Key Observations:

- Tariffs could significantly affect inflation

- Inflation expectations denting consumer sentiment

- Gold is the best way to hedge short-term inflation surprises

The US inflation rate has been stubborn in recent months, belying economists’ expectations. January’s reading of 0.5% not only exceeded their 0.3% forecast but represented the largest monthly increase in consumer prices since August 2023. It was also the third consecutive monthly increase in inflation, and price movements have met or exceeded monthly forecasts consistently since August. Price persistency is prompting investors, and Fed officials, to reconsider their outlook for inflation, especially against a backdrop of tariffs and other trade tension.

Tariffs Could Significantly Affect Inflation

Investors worry that President Trump’s plan to impose sweeping reciprocal tariffs on imports could significantly impact US inflation. While the tariffs are designed to match the taxes, subsidies, and trade barriers that US trading partners already impose on American exports, economists warn that these tariffs could lead to higher consumer prices, especially if combined with other import levies. We estimate inflation could rise by as much as one percentage point if today’s tariff exchange escalates into a global trade war, assuming companies pass about half of the tariff costs onto US households. The average tariff on US imports could rise from less than three per cent to about 20 per cent. The Fed paused its interest rate cuts due to elevated inflation levels, and concerns about tariff-related inflation spikes could prompt the Fed to keep rates higher for longer – or potentially hike.

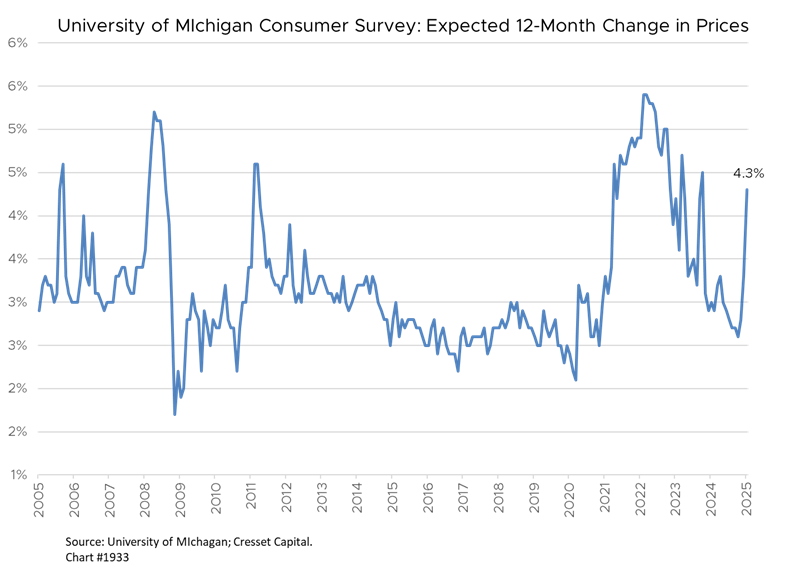

Inflation Expectations Denting Consumer Sentiment

Meanwhile, consumer sentiment in the US has fallen to its lowest level since July 2024, driven by concerns over tariffs, stock market volatility, and economic instability. Inflation expectations have surged, with consumers anticipating higher prices due to President Trump’s proposed reciprocal tariffs. The University of Michigan’s Consumer Sentiment Survey shows a significant jump in inflation expectations, from 3.3 per cent in January to 4.3 per cent in February, reflecting growing anxiety about rising costs.

Gold Is the Best Way to Hedge Short-term Inflation Surprises

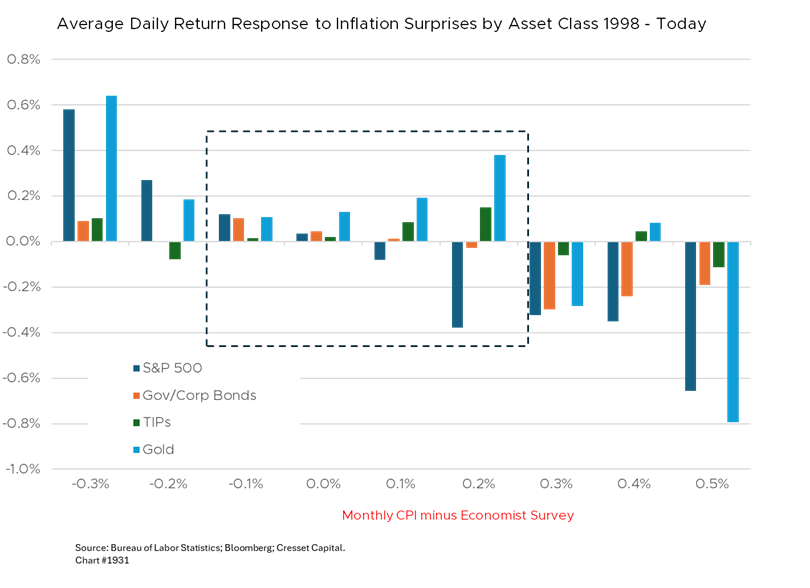

We evaluated several asset classes, including Treasury Inflation-Protected Securities (TIPs), gold, equities and bonds. Many investors, worried about the prospect of higher inflation, are turning to TIPs, since they deliver a fixed rate over the realized inflation rate if held to maturity. Gold, meanwhile, has demonstrated its ability to maintain purchasing power and has been rallying lately. Equities, thanks to companies’ ability to pass along price increases, have a proven ability to keep ahead of inflation over long time horizons. Bonds, however, due to their fixed-rate coupons, tend to underperform when inflation rates are rising.

Going back to 1998, we found that gold responds best to short-term inflation surprises, outpacing both TIPs and equities. We gathered each month’s reported headline inflation rate and subtracted economists’ expectations. A hotter-than-expected inflation was positive and cooler-than-expected inflation was negative; we found that 85 per cent of monthly observations occurred between -0.1 and +0.2 per cent. We then measured the average daily market return for each asset class. Gold outperformed TIPs in each of the most common surprise categories, and TIPs outpaced stocks and bonds when inflation surprised to the upside. Weaker-than-expected inflation readings fueled equites, although gold outpaced TIPs in those periods as well. TIPs outpaced other markets when inflation expected expectations by 0.5 per cent, but only in two months out of the 321 monthly observations.

Bottom Line:

The prospect of tariffs on top of persistent inflation presents a legitimate short-term inflation risk. We recommend investors consider buying gold versus TIPs to hedge their short-term purchasing power. Longer term, however, equities do a better job than virtually all other asset classes of staying ahead of inflation, allowing investors to maintain their purchasing power over time.