—

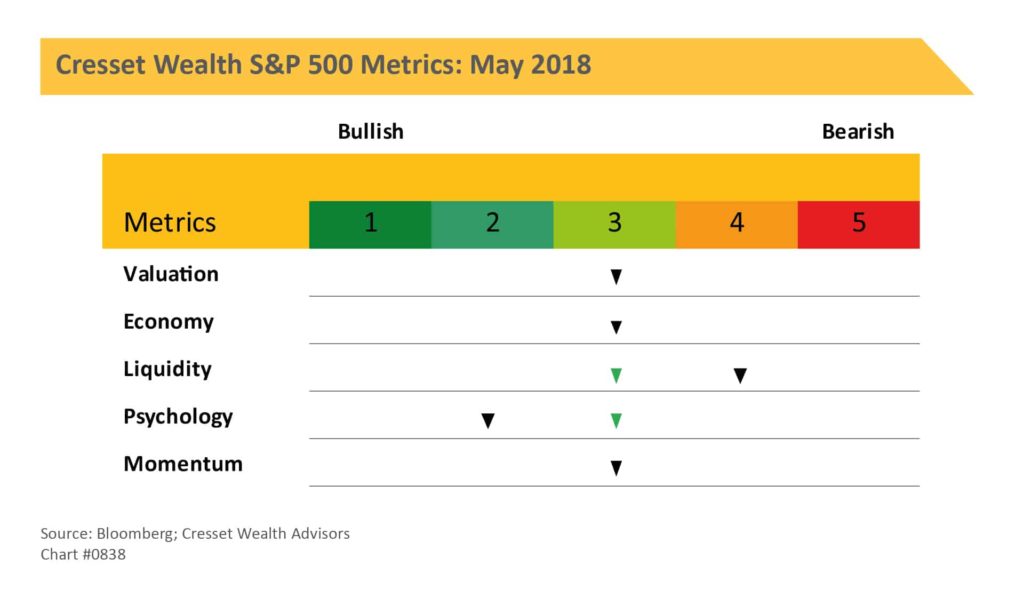

Valuation is presenting a mixed picture: equities appear cheap relative to current earnings projections, but expensive longer term. Higher interest rates represent a headwind for stocks.

—

US economic growth is solid, although foreign economies are falling short of analysts’ projections. Incentives in the new tax bill will encourage domestic growth at the expense of our trading partners.

—

Liquidity, while positive, is under pressure owing to increases in stock and bond market volatility as well as yen strength. The availability of credit, however, remains robust. Credit spreads are narrow but have widened in recent weeks.

—

Investors, reacting to global uncertainties and recent volatility, have downgraded their outlooks from bullish to neutral in recent weeks. This is in stark contrast to the overwhelming bullishness they exhibited at the beginning of the year.

—

Technical conditions deteriorated in the downturn but remain positive both at home and abroad. The S&P 500 bounced off its 200-day moving average twice over the last two months and rebounded.