Key Observations:

- China announced $425 billion in economic stimulus aimed at real estate, consumer spending and financial markets

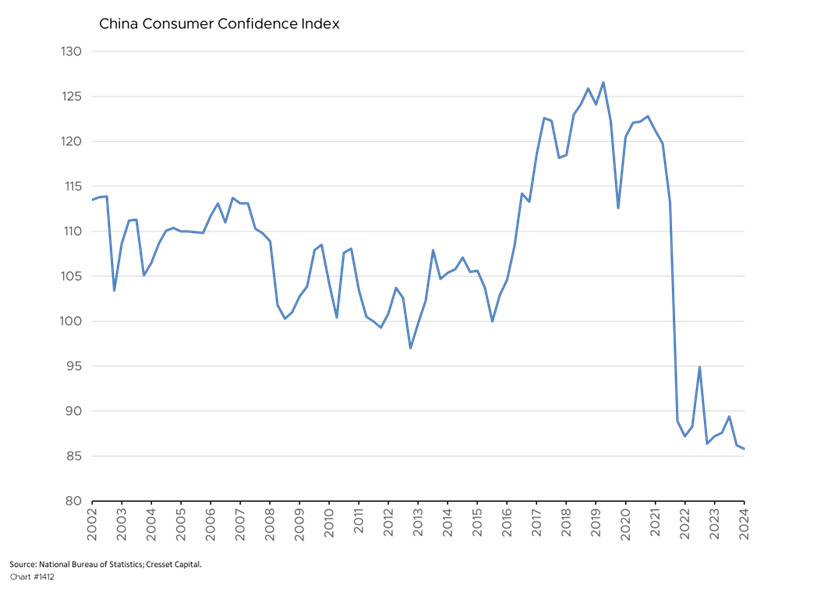

- Initiative reflects Beijing’s concern about record-low consumer confidence

- Chinese equities are cheap from a cyclical perspective

Beijing announced sweeping policies last week designed to stimulate China’s beleaguered economy, which has been weighed down by a deflating real estate bubble and lackluster household demand. The RMB 3 trillion (~$425 billion) package allocates RMB 1 trillion toward consumption incentives, another trillion to support local governments and injects a third trillion into the country’s banking system. Last week’s move was Beijing’s largest stimulus program since a RMB 4 trillion infusion during the global financial crisis in 2009. These policy actions represent a comprehensive approach to stimulating the economy and markets, with a particular focus on the real estate sector, consumer spending and financial markets. The government appears to be shifting away from its previous reluctance to provide large-scale stimulus, likely due to concerns about slowing economic growth and deflationary pressures. Beijing is concerned that Chinese consumer confidence has plunged to its lowest level on record, well below those reached in the depths of the global financial crisis. What does the stimulus mean for investors, and potential investors, in Chinese equities?

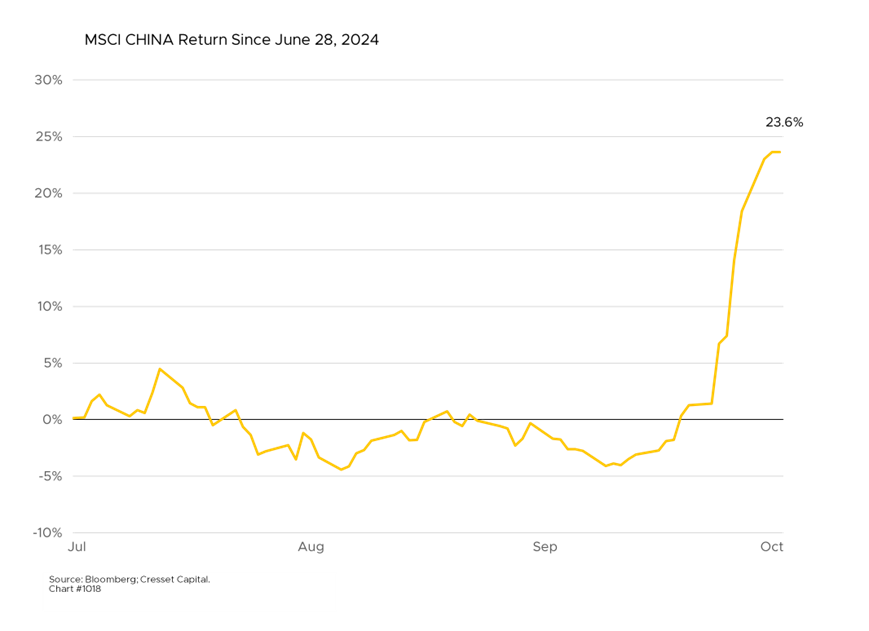

Chinese Equities, Targeted by the Stimulus, Surged on the News

The PBoC’s Monetary Policy Committee, in announcing the move, acknowledged the country’s economic challenges. A key feature of the stimulus package is a monthly allowance of RMB 800 (about $114 USD) per additional child for families with more than one child, representing about $1,400/year additional child, which is substantial compared to the average disposable income in larger Chinese cities. Other measures include lowering mortgage rates for first and second homes, reducing minimum down payment requirements and allowing homeowners to refinance at lower mortgage rates. Millions of Chinese households are making mortgage payments on apartments they’ve purchased that have not yet been built.

Other incentives, such as helping companies buy back their shares and raise capital, are designed to boost Chinese equity markets. These moves have gotten investors’ attention, and the reaction in Mainland stock markets was historic. The Shanghai Composite Index surged more than eight per cent, while Chinese tech stocks soared more than 17 per cent in response, representing the best single-day performances for Chinese markets in 16 years.

Chinese Equities Cheap from a Cyclical Perspective

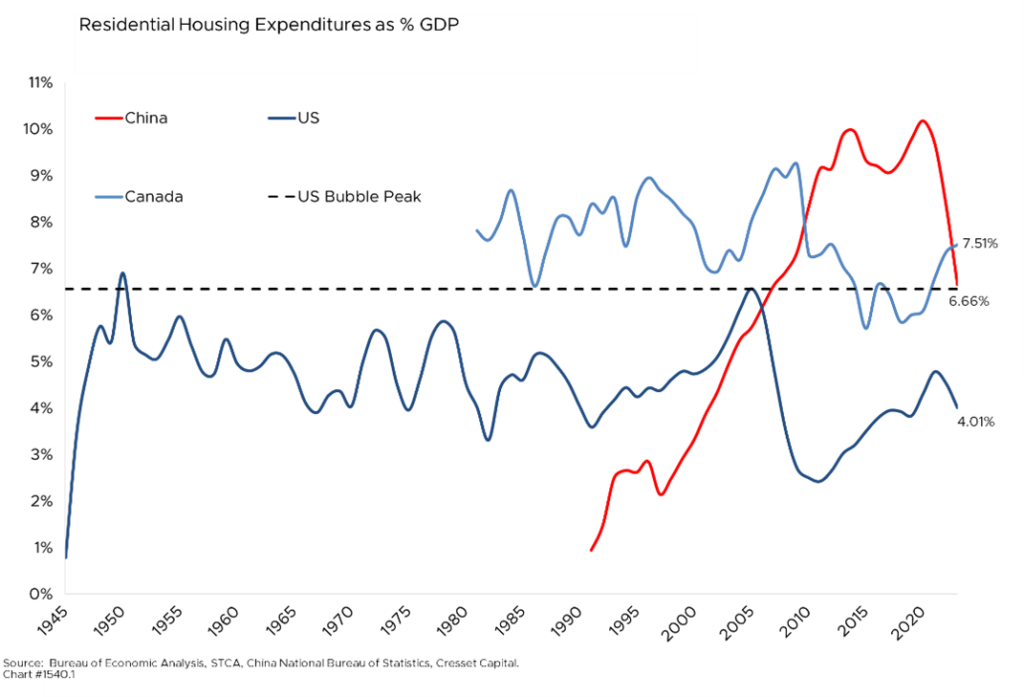

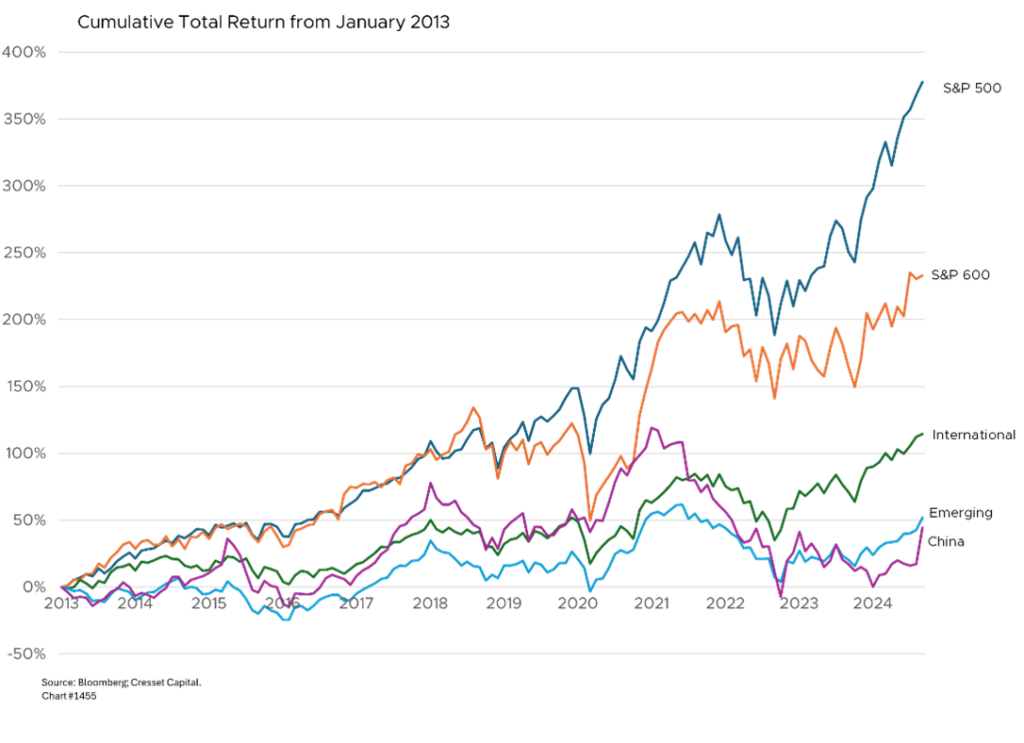

The Chinese market was ripe for a rally. Chinese equities, which at their peak represented as much as one-third of the MSCI Emerging Markets Index, have trailed developed international markets over the last decade, delivering an annualized 3.7 per cent return, while the S&P 500 advanced at an annualized 14 per cent clip. The world’s second-largest economy faces manifold fundamental challenges. China, one of the biggest beneficiaries of the globalization trends kick-started in the 1980s, struggled as the benefits of the outsourcing trend peaked in 2012 and then reversed. Many of Beijing’s programs designed to lift household incomes relied on property and infrastructure development fueled by public and private debt. At its 2020 peak, China’s residential real estate expenditures as a share of GDP exceeded 10 per cent, well above the 6.5 per cent share reached by the US at the height of the 2006-2007 housing bubble. China’s expenditures have collapsed to 6.6 per cent. Besides real estate, other heavy-handed policies aimed at China’s private sector have cooled foreign investment.

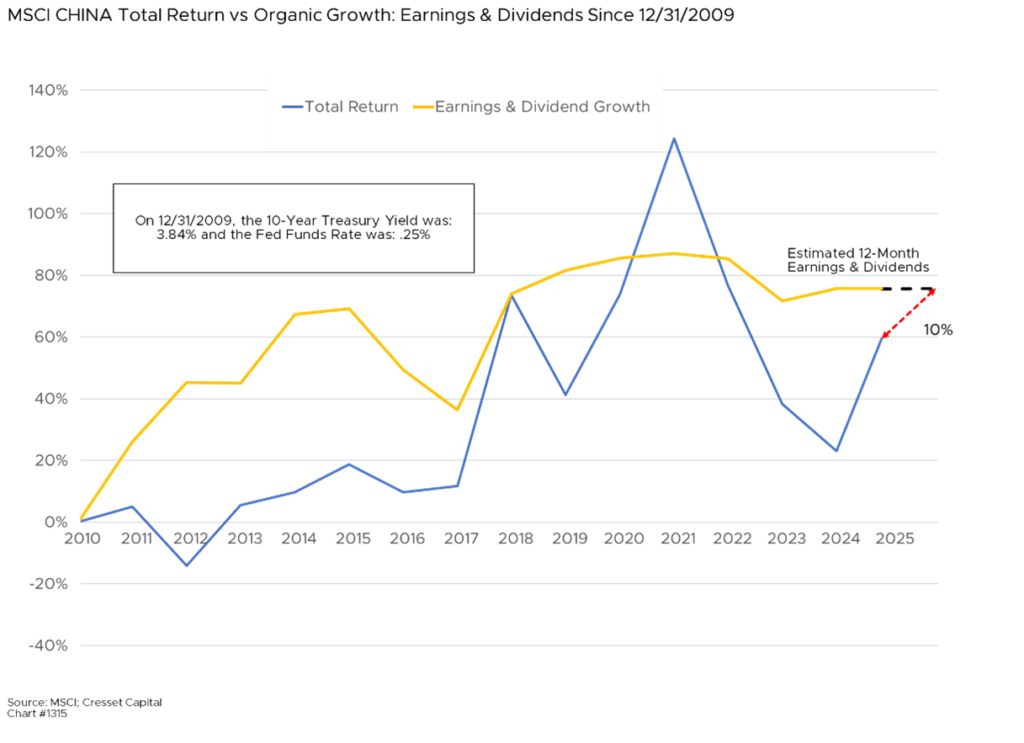

China’s equities market, meanwhile, appears cheap from a cyclical perspective. The country’s equity market underperformance in recent years has fallen below cumulative earnings and dividend growth. While expectations are for flat earnings in 2025 – in fact, next year’s expected dividends will just about offset companies’ slight profit decline – Chinese equities remain about 10 per cent below fair value.

Bottom Line:

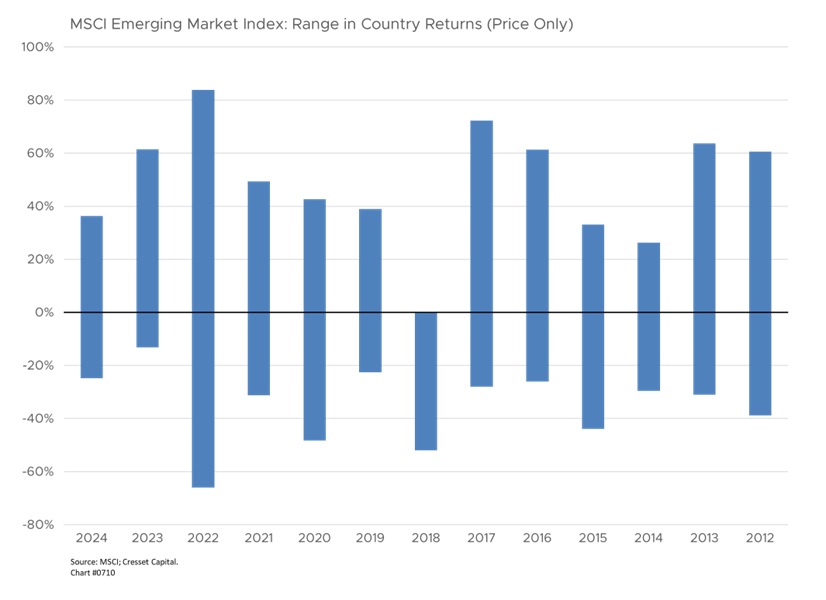

China’s equity markets are cyclically cheap, thanks to years of investor avoidance. Last week’s policy move served as a catalyst to unlock China’s undervaluation. That said, the country continues to face fundamental challenges beyond real estate, including aging demographics, overbuilding and lackluster domestic demand against a de-globalization backdrop. While we believe there is additional cyclical upside to Chinese equities, we recommend investors play the China trade through emerging market active managers. History has shown the annual range in returns among countries in the MSCI Emerging Markets Index approaches 100 percentage points, giving active managers opportunities to move between markets.