10/7/21: Equity investors are looking forward to Q4, hoping it plays out better than last quarter. Beset by a Delta variant flareup, consumer spending sagged, leading most markets lower. The S&P 500 fell nearly five per cent in September and limped through Q3 flat, in essence. Large caps finished the first nine months of the year nearly 16 per cent higher. Bonds offered no help – they flatlined in September and slipped nearly one per cent for the quarter. Year to date, bonds have fallen nearly two per cent.

Anticipation of the Fed’s impending taper program was one of the factors that set off the September swoon. Powell & Company paved the way for a reduction of the Fed’s massive bond-buying program, to begin later this year. The news helped push the benchmark 10-year Treasury yield above 1.5 per cent for the first time since June.

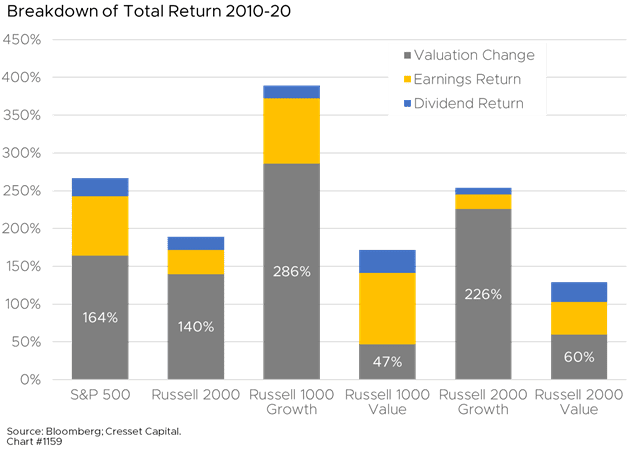

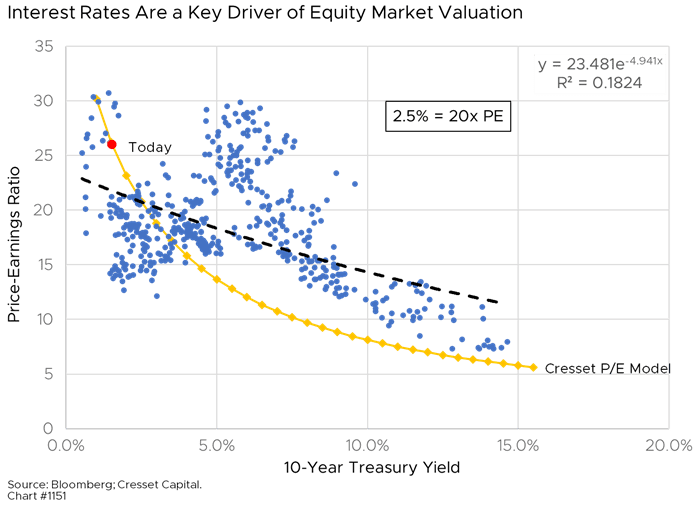

Interest rates represent one of the most vital valuation inputs for equities. Lower interest rates support higher “fair value” price/earnings (P/E) ratios, enabling equity investors to pay more for a given earnings stream. That’s what happened over the past decade: between 2010 and 2020, most of the return equity investors enjoyed from the major indices was derived not from earnings and dividends, but from valuation expansion. That’s because the 10-year Treasury yield slid to 0.9 per cent from 3.8 per cent over that timeframe.

Earnings and dividends grew, but the multiple investors were willing to pay for earnings grew even more. Cresset estimates that, without valuation expansion over the last 10 years, the S&P would have returned about 100 per cent, not 267 per cent.

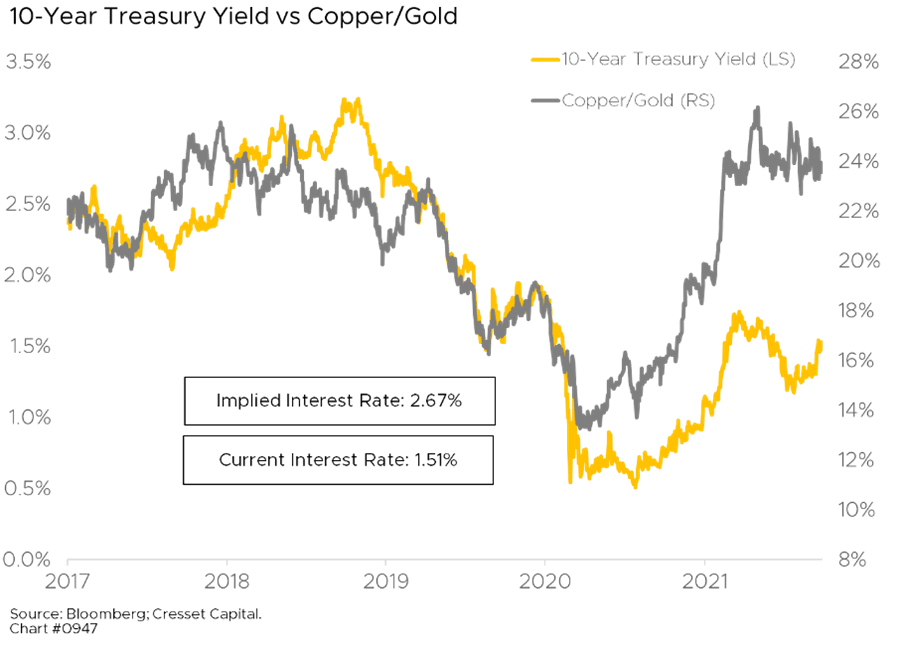

Now, interest rates are on the rise. Blame the expansion, inflation and Fed policy; the path of least resistance for the 10-year Treasury yield appears to be higher. Cresset’s copper/gold model, which tracks the relative return of pro-cyclical copper against defensive gold, has offered a useful guide to interest rates. Our copper/gold model suggests the 10-year note should yield 2.7 per cent – 1.5 per cent points higher – implying continued upward pressure on rates.

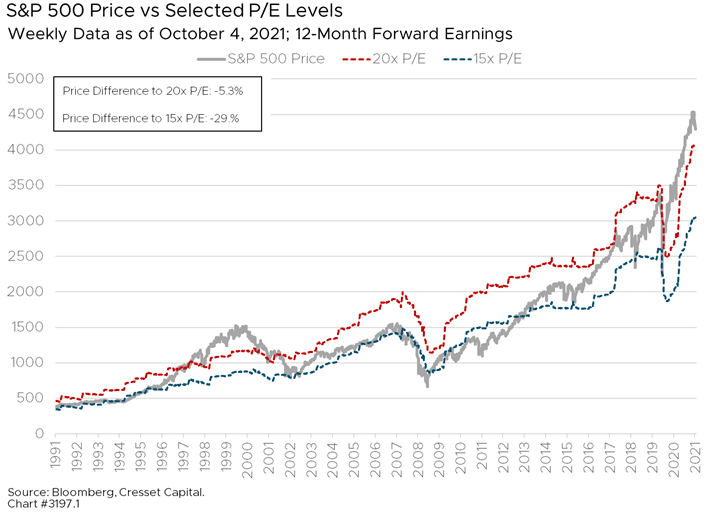

Higher rates mean the “fair value” P/E ratio would contract. Assuming earnings and dividend growth estimates don’t change, a lower price-earnings ratio means markets will likely correct. How large a correction takes place depends on how high rates rise. We believe the upward rate trajectory is limited given the economy’s dependence on low rates. It’s unlikely the 10-year note yield will rise above 3 per cent. Our interest rate vs P/E model suggests the market’s fair value price-earnings ratio will decline from 26x, where the market is priced today, to 20x if interest rates rise from 1.5 per cent to 2.5 per cent. That implies a 5.3 per cent market pullback from today’s level.

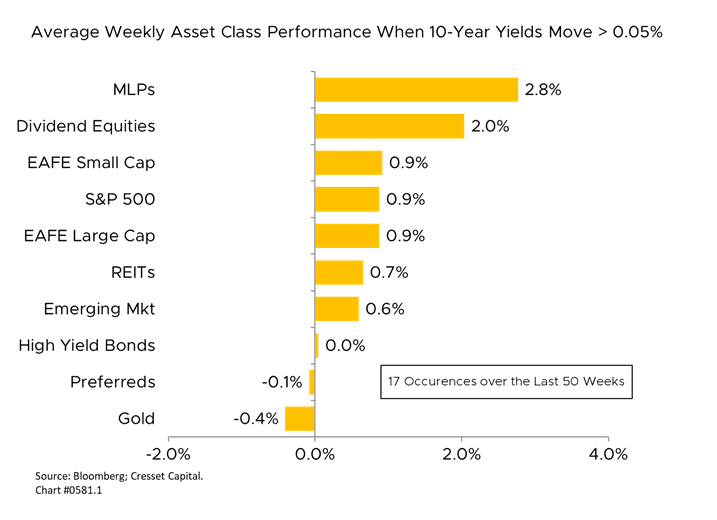

Rising rates understandably affect different asset classes and sectors differently. The 10-year Treasury yield rose by more than 0.5 per cent in 17 of the last 50 weeks. Master limited partnerships, part of energy infrastructure, benefitted the most, gaining 2.8 per cent, on average. Energy is a beneficiary of stronger growth, often a catalyst for rate increases. Meanwhile, interest-sensitive asset classes trailed, including bonds, preferred stock and gold. As the dollar strengthens, gold, an alternative currency, weakens.

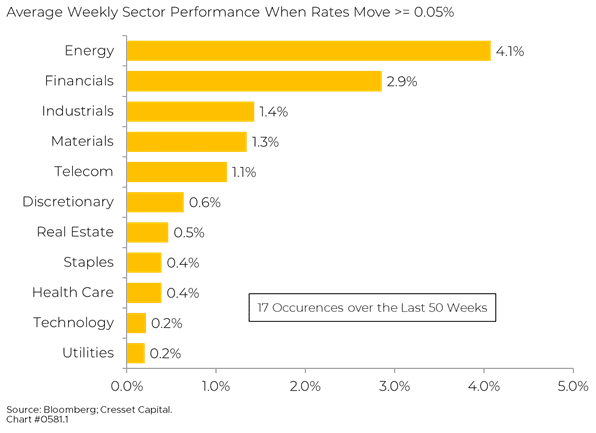

Energy and financial shares have been the biggest beneficiaries of rising rates over the last year. They rose an average 4.1 per cent and 2.9 per cent, respectively, over our 17-week sample. Not surprisingly, and similar to recent experience, interest rate sensitive utilities and growth-oriented technology trailed.

We expect interest rates to rise and stabilize, leading to a 5-10 per cent correction during the adjustment period. After that, stable rates – albeit at an incrementally higher level – will no longer serve as a headwind, nor a tailwind, to valuation. That means that quality value will lead the markets over the next few quarters, since value tends to derive the highest return from organic earnings growth and dividend yield. While growth sectors, like tech, enjoy higher earnings expansion, this comes at a higher valuation than growth in value sectors, so tech earnings yield is lower. Cresset has developed a quality dividend strategy for US large caps as well as a small-cap quality portfolio to help clients navigate the coming quarters. Feel free to reach out to us if we can be of assistance with your portfolio questions.