2.14.2024 Last November, the market’s narrative shifted owing to Chairman Powell’s pronouncement implying the Fed had achieved victory over inflation. The S&P 500 surged 13 per cent over the final two months of 2023 as investors prepared for lower short-term rates in 2024. The prospect of easier financing costs helped broaden the market, as the average stock outpaced the capitalization-weighted index in November and December, as did small caps. Meanwhile, the Magnificent Seven, whose indomitable balance sheets were seemingly impervious to financing challenges, underperformed. What is the current status of, and future prospect for, the broadening trend?

The broadening trend has reversed so far this year, however, as investors – having used ink to write a March rate cut into their agendas – were forced to strike their calendar entries and dial down their easing expectations. The market, led by smaller names, narrowed, as mega-cap technology shares led the way higher. Since January 2 the S&P 500 has gained more than five per cent and broken through an all-time high, led by a 12+ per cent advance of the Magnificent Seven that left the average stock treading water. Small caps, the darlings of Christmas 2023, have fallen two per cent since the year began.

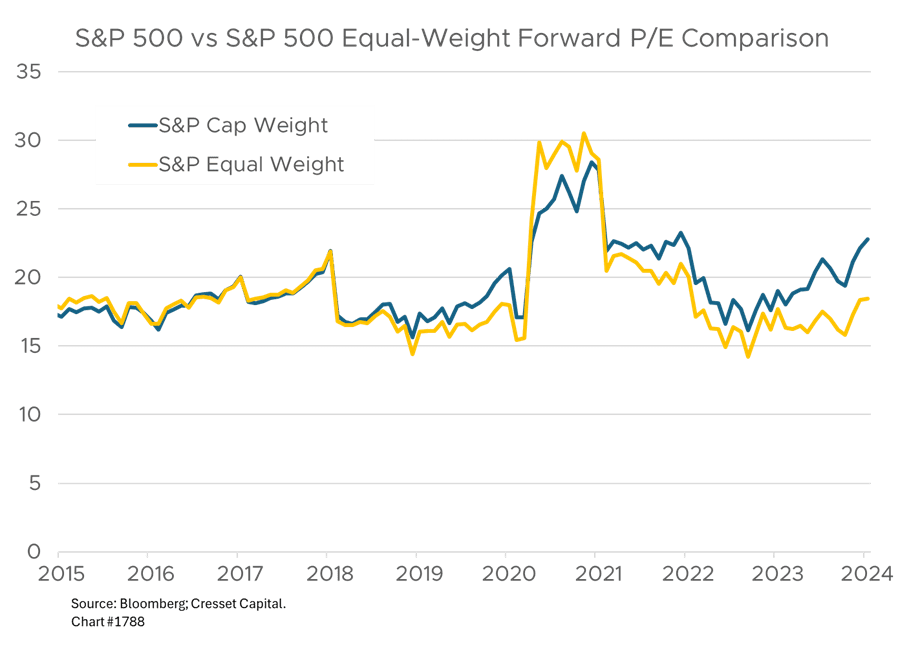

While some of the market’s broadening was drawn forward into last year, we offer two reasons to believe that the largest technology names will underperform the market as the average stock catches up. The first is valuation. The S&P 500 is trading at a sizable valuation premium to the average S&P stock: it’s currently situated at more than four multiple turns above that of the equal-weighted market. That’s the largest valuation premium in more than 10 years thanks to the dominance of the largest names.

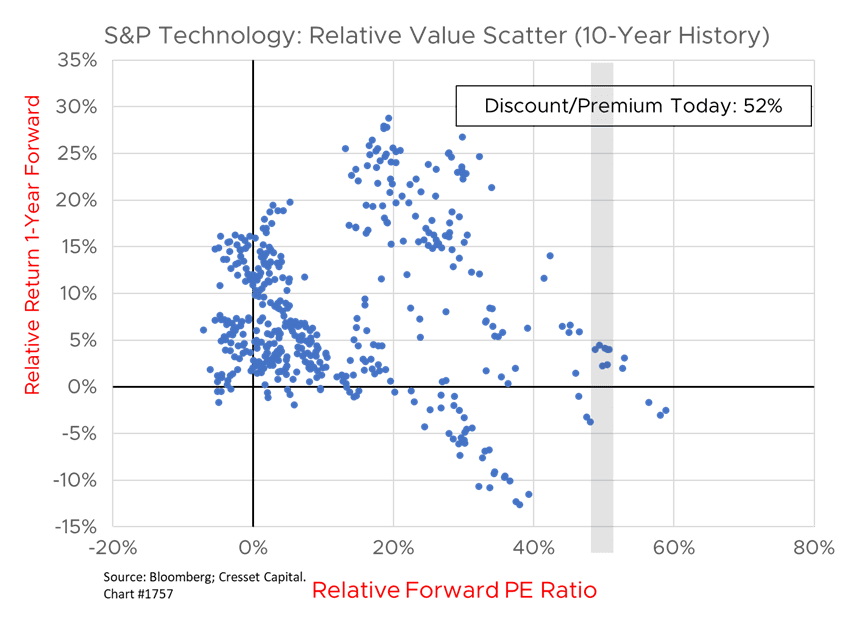

Meanwhile, the technology sector – the most expensive group in relative terms – is trading at a 52 per cent valuation premium to the rest of the market. History suggests the sector, which is over-represented in the Magnificent Seven, is likely to underperform over the subsequent year. While valuation is not a timing tool, time is on the side of cheaper, quality stocks.

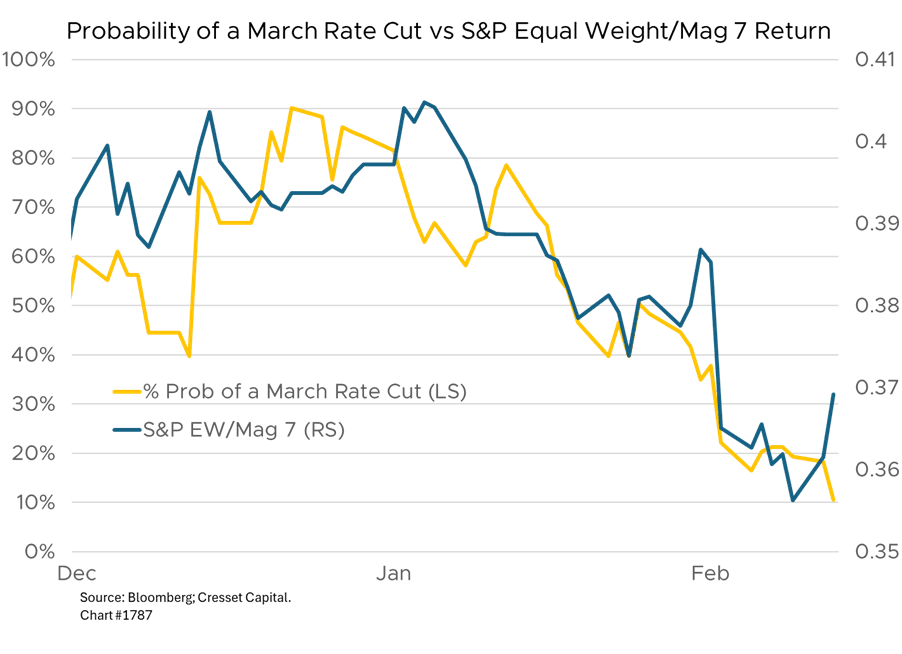

The second factor is lower interest rates. We expect markets to broaden against a backdrop of lower rates and easier financing, as the average stock in the S&P has an incrementally easier time raising capital relative to the largest companies in the market. While Tuesday’s inflation report, in essence, took the possibility of a March rate cut off the table, real overnight rates (interest rates minus inflation) are the highest they’ve been in 17 years. Every month inflation trends lower, real rates rise if the Fed stands pat. Even though Fed funds futures trading has downshifted from six rate cuts this year to four, we expect lower overnight rates in the second half of this year. The likelihood of a March rate cut has been a good coincident breadth indicator, as increases in the likelihood of interest rate cuts have coincided with the average S&P 500 stock outpacing the Magnificent Seven and vice versa. Investors ushered in 2024 with an 80 per cent chance of a March rate cut, but that number has been slashed to 10 per cent, while mega-cap technology names are again leading the market higher.

Bottom Line: We expect the market to broaden this year, with the average stock outperforming in the second half.