Key Observations:

- Inflation and shorter selling season putting damper on sales

- Credit card debt and delinquencies on the rise

- Big discounters are best positioned as retailers vie for larger slice of shrinking pie

Thanksgiving marked the beginning of the Christmas selling season this year, and insiders are wringing their hands. The National Retail Federation, the world’s largest retail trade association, forecasts 2.5-3.5 per cent holiday retail sales growth this year, representing its slowest Christmas season since 2018, with the average consumer expected to shell out $902 in holiday shopping this year. What does this tell us about the economy?

Inflation and Shorter Selling Season Put Damper on Sales

Several factors are responsible for the tepid outlook. To start, the Christmas selling season is five days shorter this year, thanks to a late Thanksgiving holiday. But the bigger issue is that Inflation-weary consumers have become increasingly price-sensitive and will be focused on deals this year. Retailers have already seen a stronger response to promotions this year, and consumers are more likely to comparison-shop online. That sentiment is consistent along the income ladder.

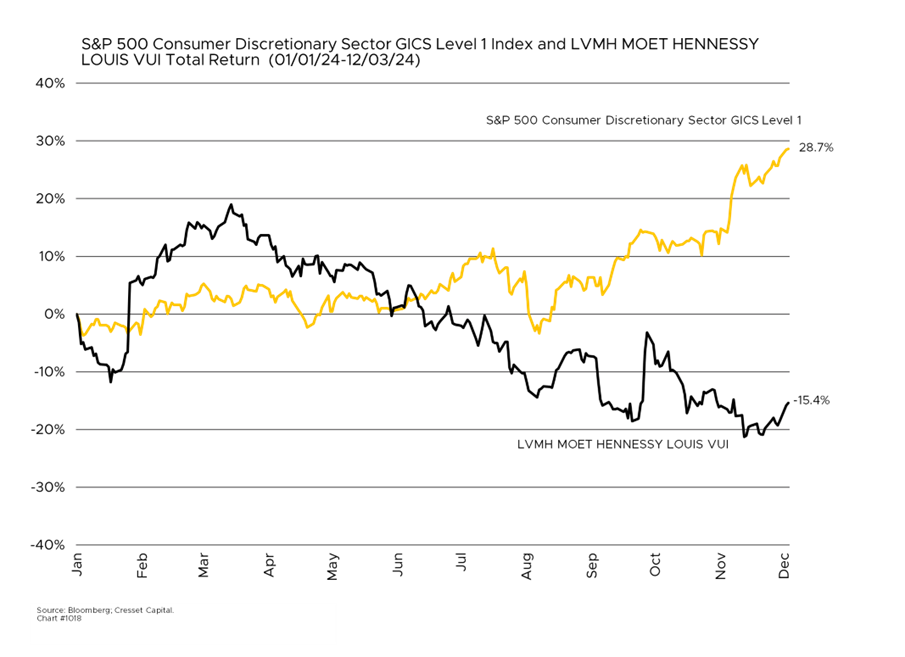

Wealthy buyers are not willing to shell out hundreds or thousands of dollars for high-end handbags, luggage and other luxury goods. According to a recent Wall Street Journal report, luxury-goods makers have lost about 50 million customers over the past two years, and demand for high-end goods are expected to flatline in 2024. Average prices for luxury products have escalated since the pandemic, prompting many customers to pull back. Exclusive brands are not only suffering with fewer clients; they are selling far fewer products to the customers that remain. LVMH, a company with a portfolio of luxury brands including Louis Vuitton, Tiffany, Bulgari and Fendi, saw its stock plunge more than 15 per cent this year against a backdrop of a 28 per cent gain among a broad basket of consumer discretionary stocks.

Credit Card Debt and Delinquencies Are Rising

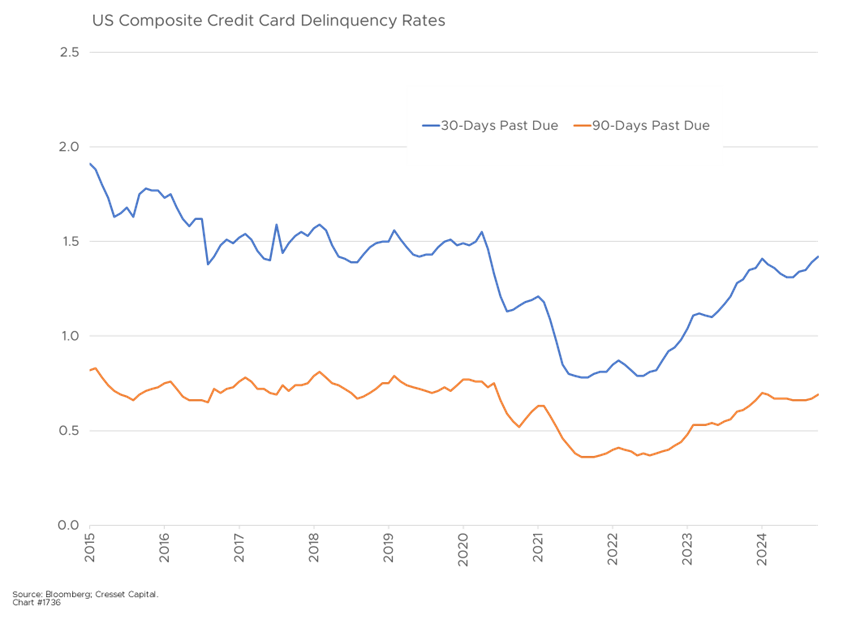

Another reason consumers will be reining in their discretionary purchases is that they are financially stretched. Households have been increasingly relying on credit cards. Last quarter, credit card debt rose 6.7 per cent and delinquencies are rising toward pre-pandemic levels. While household cash balances have been rising in recent months, they’re a fraction of where they were during the pandemic. Retailers are responding by vying for a larger slice of a shrinking pie, leaving the big discounters better positioned. Companies like Walmart, Target, and Amazon offered “Black Friday Week” this year, while Best Buys kicked off its holiday sales on November 21, a full week before Thanksgiving.

Bottom Line:

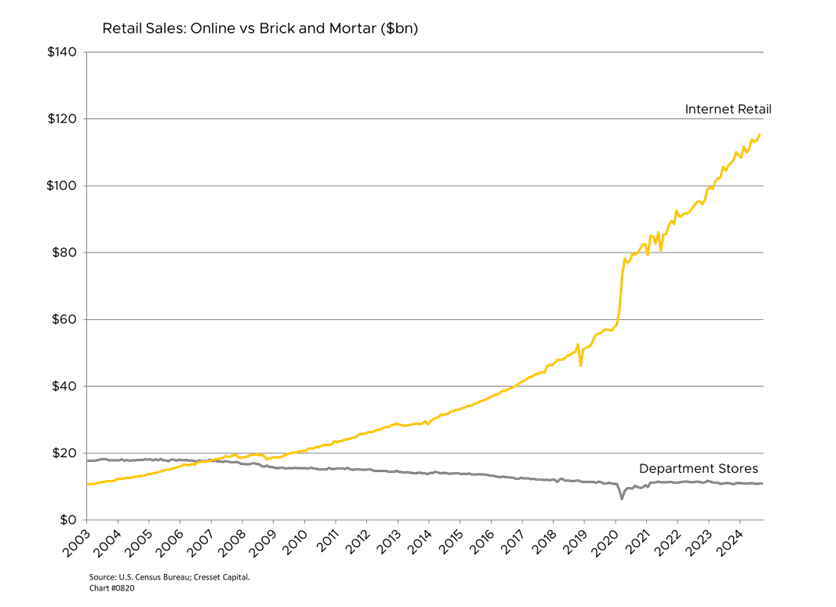

The stakes are particularly high for department stores, and they’re getting squeezed. Over the last five years, on average, Christmas sales – which include December and a portion of November – account for more than 20 per cent of annual revenue, underscoring their importance. Yet, the internet continues to siphon away sales. Online revenue eclipsed brick-and-mortar sales in 2006 and as of this year it is now 10 times that of department stores, which will ring up fewer sales in 2024 than they did 20 years ago. For the rest of the economy, Christmas sales are important, but they’re not a critical contributor to economic activity. Collectively, retail sales account for only four per cent of personal spending. So, while the Christmas selling season is a useful barometer for the US consumer, it’s less important to the overall economic picture.