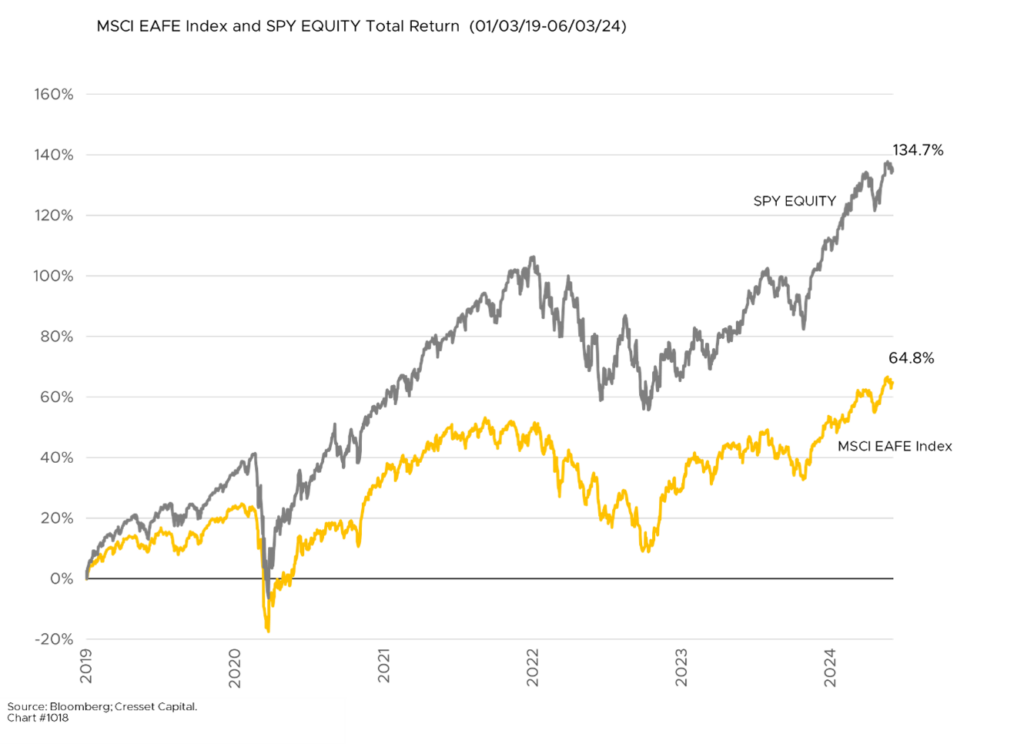

6.5.2024 US large caps, thanks to a favorable blend of fiscal and monetary stimulus, dollar strength and innovation, have led the major equity markets higher over the last decade, with the S&P doubling the return of international developed stocks over the last five years. Earnings growth was a big contributor to the S&P 500’s outperformance. Since 2019, S&P 500 earnings expanded 36%, handily outpacing the 20% growth achieved by international markets in the interim. Dollar strength added another 8% of incremental return.

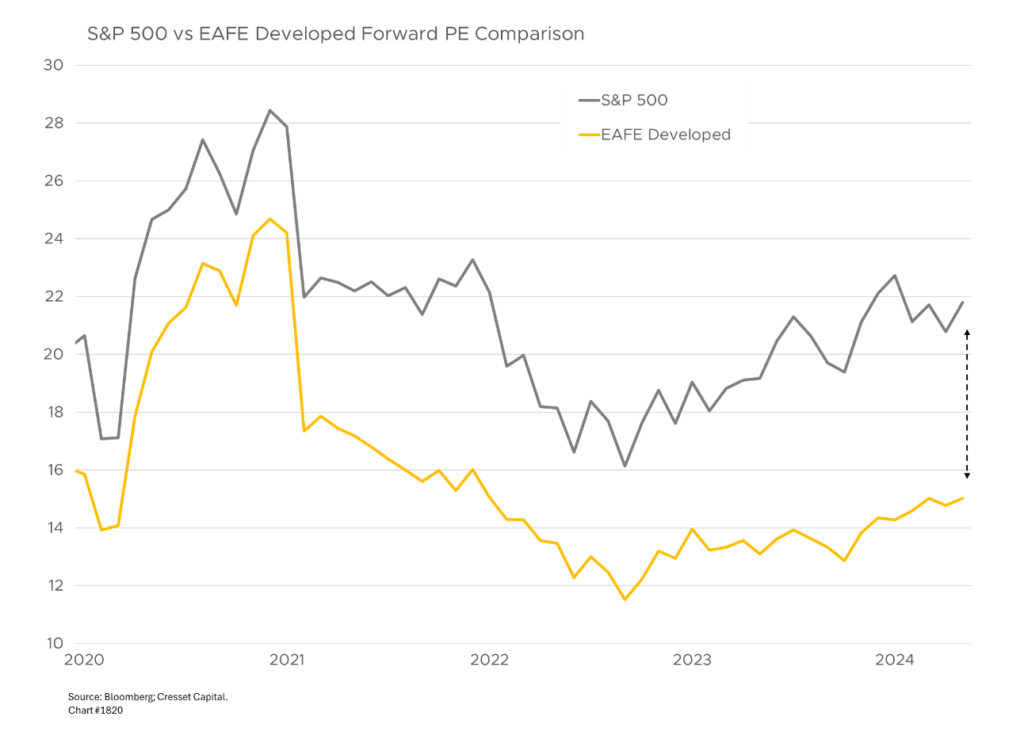

Nonetheless, investors are wondering whether it’s time to lean into international developed market stocks given their relative underperformance. Bullish pundits point to foreign markets’ cheaper valuation due to its lower forward price-earnings multiple as a rationale for shifting away from an arguably expensive US market and into a seemingly cheaper alternative. They argue that developed market equities are trading at a forward PE of 15, substantially below the S&P 22 multiple, representing the widest valuation differential in years.

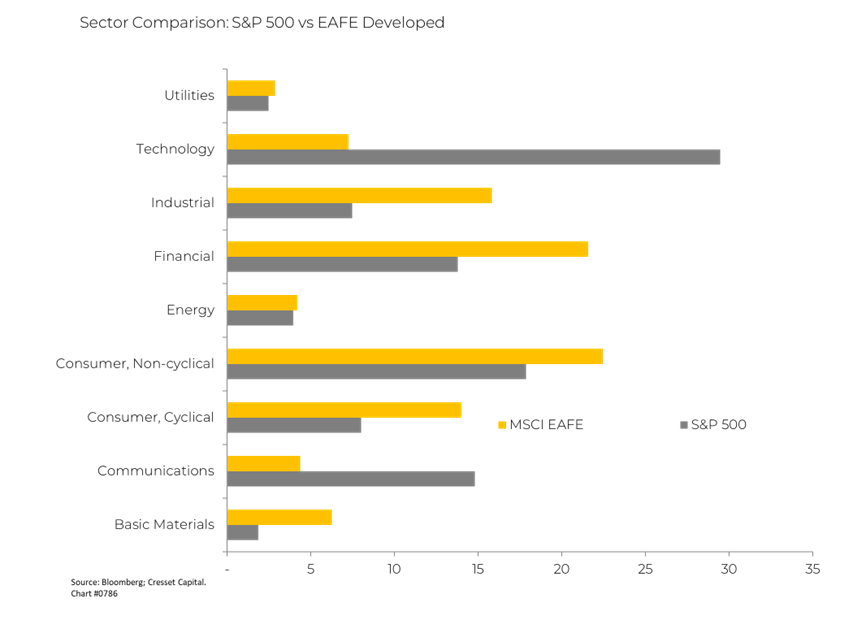

Concluding that a different market, whether it’s small cap or international, is a better deal because it has a cheaper top-line valuation, like a lower forward price-earnings ratio, misses the point. That’s because different markets are comprising different sector weightings. International large cap markets, for example, are much more heavily exposed to financials through banks, they also have an outsized allocation to industrials, and consumer stocks also. Meanwhile, EAFE large caps have only about a quarter of the S&P 500’s technology exposure. Comparing market level valuation metrics leads to distorted signals and unreliable conclusions.

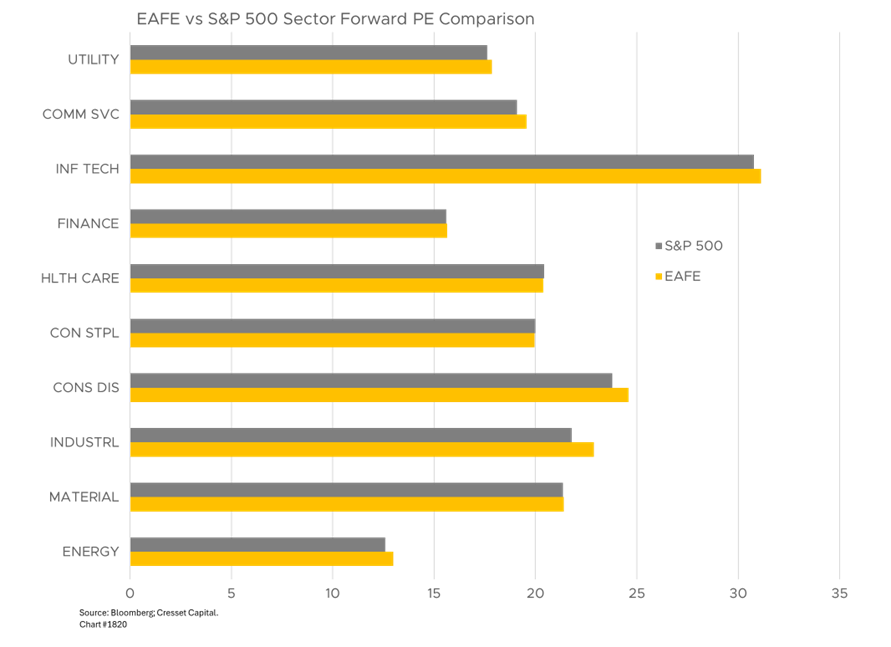

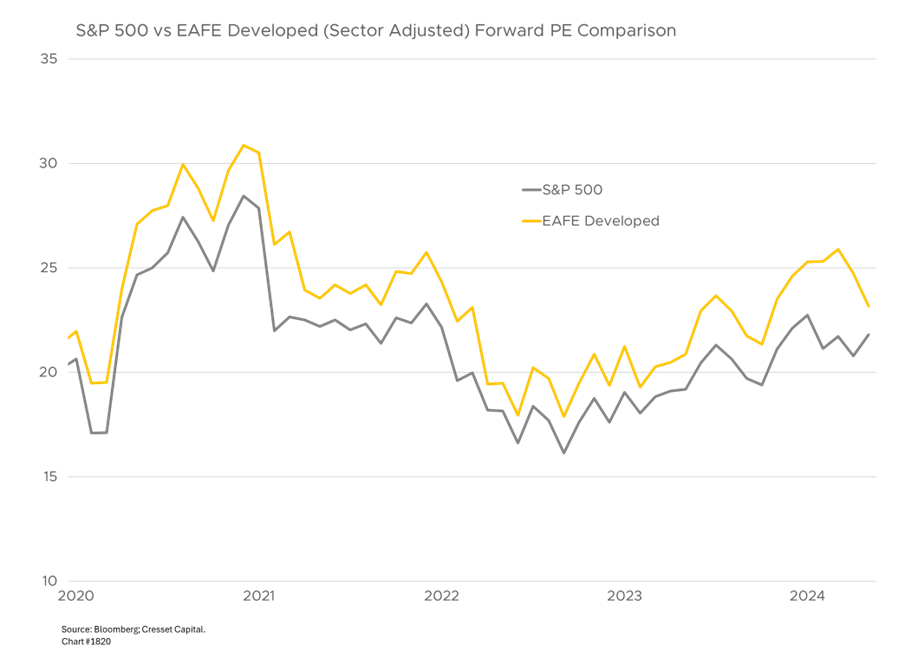

Comparing relative valuation, like forward price earnings, at the sector level offers a clearer picture. From that perspective we find that international equities are more expensively priced than their US counterparts among eight of the 10 major economic sector groups. At 31.1 times, international technology stocks, for example, have a costlier valuation than their US technology brethren, at 30.8 times.

Calculating a normalized developed markets price earnings ratio based on S&P sector weights suggests international stocks are not as cheap as their headline metrics would suggest. In fact, EAFE developed stocks appear more expensive than US large caps on a forward price earnings basis.

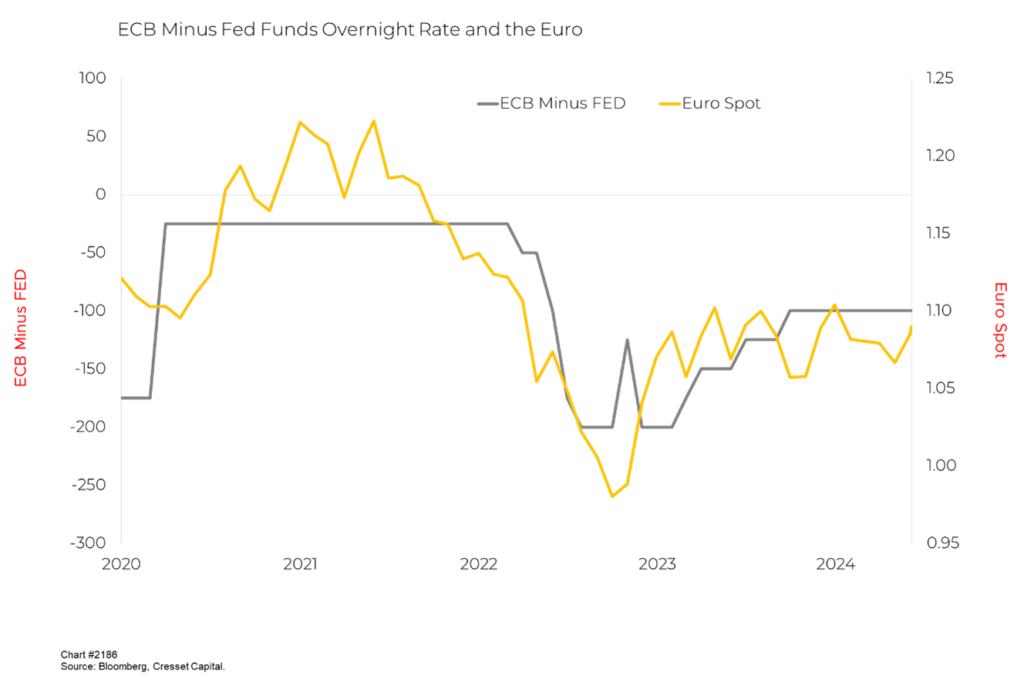

Perhaps recent runup in the dollar relative to most other currencies explains the overvaluation. It could be argued that the US dollar is expensive relative to many of its trading partners’ currencies. On a purchasing power basis, the dollar is arguably overdone. However, the near-term direction of the dollar will likely follow the path of short-term interest rates and it appears that the ECB is poised to lower rates this week while the Fed will likely stand pat, suggesting the dollar would strengthen against the euro, creating an additional headwind for US investors exposed to equities denominated in foreign currencies.

Bottom Line: While the US large caps are arguably expensive, both relative to bond yields and versus its own history, international developed market equities appear equally expensive on a sector-adjusted basis. While we continue to monitor liquidity and momentum for clues. It appears international markets would not offer a haven in the event either of those metrics break down. While international equities could offer diversification benefits, they’re unfortunately not a cheaper alternative to US large caps.