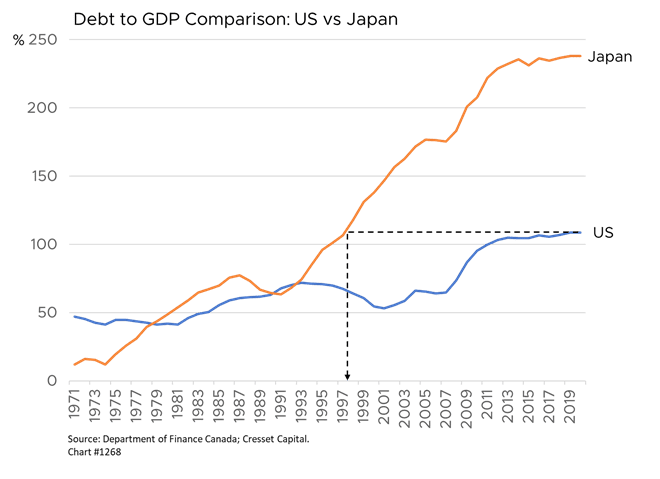

8/25/21: Navigating the investment landscape requires investors to recognize trends. Cyclical trends ebb and flow with the business cycle; more powerful, secular trends are shaped by government policy, demographics and other slow-moving, long-term factors. Notwithstanding the recent pandemic recovery, it appears the US is mired in a secular slowdown, punctuated by low growth rates and equally low interest rates, leading wary forecasters to warn our nation is following Japan’s path of economic decline. The similarities are striking. America’s population is aging while our birth rate is slowing. Japan’s prosperity peaked in the 1990s and the country, weighed down by an aging population and a low birth rate, pushed growth and interest rates to lower highs and lower lows until 2016, when its benchmark 10-year government bond yield slipped into negative territory. Faced with a rising dependency ratio – the relationship between the retired population who draw on government entitlements and the working population who contribute to government coffers – Japan ran budget deficits and borrowed the difference. In 1990, Japan carried a government debt representing about 64 per cent of GDP, about the same debt load the US had relative it its economy at the time. By the end of 2020, that figure had mushroomed to 238 per cent.

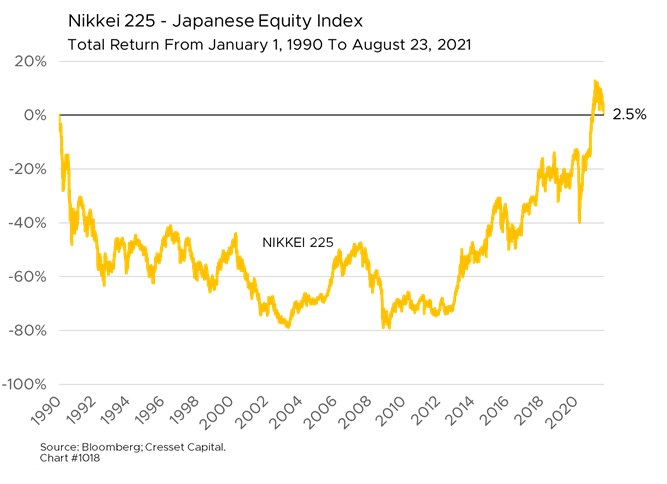

Japanese stocks have gone nowhere for 30 years: the Nikkei 250 has flat-lined since 1990, achieving a cumulative total return of just 2.5 per cent – that’s the total, not annual, return- in the interim. In fact, Japanese equities erased 80 per cent of their value over the first 18 years before clawing their way back to even only recently.

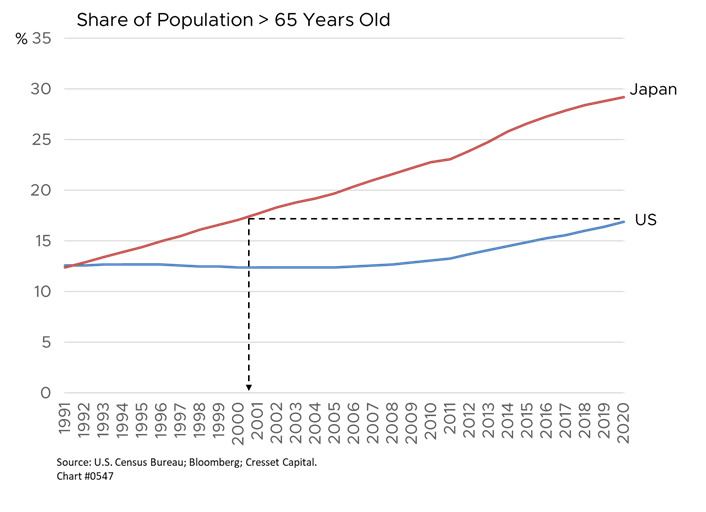

Demographically speaking, about 17 per cent of the US population is aged 65 or older, which puts us about 20 years behind Japan on that score. About 10,000 Americans celebrate their 65th birthday every day as the Baby Boom generation eases into retirement. Meanwhile, our labor force has been expanding at a scant 0.6 per cent annually for the last decade, pushing America’s dependency ratio higher.

Like our Asian trading partner, diminished demand and excess savings due to the demographic shift have dragged down economic growth and interest rates in the US, as retirees rein in spending and search for investment income. The trailing 10-year annualized growth rate at the end of last year was 1.6 per cent, down from 3.4 per cent 20 years earlier. Meanwhile, the federal government has consistently run budget deficits since 2000 to plug the demand shortfall. Last year the annual budget deficit exceeded $2.5 trillion.

As of the end of 2020, US federal debt levels exceeded GDP for the first time since the 1940s, in the aftermath of World War II. Unfortunately, deficit spending and debt accumulation appears to be one strategy on which both Democrats and Republicans agree, enabling Democrats to tout government support and Republicans to crow about no new taxes. At just over 100 per cent of GDP, America’s debt level corresponds to 1998 debt levels in Japan. And thanks to quantitative easing, the Federal Reserve is facilitating lawmakers’ profligate policies.

The risk America gets caught in the sort of demographically induced, secular undertow that befell Japan is real, but avoidable. Our first weapon for fighting it is immigration. While it may not appear that way, America is an open society that thrives by attracting talented people to live in, work in and contribute to our nation’s economic advancement. The US Citizenship and Immigration Services reports nearly 45 million immigrants in the country as of 2019, representing nearly 12 per cent of the population. The H-1B visa program attracts a quarter of a million skilled immigrants annually to fill value-added jobs in technology, health care and other industries. Japan, meanwhile, is a relatively closed society with fewer than 2 per cent of its population classified as immigrants, according to Japan’s Ministry of Justice.

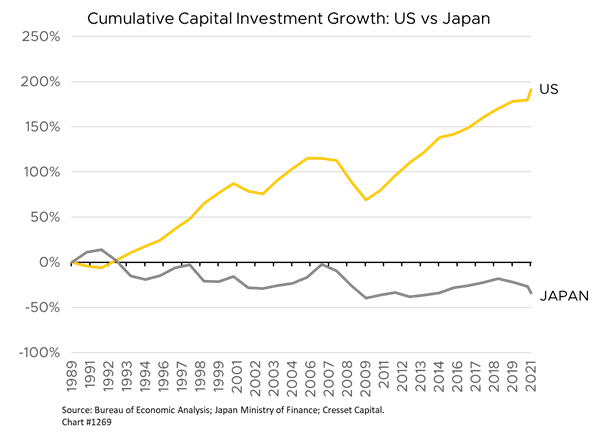

Productivity is another way to overcome secular stagnation by enabling workers to do more with the same effort. Productivity, the ability to advance our living standard without inflation, is fueled by favorable blend of innovation and capital investment, an abundant supply of talented workers, cheap capital and little or no red tape. On that score, US capital investment growth remains well ahead of Japan’s: since 1990, Japan’s capital investment growth, like its stock market, has remained flat while US capital investment has expanded by nearly 200 percentage points. The US economy will avoid a Japan-like demographic undertow if policymakers promote workforce education and training, facilitate innovation through business spending – and stay out of the way.