Key Observations:

- Fundamentals have favored US stocks over the past decade

- International markets cheap compared to US, but for good reasons

- Political and economic uncertainties in Germany and France

- Demographics and deleveraging will suppress Chinese consumer demand for years to come

- Japan shows some promising signs of reform; yen is remarkably cheap

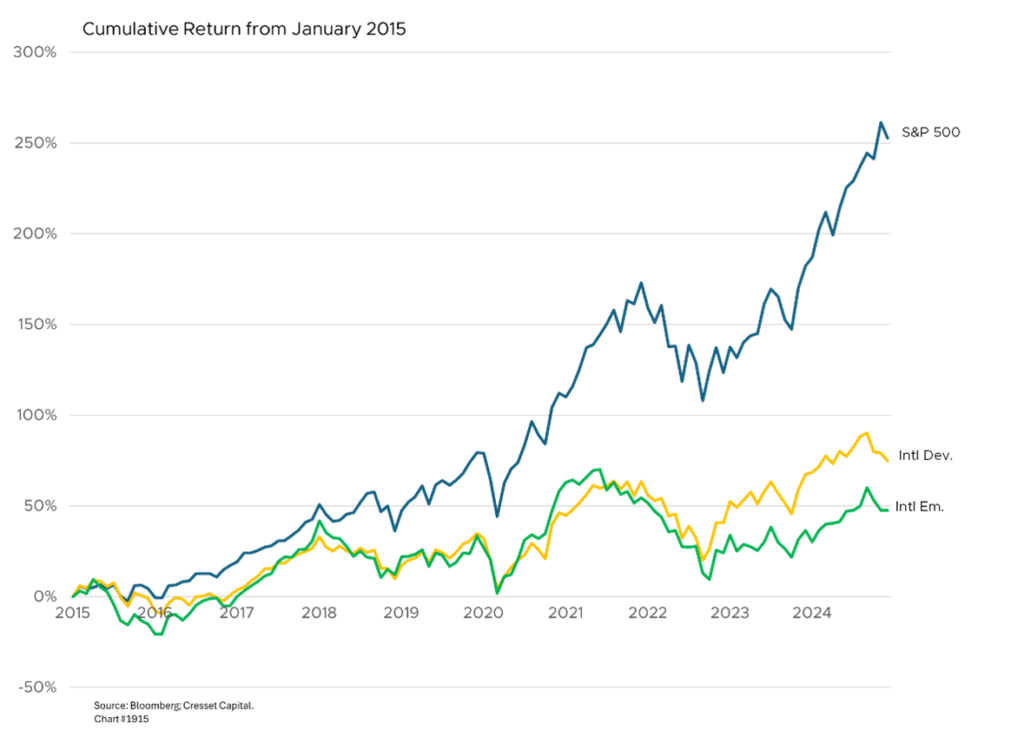

The S&P 500 Index, led by mega-cap technology companies, has delivered an impressive 14+ per cent annualized return over the last five years and more than 13 per cent annualized over the last decade. This puts the US well ahead of foreign markets, both developed and emerging. Over the last five years international developed markets, including Europe, Japan and the UK, gained six per cent, while emerging markets, including China and India, managed 1.7 per cent. This comparatively weak performance has investors scratching their heads and wondering if owning international equities is worth it. Here, we explain the downside.

Fundamentals Have Favored US Stocks Over the Last Decade

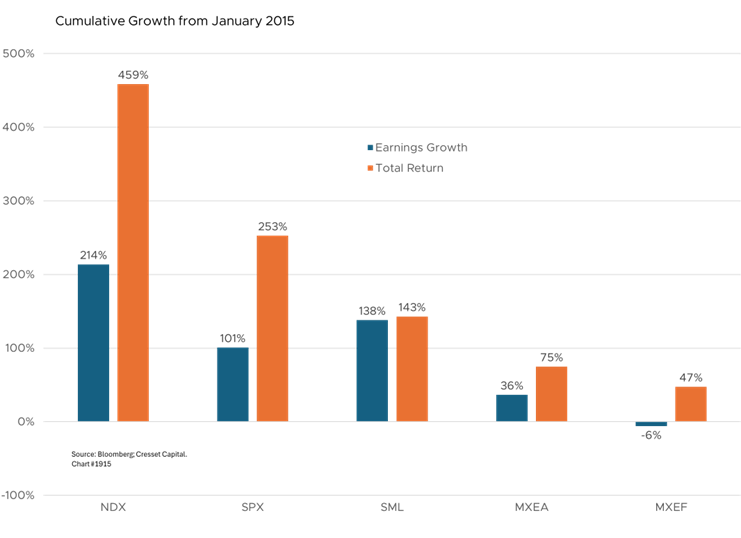

The US economy helped propel domestic earnings growth to the top of the global league tables. Part of America’s success is its laissez-faire approach to economic policy, which allows the country’s most successful and profitable companies to grow – particularly scalable businesses like tech. The Magnificent Seven’s market cap of nearly $16 trillion ranks above all developed markets. Since 2015, S&P 500 earnings have doubled, helped by tech profit expansion. At the same time, developed-market earnings grew by 36 per cent and emerging market earnings contracted. Even though earnings growth among US small caps eclipsed US large cap profits, higher financing costs after the Fed rate hikes have benefitted larger stocks with lighter debt loads.

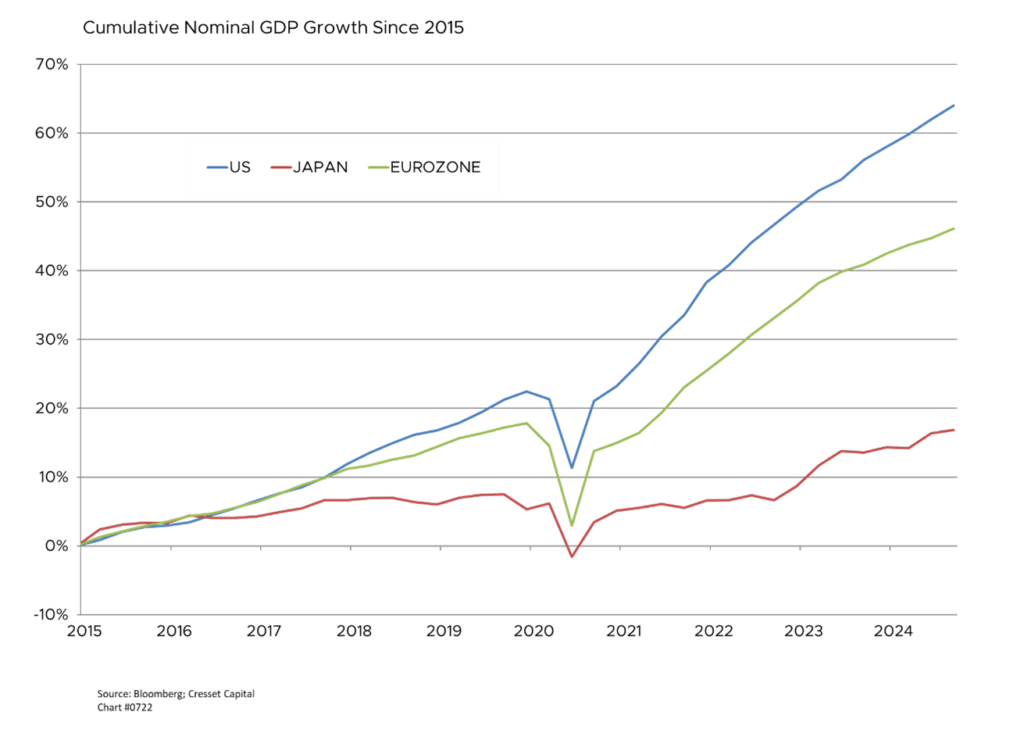

The US economy expanded by 60 per cent over the last 10 years, outpacing Eurozone expansion of 46 per cent and running circles around Japan, which has expanded 17 per cent from 2014 through Q3 2024. While US and Europe grew in tandem for the first three years, the pandemic took a larger toll on Europe and Japan while pandemic stimulus measures, amounting to more than $7 trillion in the US, helped America rebound more quickly.

International Markets Cheap Compared to the US, but Face Structural Issues

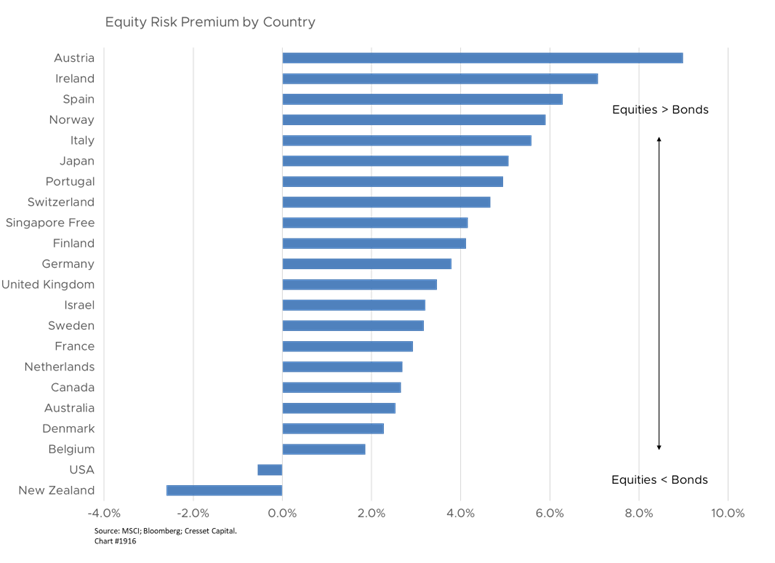

While fundamental divergences explain return dispersion over the last decade, looking forward, international markets remain relatively cheap to earnings growth expectations when gauged against the US. The US equity risk premium – the S&P 500’s forward earnings yield relative to the US 10-year Treasury yield – is negative, leaving it among the most expensive markets internationally. US markets are trading more than 20x next year’s earnings, while foreign markets are trading below 15x theirs, begging the question: Are foreign markets cheaper for a reason?

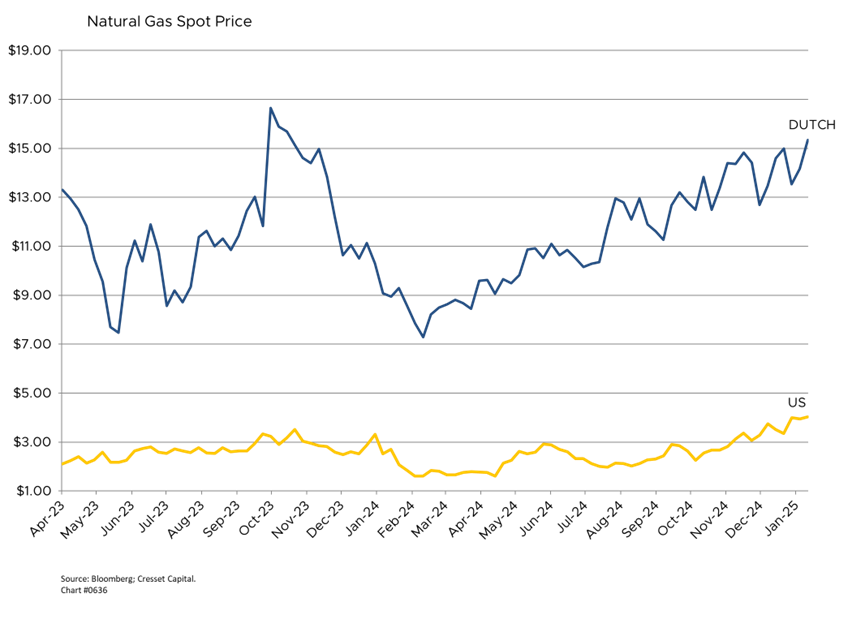

Energy Cost Disadvantages Hurting Europe

European and Japanese markets are relatively cheaper, but they are facing structural challenges. For example, Germany optimized its export economy while fueled by cheap Russian gas, but that strategy has been turned upside down. China, meanwhile, is grappling with structural overinvestment in real estate and infrastructure. European energy costs remain significantly higher than US levels. Natural gas in Amsterdam trades at over $15/MMBtu, more than three times the price of natural gas in New York. Persistent energy cost disadvantages affect long-run corporate profitability and competitiveness.

Political and Economic Uncertainties in Germany and France

The German economy has suffered two straight years of contraction, and its government recently cut its growth forecast from 1.1 per cent to 0.3 per cent for 2025. Meanwhile, the country also faces political instability. Chancellor Olaf Scholz will likely be ousted, as the far-right AfD party gains support. Friedrich Merz, the likely next Chancellor, has promised lower taxes and a return to a growth path. France is also struggling with anemic growth and political uncertainties, but it doesn’t have a growth plan. Instead, the current government led by Prime Minister Francois Bayrou is targeting spending cuts and tax increases.

China Burdened by Demographics and Deleveraging

Overall, the Euro area is expected to have expanded by just 0.8 per cent last year and zero per cent in 2025, significantly below US growth rates. Former ECB President Mario Draghi identified three key issues holding Europe back: reliance on cheap Russian energy, which has backfired since the invasion of Ukraine; dependence on US-provided security, but President Trump has made it clear to NATO partners they will need to shoulder more of the defense burden; and overreliance on faltering Chinese consumer demand. Beijing’s effort to promote a Chinese middle class led to overbuilding on top of an overhang of debt. China will eventually work themselves out of that bind, but aging demographics and deleveraging will weigh on Chinese demand for years to come.

Bottom Line:

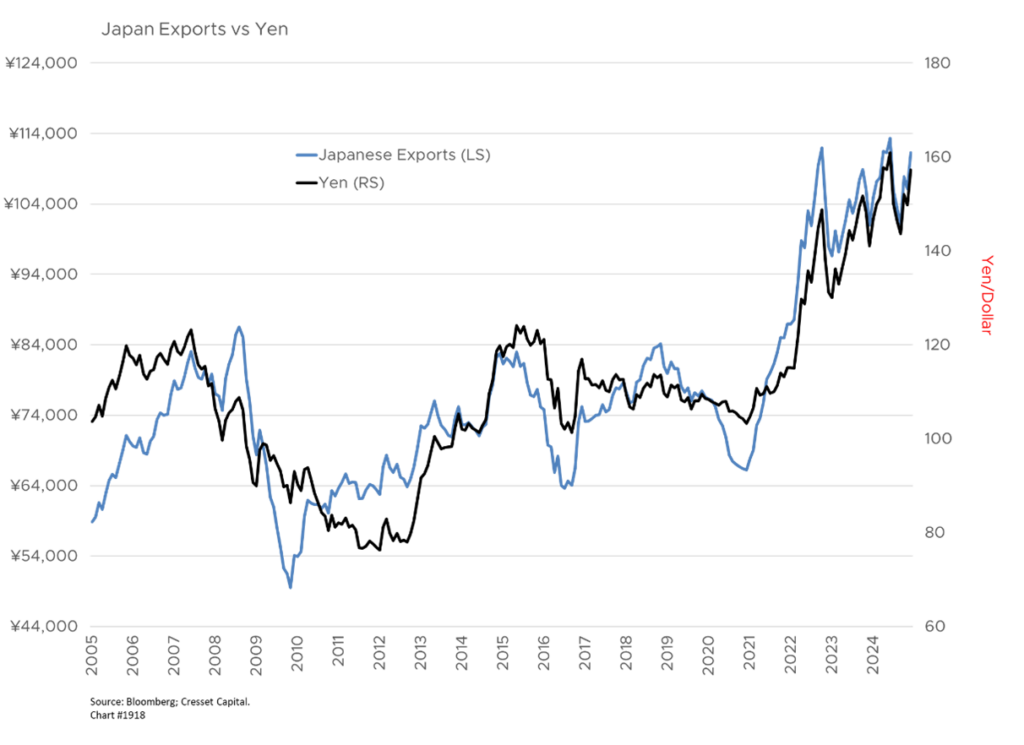

While cheaper valuations appear attractive to contrarian investors, several markets are cheap for good reasons. European countries are fundamentally fraught, and restructuring will not be achieved quickly or easily. Political instability remains a risk overhanging France and Germany as growth stagnates. Japan, however, shows some more promising signs of reform, like delisting underperforming companies, but still faces structural challenges like aging demographics. The Bank of Japan is expected to initiate a series of rate hikes. Market reforms are still in their early stages and represent a gradual shift in policy, rather than a dramatic overhaul of Japan’s economic system. In the meantime, the yen is remarkably cheap, helping Japanese exporters stay competitive.