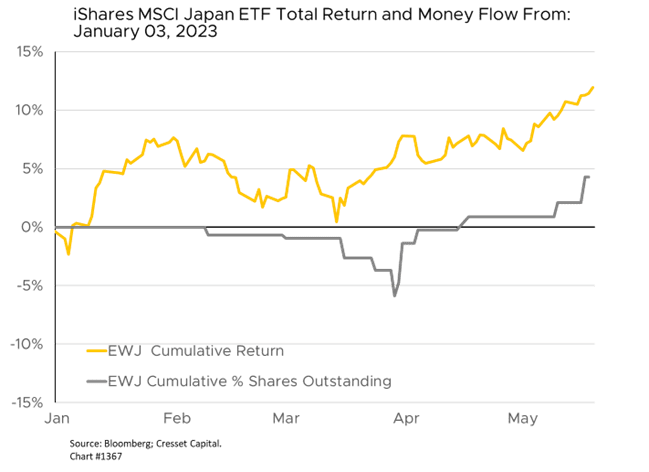

05.24.2023 Japan is basking in the international spotlight. The country just played host to the G7 Summit, burnishing its image as both an industrial and political force. At the same time, the Nikkei 225 just reached a level not seen since 1990, a time when Tokyo real estate was valued as much as $139,000/sq ft, nearly 350 times as much as equivalent space in Manhattan, and corporate management from all industrialized nations aspired to mimic the business practices of the Land of the Rising Sun. Year to date, Japanese equities are more than 12 percent higher while inflows into the most popular Japan ETF began ramping up at the end of the first quarter. We examine several factors that have sparked the move.

Valuation: Japanese equities are cheap. In 1990, the Nikkei 225 traded at 61x earnings and its price-to-book ratio was 5.6x. This time around, the Nikkei’s forward price/earnings ratio is 15x and the price-to-book ratio 1.7x, less than half that of the S&P 500. Moreover, Japanese equities are trading at a 5.4 per cent earnings yield (the reciprocal of the P/E ratio). That stands head and shoulders above Japan’s 10-year, BBB industrial bond yield of 0.84 per cent. In the US, the S&P 500 earnings yield and the corporate bond yield consistently trade in tandem. Meanwhile, Japanese earnings are expected to rise two per cent over the next four quarters, compared to a two to three per cent decline in S&P earnings.

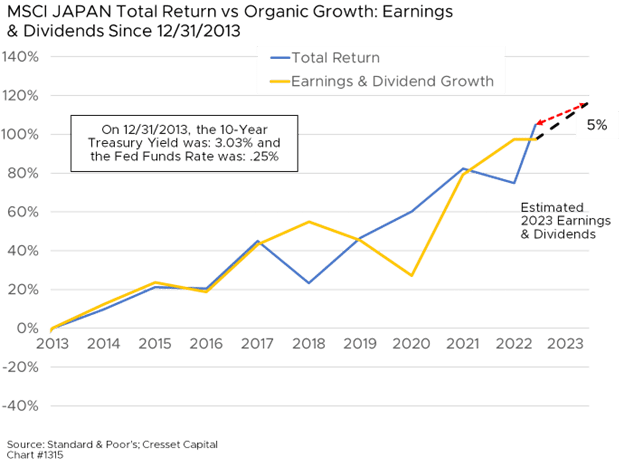

Improving corporate governance: State policymakers frustrated by managements’ poor receptiveness to shareholders have pressured them to improve their market performance. Authorities introduced a stewardship code for institutional investors in 2014, which means addressing investors’ concerns through shareholder-friendly practices. The recent increase in nominal GDP has helped management comply. Additionally, new financial regulations will penalize banks that maintain equity stakes in underperforming businesses. The pressure to perform is coming from shareholders, too. Activism, a strategy that prevents underperforming companies from staying lazy, is beginning to permeate the Japanese equity market, helping boost both management and price performance. Dividend increases and share buybacks are also on the rise.

Geopolitics: US tensions with China have benefitted Japan, which is positioning itself as a politically stable partner in the region. CEOs interested in diversifying away from China have warmed up to the idea of investing in Japan. The world’s largest chip manufacturers, including TSMC, Samsung, Micron and Intel, are considering significant investments in Japan, according to the Financial Times.

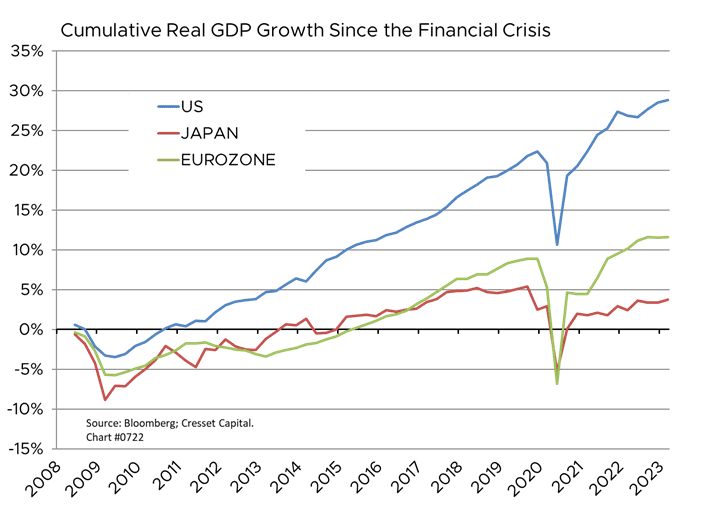

Economic improvement: Japan’s growth has trailed those of its US and European trading partners, but is beginning to show signs of life as deflation lifts. Gross domestic product is expanding at an annualized rate of 1.6 per cent, and wages are increasing after years of stagnation. The prospect of higher prices has boosted demand. Retail sales in March expanded 6.9 per cent over the previous 12 months, after a 7.4 per cent advance in February, among the highest readings in years. The surge was fueled by a steady increase in consumer confidence, albeit that move is similar to ascending from the basement toward the lobby level.

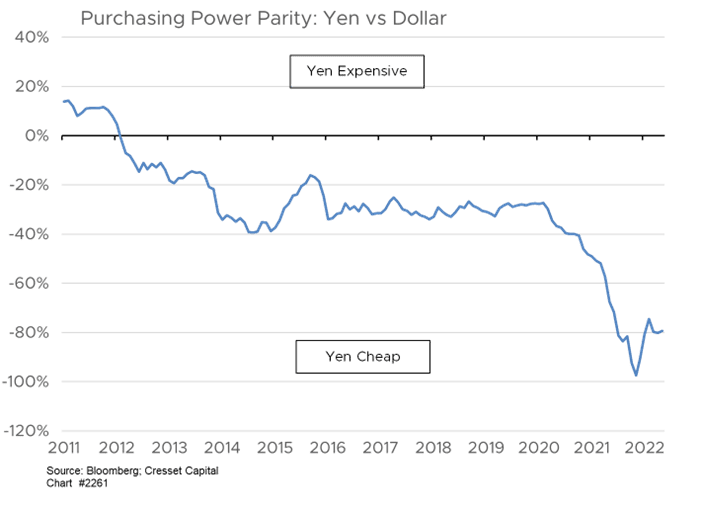

Cheap Yen: The currency is remarkably cheap when gauged against the dollar. Purchasing power parity, one of our favorite measures of a currency’s relative value, compares the purchase cost of a similar basket of goods in both countries with each corresponding currency. On that measure, the Yen is just off the cheapest level it’s been relative to the dollar in its history. We expect incrementally tighter monetary policy by the Bank of Japan will continue to boost the Yen. Meanwhile, a cheap Yen offers Japanese exporters an enormous cost advantage, as any revenue generated abroad will translate to stronger Yen-based profits at home.

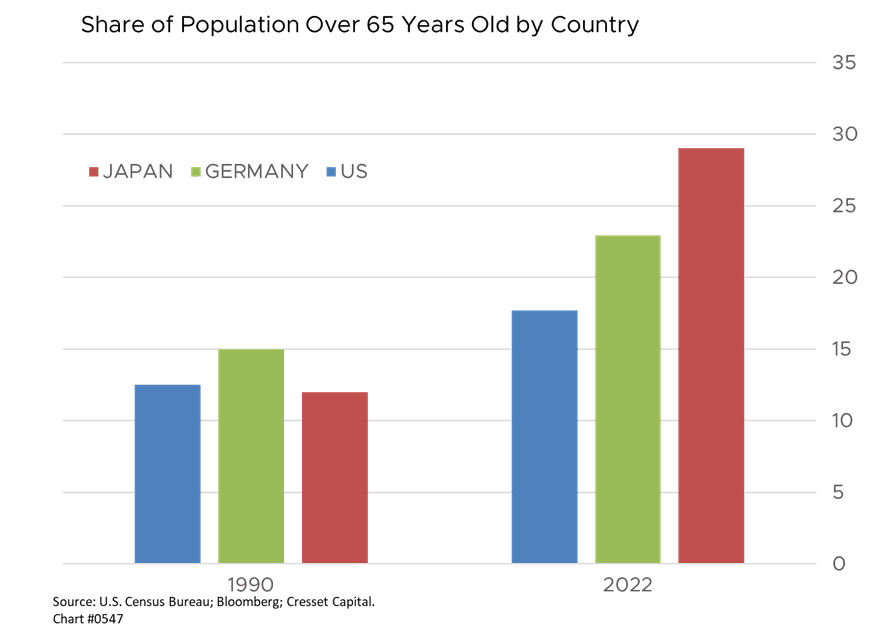

The world’s third-largest economy isn’t without challenges, however. Its aging population is well known: Japan has the dubious distinction of producing more adult diapers than baby diapers. Nearly 30 per cent of its population is aged 65 or older, suggesting Japan’s dependency ratio, the share of retired people supported by those who are working, is among the highest in the developed world. Without a sudden surge in fertility, immigration or productivity, Japan’s potential growth rate will be flat at best for years to come.

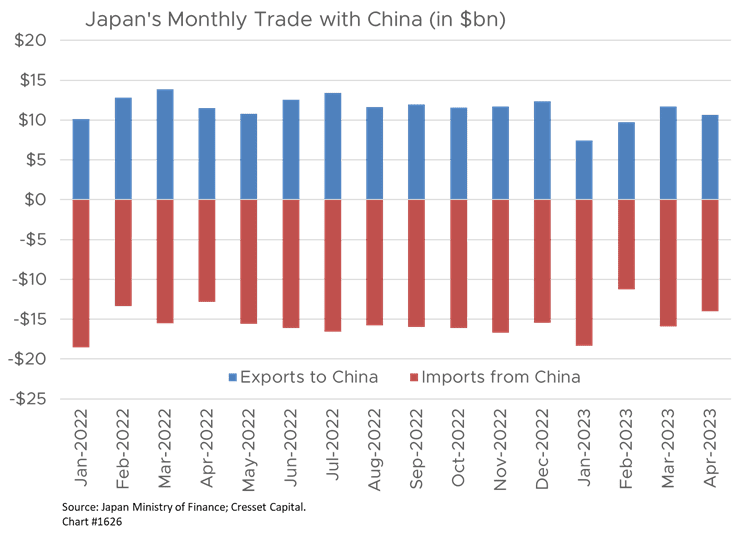

Another impediment on Japan’s potential is the country’s trade reliance on China, which could be a vulnerability if China decouples from the developed world. Japan’s trade balance just posted a record $162 billion deficit overall, according to the Global Times, which is a shocking state of affairs for a country that was built on exports. An export-led turnabout is unlikely, given the global economic slowdown and tighter monetary conditions among Japan’s largest trading partners in Europe and North America.

Bottom Line: We are encouraged by attractive relative valuations among developed market equities, particularly Japan. Developed market currencies, particularly the Euro and Yen, are also cheap relative to the US dollar and could benefit dollar-denominated shareholders, particularly if they trend toward fair value. We’re not convinced that a new day is dawning on Japan, given its fundamental challenges. However, there is no doubt that Japan equities are relatively cheap. Buying cheap equities denominated in cheap currencies offers US investors two ways to win.