Key Observations:

- AI will drive tech profits, but at a slower pace than last year

- ‘S&P 493’ poised for double-digit gains, but not until Q1 2025

- Consumers are the key, but are showing signs of fatigue

- US election outcome could shift focus to international markets

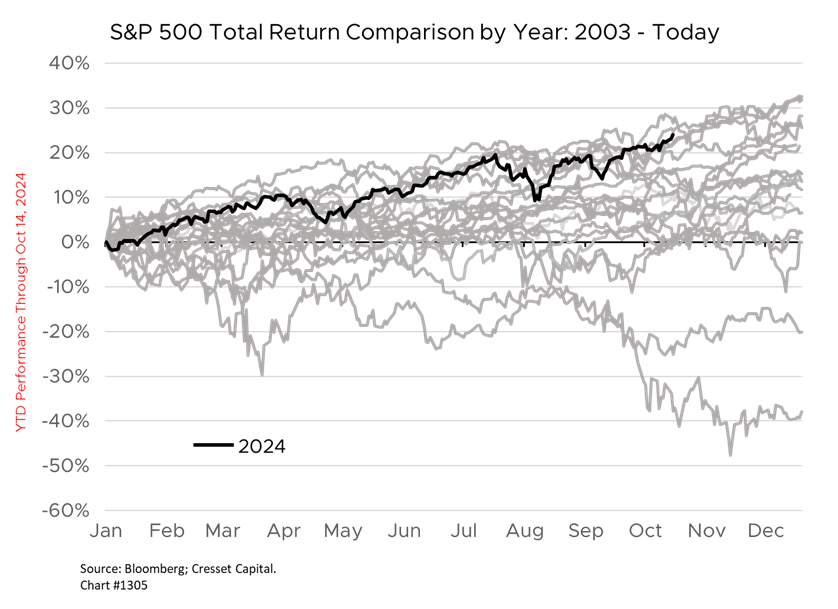

Third-quarter 2024 earnings season is about to kick into high gear. The S&P 500 is pushing new all-time highs thanks to favorable fundamentals, an easy Fed, and better-than-expected results last week from some of the big banks, including JP Morgan Chase and Wells Fargo. Analysts expect S&P 500 companies to post 4.2 per cent profit growth overall last quarter, fueled by strong results in health care and technology. With the US elections less than three weeks away, how should investors be thinking about corporate results, the markets and their portfolios?

AI Will Drive Tech Profits, but at a Slower Pace Than Last Year

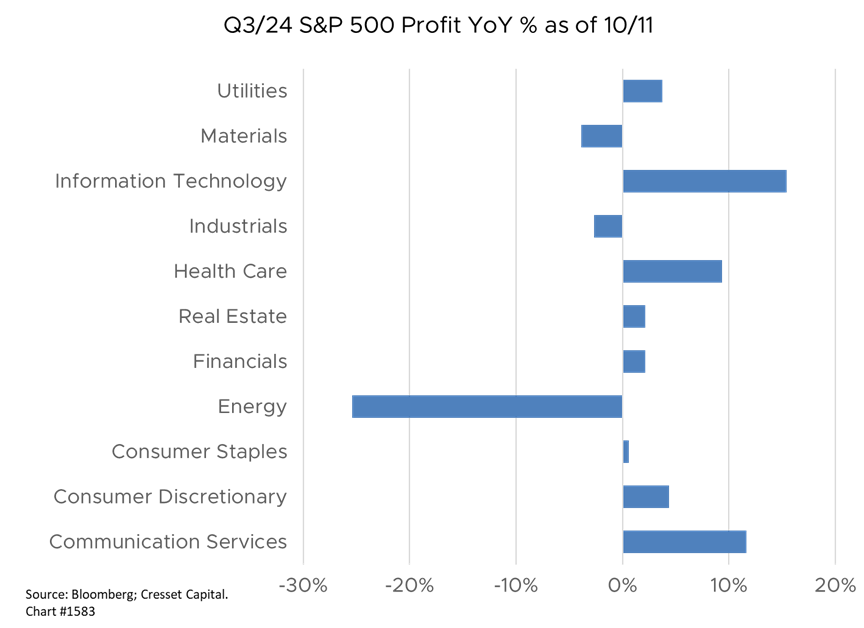

Artificial intelligence (AI) is expected to drive tech profits, with companies like Nvidia and AMD leading the charge in AI chip development. The recent unveiling of Tesla’s “robotaxis” also highlights the growing importance of AI across various sectors. Analysts expect technology profits to have grown more than 15 per cent year over year through Q3, with the Magnificent Seven firms posting profit gains of 18 per cent. That’s down from more than 30 per cent in 2023, according to Bloomberg.

‘S&P 493’ Poised for Double-Digit Gains, but not until Q1 2025

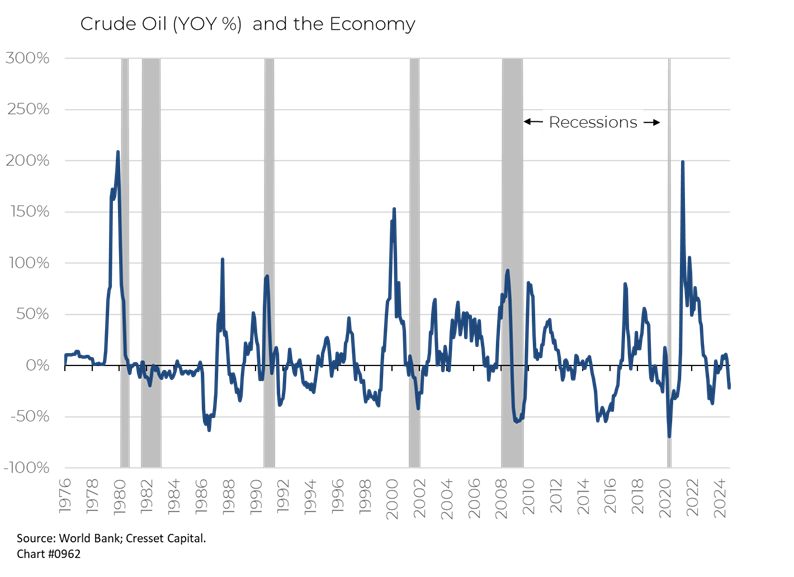

For the rest of the S&P 500, profits are expected to edge 1.8 per cent higher, although Q3 would represent their second consecutive quarter of annual profit growth. The good news is profits from the “S&P 493” are projected to deliver double-digit gains in Q1 2025. Healthcare profits are expected to be boosted by GLP-1 weight-loss drug sales last quarter. Analysts expect sector profits to have grown more than nine per cent over the last four quarters, with pharmaceutical earnings expanding by more than 18 per cent. Drugmaker Eli Lilly enjoyed revenue of more than $4 billion in the second quarter from GLP-1 products Mounjaro and Zepbound, accounting for nearly 40 per cent of company sales. Meanwhile, profits in the energy sector are expected to have declined 20 per cent on a 17 per cent slide in spot crude prices during the quarter.

Consumers Are the Key, but Are Showing Signs of Fatigue

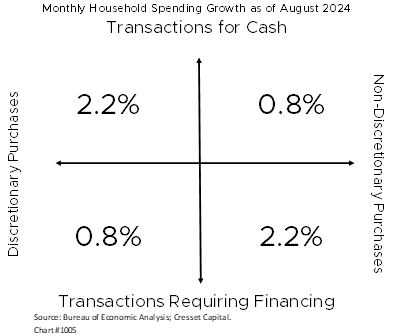

Investors and companies are grappling with mixed economic signals as we enter earnings season, with several macro factors potentially influencing corporate profits. Most important are consumers, who account for about two-thirds of economic growth. Even though the job market is tight, consumers, weary of higher prices, are pulling back. Discretionary spending with cash, like dining out and travel, continues to climb, but discretionary spending requiring financing, like autos, recreational vehicles and furniture, has slumped – an early sign of consumer fatigue. Perhaps lower interest rates will spur spending here. Non-discretionary spending requiring financing, like hospital stays and education, remains robust. As the demand for big-ticket discretionary items wanes, companies that sell those goods are finding themselves in a battle to maintain their slice of a shrinking revenue pie. We will be paying close attention to management comments on the consumer and spending patterns.

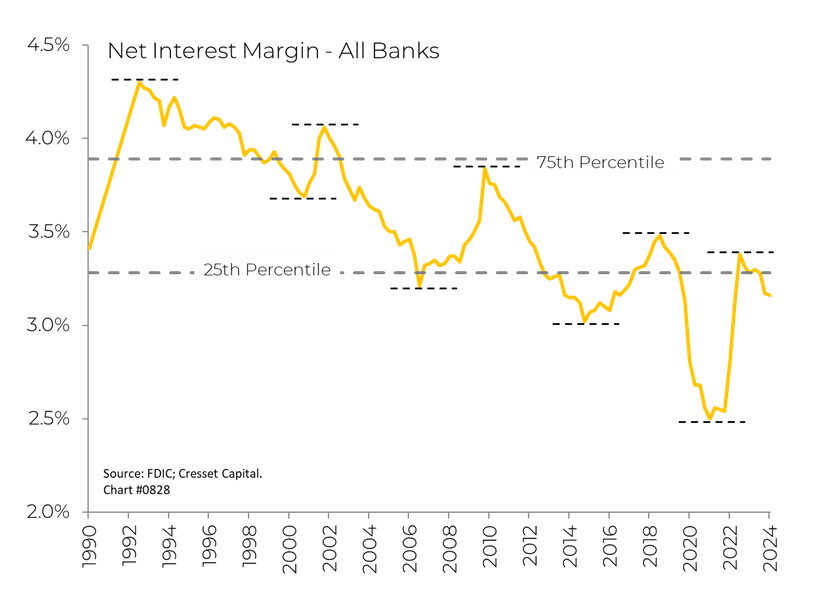

Favorable Backdrop for Large Banks, but Smaller Banks Face Stressed Balance Sheets

Even though the Fed just kicked off its first rate-cutting program in four years, the 10-year Treasury yield rose 0.5% in response. The widely followed Treasury borrowing benchmark helps determine everything from mortgage rates to valuation multiples. However, lower overnight rates and higher intermediate-term rates create a favorable backdrop for bank lending, a sector that so far has delivered better-than-expected results this reporting season. Banks’ net interest margin, their collective lending spread, has been in a secular decline, making lower highs and lower lows. Meanwhile, loan demand has been contracting since 2022, the year the Fed kicked off its 18-month hiking program. We expect large banks, with unfettered access to deposits, to successfully navigate earnings season. We will be paying particular attention to results from smaller banks as they are grappling with bulging balance sheets of challenged assets.

Global Macro Factors, Like China’s Slump, Hurt Sellers of Luxury Goods

Global macro factors will also influence quarterly results. China’s economy, hamstrung by overbuilding and lackluster demand, has crimped global growth and affected global sellers of discretionary goods. Luxury goods companies like LVMH, a maker of expensive handbags, have seen sales fall for the first time since the pandemic on anemic Chinese demand. Other luxury product companies like Ralph Lauren and Estee Lauder are expected to suffer top-line disappointment. Geopolitical tensions in the Middle East and Ukraine have disrupted the supply chain, creating price volatility in energy and other commodities. Companies with diversified global operations may be better positioned to navigate these challenges.

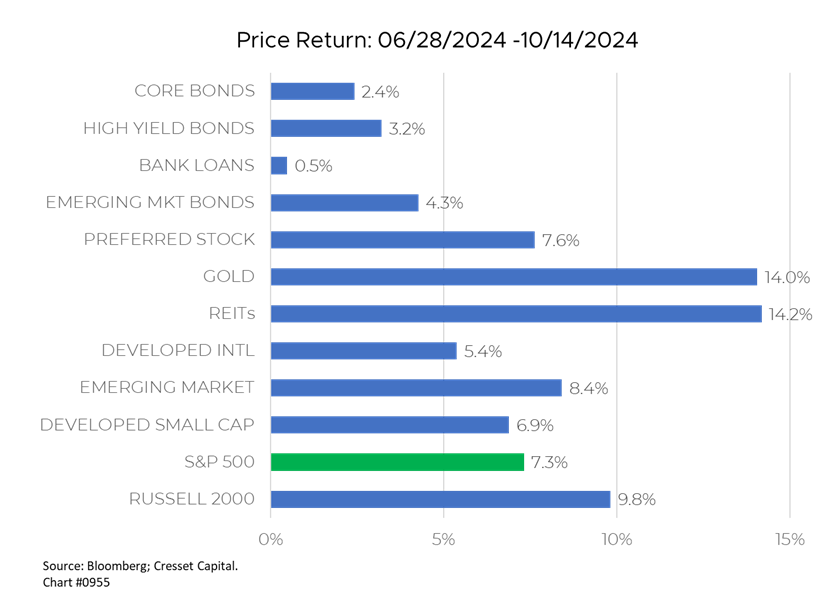

Rotation Out of Tech Has Fueled Performance of Utilities and REITs

S&P 500 and Dow Jones hit new record highs entering earnings season, fueled by a rotation from tech stocks into value/dividend-oriented names. Utilities were the best-performing sector, up more than 18 per cent since the end of the second quarter and REITs, another dividend-forward group, were not far behind on the prospect of lower yields. High cash flow and low debt – the biggest driver of performance over the last 18 months – reversed course last quarter, as investors anticipated lower borrowing costs would disproportionally benefit higher-leveraged companies while valuation concerns enveloped the tech sector. Gold, a store of value and general-purpose hedge, has been among the best-performing asset classes since the end of Q2.

Bottom Line:

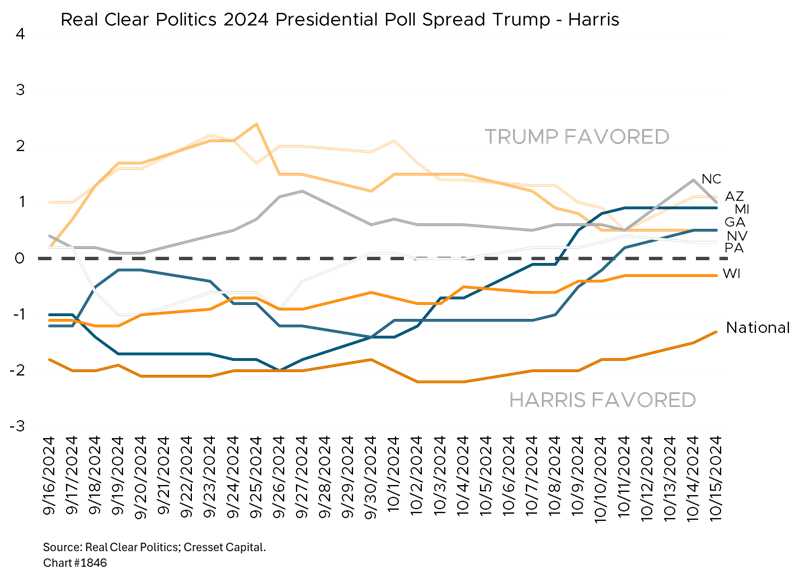

Earnings season forces investors to focus on fundamentals. US large caps are relatively expensive and other markets, like mid and small caps, international and emerging equities enjoy cheaper valuations on lower expectations. Perhaps lower short-term rates and dollar weakness could serve as a catalyst for broader equity market participation. Before everyone rushes into international equities, investors must also recognize that the US presidential election is weeks away, carrying near-term uncertainty given how close the race has been. Its outcome could shift the balance between domestic and foreign markets. Additionally, Google faces regulatory challenges here at home, and the outcome has the potential to prompt investors to rethink just how insulated mega-cap tech companies are from government action. We recommend investors maintain equity allocations through the election – there will be adequate opportunities to diversify internationally after November 5.