Key Observations

- Quality of life and fiscal freedom have motivated relocation, benefitting lower-tax red states

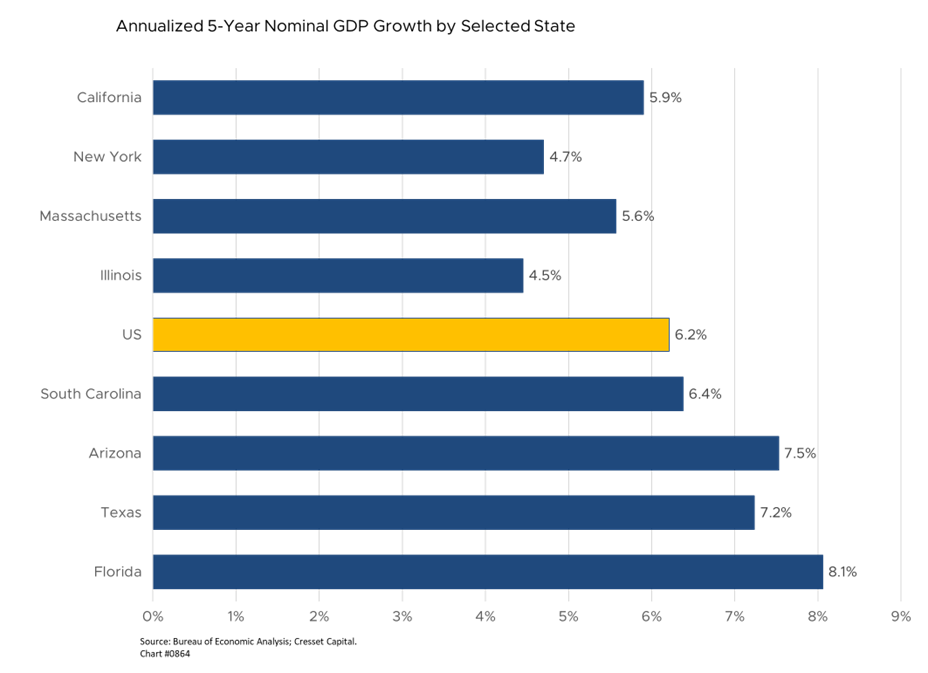

- Lower-tax red states generally outpace national growth, while higher-tax blue states lag

- Higher-tax blue states with shrinking tax bases face fiscal fragility

- State-specific municipal bond investors should stick with bonds rated AA or higher

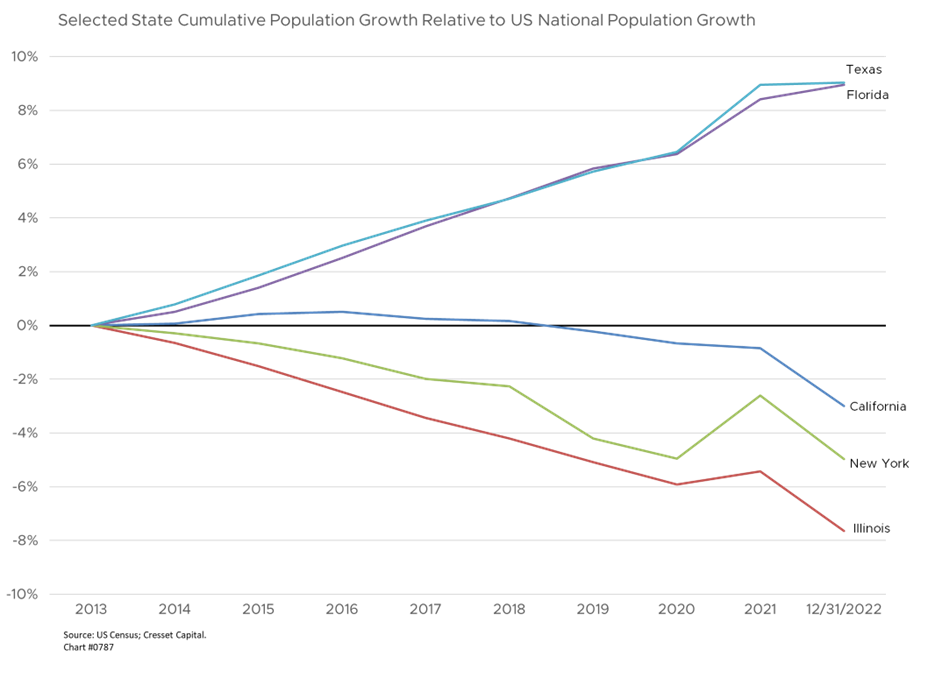

Democrats have been soul searching since a consequential election in which Republicans swept the White House, the Senate and the House. The results reminded us of a trend that has been in place for many years: the large-scale migration from higher-tax blue states to lower-tax red states. Over at least the last decade, states like California, New York, Illinois, New Jersey, and Massachusetts have steadily lost population to states like Florida, Texas, North Carolina, Arizona, and Tennessee. The pandemic accelerated this trend. Over the last decade, Texas and Florida – two warm-weather states with no personal income tax – expanded nine per cent relative to the national growth rate. Meanwhile California, New York, and Illinois – with top marginal income tax rates of 13.3, 10.9, and 4.95 per cent, respectively, trailed the national growth rate. Demographic trends have consequences for elections.

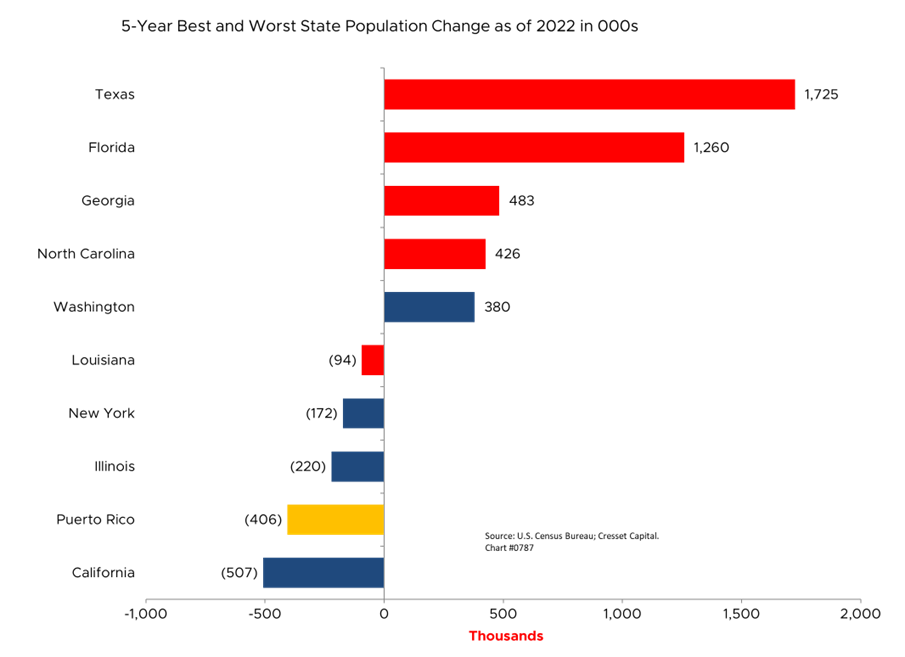

Over the last five years through 2022, the top five states (Texas, Florida, Georgia, North Carolina, and Washington) added 4.2 million residents, while the bottom five states and territories (California, Puerto Rico, Illinois, New York, and Louisiana) shrank by 1.4 million. That’s against a backdrop of the US growing by 7.6 million people. In other words, the top five states accounted for 55 per cent of our nation’s population growth since 2015 – and four of them voted Republican in the last election.

Quality of Life and Fiscal Freedom Motivate Relocation

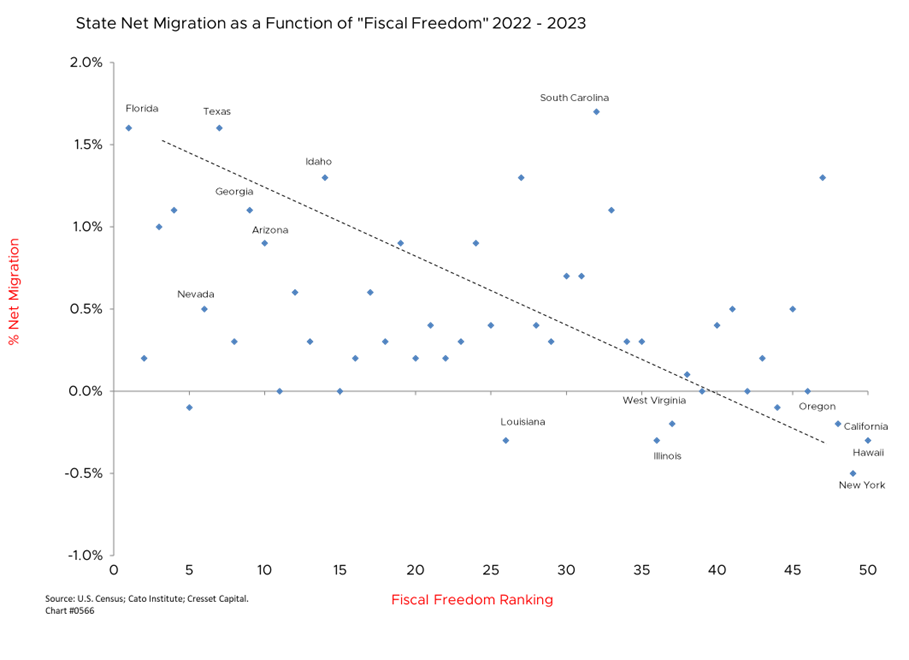

Migrating Americans are literally voting with their feet. Many cite taxes and housing costs as their primary reason for moving. Quality of living, a catch-all that includes costs and density (like traffic and the time spent commuting to and from work), also factors into the decision to relocate. For example, average commute times in New York and Chicago are between 35 and 41 minutes, among the longest in the nation.

The Fiscal Freedom Index, a ranking of all 50 states created by the Cato Institute, consists of six variables: state tax revenues; government consumption; local tax revenues; government employment; government debt; and cash and security assets. Florida, with no personal income tax and a AAA municipal credit rating, ranks at the top of the list at number one. New York, by contrast, comes in net-to-last at 49. Fiscal freedom influenced state migration last year, with highly ranked states gaining ground against their low-ranked counterparts.

Where Are Americans Going?

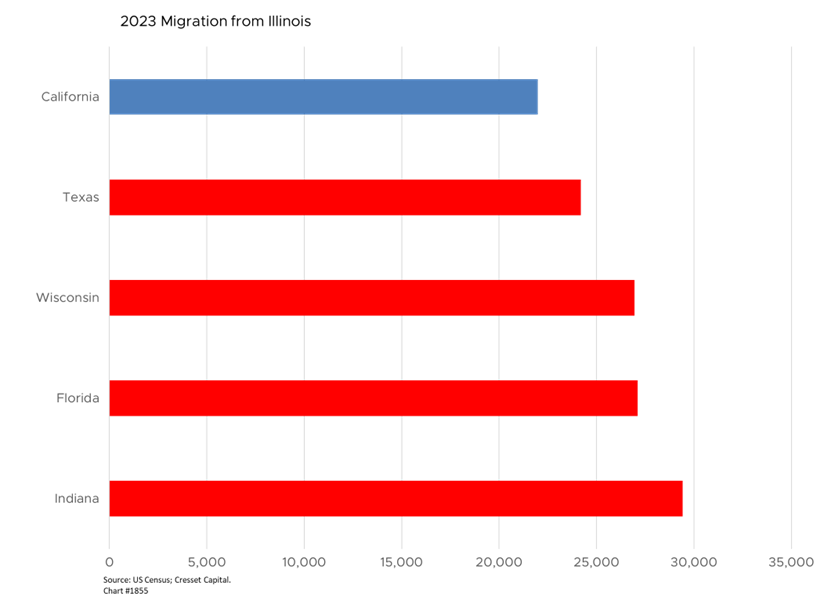

According to US Census data, more than 70,000 New Yorkers fled to Florida last year, the biggest destination state, while 93,000 Californians relocated to Texas. Red states comprised four of Illinois’s top exit destinations. While thousands of Illinois taxpayers traded in their show shovels for the warmer climes of Florida, Texas and California, 56,000 of them hopped just over the border to lower-cost Indiana and Wisconsin. U-Haul data confirms our view. Earlier this year, the national truck and trailer rental company calculated growth according to each state’s net gain (or loss) of one-way equipment from customer transactions in 2023. The U-Haul Growth Index is compiled from more than 2.5 million one-way U-Haul truck, trailer and U-Box moving container transactions that occur annually across the US and Canada. Texas and Florida were ranked first and second in-bound according to the U-Haul Index. Illinois, Massachusetts and California suffered the greatest number of one-way tickets out of state.

Notwithstanding America’s population growth, interstate migration is a zero-sum game: recipient states grow their tax bases as their economies expand, while states with shrinking populations are often forced to spread the tax burden among a smaller base. Over the last five years, lower-tax states have generally outpaced national growth, while many high-tax states have fallen behind by losing skilled workers and business opportunities.

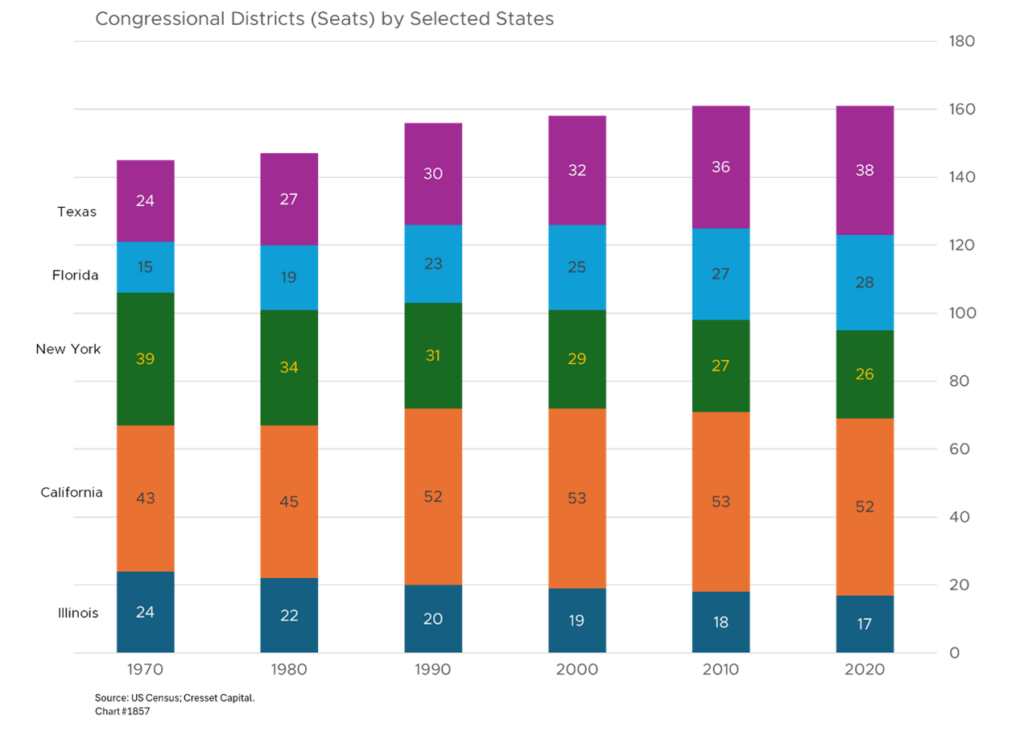

Moreover, demographic shifts over the years have benefited red states politically. Since 1970, New York and Illinois have collectively lost 20 Congressional seats, while Florida and Texas have picked up 27 seats between them. While California added 10 seats between 1970 and 2000, the Golden State lost one seat as a result of the 2000 census.

Bottom Line:

Current trends will eventually weigh on municipal finances as operating budgets and pension liabilities are borne by a smaller population base. While credit quality among higher-tax states, like California, New York and Massachusetts, remains strong, Illinois’ credit situation is a concern. High tax rates and a shrinking tax base leaves Illinois among the states in the weakest fiscal condition. Chicagoans face the second-highest commercial property taxes and some of the highest residential property taxes in the nation. We recommend that state-specific municipal bond investors pay close attention to their holdings and stick with municipals rated AA or higher. Demographics is a slow-moving trend, but a powerful one.