Key Observations:

- Global benchmark yields are rising in major economies including the US, Japan, the UK, and China.

- The “distrust premium” surrounding sovereign quality accounts for nearly two-thirds of the recent yield moves.

- We believe investors must plan on persistently higher real interest rates.

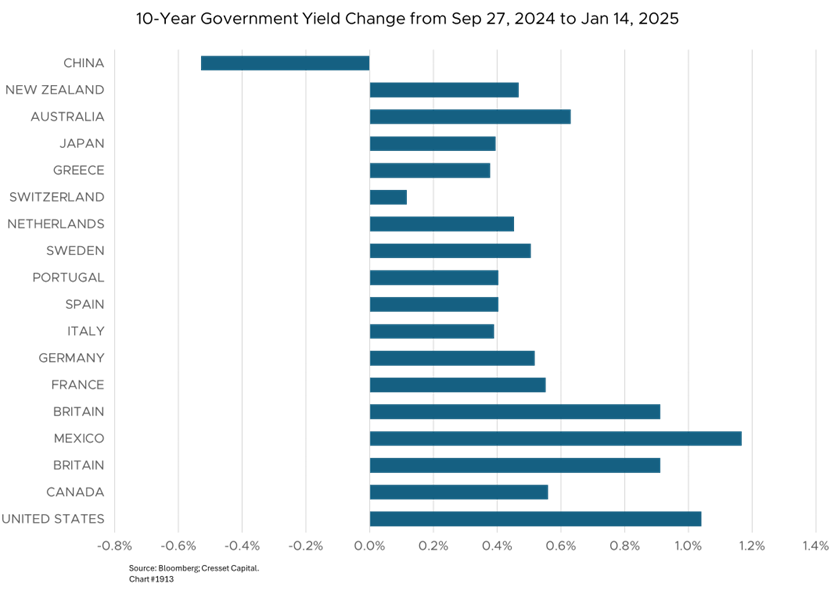

Bond yields are rising sharply across major economies. The US 10-year yield has surged more than one percentage point since last September, coinciding with the Federal Reserve kicking off their rate-cutting program. Global benchmark rates are rising as well: yields among most developed market economies are up 50-100bps. The US 10-year yield is fast approaching five per cent, the highest it has been since mid-2023. Japan’s government bond yields are posting their highest levels since 2007, while UK gilts are nearing their peak of 2008. What is driving this global trend, and what does it mean for investors?

Government bond yields typically climb due to:

- Rising inflation expectations. Fixed-income bond holders demand to be compensated for purchasing power risk; as their inflation expectations rise, so do their yield demands.

- Higher growth and productivity expectations. Faster economic growth commands higher rates.

- Rising fiscal budget or sovereign debt concerns. Investors will demand higher “distrust premiums” if they sense sovereign quality deterioration. Investors worry that global “bond market vigilantes”, expressing concern about government debt and deficits, are resurfacing.

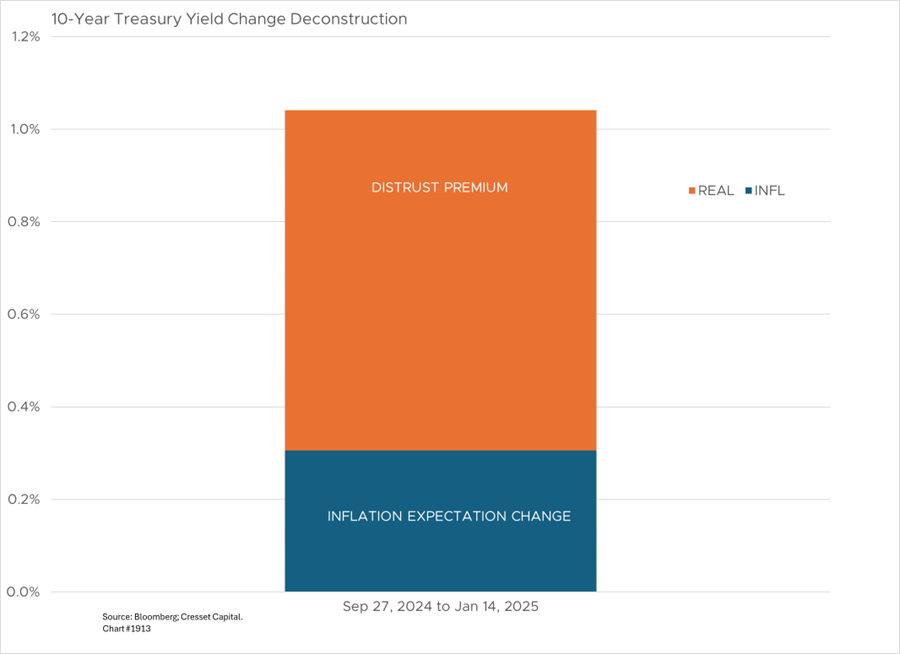

Breaking down the recent Treasury yield rally, nearly one-third of the yield change was the result of higher inflation expectations and more than two-thirds from an increase in the “distrust premium.” A similar pattern is playing out in other markets.

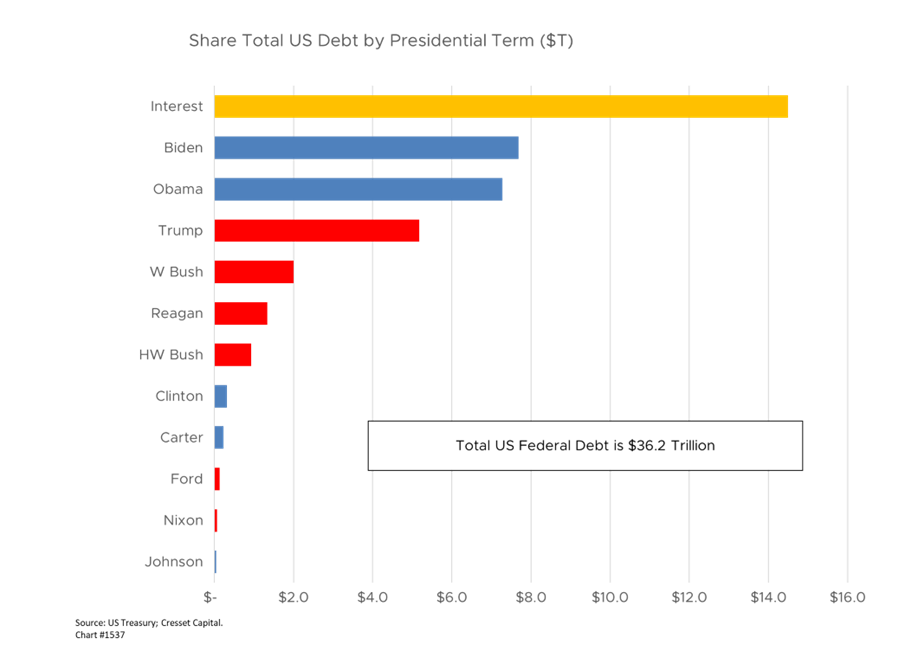

Bondholder Anxiety About Debt Impact of Potential Trump Administration Policies

Bond investors are rightfully concerned about political developments and their impact on government debt and deficits. Policies that might be enacted by the incoming US administration are making bondholders anxious. Many are wringing their hands over the potential 60 per cent tariffs on Chinese goods. Meanwhile, policy projections suggest that Treasury Secretary-nominee Scott Bessent could add $7.75 trillion to the deficit, concerning bond markets already wary of US debt levels.

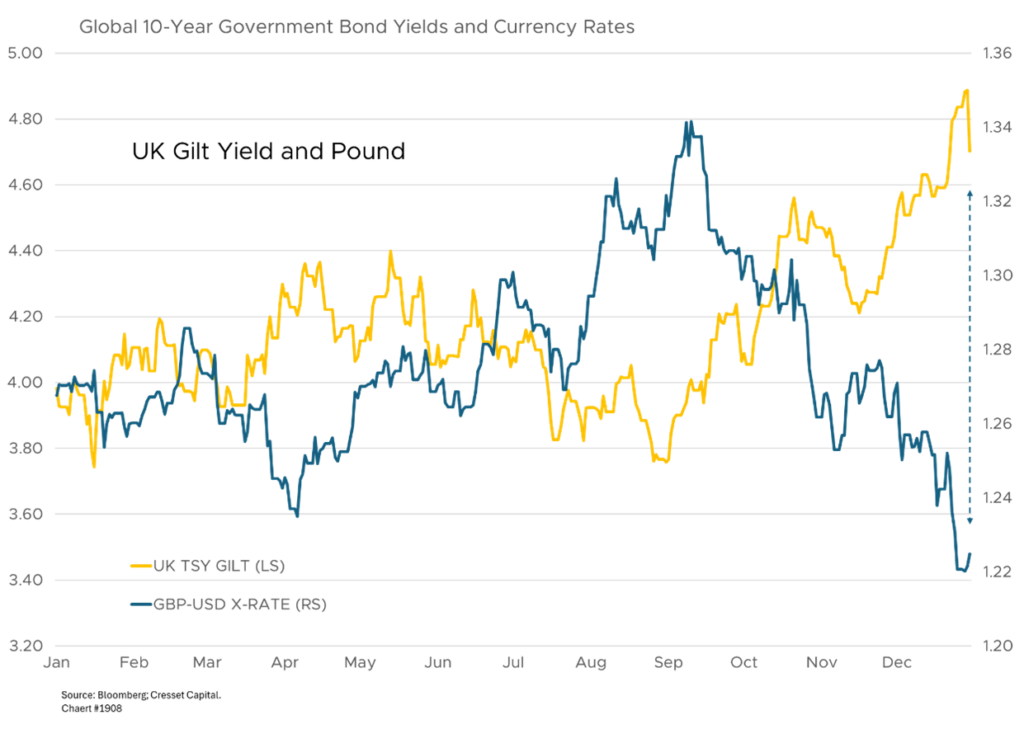

Ambitious Labour Spending Plans Upsetting UK Gilt Market

Meanwhile, the UK’s Labour government under Chancellor Rachel Reeves faces intense market scrutiny over ambitious spending plans, with rising bond yields reflecting investor concerns. The situation echoes the 2022 Liz Truss crisis, pressuring fiscal policy choices. UK gilt yields are rising while the pound is falling, leaving little flexibility for the Bank of England to spur growth with lower overnight rates.

China Facing Multiple Economic Crises

Despite Xi Jinping’s efforts to boost spending through 15 per cent subsidies on electronics and appliances, households continue to hoard savings due to inadequate social safety nets. Consumer prices barely rose 0.1 per cent in December, while factory prices fell 2.3 per cent – the 27th consecutive month of decline – signaling entrenched deflation. Youth unemployment remains stubbornly above 17 per cent, contributing to a broader consumer confidence crisis. The property sector remains troubled, and manufacturing workers are increasingly protesting over economic conditions. Meanwhile, the pension system faces mounting pressure as young workers stop contributing, creating a demographic challenge similar to that experienced by Japan. Bond investors accuse President Xi of patching the economy’s symptoms, not addressing their root causes. Yields and the yuan are both declining.

Bottom Line:

Bond investors are waking up and putting governments on notice that they will no longer tolerate profligate spending policies. Reverberations are being felt in countries like the UK. For now, the US has a pass, since the dollar is a fiat currency. Nonetheless, investors must plan on persistently higher real rates.