Key Observations

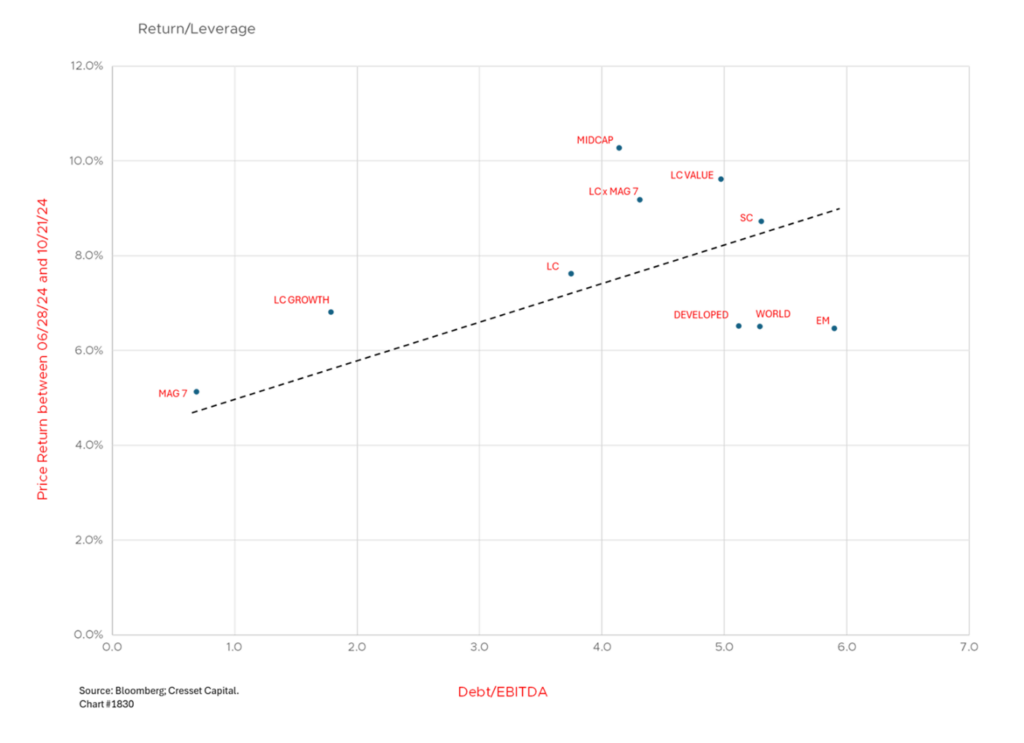

- The broadening trade that began in June has stalled as investors focus on the election; we expect it to resume afterward irrespective of who wins.

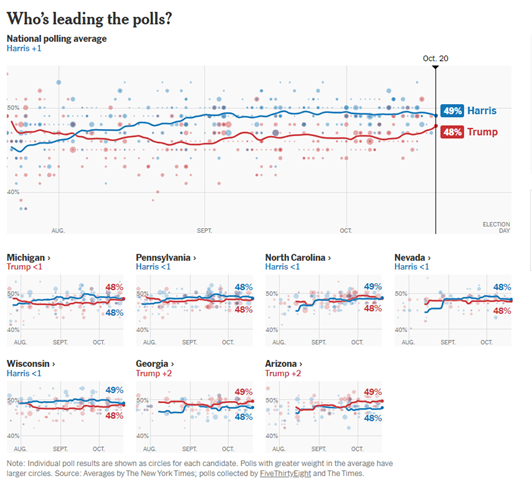

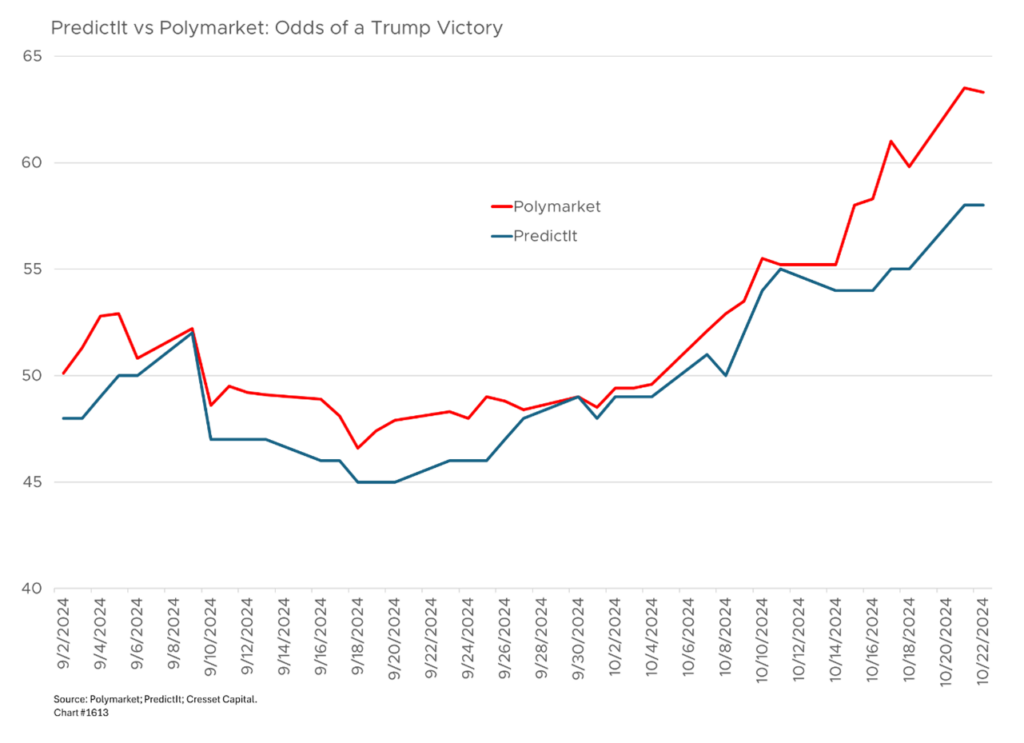

- Polls currently give Harris narrow national edge, while political exchanges favor Trump

- Historically, markets react to new presidents in the near term but, longer term, valuations and fundamentals take charge

In a fraught fortnight, Americans will vote in one of the most consequential elections in modern history. While pundits, politicos and supporters of Trump and Harris are scrutinizing every poll and sound bite, markets are largely ignoring election details. The latest polling shows the race is a dead heat with Harris marginally ahead nationally while the swing states are split, with virtually all polling within the margin of error. What consequences do elections actually have for market returns?

Polls Currently Give Harris Narrow National Edge, While Political Exchanges Favor Trump

Besides crypto-based Polymarket, which shows Trump holding a 63% chance of winning the White House, other political exchanges, like PredictIt, give Trump a seven-percentage point edge over Harris, with Trump crossing above Harris nearly two weeks ago. Polymarket results appear to have been distorted by four accounts ploughing $30 million into Trump bets over the last two weeks, according to reporting by The Wall Street Journal.

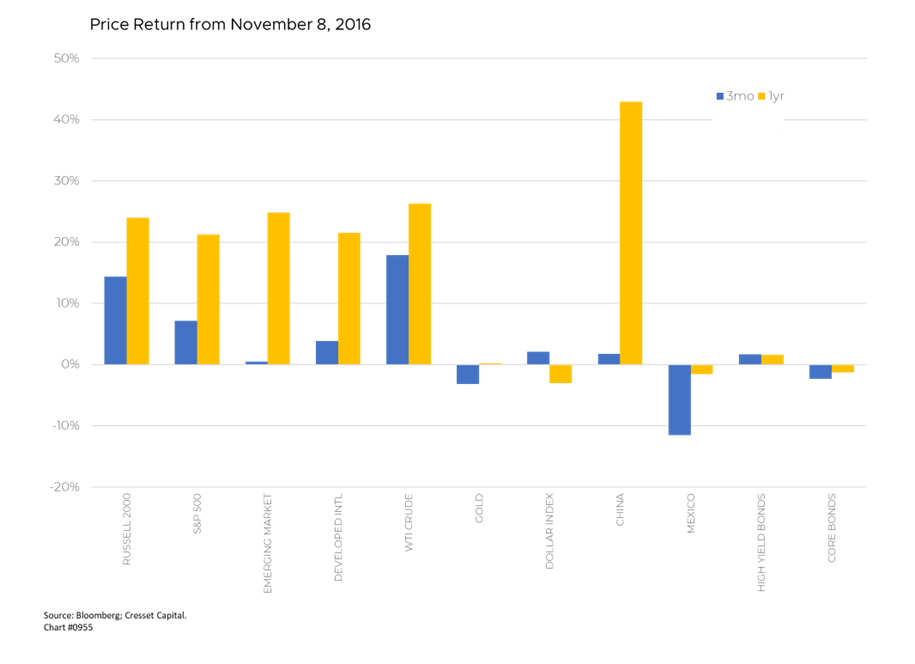

Most Investors Think Presidents Have Only Modest Impact on Long-Term Returns

While most investors believe the person who sits in the White House has a modest impact on long-term investment returns, the broadening trade that began in June in anticipation of lower financing costs has been stalled as investors turn their attention to the impending election. Investors remember their surprise in 2016, when Trump was first elected, even though the polls and election markets going into the final weeks that year had essentially written off the Republican contender. Markets responded quickly. Emerging markets, including China, trailed US equities over the first three months after the November election, fearful of Trump’s protectionist platform. EM sat still while US markets surged nearly 15 per cent. One year later, however, emerging market equities gained 25 per cent, matching US returns, while China rallied more than 40 per cent.

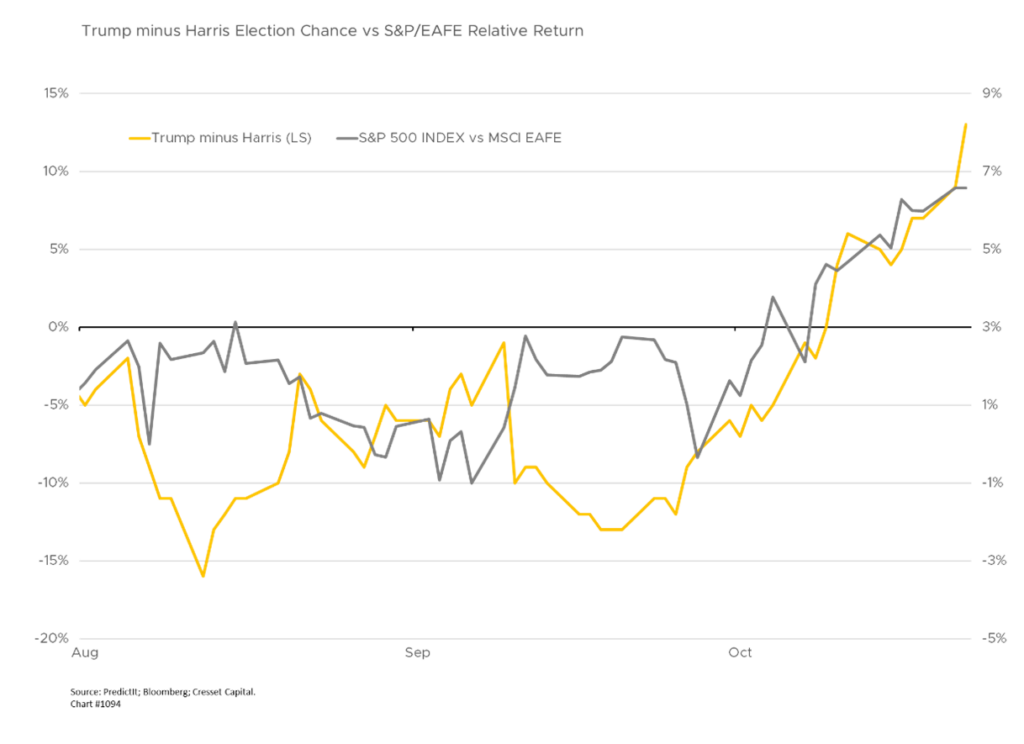

International Markets Lagging US Markets in Run-Up to Election

While most investors appear to be watching the drama play out from the sidelines, certain markets are responding to the final weeks of the Trump-Harris tussle. Investors are focused on the biggest differences in policies between the two candidates, and the prospect of tariffs, tax cuts and immigration restrictions appear to be influencing stock, bond and currency markets. The relative performance of international equity markets vs US large caps shows they are responding to potential trade policies, with US equities outperforming their international counterparts as Trump’s election chances improve.

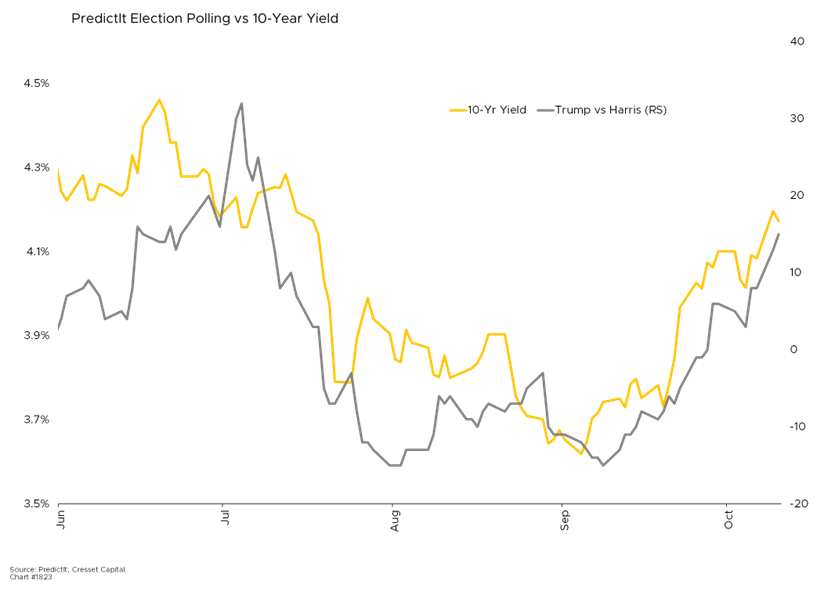

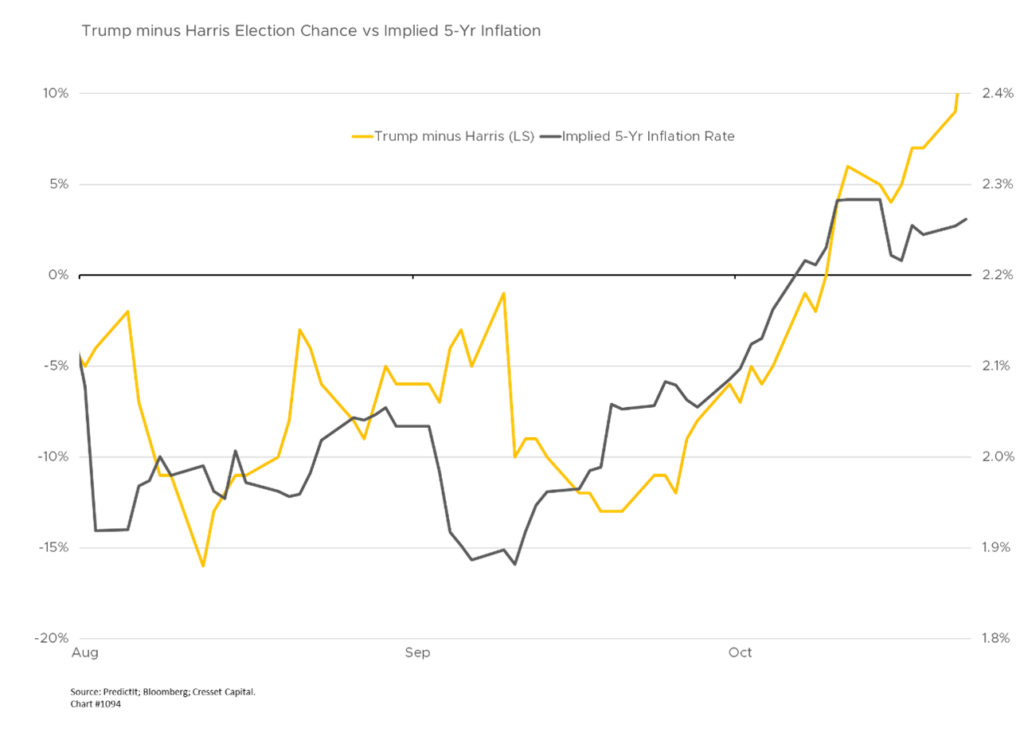

Bond Market Suggests Investors Expect Higher Rates and Inflation Under Trump

Bond market investors are tracking the election prospects as well. The 10-year Treasury yield appears to be ebbing and flowing with the candidates’ respective election chances, and suggest that bond investors believe a Trump administration would imply higher interest rates, and that tariffs, tax cuts and immigration restrictions could spur growth with inflation.

The five-year inflation rate, implied by inflation-protected Treasury yields, suggests bond investors fear inflation could rise with a Trump victory, although this linkage has weakened over the last week or so.

Bottom Line:

The broadening trade that began last June – in which relatively higher leveraged markets outperform lower leveraged markets as financing costs are reduced globally – stalled about a week ago as investors turned their attention to the 2024 US election. We believe the broadening trade will continue once the election results are behind us. As previous elections have shown, markets react to new presidents in the near term, but longer-term, macro dynamics, like valuation and fundamentals, take charge.