Key Observations

- Market evolution kick-started by traditional bank de-risking and now boosted by interest rate cycle

- Industry consolidation is on the rise

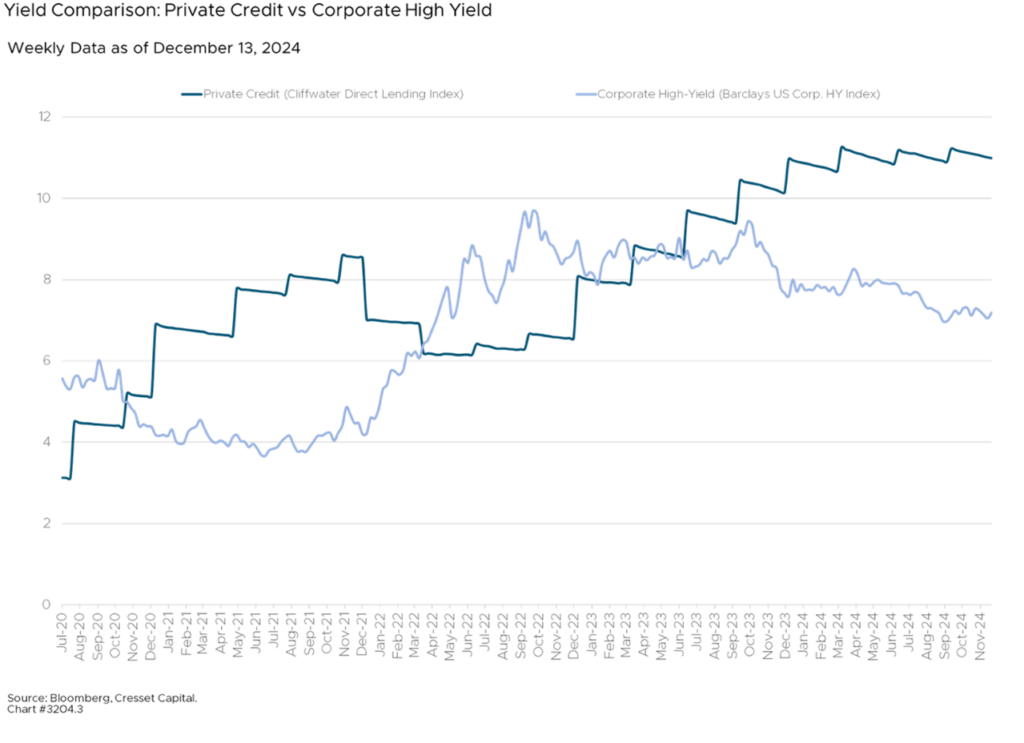

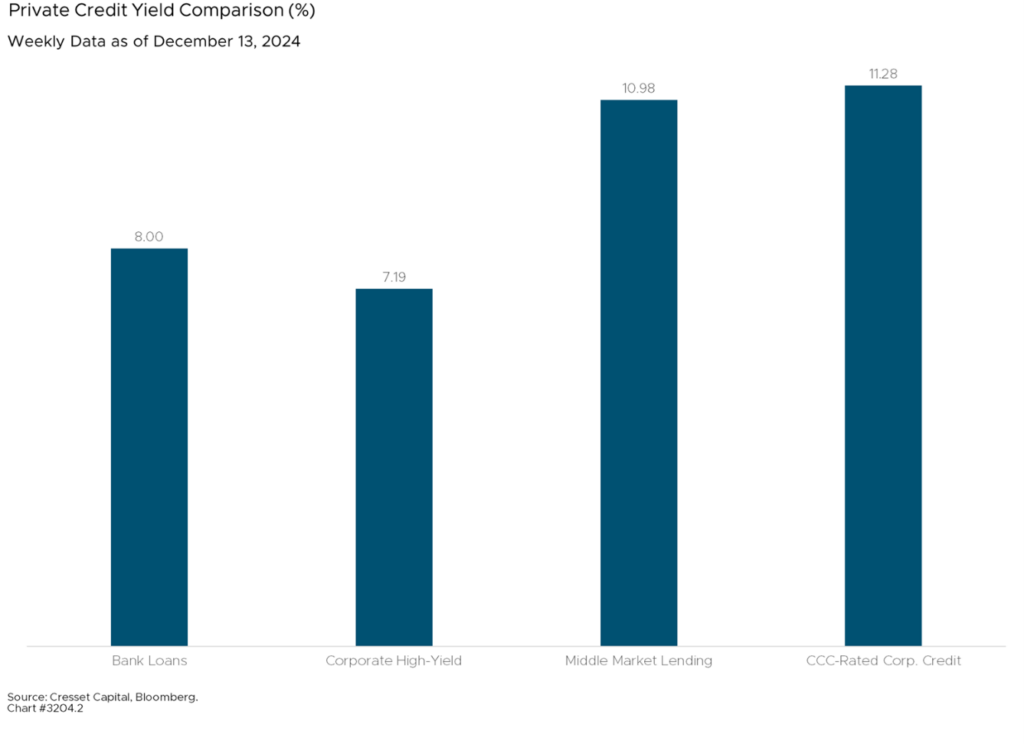

- For investors, benefits include higher yields and no long-term interest rate risk

- Biggest concerns are credit quality, borrower cash flow, and leverage at the fund level

Private credit – primarily, direct lending to privately held businesses – has surged in popularity in recent years. The space has grown into a $1.7 trillion industry and is still rapidly expanding, with projections suggesting it could reach $3.5 trillion by 2028. We examine the reasons for its meteoric growth and the implications for investors.

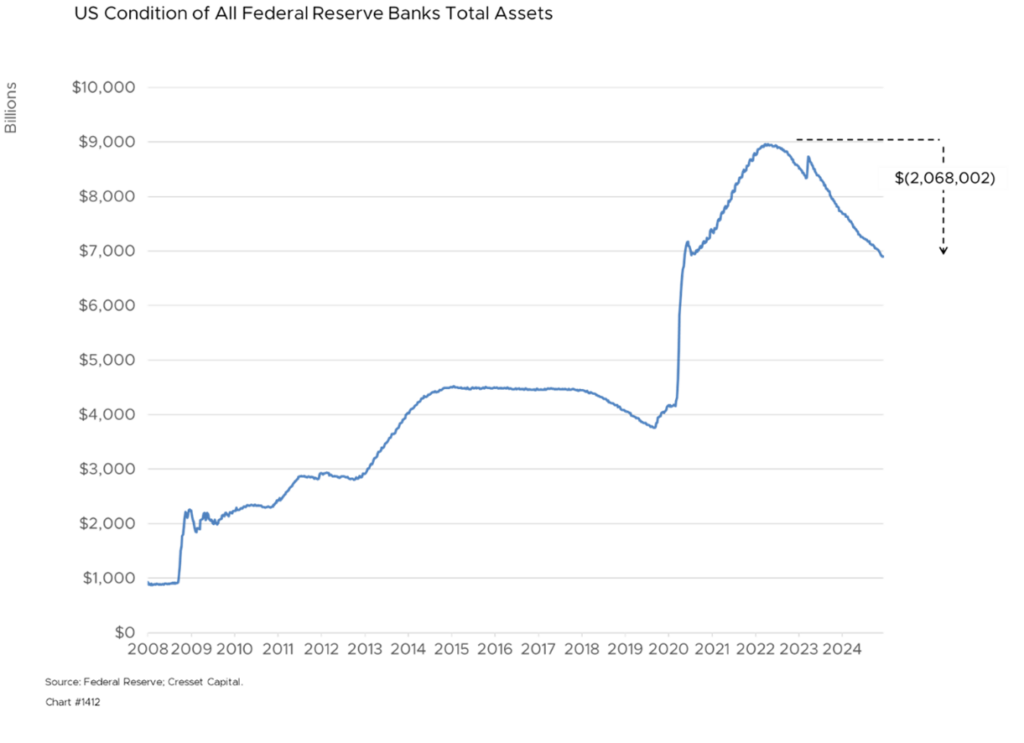

Market Evolution Kick-Started by Traditional Bank De-Risking

Private credit emerged as a significant force after the 2008 financial crisis when traditional banks pulled back from risky lending due to increased regulations. Private lenders stepped in to fill this gap, offering direct lending, distressed debt financing, venture debt, and other forms of private financing. As direct lending has shifted from bank balance sheets to the private markets, so did bank underwriting teams, maintaining previous banking relationships and underwriting standards.

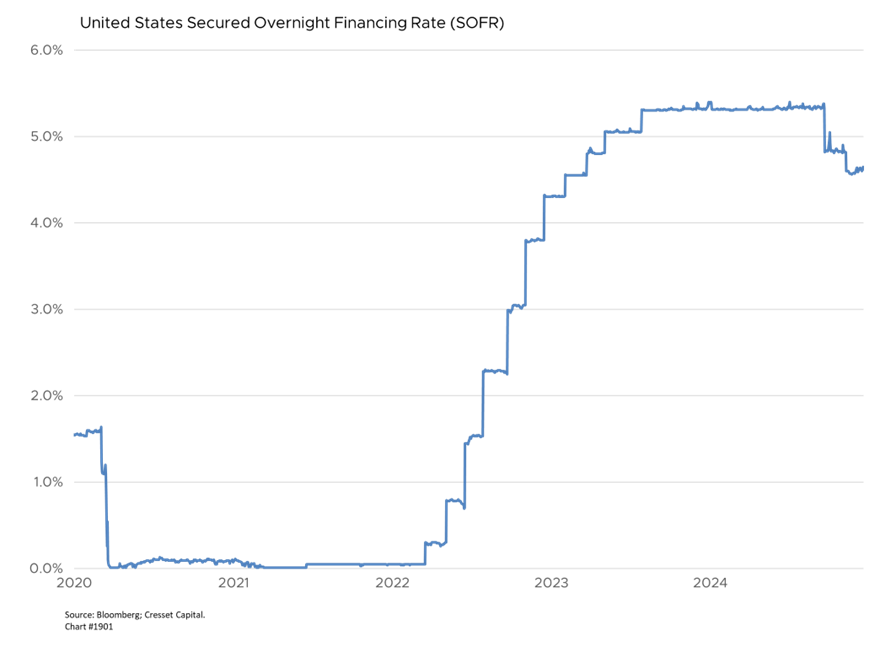

Floating-Rate Lending Has Become Attractive

Private credit loans are typically floating rate, indexed off an overnight rate, either Fed funds or the Secured Overnight Financing Rate (SOFR). Thanks to years of quantitative easing when the Fed held rates below fair value, SOFR was zero until as recently as March 2022. One year later, the rate, at 5.5 per cent, adequately reflected market forces, making floating-rate lending attractive.

Private Credit Lending Has Advantages for Both Borrowers and Investors

Private lenders can offer more flexible terms to borrowers than traditional bank loans, often with faster execution and certainty of funding. Not burdened by regulatory restrictions, private lenders can accommodate companies that might not qualify for traditional bank loans. From an investor’s perspective, private credit funds offer higher yields compared to public markets and, thanks to their floating rate structure, investors don’t take on the long-term interest rate risk that traditional fixed-rate loans require. Like bank loans, most direct loans are senior and are often secured by assets or cash flows.

Growth of Private Credit Reduces Systemic Financial Risk

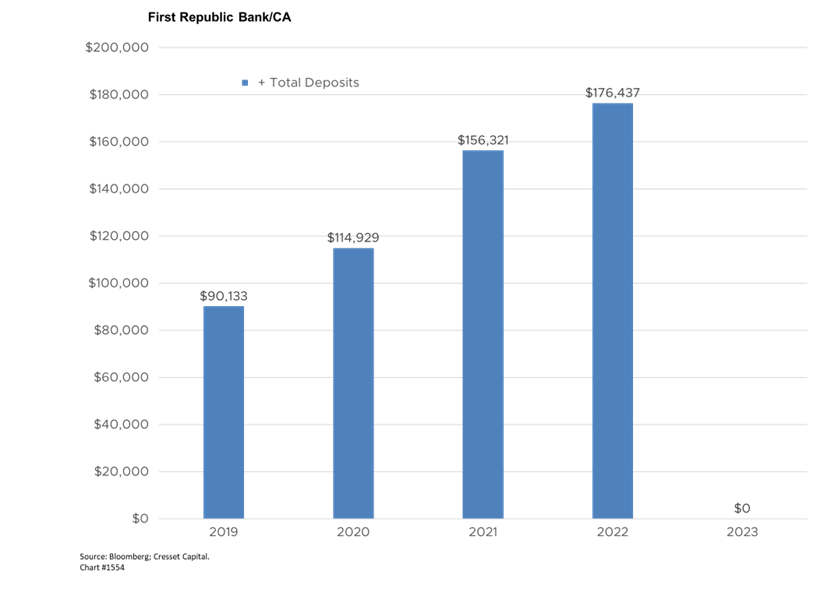

The loan shift from bank balance sheets to private credit funds helped reduce systemic financial risk as well, by more closely matching the illiquidity of the underlying loans with their funding source. In private credit, investors are not simply able to withdraw their funds like they could with federally insured bank deposits. Runs on bank deposits, as we learned most recently from Silicon Valley Bank and First Republic Bank, were as easy as a point-and-click on a banking app. The federal government must backstop the banking system but they offer no guarantees to private credit lenders.

Retail Investor Demand for Private Credit Is Booming

The private credit industry is at an inflection point, with traditional institutional investment potentially plateauing while retail investor interest grows. This has led to new product development and distribution channels, though concerns remain about the democratization of illiquid investments. Nonetheless, asset management firms are rolling out funds aimed at retail investors. The market size is expected to nearly double to $3.5 trillion by 2028, according to BlackRock. The company, which earlier this month announced its planned acquisition of $148 billion private credit manager HPS Investment Partners, intends to expand retail investor access through new products like interval funds and ETFs.

Biggest Concerns Are Credit Quality and Borrower Cash Flow

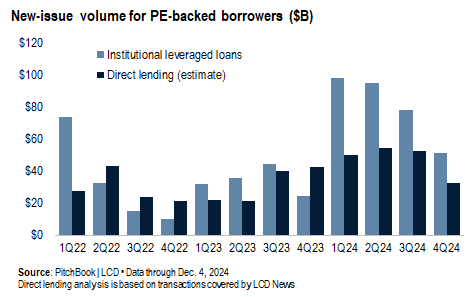

Risk and opportunities remain for private credit strategies. According to industry insiders, 43 per cent of survey respondents cited credit quality and borrower cash flow as the biggest risks facing private credit. Direct lending has had a strong credit history and relatively low defaults, with a trailing 12-month default rate of two per cent, down from 2.3 per cent at the end of 2023. According to industry group LSTA, the overall default rate for direct lending is forecast to be 2.75 per cent in 2024, an increase of 0.45 per cent year-over-year, reflecting a mild and benign default environment. Sponsor-backed borrowers are expected to fare better (2.5 per cent) compared to non-sponsored borrowers (four per cent). We believe most of the credit pressure has been felt by deals originated in 2021, when rates were substantially lower. More recent originations appear to be holding up. Meanwhile, the volume of private-equity-backed loans has been declining after peaking earlier this year, with under $40 billion in incremental demand in Q4 2024, according to private markets research firm Pitchbook.

Industry Consolidation Is on the Rise

Scale matters in this industry and we expect to see large firms grow by acquisition. Like the BlackRock deal for HPS, large players will consolidate smaller upstarts to grab market share over time. At the same time, as private equity firms consolidate, they will need scaled lenders to meet their needs, suggesting we’re in the early stages of consolidation. Banks have also moved to partner with private credit firms that have origination capabilities to offer their clients additional borrowing options. This year saw the announcements of Citigroup’s $25 billion private credit partnership with Apollo, Webster Bank’s venture with Marathon, and Wells Fargo’s $5 billion strategic relationship with Centerbridge Partners. In October, JPMorgan Chase announced it will allow a select group of private credit lenders to invest side-by-side on its deals in exchange for fees, according to Pitchbook.

Bottom Line:

We expect credit spreads to narrow next year, thanks to increased competition from banks. That, combined with lower overnight rates from the Federal Reserve, is expected to deliver lower yields to investors next year. The outlook suggests continued strong growth driven by institutional demand and retail democratization. However, success will depend on managing credit quality risks and navigating potential regulatory changes. The largest managers with diversified capabilities appear best positioned to capture market share and fee opportunities. While the underlying asset class appears stable, investors should pay attention to the amount of leverage at the fund level, as over-extended credit funds could find themselves under water if spreads between underlying loans and borrowing costs invert.