Key Observations:

- Economic impact will be national, but damage will be minor

- Wildfire losses will drive core inflation at the margin

- California payrolls will affect national employment data

- LA real estate market can influence national trends and confidence

- Insurance rates likely to be pushed higher nationwide

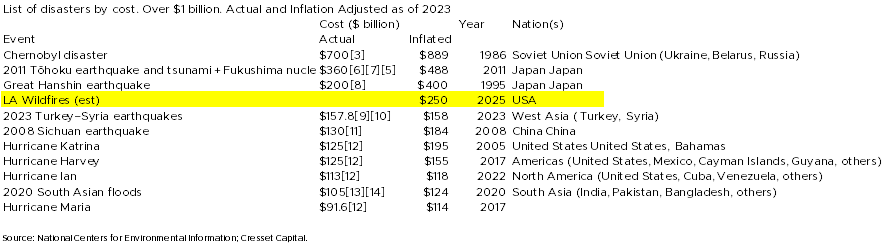

The tragic Los Angeles wildfires are not over, and they will continue to reverberate around our national economy for months to come. The financial impact of the wildfires is estimated to be at least $200 billion, with some estimates placing total damage as high as $275 billion, making it the costliest US natural disaster in history, even when adjusted for inflation. Meanwhile, with insured losses estimated at $50 billion, out-of-pocket losses are likely double that amount. Over 12,000 structures were destroyed across Los Angeles County and at least 25 people were killed. Thousands of residents have been displaced and are seeking temporary housing. What local and ripple effects will the LA wildfires cause for inflation, real estate, employment, and insurance?

Economic Impact Will Be National, but Damage Will Be Minor

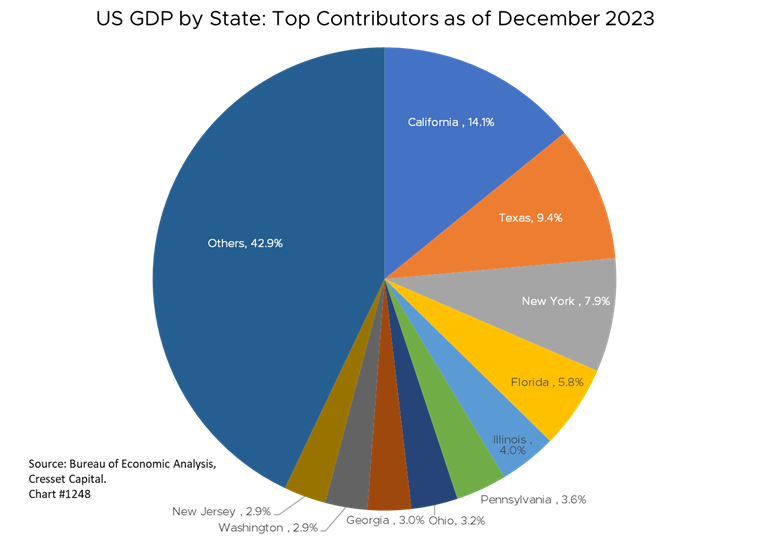

California accounted for more than 14 per cent of US GDP as of 2023 and LA County comprises about a quarter of the state’s economic activity, equivalent to a little more than three per cent of the national economy. Economists estimate lost economic activity between $2-3 billion, reducing Q1 2025 GDP between 0.1-0.3 percentage points. While in the longer term a major rebuilding effort will spur demand for building supplies and construction workers, reduced output and consumption will be felt immediately – for example, relocating an NFL playoff game from Los Angeles to Scottsdale. With personal losses exceeding $50 billion, the wealth effect will likely curtail discretionary spending in other areas, like travel.

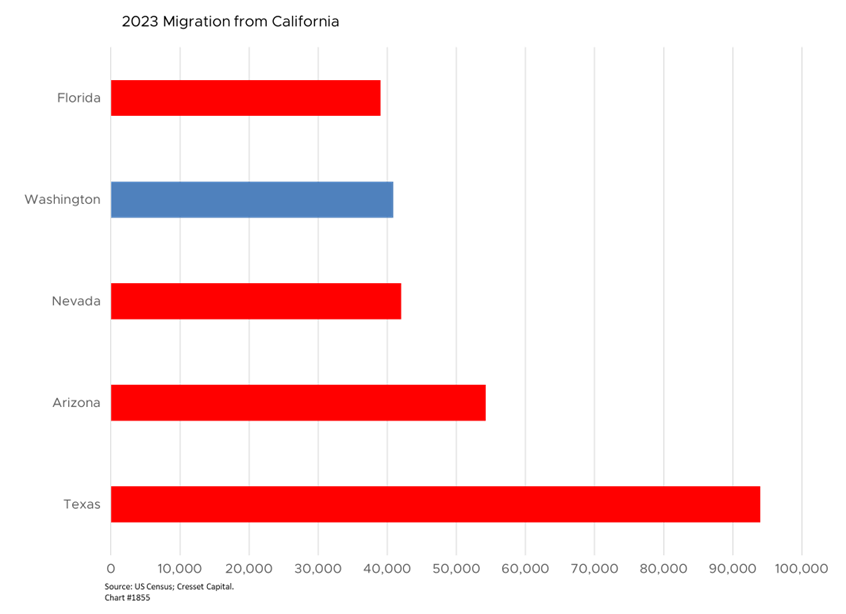

California Payrolls Will Affect National Employment Data

California created about 10,000 net new jobs each month for the last three months through November. Economists expect California payrolls to drop by 20,000-40,000 in January. That is expected to reduce national employment by between 14,000-27,000 positions. The greatest impact will likely be seen in fewer hours worked rather than outright job losses. State migration will likely accelerate as California workers move to other states. Nearly 350,000 Californians relocated to other states in 2023, with nearly one third of those moving to Texas.

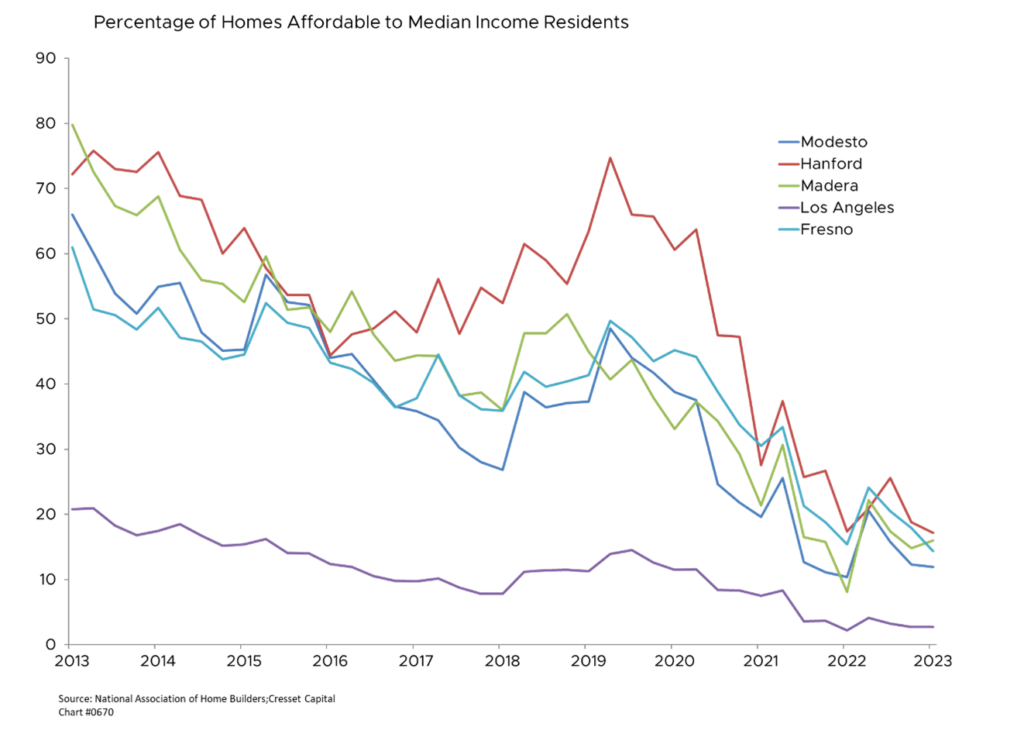

LA Real Estate Market Can Influence National Trends and Confidence

Destabilization of property values in one of America’s largest real estate markets created by an acute shortage of housing has raised demand for available rentals, causing rents to spiral. The region is important enough to influence national housing market trends and impair confidence. At the same time, the scarcity of insurance is creating problems for lenders who require liability coverage to guarantee their loans can be repaid in the event of a fire or other natural disaster. The impact of wildfires comes at a time when housing affordability is near an all-time low in the area. As of 2023, only 2.3 per cent of the local population could afford a median-priced home in Los Angeles.

Wildfire Losses Will Drive Core Inflation at the Margin

Local prices will be pushed higher in the short term by the losses of housing, labor, and vehicles. While the number of vehicles destroyed in the LA wildfires is not yet known, about 7.8 million vehicles were registered in LA County as of 2023, according to California DMV. Even if only five per cent of them were lost, that means that nearly 400,000 vehicles could have been destroyed in the fires – equivalent to about three per cent of the number of new cars sold in a year in the US. We therefore expect higher vehicle prices to be one of the primary drivers of inflation pressure in the near term. Regional rent increases will lag between six and nine months thanks to lease terms. Material costs will increase in the coming quarters as rebuilding efforts get underway. Economists estimate about a 0.1% increase in core inflation because of wildfires.

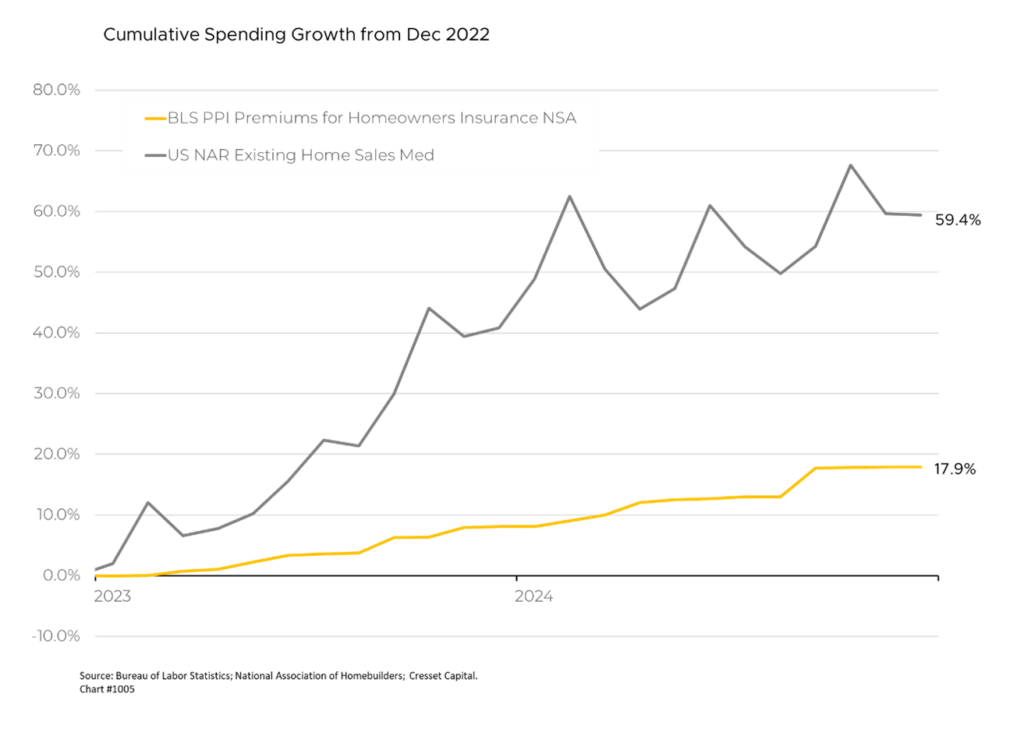

Wildfires Like to Push Insurance Rates Higher Nationwide

While $30 billion in insured losses represents a sizable hit to the insurance sector, it didn’t move the needle much – as exemplified by catastrophe bond trading. These bonds are issued by insurance companies to hedge their property and casualty exposure and bondholders receive a generous coupon as long as nothing happens. A sizable series of catastrophes could force issuers to default on the bonds. However, the Swiss Re Catastrophe Bond Index is only off fractionally from the beginning of the year. Part of the reason, we suspect, is that investors expect insurance companies to raise premiums. Not just in Southern California, but across the board as companies spread risk nationwide. Spending on homeowners’ insurance rose over nine per cent last year and nearly 18 per cent over the last two years, according to Bureau of Labor Statistics data. It should be noted that the median home price rose nearly 60 per cent in the interim. We expect the wildfire experience will further restrict coverage in high-risk areas across the country and cause a ripple effect through reinsurance markets.

Bottom Line:

While the fires will have significant local economic impacts, the national economic effects will be noticeable but relatively contained, with the main concerns being temporary inflation pressure and employment disruption. Nonetheless, Los Angeles County, representing 25 per cent of California’s economy, could see economic activity cut in half in the near term. It will take years and hundreds of billions of dollars to rebuild that community.