Key Observations:

- Best two-year run for S&P since ’97-’98 internet mania

- For markets to move ahead this year, companies must deliver profits and interest rates must remain tame

- Uncertainty in 2025 over tariffs, tax cuts, immigration reform, interest rates

- Biggest risks in 2025 are valuation and concentration

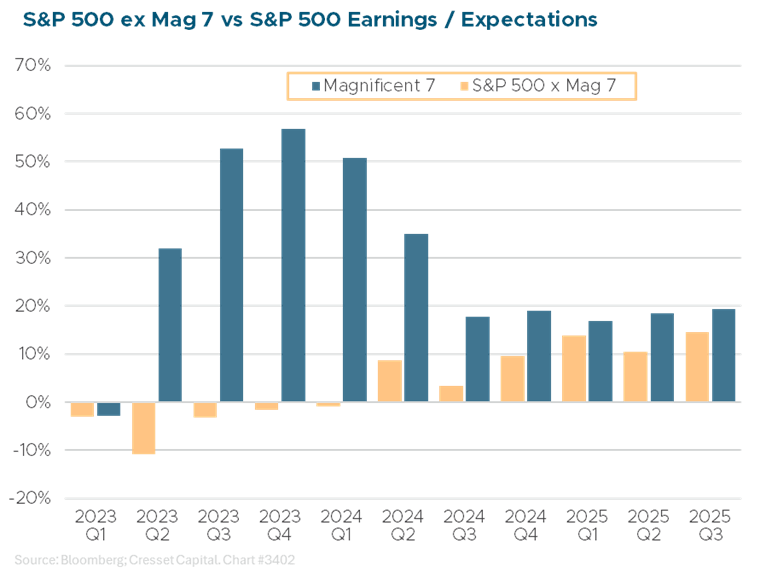

- We expect profit picture to broaden with Mag 7 and S&P 493 profit growth converging toward the low-to-mid teens

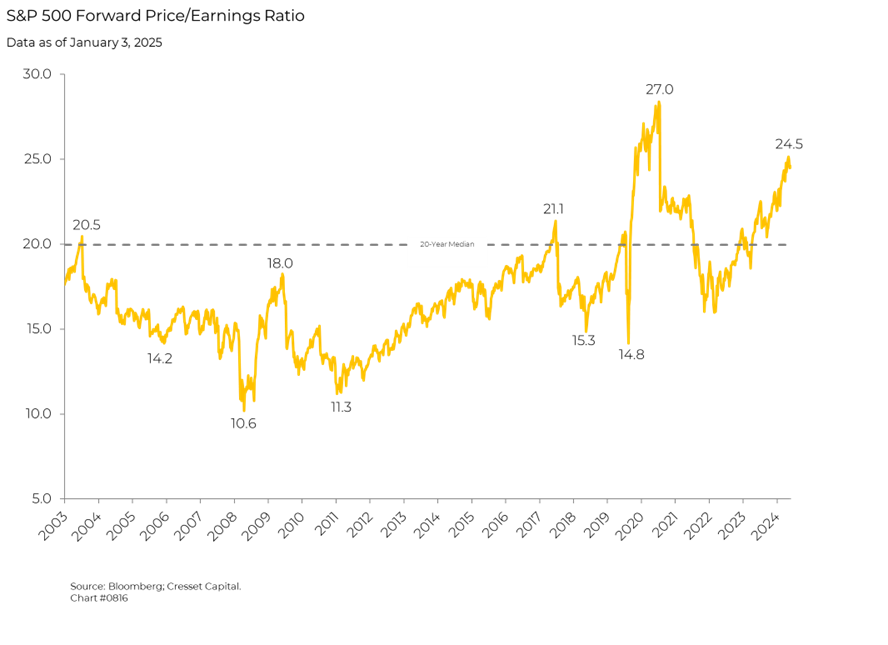

US large caps delivered an impressive 23 per cent return last year on top of a 26 per cent gain in 2023, capping the best run of two consecutive years since the internet enthusiasm of 1997-1998 enveloped investors. The Magnificent Seven mega-cap technology shares surged 67 per cent, accounting for more than half of the S&P 500’s advance. Investment gains outpaced earnings growth by a factor of two-to-one last year, leaving valuations stretched. At 25x next year’s earnings expectations, the market’s current forward PE ratio has reached its highest level since February 2021. Where will 2025 take us?

2024 Review

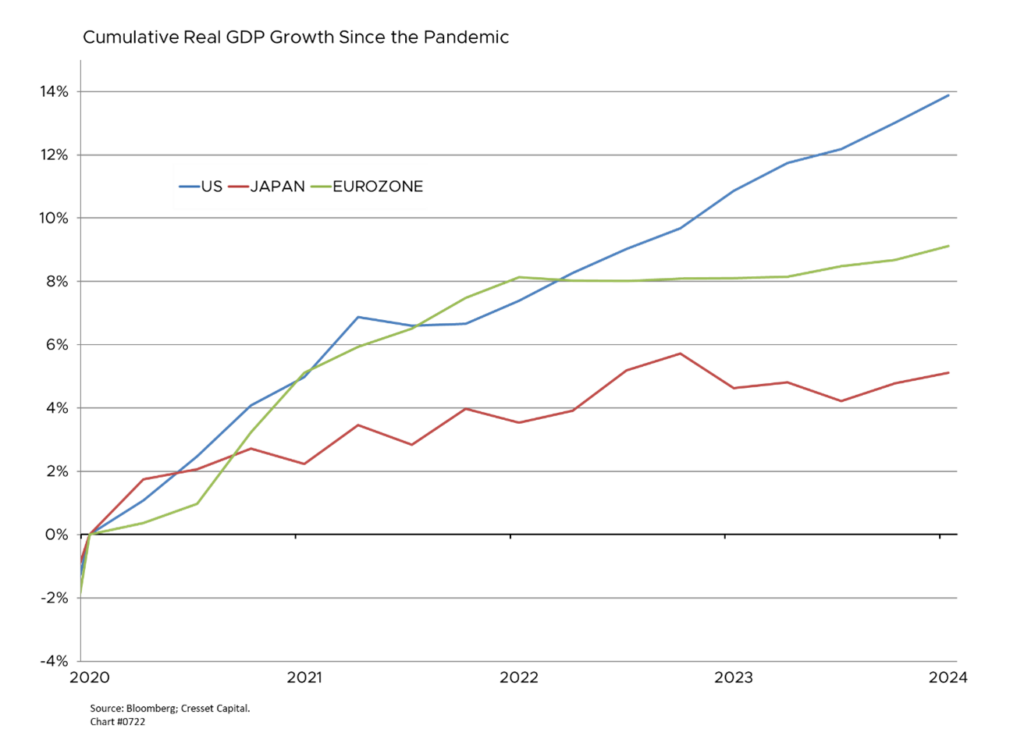

US economic growth was resilient despite high interest rates. But inflation remained stubbornly and significantly higher than the Fed’s stated two per cent target, prompting the Fed to cut rates three times – fewer than half the cuts investors expected at the outset of the year. The US economy did outpace its global peers, with the unemployment rate rising fractionally to 4.2 per cent, and core inflation ticking down to 3.3 per cent year-over-year from 3.9 per cent in January.

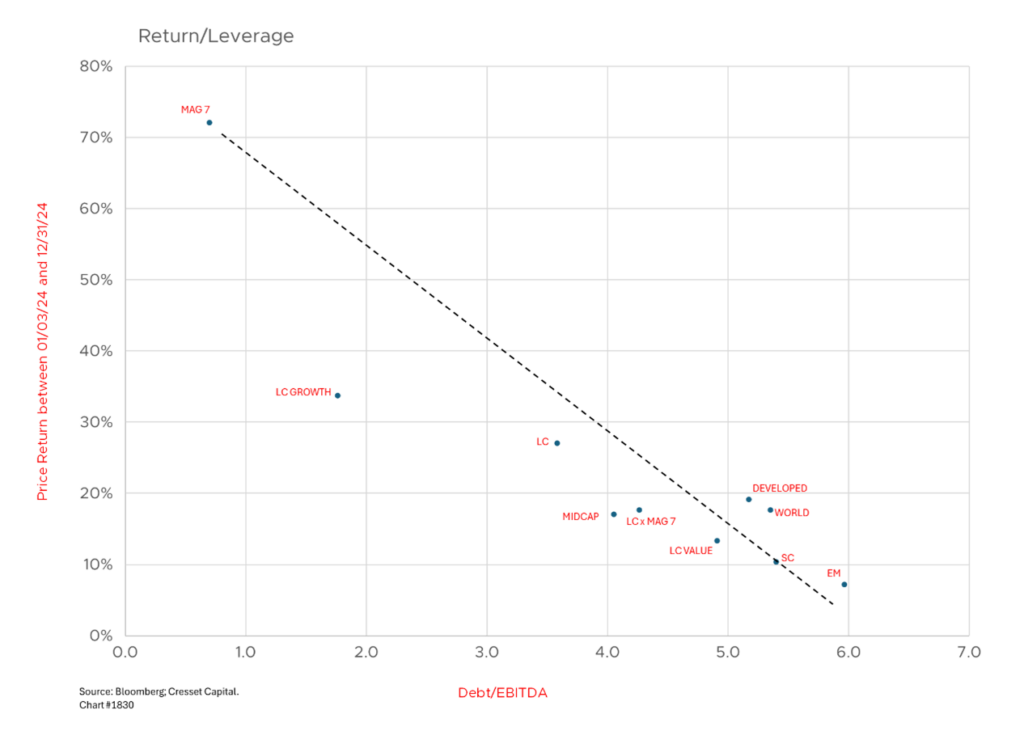

Investors Favored Markets and Sectors with Lower Leverage

Higher-than-expected interest rates prompted investors to favor lower-leveraged markets and sectors last year. Debt-to-EBITDA was one of the most powerful factors influencing major market returns last year. At 0.75 per cent, the Magnificent Seven generates enough cash flow in three quarters to pay off all their debt.

Strongest Year Ever for Investment Flows

US-based exchange-traded funds enjoying record inflows of $1 trillion. Total US ETF assets reached $10.6 trillion, up 30 per cent from the start of 2024, according to The Wall Street Journal. While much of inflow was fueled by American exceptionalism and AI optimism, active mutual funds suffered $450 billion in outflows as investors shifted to passive strategies.

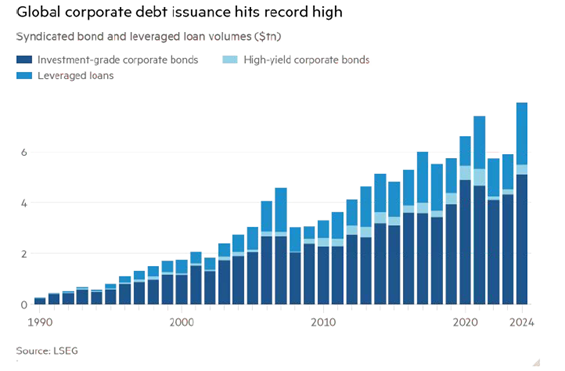

Higher-for-Longer Interest Rate Policy Helped Bond Issuers Raise Record Capital

Global corporate debt sales reached a record $8 trillion in 2024. Volume climbed by more than a third from 2023 levels, surpassing the previous peak set in 2021. Companies benefited from strong investor demand as spreads – the yield premium investors required relative to government debt – fell to its lowest level in decades. Bond investors appear to be more interested in nominal yield than the incremental yield advantage over Treasury securities. At 2.9 per cent over comparable maturity Treasurys, high yield bond spreads are at their lowest level since 2007. The investment-grade bond spread, at 0.8 per cent, is at its lowest level since 1998.

Outlook for 2025: Uncertainty Over Tariffs, Tax Cuts, Immigration Reform, Interest Rates

Uncertainty is swirling as we look out over the coming year. Rarely does the market deliver superlative results after two consecutive years of 20-plus per cent gains. Going back to 1980, the market delivered 20-plus per cent returns for two consecutive years only five times. The best subsequent year was 1997, delivering a 33.3 per cent increase on the back of gains of 22.9 per cent and 37.6 per cent in 1996 and 1995, respectively. The worst subsequent year was 2000, handing investors a 9.1 per cent loss after 21 per cent and 28.6 per cent gains in 1999 and 1998, respectively.

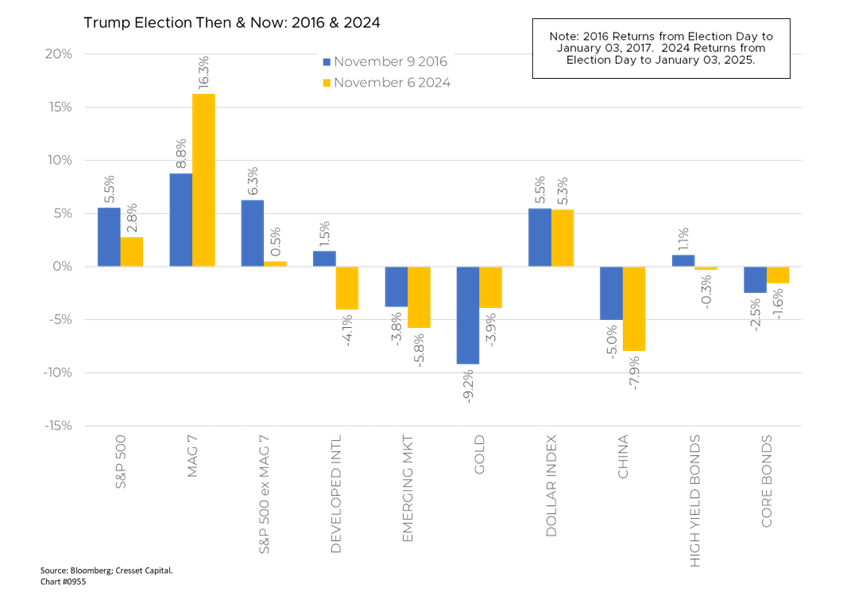

With the Trump administration set to take office on January 20, analysts and investors are weighing the impact of possible new policies. The potential for tariffs on imports as high as 60 per cent, sweeping immigration reform, tax cuts, and deregulation are shaping current investment trends. Markets are responding very similarly to the period after the 2016 election, when Trump won the first time. Between election day and the first week of the new year, US large caps are higher, led by mega-cap technology shares, while international equities, particularly emerging markets, trail. The dollar, helped by higher interest rates, charted a nearly identical path between election day and the first week of January. If past is prologue, we expect Trump’s potential policy moves to dominate investor attention through Inauguration Day, after which their focus will shift to Fed policy, fundamentals and earnings.

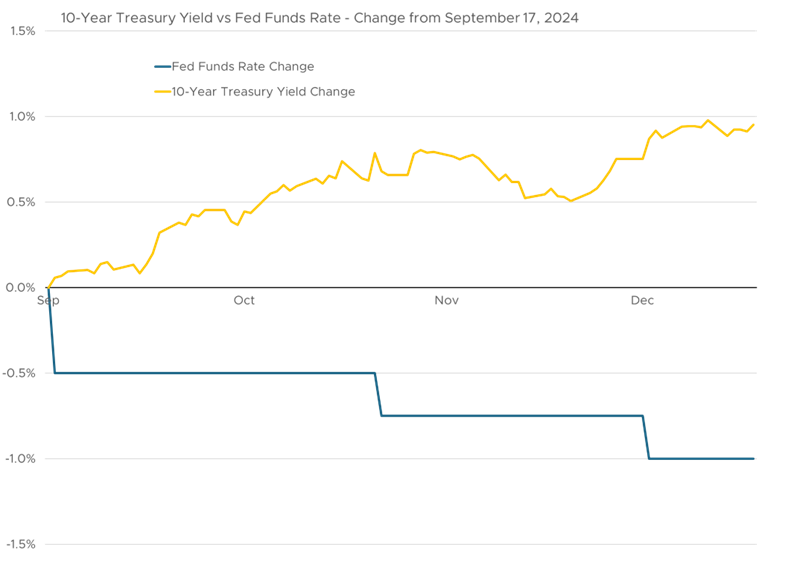

Investors Now Expect Fewer than Two Rate Cuts this Year

Federal Reserve policymakers are reluctant to ease rates with inflation running higher than their target and the prospect of fiscal policy measures promoting growth and the possibility of higher import prices. Investors now anticipate fewer rates cuts this year, now expecting fewer than two. Interest rates will likely remain higher than originally expected. Since the first rate cut in September, the 10-year Treasury yield is one percentage point higher while the overnight rate is one percentage point lower.

After Two Spectacular Years the S&P 500 Appears to Be Priced for Perfection

For markets to move ahead this year, companies must deliver profits and interest rates must remain tame. Analysts are now penciling in 12.2 per cent 2025 earnings growth, down from the 14 per cent they were forecasting a few weeks ago but still robust. We also expect the profit picture to broaden with Magnificent Seven and S&P 493 profit growth converging toward the low-to-mid teens this year. That could set the stage for a greater share of the market participating this year, particularly if financing costs ease. Of course, high expectations carry the risk of disappointment, should profits fail to keep up with expectations or interest rates move higher.

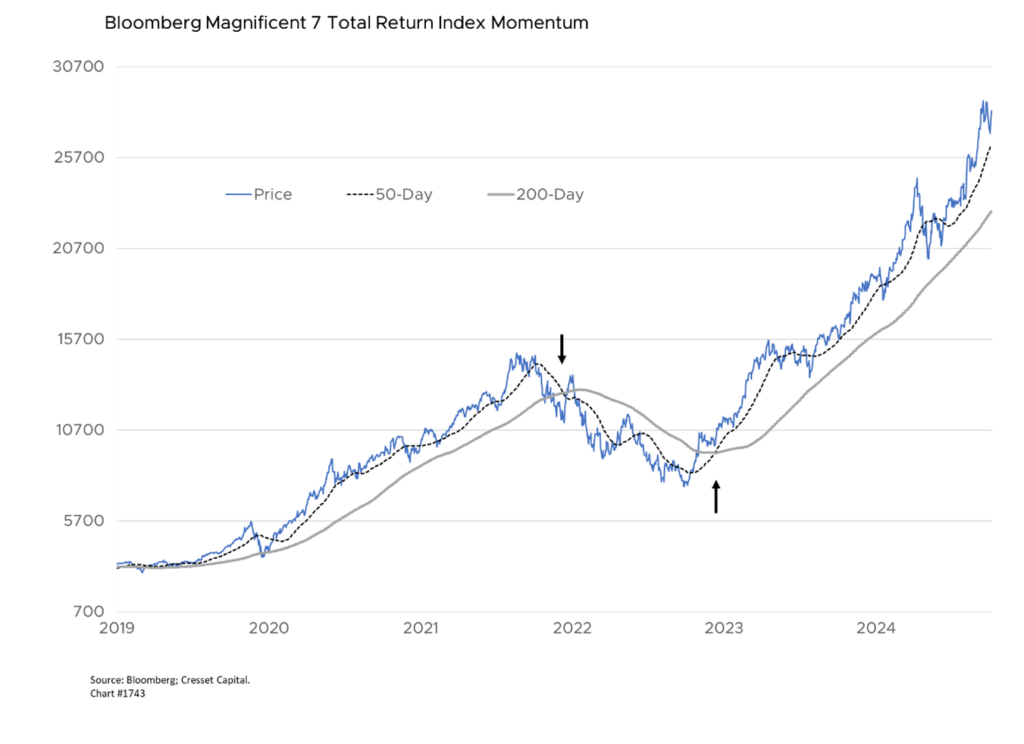

Will Valuation or Momentum Pave the Way in 2025?

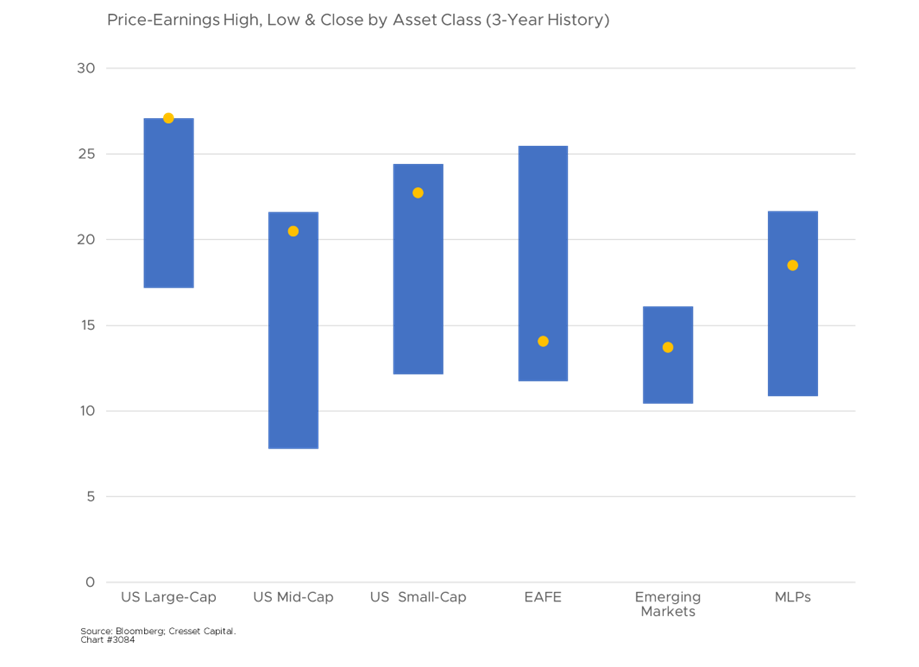

One of the biggest questions facing investors: which will pave the way in 2025, valuation or momentum? Will mega-cap tech stocks continue to lead the market higher, or will markets broaden to include cheaper asset classes? Mega-cap technology shares have been on a tear, and even though the group is expensive, momentum is strong. This year investors will likely focus on how much these companies are spending in their race for AI dominance. Big tech has spent $62 billion on AI in recent years, according to Bloomberg. Investors want to ensure that today’s spending will translate into tomorrow’s profits. Relatively high interest rates tend to favor the mega caps, which carry little debt and generate a cavalcade of cash.

Small caps offer a relatively cheaper alternative to the AI players but will require borrowing costs to ease this year. That means interest rates, either overnight or intermediate term, must come down for small caps to take the lead, since credit premiums are already at multi-year lows. Moreover, US small caps are not as exposed to global trade risks as their mega cap counterparts. While international markets are cheapest, their fundamentals currently pale relative to the US.

2025 Risks: Valuation and Concentration

Notwithstanding a solid economy coupled with strong equity market performance, several risks could weigh on markets this year. First, as we’ve discussed, is valuation. Given current market multiples, everything must go right for markets to gain significant value. US large caps are as much as 20 per cent overvalued relative to bonds. Another risk is the possibility of resurgent inflation. While higher inflation could raise revenue growth, a pricing spiral comes at the cost of higher interest rates, which would compress market multiples. Political uncertainties must also be considered. President Trump has vowed to reverse existing policies and establish his own domestic and global initiatives. While these America First policies are meant to be business friendly, they have the potential to carry political blowback. The second risk investors must consider is concentration risk. The five largest US companies represent more than a quarter of the weight of the S&P 500, its largest concentration since the tech bubble. Such concentration leaves the S&P vulnerable to stock-specific risks should Apple, NVIDIA, Microsoft, Amazon, or Meta stumble.

Bottom Line:

Fundamentally, 2025 is shaping up to be a solid year with the economy and market running well. The biggest risk the markets face is extended valuation, which means equities can ill afford to have rates rise appreciably. Meanwhile, relatively cheaper markets and sectors could advance if inflation cools and interest rates ease. We will continue to monitor interest rates and momentum for clues as we navigate the new year.