Key Observations

- Federal deficit a growing concern, with no solution posed by either party

- Higher real Treasury yields recently driven by the ‘distrust’ premium

- Credit conditions expected to remain healthy

- Investors are anticipating higher growth and inflation, which would be favorable for risk taking

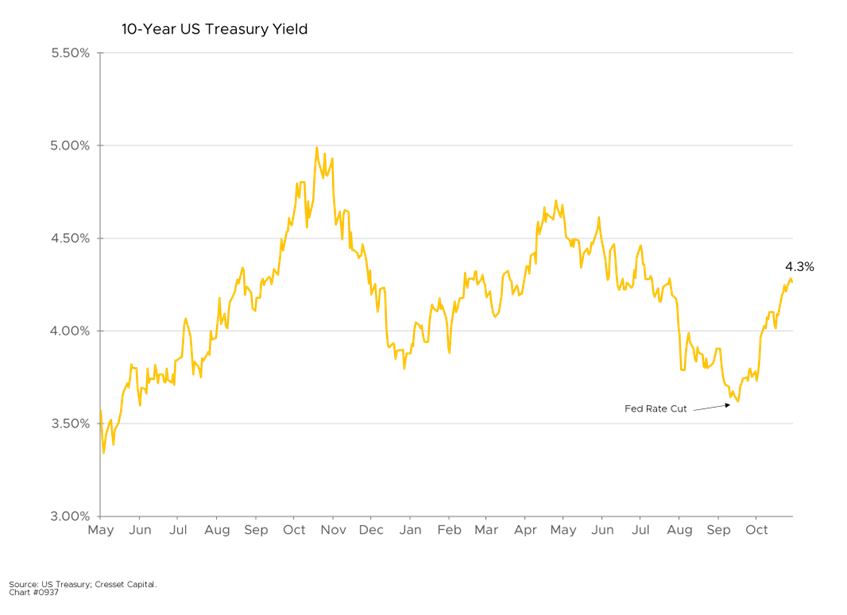

September 18 was a pivotal day for the bond market. Not only was it the day the Federal Reserve cut interest rates for the first time since March 2020; it also marked the low point of the year for the 10-year Treasury note. Over the next four or five weeks, the 10-year Treasury yield spiked nearly 0.6%, to 4.28%, begging the question: What is the bond market telling us?

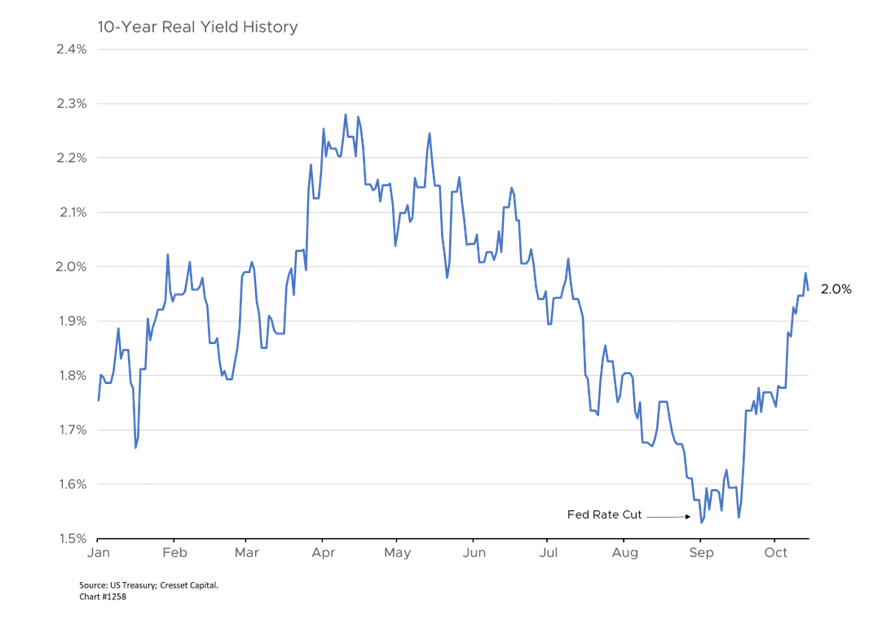

Higher Real Treasury Yields Recently Driven by ‘Distrust’ Premium

Two sources drive changes in Treasury yields: changes in inflation expectations and changes in the real rate, which is the premium the government pays over inflation. The bulk of the most recent move was almost entirely attributable to a higher real yield – in many respects, this can be considered the “distrust” premium Treasury lenders require to extend credit to the federal government. So, 0.46 per cent of the 0.6 per cent move was the result of the 10-year real rate rising to 1.98% from 1.53% on September 18. Meanwhile, bond market volatility rose to its highest level this year, reflecting the sudden rise in rates.

Credit Conditions Expected to Remain Healthy

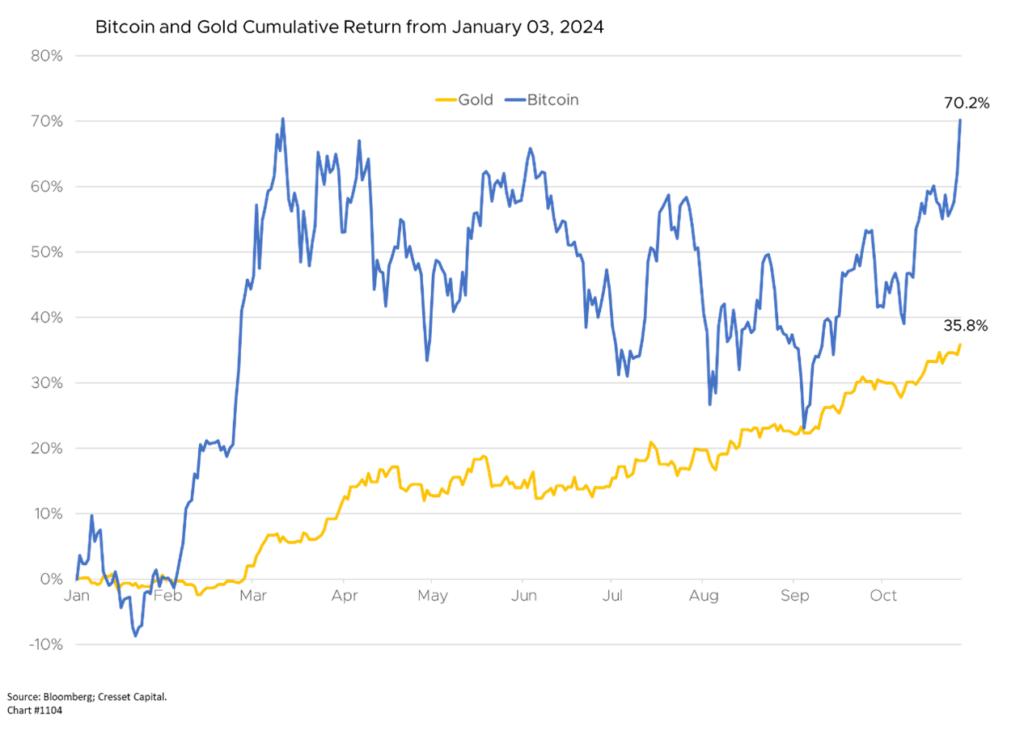

The bond sell-off sent ripples through other markets from currencies to crypto. The US dollar, which broke down in early September in anticipation of the Fed’s rate cuts, has reversed course with the greenback trading again above its 200-day moving average in recent days. Yet bond spreads, the yield premium lenders require to extend credit to non-Treasury borrowers, are tight for public corporate bonds and private direct lending, suggesting credit conditions are expected to remain healthy. Gold and bitcoin, both perceived as stores of value, have rallied this year, with the bulk of their gains coming in recent weeks.

Government Deficit a Growing Concern, with no Solution Posed by Either Party

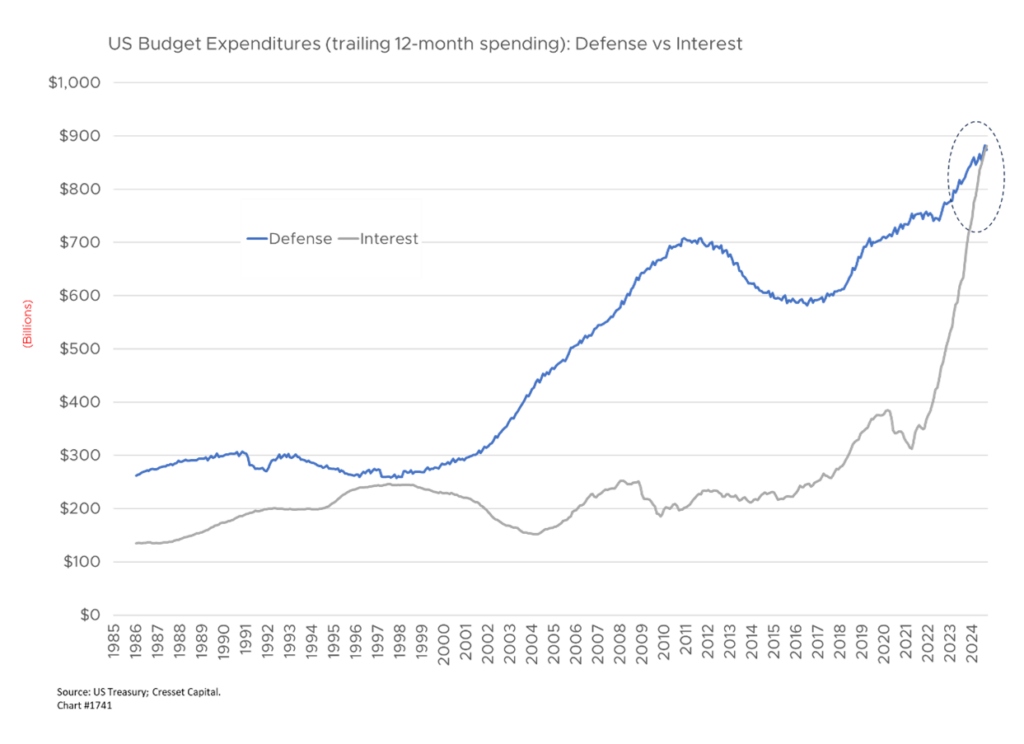

Bond investors are also evaluating other risks and uncertainties. With the election taking center stage next week, investors fret that both candidates’ policies are poised to increase the federal deficit by between $3.5 – $7.5 trillion over the coming decade, according to economists. Harris is leaning on tax credits and incentives, while Trump pledges tariffs and tax cuts. Treasury investors also worry about the US government debt load, which recently eclipsed our annual GDP – and, at 120 per cent of GDP, is nearly double 2008 levels and growing. Neither candidate nor party has taken a leadership role in reining in federal spending and debt. In 2024, spending on interest on the debt now exceeds what the government will pay for national defense.

Bottom Line

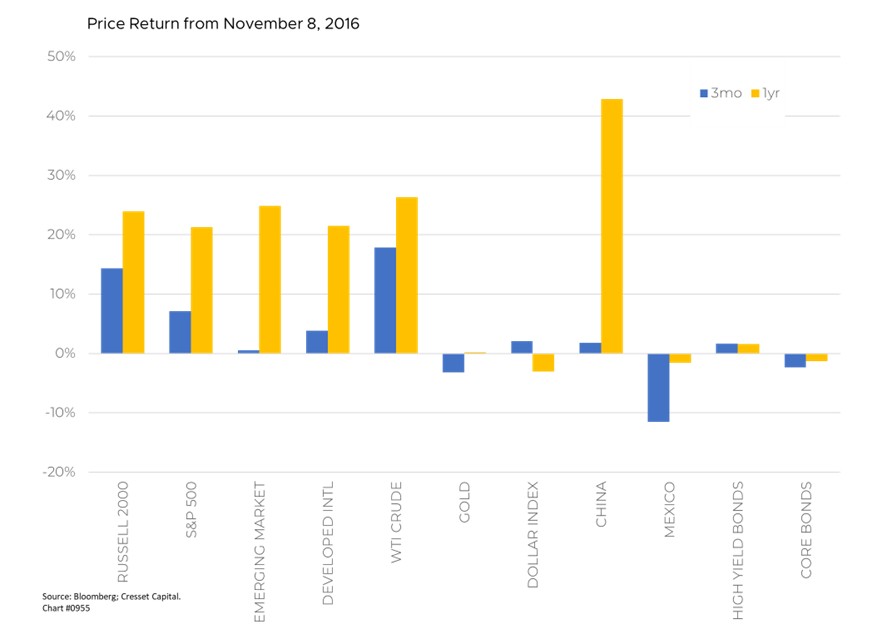

The bond market appears to be bracing for higher growth and inflation, thanks in large part to prospective presidential policies. Such an environment would be favorable for risk taking, since the propensity to repay debts increases with cheaper dollars. Bond volatility is expected to spike in the days following the election. Conditions keeping the Fed from lowering overnight rates represent the biggest risk to investment markets in the near term. Monetary authorities could be sidelined if they sense impending fiscal stimulus would push spending and prices higher. History suggests presidential elections influence investment markets in the near term, but over the subsequent year longer-term trends reassert themselves. In response to Trump’s 2016 presidential surprise, investors sold international equities and bought US equities over the first three months. One year later, however, international markets had not only caught up to their US counterparts, but China, a country vilified throughout the campaign, had surged more than 40 per cent.