Key Observations:

- Gold and long-dated Treasurys add value amid equity market distress

- Gold’s stability a hedge against currency devaluation and event risk

- Gold is a leading indicator for inflation

- Markets not pricing in financial implications of US fiscal imbalance

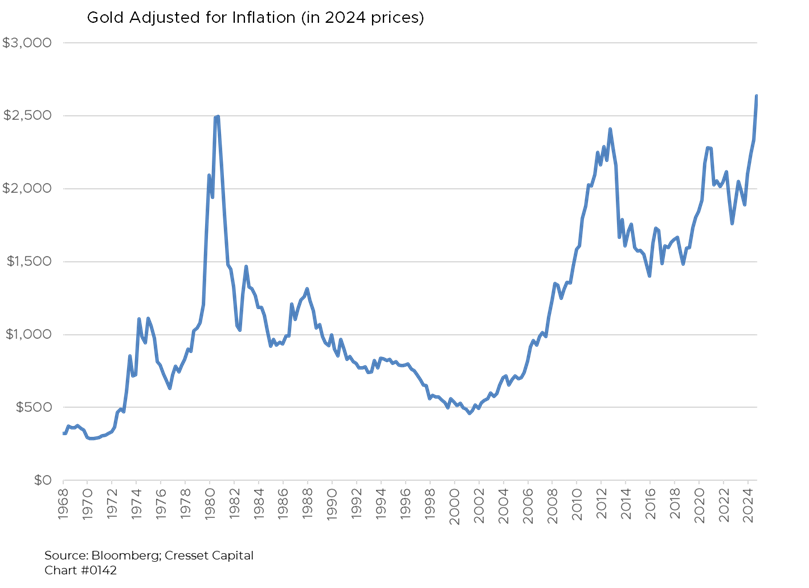

Gold has gotten a lot of attention this year, thanks in large part to its impressive performance. Year to date, the precious metal has surged more than 25 per cent. Gold is not only at its all-time high, but it’s pushing its all-time high relative to inflation. While gold’s surge in the 1980s crested at $800 at the time, that equates to about $2,500 in today’s dollars – about $100 dollars below where gold is trading today. What should investors think about gold at current levels?

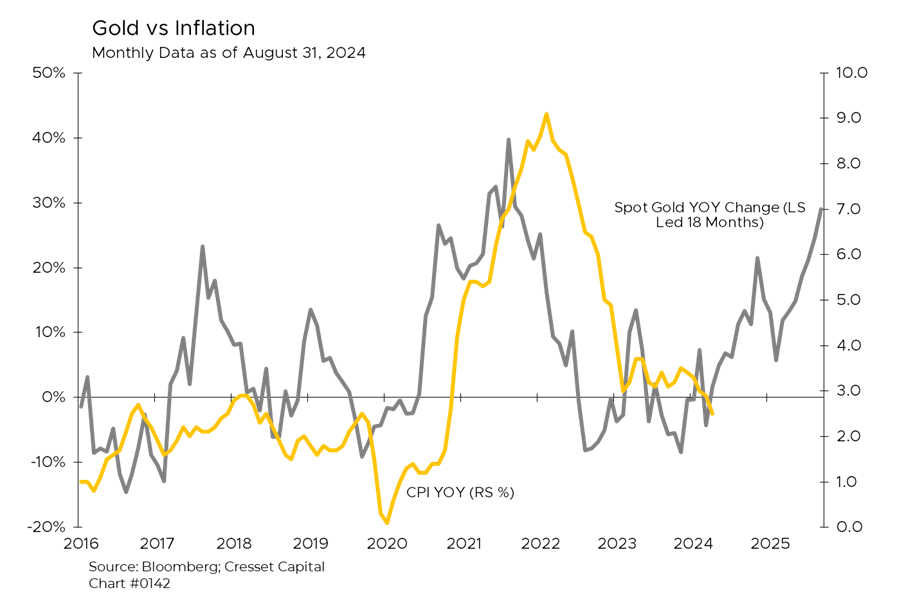

Gold is a Leading Indicator for Inflation

Gold, the coveted precious metal, has served as a useful store of value for thousands of years. Gold’s longevity and stability has enabled the scarce commodity to serve as a hedge against inflation, currency devaluation and event risks. As an inflation hedge, there’s an old saying that “an ounce of gold can buy a good men’s suit.” When gold was $35/ounce back in the 1920s and 1930s, that would indeed have bought a very nice men’s suit. Today, at over $2,500/ounce, gold can still buy a very nice men’s suit. Owing to its purchasing power stability, gold, in recent years, has been a useful leading indicator for inflation. Directionally, gold has tended to lead inflation by about 18 months. Gold’s rally since the beginning of the year suggests inflation could be on the rise over the next six quarters.

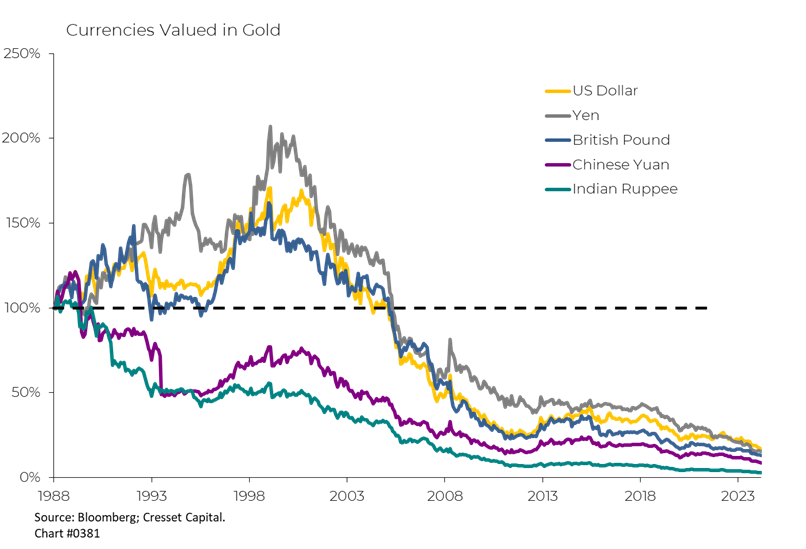

Gold’s Stability a Hedge Against Currency Devaluation and Event Risk

Gold is also a stable currency. Unlike paper currencies, sovereign governments can’t dilute its value by printing more of it. For that reason, gold is a useful hedge against currency devaluation. Since 1988 most major currencies, including the dollar, Japanese yen, British pound, Chinese yuan and Indian rupee, have lost 80-90 per cent of their value when measured against gold. Between 1990 and 2020, the US money supply (M3) grew more than six-fold from $3 trillion to $19 trillion.

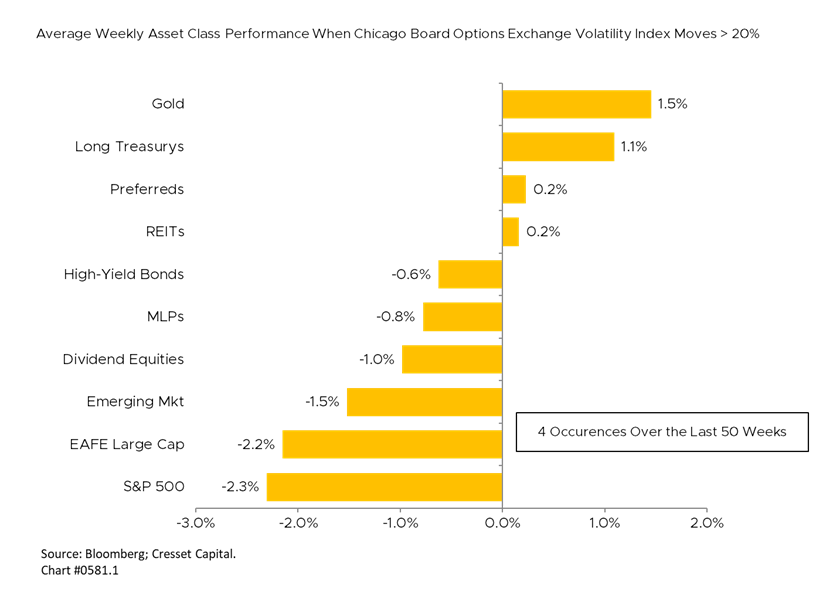

Thanks to its historical stability, gold also serves as an event risk, or black swan, hedge. Market volatility, as reflected by the VIX index, is a real-time measure of risk. Generally, the VIX spends nearly 60 per cent of its time between 10 and 19, equating to expected annualized volatility of the S&P 500. Occasionally the index spikes when investors sense danger. The VIX spiked to over 43 in 1998 during the Asian Contagion, nearly 80 in 2008 at the height of the financial crisis and 66 in 2020 at the outset of COVID pandemic. Over the last 50 weeks, the VIX index has spiked by more than 20 per cent four times. On average, gold, which rose 1.5 per cent, was the best-performing asset class, while the S&P 500 lost 2.3 per cent.

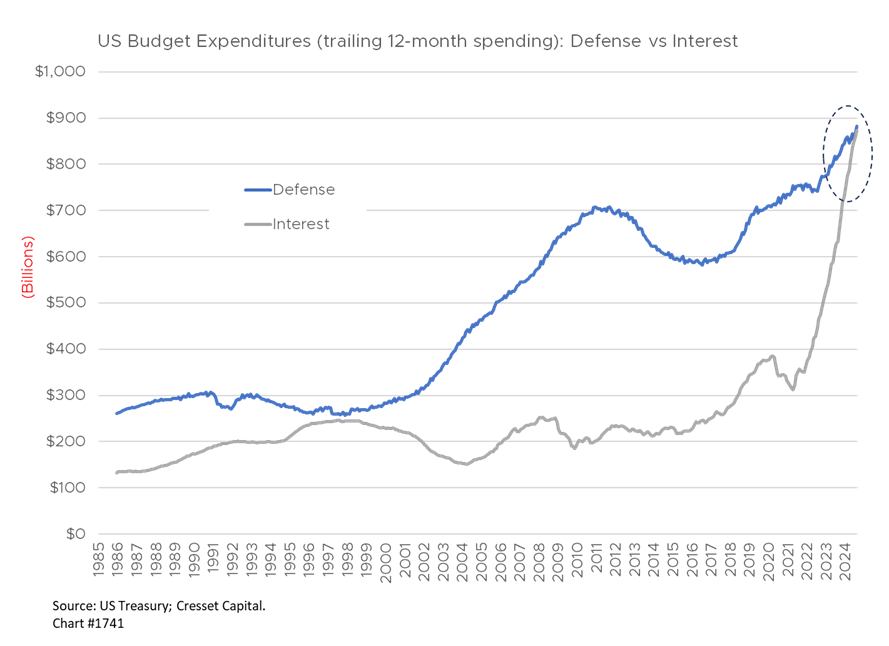

Markets not Pricing in Financial Implications of US Fiscal Imbalance

Investors worry that today’s US fiscal imbalance is a ticking timebomb that has the potential to explode into tomorrow’s black swan. The US budget deficit topped $1.8 trillion in the latest fiscal year, according to the The Wall Street Journal, and is on pace to exceed $2 trillion next year (7.2 per cent of GDP). All told, the US debt-to-GDP ratio is just over 100 per cent and will grow at a faster pace than our economy, thanks to a noxious blend of interest expense and budget deficits. While our level of debt is intangible, making it difficult to imagine a tipping point, our government’s interest expense is real and will eventually crowd out other discretionary spending. This year, US interest expenses (currently about $872 billion) will exceed defense spending ($882 billion) for the first time, a concerning milestone. Economic historian Niall Ferguson worries, “If you really want to see when an empire is getting vulnerable, the big giveaway is when the costs of serving the debt exceed the cost of the defense budget.” While it’s uncertain what the financial implications will be, it’s clear that markets are not pricing in any potential pitfalls.

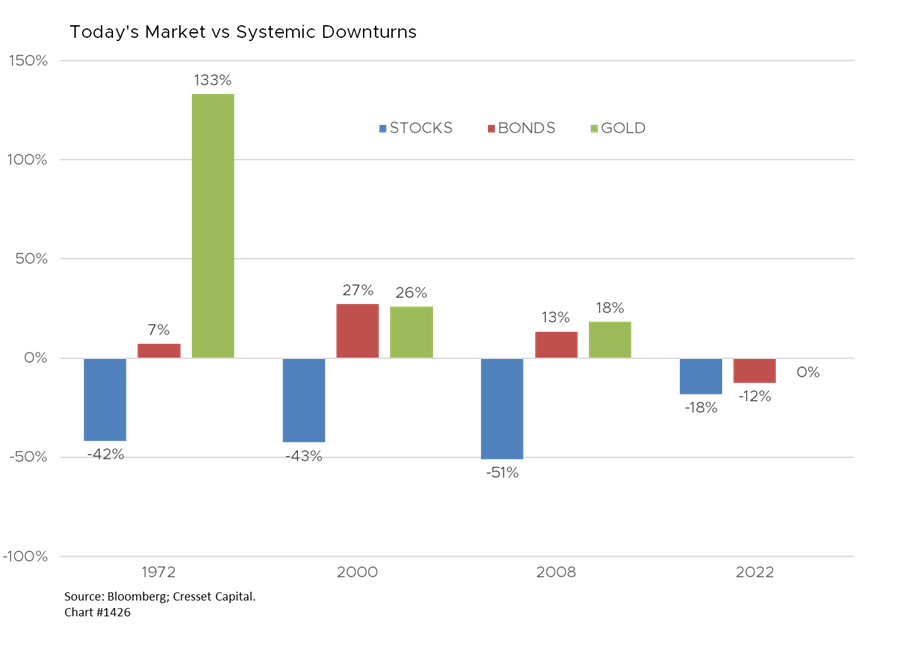

Gold and Long-Dated Treasurys Add Value Amid Equity Market Distress

Gold, and long-dated US Treasury bonds, have added value during periods of equity market distress. US stocks suffered severe downturns in 1972 (during a period of stagflation), in 2000 (the tech bust), and 2008 (the financial crisis). While 2022 was arguably one of the most orderly downturns, it was precipitated by a revaluation of the bond market in which bonds suffered their worst annual performance in history. Gold added value to the portfolio in each case and represented the best-performing asset class in three of the four market scenarios, having trailed long-Treasurys by one percentage point in 2000.

Bottom Line:

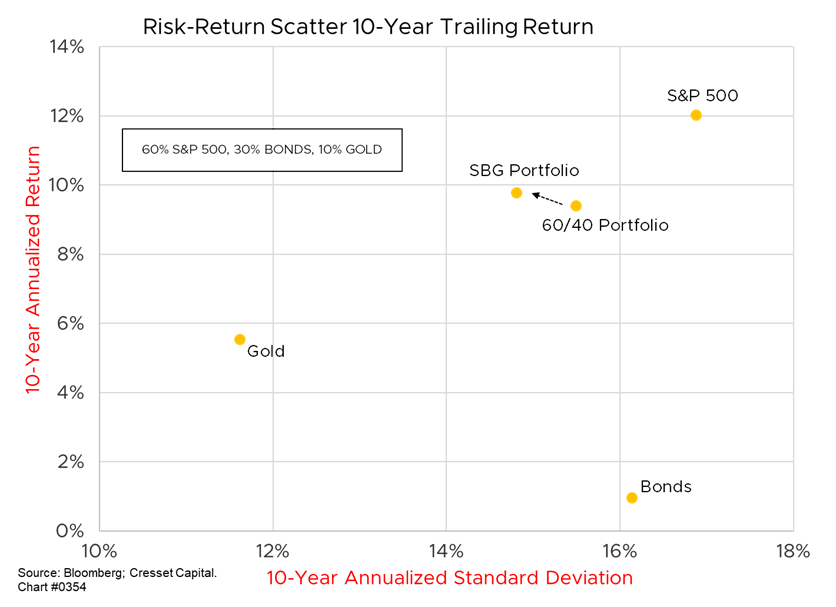

Gold, thanks to its longevity and stability, offers unique diversification benefits to investment portfolios. Of course, that benefit comes at a cost. The S&P has gained about 13.5 per cent annually over the last 10 years, while gold is up about 7.6 per cent. Long government bonds, however, were flat. Putting it together, a 60/30/10 stocks, bonds and gold portfolio not only outperformed the traditional 60/40 mix over the last decade but also achieved it with lower risk. The next 10 years, however, could look different. Interest rates have normalized, and gold is trading at an all-time high relative to inflation. Investors should think of gold, or any hedge, as an insurance policy that has either a tangible cost or an opportunity cost every year in which nothing happens. That said, gold could be a useful addition for investors who choose to expect the unexpected.