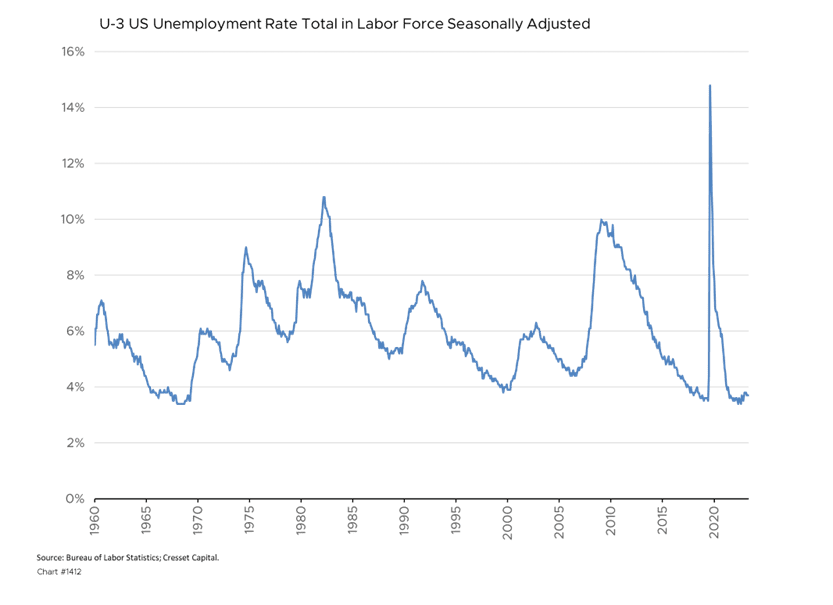

3.6.2024 The US economy is a standout in global terms. While China and Europe struggle to regain their footing, American growth is robust. Q4 GDP expanded 3.1 per cent year over year, outpacing Japan, the UK and the Eurozone. At the same time, China, the world’s second-largest economy, is grappling with a deflating property market bubble and massive debt accumulation that are spawning local deflation. At 3.7%, the US unemployment rate has dipped to a level not seen consistently since the 1960s. Meanwhile, the Dow, the S&P 500 and the NASDAQ are breaking through all-time highs. What’s not to like? Well, Americans have compiled a list.

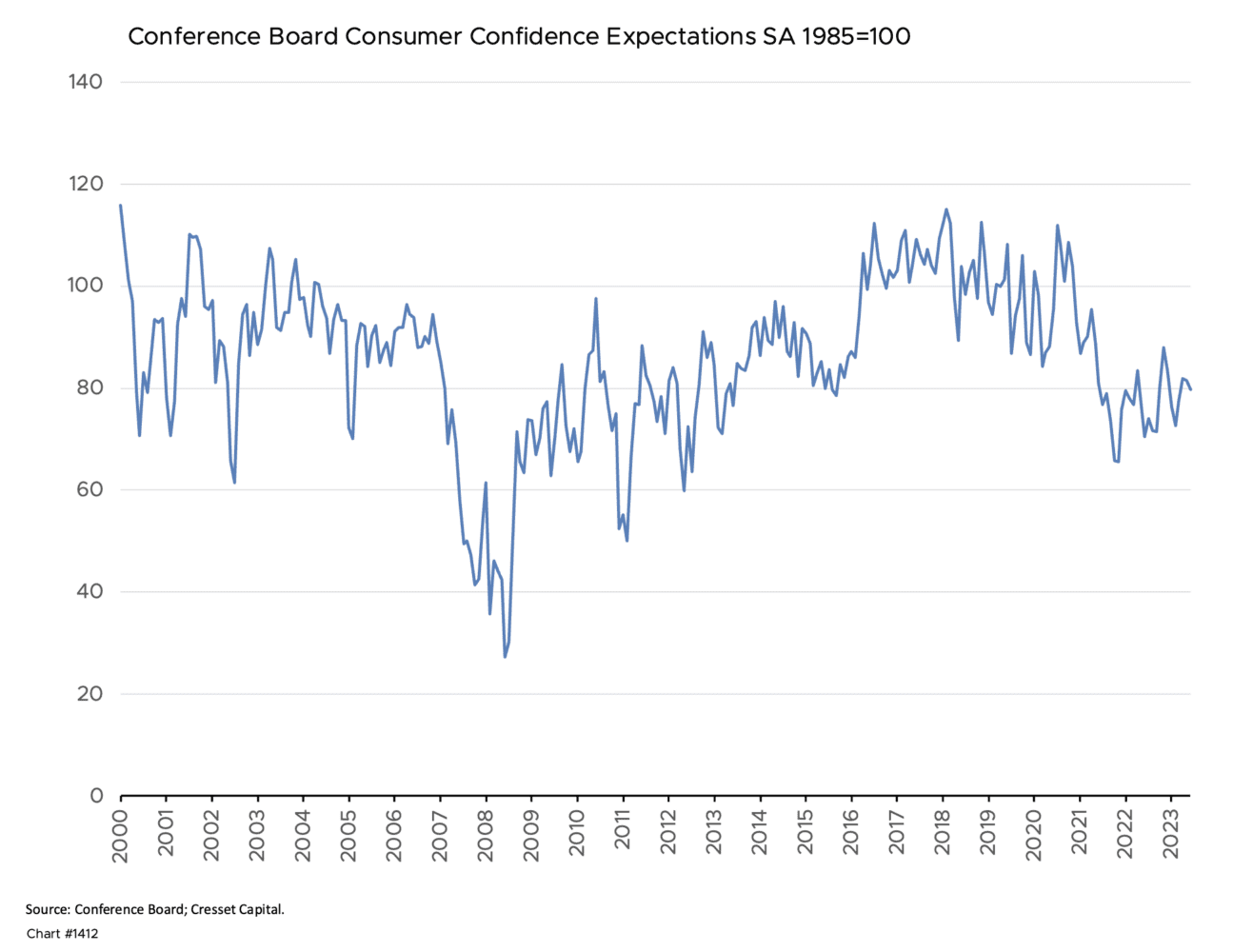

In recent presidential polling cited by the Wall Street Journal, only one-quarter or less of Americans think the country is moving in the right direction. While their somber view may not necessarily reflect the economy exclusively, other reports confirm America’s pessimism. Consumer confidence fell in February for the first time in four months, according to data from The Conference Board. A measure of expectations of the future dropped to a three-month low, dragged down by consumers’ dour view of their family’s current and future financial situation. Expectations plunged in 2022 as interest rates rose and, notwithstanding a recent uptrend, they remain well below pandemic levels.

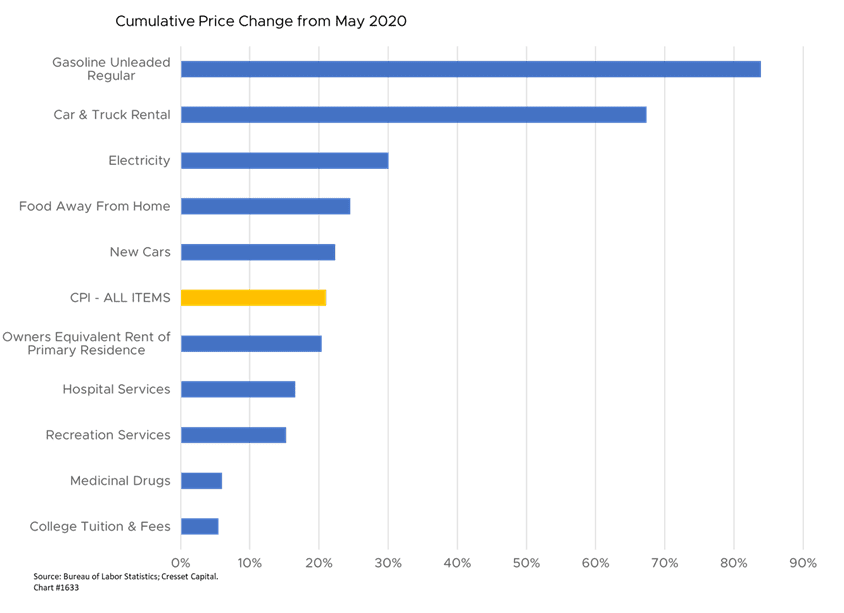

The spike in prices since the COVID lockdowns has altered the financial landscape. Beginning in May 2020, inflation trended higher when stimulus-fueled demand came up against supply chain shortages. Between May 2020 and now, prices, as measured by headline inflation, are 20 per cent higher. In other words, the cost of living for most Americans is 20 per cent more expensive than it was nearly four years ago. Making matters worse, many of the items that Americans buy, like fuel, automobiles and food, have risen substantially more than the overall trend. The price of a gallon of unleaded gasoline has surged more than 80 per cent since May 2020, while car and truck rentals are nearly 70 per cent more expensive. Electricity costs rose 30 per cent while dining out is nearly 25 per cent more costly.

At the same time, home prices are on the rise, making homeownership unattainable for many. Between May 2020 and the end of last year, the selling price of a single-family home is 42 per cent higher, while mortgage rates are hovering around their highest level in well over 20 years. Growth in disposable income, even factoring in COVID relief payments, has trailed inflation since the pandemic, leading to lower living standards. Even unionized workers’ wages are not keeping pace – adjusted for inflation and productivity, union wages are 10 per cent below their 2020 level as of the end of 2023. The stock market has been a plus. The S&P 500 expanded more than 60 per cent in value, nearly three times the rate of inflation. Sixty per cent of Americans own equities, although holdings are concentrated among the wealthiest households.

According to a recent Wall Street Journal article, restaurants and other small businesses are having a difficult time passing their high costs along to their customers, leading to margin compression, and in some cases, closures. While fast-food restaurants have largely averted margin pressure, certain national brands, particularly quick service, sit-down restaurants, have been caught between higher costs and a customer base unwilling to shell out more than $15 for an entree. Last week Bloomin’ Brands, whose chains include Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill and Fleming’s, announced plans to close 41 locations nationwide. TGI Friday’s will be closing 36 locations.

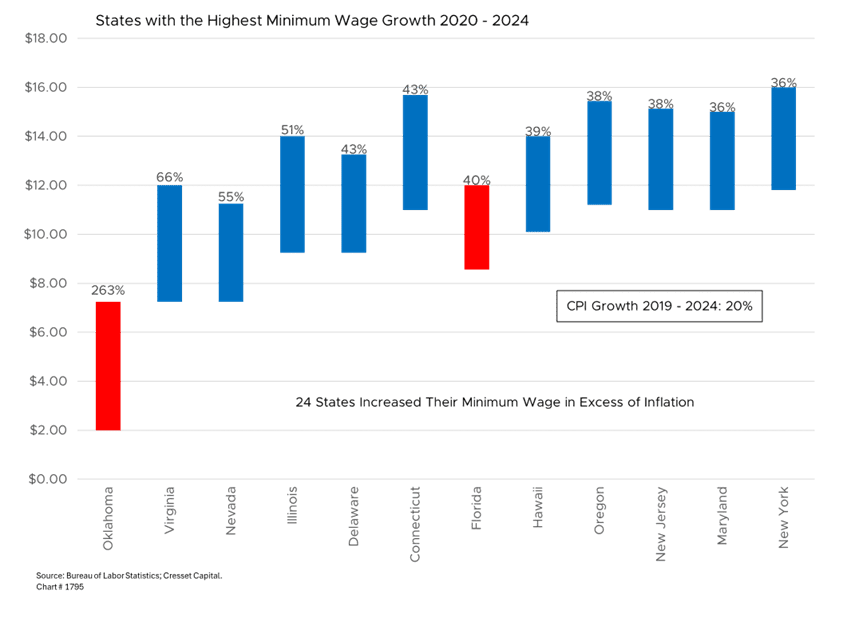

While food inflation is abating, labor costs, most notably minimum wages, are on the rise. Between 2020 and 2024, wages among lower-skilled workers, leisure & hospitality, and fast-food workers, are more than 30 per cent higher, as shuttered hotels and restaurants suffered staff shortages when businesses reopened. At the same time, minimum wages are skyrocketing. Since the pandemic, half of the states increased their minimum wage higher than the inflation rate and some states, like Virginia, Nevada, and Illinois, meaningfully so. A survey of small business owners found that 10 per cent of respondents claimed that labor costs were the single most important problem they currently face.

In his upcoming state-of-the-union address, President Biden will undoubtedly take credit for economic growth, the job market, and an easing inflation rate – and, by all standards, he should. However, the drivers of household confidence and optimism are complex, the result of a blend of economic, social, and political realities and perceptions. While today’s big-picture data paints a rosy picture, it’s “kitchen-table economics” that drives confidence and approval ratings. Yes, the rate of inflation is lower, but prices are still rising, dampening living standards and sentiment.