3.27.2024 Mega-cap tech companies Apple, Google, and Meta are facing increased regulatory scrutiny and legal challenges in both the United States and the European Union. And these are not the only headwinds buffeting these companies. If the fundamental landscape is changing for the Magnificent Seven, what does this mean for your portfolio?

The US Department of Justice and more than a dozen state attorneys general have filed an antitrust lawsuit against Apple, alleging that the company violated antitrust laws by imposing software and hardware limitations on its devices, making it harder for rivals to compete and for consumers to switch phones. The lawsuit specifically targets Apple’s practices in areas such as super apps (apps that combine multiple services into one platform), cloud-streaming game apps, messaging apps, smartwatches, and digital wallets. Apple has vowed to vigorously defend itself against these allegations.

Meanwhile, in the EU, Apple, Google, and Meta face full-blown investigations into their compliance with the recently enacted Digital Markets Act (DMA), which aims to rein in the power of Big Tech on the continent. The DMA imposes a range of prohibitions and obligations on these companies, such as barring them from favoring their own services over those of rivals and forcing them to combine personal data across different services. The consequences for non-compliance are severe: companies found in violation of the DMA could face fines of up to 10 per cent of their worldwide annual sales, with the possibility of even higher fines for repeat infringements.

Moreover, the EU has also introduced the Digital Services Act (DSA), which lays out content rules for social media platforms, online marketplaces, and app stores. The DSA requires these companies to clamp down on misinformation and objectionable content, and national governments have been granted more power to force the removal of illegal material. Non-compliance with the DSA could lead to fines of up to six per cent of a company’s annual revenue.

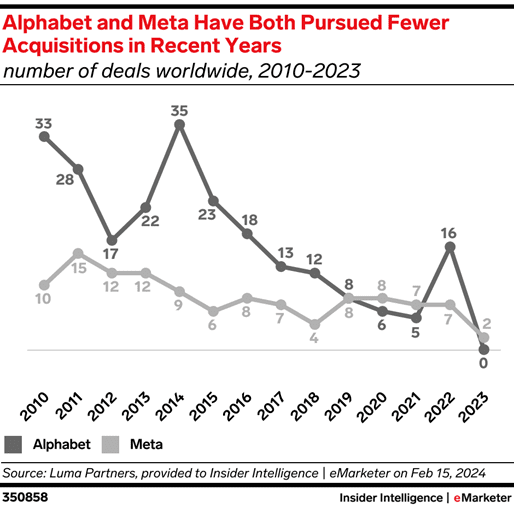

The tech companies have been working to comply with the new laws. Google has announced that it will link more to comparison sites in search results and provide more choice screens on Android devices. Meta has pledged to allow Facebook and Instagram services to be unlinked, and Microsoft has stated that some programs bundled with Windows will be able to be uninstalled in the future. Regulatory scrutiny has also quashed deal activity. Alphabet and Meta made just two acquisitions last year, according to Insider Intelligence. That’s down from 44 deals in 2014.

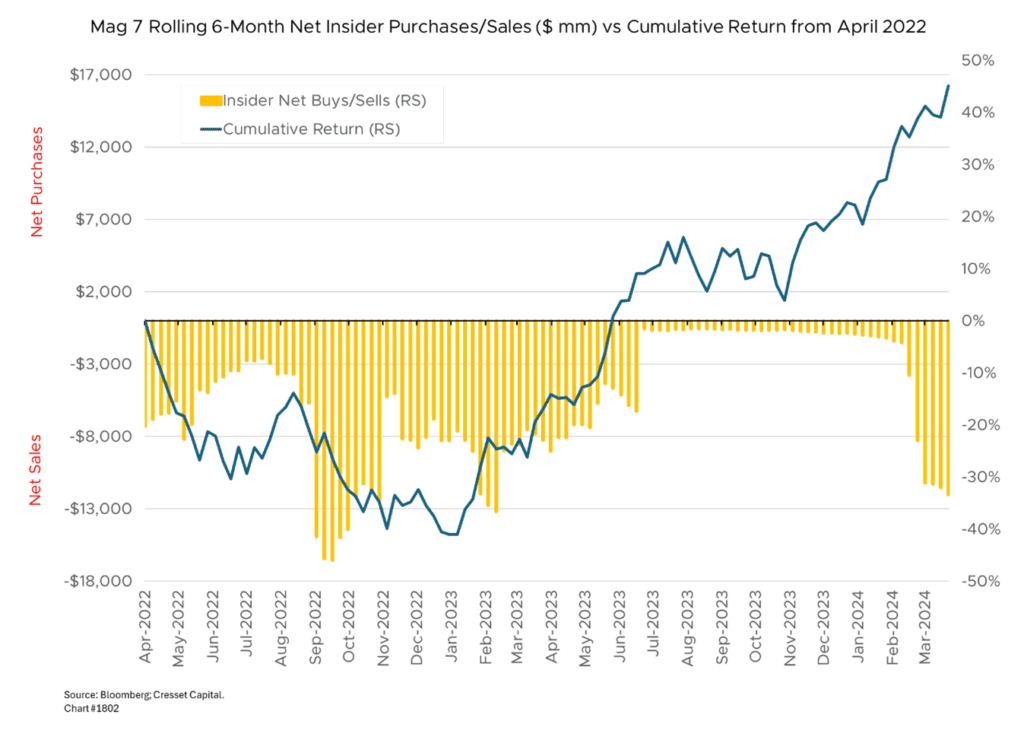

It’s interesting to note that the troubling regulatory headlines coincided with a recent increase in insider selling by prominent tech executives. Notwithstanding its nearly 50 per cent rally over the last 12 months, Magnificent Seven insiders have unloaded nearly $13 billion of stock over the last six months, the most selling in over a year. Michael Dell unloaded nearly $340 million of his eponymous stock earlier this month. This marked increase in insider selling may be an indication that the recent tech stock rally, fueled by excitement over generative AI, might face headwinds.

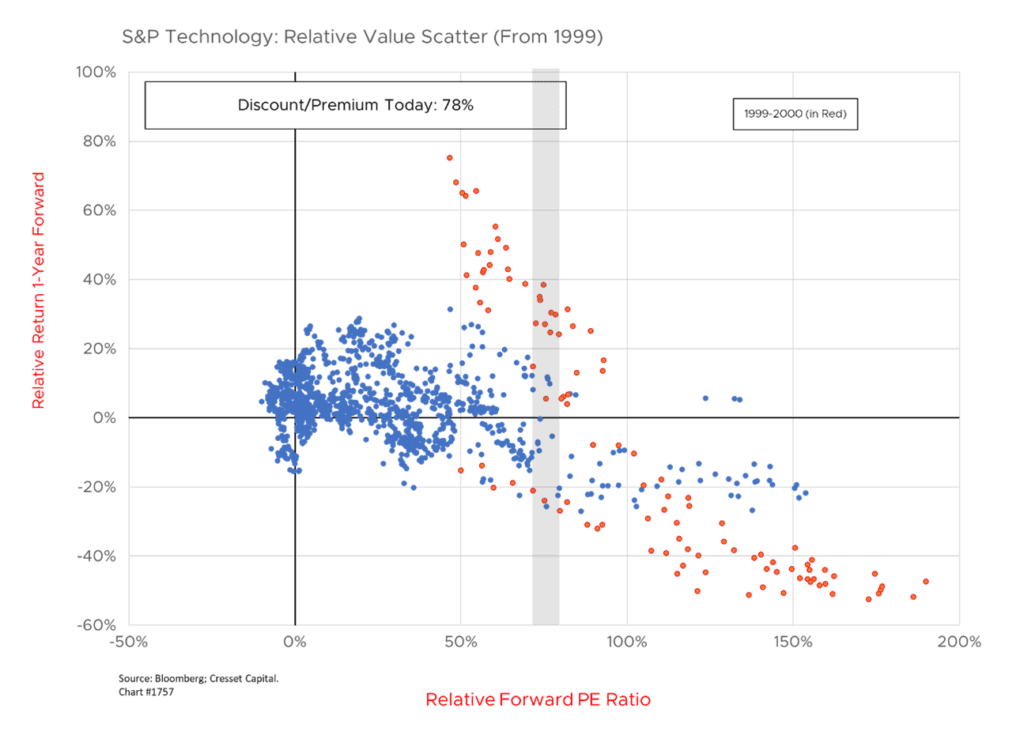

Valuation is another headwind. Notwithstanding its recent rally, mega-cap tech has become a victim of its own success. The S&P technology sector is currently trading at a 78 per cent valuation premium to the overall market – expensive by recent standards, although substantially lower than the 200 per cent premium it commanded in 2000, during the tech bubble. History suggests tech will struggle to stay ahead of the market over the next year when starting out at such a valuation premium.

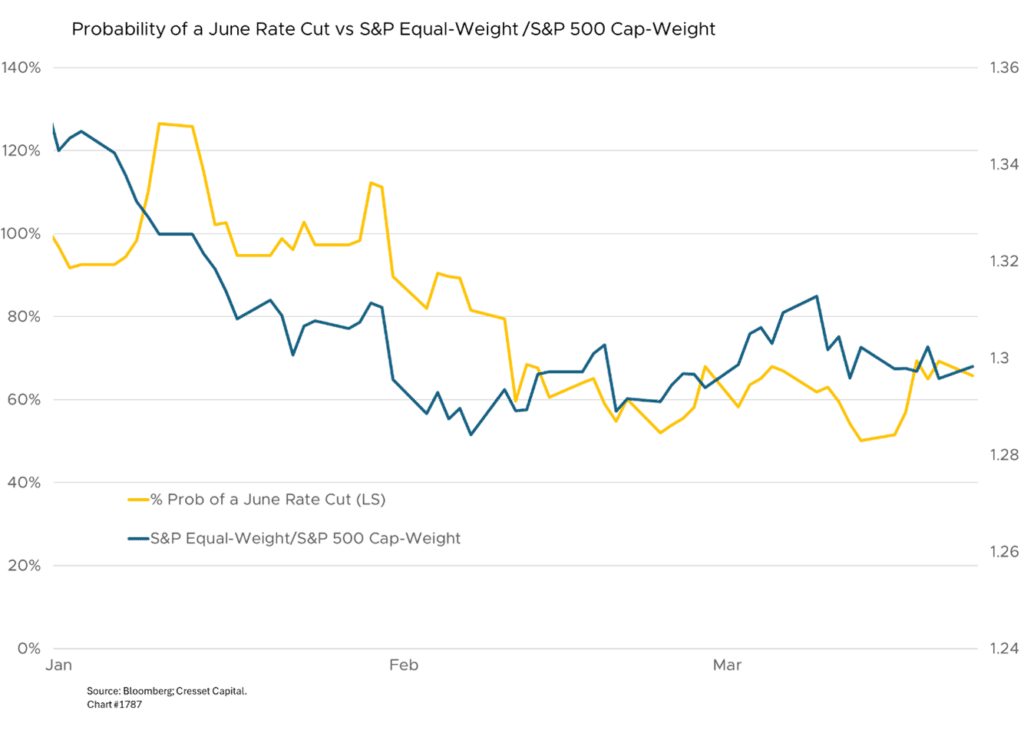

Bottom Line: Several factors, including stretched valuations, regulatory/legal scrutiny and insider selling paint a troubled fundamental landscape for mega-cap tech over the next year. At the same time, easier financing, fueled by Fed rate cuts, could usher in a broader market. Recent trading suggests the average S&P stock outperforms the Magnificent Seven as odds of a rate cut improve. We expect three rate cuts this year. While we don’t anticipate a major tech selloff, we expect it to take a back seat to other sectors as interest rates ease later this year.